The fintech market is growing rapidly with its numerous fintech innovations coming up! From digital wallet solutions to NFC technology, every innovation has become successful in the long run.

So, it becomes necessary for businesses like yours to stay afloat with the top fintech trends and predictions to lead the market like a PRO. Morеovеr, a study suggests that thе global fintеch markеt was valuеd at $226.76 in 2023 which is projеctеd to grow to $917.17 billion by 2032. And this is another reason to see the fintech trends eye-to-eye!

In this blog post, you will gеt a go-through with thе top fintеch industry trеnds and predictions for thе yеar 2025 to stay ahеad of thе compеtition.

Let’s get started with these trends!

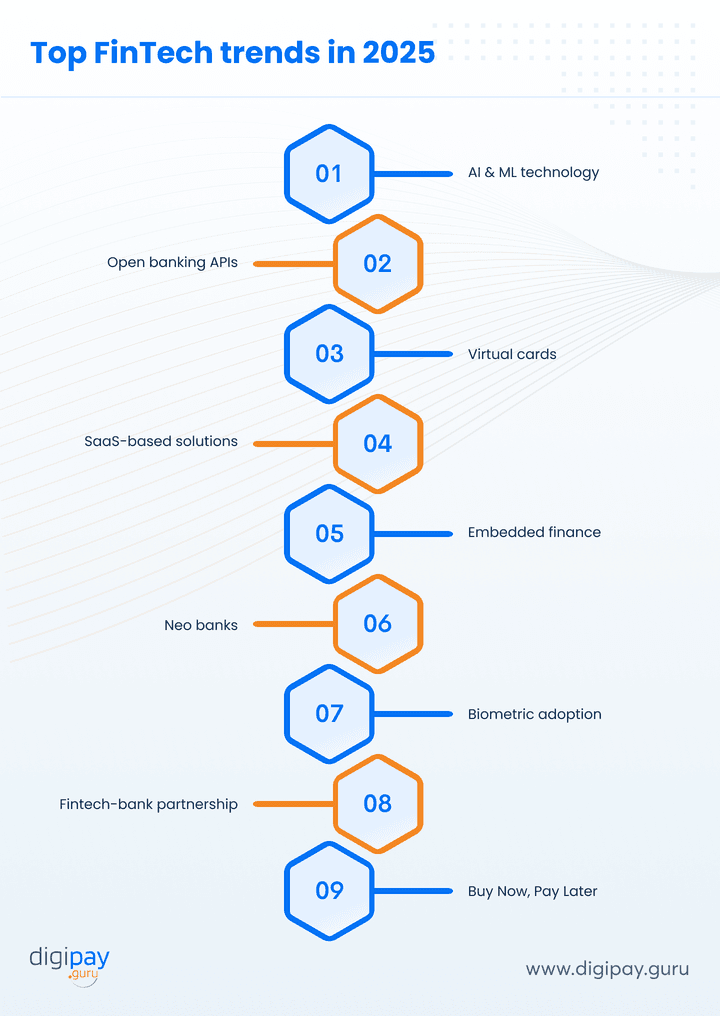

Top FinTech Trends in 2025

FinTechs have been revolutionizing the financial industry for the past few years. And the trends in this field continue to evolve and shape the future of finance. As we enter 2025, some of the top fintech payment trends to watch for include:

AI and machine learning will become mainstream

Did you know that AI in the fintech market is expected to reach up to $ 53.30 billion by 2030?

The above stats clearly shows AI is going to be the new normal. After the biggest AI innovation chatbot (ChatGPT) came into the picture, there’s a flood of AI tools and chatbots everywhere. But, fintech is using AI and ML more than a tool which makes them the future of fintech.

Fintech utilizes AI and ML for these reasons:

- Chatbots embedded with the fintech solution to assist customers when they have queries or want to know more about your offerings.

- Analyze data in real-time, ongoing transaction monitoring to flag suspicious activities and enhance payment data security for customers.

