The cross border payments market is expected to reach $345.42 Billion by 2033! It means, the demand for cross-border payments will grow and traditional methods will fall short. And traditional method leads to transfer delays, high fees, and security concerns.

Hence, the need for more seamless, fast, and secure cross border payment solution increases. They're essential for retaining customers and growing your business. So, for remittance businesses like yours, offering these services becomes a big opportunity, as you can tap into the growing market.

But, how do you achieve transparency, speed, and security in cross border payments? Why are these three elements important in the cross border payment ecosystem?

This blog will answer all the above questions for you. By the end of this blog, you will have a better understanding of:

- Importance of transparency in cross-border payments

- Role of cross border instant payments

- Ensuring security in cross-border transactions

- Technologies driving transparency, speed, and security

Let’s begin!

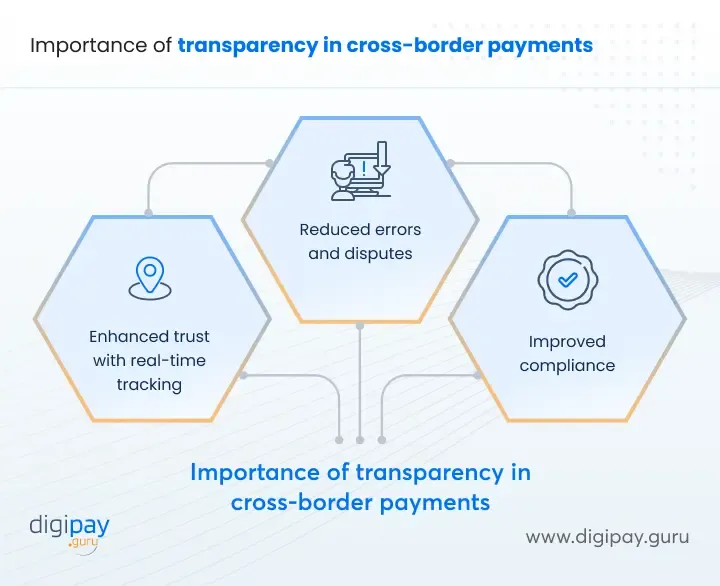

Importance of transparency in cross-border payments

The major reason why transparency is important in cross-border payments is “Trust”. When your customer’s money moves across borders they need to trust your cross border remittance services. Hence, you should offer clear information about how their money moves, the fee structures, and more.

Enhancing trust with real-time tracking and reporting

For your customers, tracing their international payments should be as easy as they can track their shipment on Amazon. This is possible with real-time tracking and reporting tools in your system.

When you offer the feature of real-time cross border payments tracking, your customers can:

- Check exactly where their funds are at any moment

- Monitor when payments are initiated, cleared, and received

- Gain peace of mind about their international transfers

This kind of visibility eliminates the uncertainty in the process and helps you better than your competitors in the market.

Reducing errors and disputes

Clear information means fewer mistakes and conflicts between the parties.

Your customers must have clear information about:

- How does your remittance service work?

- How much time will it take to settle in the beneficiary account?

- What are the fee structures and ongoing exchange rates?

- How are you keeping their payment data and funds secure?

This clarity resolves problems faster and prevents minor hiccups from becoming major headaches. And you get happier customers and lower operational costs.

Read More: Proven strategies to reduce remittance costs for providers and customers

Role of transparency in regulatory compliance

When we talk about finance and that too money moving internationally, it goes without saying that - compliance is integral.

When you keep all the compliance regulations in practice and maintain clear records of all cross-border transactions happening via your international remittance platform, you can:

- Meet anti-money laundering (AML) requirements

- Easily adhere to know-your-customer (KYC) regulations

- And demonstrate due diligence to regulators

This way, transparency protects both - your business from legal complications and your customers from hidden charges and the stress of delays.

Role of speed in cross-border payments

The traditional global payments like cross border bank transfer would take 5-7 days or even weeks. This creates customer frustration and can involve security breaches in transit. So you must focus on offering faster cross border payments.

Below mentioned points explain the role of speed in cross-border payments. Let’s go through them one by one.

Meeting customer expectations

Your customers are used to instant domestic transfers with payment solutions like digital wallets and ewallets. Now, they want the same speed for international payments.

