With mobile payment becoming a reality more people are choosing it for various reasons like staying card-free, promoting cashless economy and leveraging order-in-one-click technology. Peer-to-Peer payment apps (P2P) are essential to accelerate and optimize all sorts of mobile payment like sending remittances, bills splitting, trip bookings and even for expenditure management.

Indeed, the financial technology gets revamped when you build a payment application as it allows users to pay money using peer-to-peer payment apps, mobile wallet apps, cryptocurrency platforms and m-commerce apps.

It is no shocker that more than 62% of American millennials users prefer P2P mobile payments as they are fast, convenient, and secure.

What is peer to peer payment App?

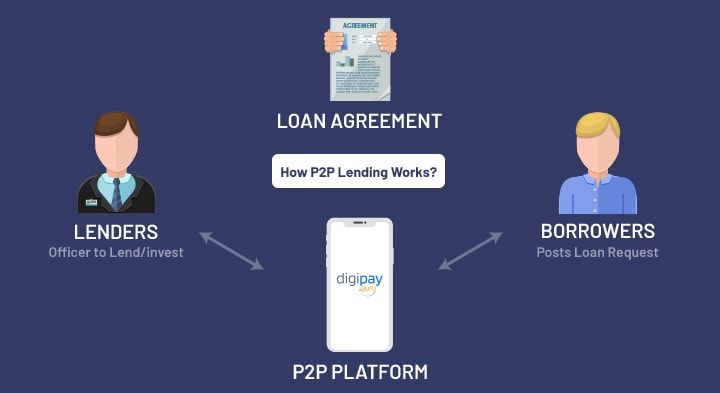

Peer to peer or P2P payments forms a transactions that can be anything from splitting a $50 lunch bill with your colleagues to even paying for rent and gas. It is a peer to peer payment platform that allows fund transfer between two parties while using their banking accounts or even credit cards through a P2P mobile app or third-party online platform.

To understand P2P mobile solutions software better, it is best to go back to how Western Union used to operate long before mobile phones came to existence for money transfer. A peer to peer payment app transfers money from person to person using an electronic transfer method where the other party could be a friend, a relative, client or an employee who receives the cash almost instantly.

What does a P2P payment do?

A P2P payment app does the following albeit with some other usages too.

- Enabled payment to a landlord or a merchant who is on an instalment plan.

- Making payment for taxi or cab services along with applied discounts.

- Settling the balances when money is borrowed from a friend or a relative.

- Set borrow limit for anyone and thereby allow them to withdraw some amount at a specific time or predefined intervals.

- Transfer money on any borrowing request from the people you know (typically from within your contact list)

- Splitting the bill amongst multiple people, especially for expenses like dinner, outings, trip payment, etc.

- Transferring money to your loved ones instantly.

- Make payment for utility bills, services, etc.

P2P app allows money transfer beyond the geographical boundaries as well. There are a few Peer to Peer mobile app solutions explicitly aimed at making such transfers that enables you to send money outside your friends and groups. Such applications have the following usages:

P2P cross-border money transfer apps

There are peer to peer payment platforms solely created for international money transfer. Such international P2P money transfer apps make remittances cheaper. It is a promising new market aided by smart technology that makes cross-border money transfer secure and faster than before.

P2P FX

Users from across the globe come under Peer-to-peer foreign currency exchange as they negate the middlemen like banks and brokers. It leaves a tremendous impact on clients as they end up saving around 90% of the money that goes into payment of transfer fees for international exchange.

P2P lending apps

A remarkable P2P payment solution assists users in need by offering to repay microloans at cheaper interest rates. Users also find this as a lucrative loan option sparring the tedious bank processes and availing money at lower interest rates. Again, investors who build such a mobile payment system find it profitable to monetize their funds.

It is the technology within the peer to peer payment app that allows users to make transfers without the need to go to a bank. Also, it enables sharing money from multiple sources like a bank, credit card, and even though escrow who works as a non-banking agent.