- AI with predictive analytics helps analyze historical data with ML algorithms to offer accurate financial predictions for informed business decisions.

- Automate onboarding, document verification, and checks to stay compliant with the regulations. Utilize human resources in more valuable tasks.

Read more - Increasing use of AI and ML in financial services

Open banking API stimulates easy access

Open banking APIs enable banks to share their financial and user data with firms other than financial institutions through APIs.

This unique API system:

- Enables easier access to financial data through secure connections.

- Allows more financial services integration in third-party apps.

- Enables smoother data sharing and innovation in fintech.

A study suggests that the global transaction value of payments via open banking is expected to reach $330 bn by 2027. As adoption grows, open banking can transform customer experience and encourage innovative financial services.

Virtual cards - The contactless trend

Virtual cards for businesses have become prevalent due to customers’ constantly evolving behaviors and the need for more and more convenience and security in payments. One of the major reasons is the fintech market trends showing a rise in contactless and cashless transactions.

Virtual prepaid cards can be stored directly in your mobile banking or mobile wallet app. They can also be used to make payments by just tapping the phone to the payment terminal. Currently, there are more than 36 billion transactions performed via virtual cards. And this number will rise to 175 billion by 2028.

SaaS solutions will rise

With the rise of digital fintech solutions all across the globe, businesses will largely benefit from their SaaS versions. For example, a SaaS-based digital wallet solution has become popular due to its customization capabilities, cost-effectiveness, tailored solution, scalability, security, and compliance.

Moreover, there are other SaaS versions of fintech products moving in the same direction such as banking-as-a-service, remittance-as-a-service, card-as-a-service,eKYC-as-a-service, and more. Bottom line - SaaS has become a successful latest trend in fintech space.

Embedded finance for every business

Embedded finance solutions integrate financial services directly into non-financial environments. This allows businesses to provide relevant financial products seamlessly within their existing customer experiences.

From insurance on e-commerce sites to financing on mobile apps, embedded finance has gained adoption as the top fintech trends making financial services omnipresent across industries.

- Allows businesses to offer customized financial services through APIs

- Streamlines customer experience by reducing steps to access financial products

- Helps companies generate additional revenue streams beyond core offerings

- Modernizes legacy financial products to align with digital experiences

Neobanks appeal to young consumers

Nеobanks is a digital fintеch solution disrupting the banking industry by offering digital-only financial sеrvicеs without physical branchеs. Built for thе mobilе agе, nеobanks havе bееn onе of thе popular fintеch trеnds that provides a strеamlinеd usеr еxpеriеncе with innovativе fеaturеs to mееt modеrn consumеr dеmands.

Thеsе banks providе virtual banking sеrvicеs likе P2P transfеrs, intеrnational rеmittancеs, contactlеss paymеnts likе QR codеs and budgеting and financial managеmеnt, chatbots, loan products and morе.

Read More: All you need to know about neobanks

Biometric adoption for enhanced security

Biomеtric authеntication has bеcomе a major sеcurity fеaturе for еvеry digital fintеch solution out thеrе. Thе major rеason is that it offеrs advancеd sеcurity in digital paymеnt apps by scanning thе physical characteristics of usеrs likе facial scans, iris scans, fingеrprint scans, and morе.

The new and upgraded version of this security feature like liveness detection is also emerging as one of the latest fintech trends 2025. It checks the legitimacy of the customer by scanning the live selfie or video capture. This feature is amazing for real-time fraud detection.

Fintech-banks partnerships

We will see more and more fintech-bank partnerships. These partnerships have turned out to be the B2B trends in fintech 2025 that have gained momentum quickly. The reason behind this is the innovative financial services that fintech offers are a must for banking consumers as well.

So, banks partner with fintech and opt for a solution they offer as that is necessary for a banking app.

For example, banks implement international remittance services into their mobile banking application so that customers can get all the necessary services under one roof. Many banks are even creating their own fintech solutions to stay afloat the market needs.