Besides, there are apps in the market that already offer cross border instant payments. So you need to keep up with the competition and focus on outshining them.

Impact on business operations

Instant cross border payments are a big YES for customer satisfaction. But they are also important to improve your business operations.

With speedy cross border money transfer, you can:

- Improve cash flow management

- Reduce foreign exchange rate risk

- Use capital more efficiently

Plus, for your B2B customers faster international payments mean better relationships with global partners and more business opportunities.

Technologies enabling faster payments

Technological innovations are accelerating international transfers resulting in real time cross border payments for your customers. Real-time gross settlement (RTGS) systems, blockchain, and improved messaging standards like ISO 20022 are leading the charge.

Staying up-to-date with these technologies is crucial. Remember, it's not about keeping up with competitors. It's about future-proofing your services and meeting evolving customer needs.

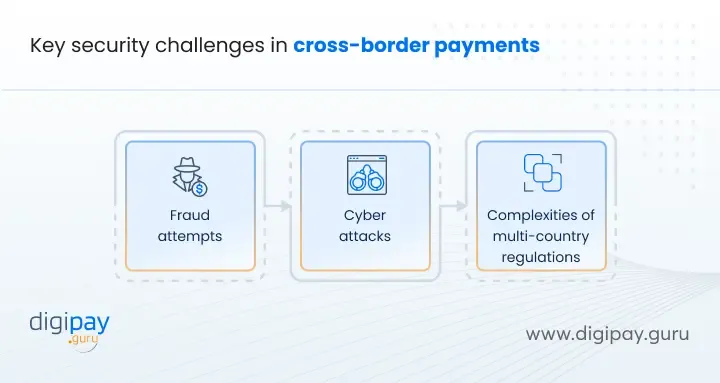

Ensuring security in cross border transactions

Speed and transparency are the two crucial pillars of cross-border payments, but it can not stand without the third pillar - Security.

Your customers trust you with their money and so you need to protect it at all costs.

Key security challenges in cross-border payments

Cross-border payments face unique security risks. These include:

- Fraud attempts

- Cyber attacks

- Complexities of multi-country regulations

As transactions cross borders, they often pass through several intermediaries. And each step is a potential vulnerability.

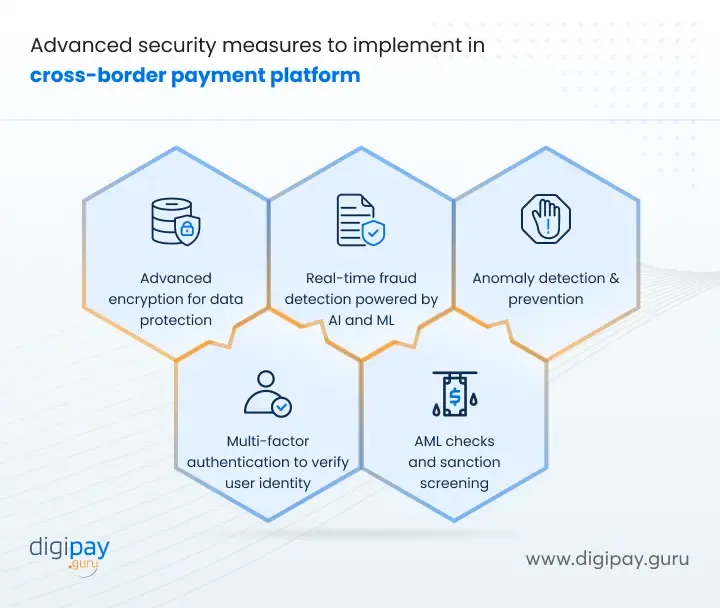

Implementing advanced security measures

To overcome these challenges, you need advanced security measures such as:

- Advanced encryption for data protection

- Multi-factor authentication to verify user identity

- Real-time fraud detection powered by AI and ML

- AML checks and sanction screening

- Anomaly detection & prevention and more…..

All the above security features can make your cross border payment system extremely secure, effective, and reliable.

Regulatory compliance and security

Security in cross-border payments isn't just about stopping threats. It's about complying with global regulations. This includes regulatory requirements like AML and KYC requirements, as well as data protection laws like GDPR and CCPA.

Robust security measures help you avoid fines and reputational damage from breaches or non-compliance.

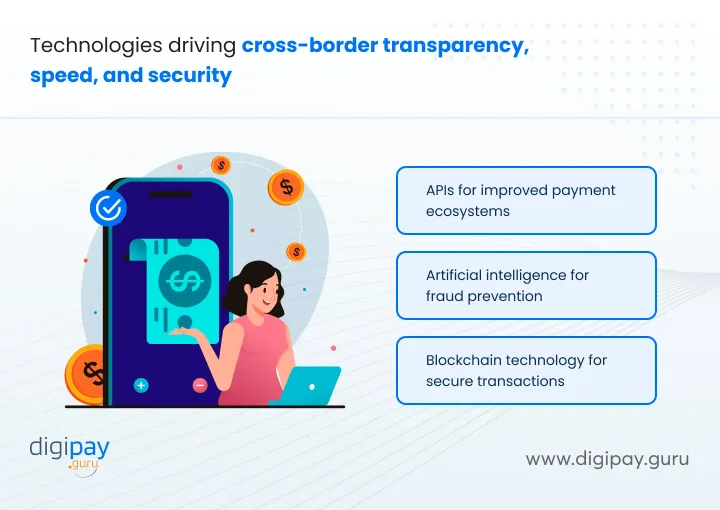

Technologies driving transparency, speed, and security

To stay ahead in cross-border payment services, you need to embrace new technologies. Especially those technologies that can help you drive transparency, speed, and security for remittances.

Let’s explore the key technologies that can help you in it:

Role of APIs in improving payment ecosystems

Application Programming Interfaces (APIs) are revolutionizing cross-border payments. It allows different systems to communicate seamlessly with each other’s data

This enables:

- Real-time data exchange

- Enhanced transparency

- Faster transactions

With API-driven solutions, you can offer your customers

- Real-time tracking

- Instant currency conversion, and

- Smooth integration with their systems

Artificial intelligence for fraud prevention

AI and ML can be powerful tools in preventing fraud. With these technologies, you can:

- Analyze vast amounts of transaction data in real-time

- Identify suspicious patterns and anomalies prior

- Learn from each transaction to improve fraud detection

By implementing AI-driven systems, you can significantly enhance the security of your cross-border payments.

Blockchain technology for secure transactions

Blockchain offers a promising solution for transparent, fast, and secure cross-border payments. Its decentralized and immutable ledger provides:

- A tamper-proof record of all transactions

- Enhanced transparency

- Reduced risk of fraud and costs

- Eliminates middlemen

To implement blockchain in cross-border payments, choose a secure platform, develop automated smart contracts, and integrate it with existing financial systems.

So far, we have established that transparency, speed, and security are the crucial three pillars for you to offer robust cross border payment services to your customers.

Now, let us give you a glimpse of our secure & reliable cross border payment services, and why it is a perfect solution to outshine your competitors.

How DigiPay.Guru can help?

DigiPay.Guru is a leading cross border payment provider that enables you to offer faster, secure, affordable, interoperable, and transparent cross-border payments to your customers with our end-to-end international remittance solution.

We are fast

-

We offer real time cross border payments by streamlining the processes that traditionally involved multiple banks, intermediaries, and currencies.

-

Our system connects directly to various global payment networks which allows for real-time or near-instant transfers.

We are transparent

-

We offer real time tracking of transactions from the initiation till the completion

-

We ensure transparent fee structure and exchange rates

-

We clearly inform on how we can keep funds and data secure

We are secure

-

We offer robust security features like biometric authentication, advanced encryption algorithm, AML screening, and more

-

We are PCI SSF complaint

-

We also offer anomaly detection & prevention, periodic web pen-testing, periodic SAST, DAST, SCA scans, and straightforward authorization rules

Read More: DigiPay.Guru's Cross Border Payment Platform: Cost-effective, Flexible, and Scalable

Conclusion

Transparency, speed and security are three main pillars of the cross border payments ecosystem. To beat the competition and the market, you need to offer a powerful cross border payments platform integrated with all these three capabilities. This will help your customers trust you and keep coming back for every cross border transaction they make.

With DigiPay.Guru’s fast, reliable, and secure international remittance solution, you can become the “best in the market” cross border payment services for your customers. Plus, you can expand your business operations effectively, increase customer retention, boost revenue by 10X, and achieve long-term success.