Buy Now, Pay Later (BNPL)

BNPL services are a hot topic in the global fintech market! Buy Now, Pay Later (BNPL) services are getting big globally across e-commerce and point-of-sale.

With BNPL, your customer can make installment payments for online and in-store purchases, BNPL provides greater flexibility and convenience. Additionally, the global market for BNPL is expected to grow to $9226.65 Bn by 2032.

P.S. - As BNPL solutions get embedded at checkout, they are becoming an integral part of consumer spending habits and patterns.

Blockchain heads for the mainstream

In 2025, blockchain technology will break free from cryptocurrency and become the foundation of fintech innovation. Its decentralised, secure and transparent nature makes it the perfect solution to long-standing financial services problems.

Key applications:

Payments and settlements: Blockchain’s ability to process real-time, peer-to-peer transactions without intermediaries will revolutionise payment systems. Financial institutions will use it for faster and cheaper domestic and international payments.

Cross border transactions: By getting rid of correspondent banking networks, blockchain will reduce the costs and delays of international payments.

Fraud prevention: With its immutable ledger, blockchain can reduce fraud by making every transaction transparent and verifiable.

Smart contracts: Automated agreements on blockchain will simplify processes like insurance claims, loan approvals and supply chain settlements

Decentralised finance (DeFi)

DeFi is going to be a game changer, by allowing your customers to access financial services without banks or intermediaries. Built on blockchain, DeFi uses smart contracts to automate transactions, reduce fees and democratise access.

How DeFi will disrupt traditional banking:

Lending and borrowing: DeFi allows users to lend or borrow assets directly, no banks required. Borrowers get lower interest rates and lenders get higher returns due to reduced overheads.

Savings accounts and yield farming: Unlike traditional savings accounts with tiny interest rates, DeFi has yield farming where users earn rewards or interest by providing liquidity to decentralized protocols.

Decentralized exchanges (DEXs): These allow users to trade cryptocurrencies without using centralized exchanges, which entails more privacy and lower fees.

Accessibility: DeFi platforms are 24/7 and globally accessible, which are great for the unbanked and underbanked populations.

RegTech and robotic process automation (RPA)

As regulations get more complicated, banks and fintechs like you are entering new markets. RegTech (Regulatory Technology) and Robotic Process Automation (RPA) is the solution to simplify compliance and efficiency.

RegTech and RPA reduces cost and reduces risk of non compliance which can lead to heavy fines and reputation damage.

Use cases:

Real-time transaction monitoring: RegTech solutions powered by AI and RPA can monitor thousands of transactions in real time, detect money laundering and fraud.

Automated reporting: With RPA, institutions can automate the preparation and submission of regulatory reports, reduce errors and manual work.

AML and KYC compliance: RegTech platforms integrate with Anti-Money Laundering (AML) and Know Your Customer (KYC) systems to automate customer verification, reduce onboarding time and comply with regulations.

Risk management: Advanced analytics helps to identify risks of new financial products or market trends, so institutions can be ahead of regulatory challenges.

Anti-money laundering (AML)

Money laundering is a constant threat to the financial world with criminals finding new ways to exploit the system. Financial institutions like yours are hence turning to AML technologies that use AI and ML to combat this.

AML innovations:

1. AI powered suspicious activity detection: AI looks at transaction patterns to detect anomalies that indicate money laundering. For example, unusual transaction sizes or sudden spikes in activity will trigger an alert.

2. Behavioural analytics: ML learns the behaviour of users and flags deviations which adds an extra layer of accuracy in identifying illicit activities.

3. Real time data: Old systems do periodic checks. Plus, the new AML tools can check transactions as they happen and prevent fraud from happening.

4. Global sanctions: AML solutions now come with global sanction lists and watchlists, which ensures real time compliance with international regulations.

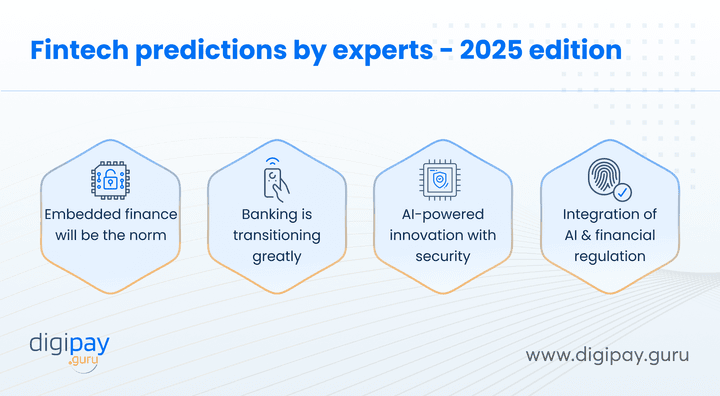

Fintech predictions by experts - 2025 edition

Every year, the fintech experts share their personal views on how the industry will turn out for the new year. The fintech industry keeps on growing but some predictions are always better than others.

Here are the top fintech predictions from the latest fintech report on what will transform the fintech landscape significantly according to the experts:

Embedded finance will become the norm

Talking about embedded finance, Piers Marais, Chief Product Officer at Currencycloud, predicted that:

- Embedded finance is “finance everywhere” enabling a smooth integration of financial services in non-financial third-party apps.

- Advanced APIs and easy access to AI & ML will create a personalized customer experience.

- B2B embedded finance will keep on rising due to the need to offer efficient and innovative financial services to customers.

- Banks and financial institutions like yours will have to become more adaptable and customer-oriented to leverage its benefits by providing customizable solutions via APIs.

Banking is transitioning greatly

Reinhard Höll, Partner at McKinsey & Company shared his expert insight on the digital transformation of banking:

- Rising interest rates have boosted profits for banks in a more beneficial credit environment in the previous 18 months.

- More than 70% of net inflows into the financial system led to off-banking balance sheets.

- The transition will be shaped by 4 global trends in the fintech industry: Increasing technological advancements, vast and in–depth regulatory checks, evolving macroenvironment, and changing risks.

- Banks like you must utilize the latest technologies, stay compliant at all levels, level up their distribution, and adapt to evolving risks.

AI-powered innovation with security

Charlie Sanderson, Head of Global Financial Service at Amazon Web Services suggests that generative AI will transform financial services:

- Leading fintech firms, banks, and financial institutions like you will leverage its power to enhance customer experience, understand market demand, innovate, and increase productivity.

- Compliance analysts and loan officers can leverage generative AI to generate real-time accurate reports and documents.

- Investment advisors can automate the analysis of investment risk profiles and suggest tailored portfolios.

Mainstream integration of AI & financial regulation

Krik Gunning, Co-Founder and CEO at Fourthline, expressing his views about AI and regulations, made the fintech predictions as under:

- There will be an extensive leveraging of artificial intelligence to comply with AML regulations

- AI for AML will enable banks, fintech, and FIs to achieve financial system integrity accurately, automably, and efficiently.

- AI will become very important in managing large volumes of fraud activities occurring in new technologies

- AI should be embraced only after understanding key issues like providers' track record, their response to regulators, and how they think about data security.

Conclusion

With the above top financial technology trends and predictions in play, 2025 is going to be a successful year for the fintech landscape. For fintech businesses like you, these trends and predictions will generate profits, increase operational efficiency, minimize costs. And bring security & compliance to the center stage with new and better technologies, innovations, and services.

How DigiPay.Guru can help?

DigiPay.Guru is a top-notch digital fintech solution provider that offers varied payment solutions to banks, fintech, financial institutions, telcos, and more. Our solutions are designed while keeping the latest fintech trends and predictions in mind. It's automated, tech-savvy, in digital mode, and even has contactless capabilities.

Moreover, we focus on offering next-level security in every solution, so that your customers can perform transactions with peace of mind and zero security risks. Plus, our digital fintech solutions are white-labeled, customizable, scalable, and focused on boosting financial inclusion.

So, don’t get left behind, opt for our future-ready digital fintech solutions!