Creating a robust and compliant P2P payment applications

While it is easy to build a P2P payment mobile application, such a quick payment through an app demands some standardization and security. There is generic compliance hygiene to follow when one is to build a mobile payment system. The reason why it is accepted worldwide and preferred by many users is that people put trust in such peer to peer mobile apps.

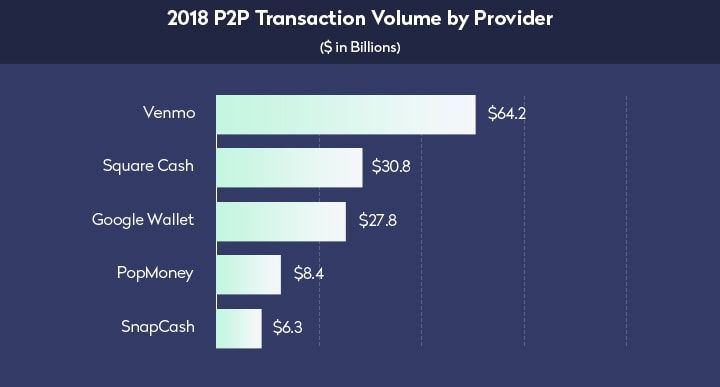

And such P2P payment solutions must, at all cost, prevent any fraud and other trust issues. The transaction volumes on top Peer to Peer apps are only bound to increase in coming times and therefore having users to put their trust on such apps is crucial for its success.

Creating a robust P2P app design

There are instances where many peer to peer app development systems overuse the commonly shared resources purely for the self-interest. The key is to prevent storage and bandwidth overuse by creating a decentralized peer-to-peer system with a planned resource allocation and protection requirements.

There are usually two types of attacks that pose threats to any peer to peer money transfer – DoS and storage flooding. It gets imperative to design a highly robust P2P mobile payment app that considers taking some serious accountability measures by incorporating the following:

Favourite user selection

Enable implementing this favourite user via his/her reputation. Such peer to peer payment platforms will have user scores that impact the user’s access to resources and enable the transaction.

Access restriction

Most of the access restrictions are to be levied on the micropayments which may not necessarily involve money exchange in every circumstance.

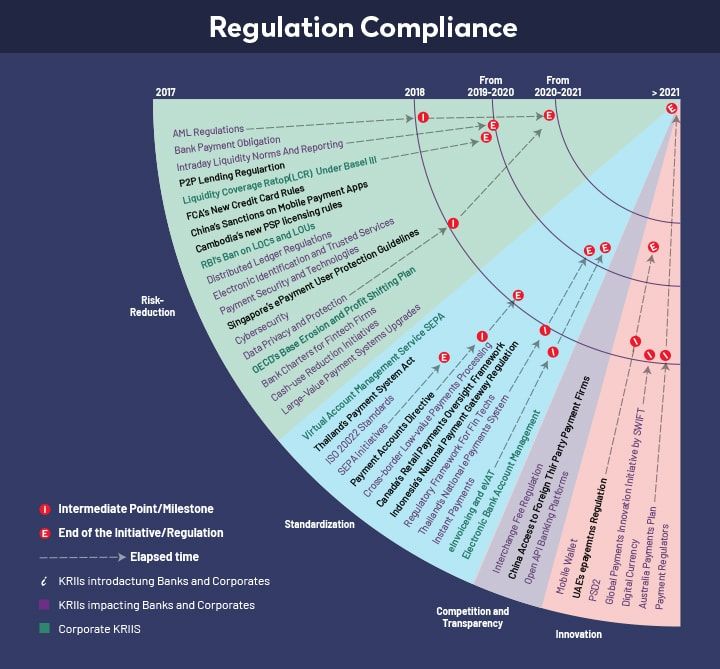

Regulation compliance

While the FinTech market is reaching new heights, there are a specific set of regulations and complicated laws that everyone developing peer to peer mobile applications need to follow throughout the payment process. Many countries are already defining its centralized compliance and ask P2P app owners to follow regulatory compliance as other nations follow.

Most of the Asian countries are already heading towards making the FinTech sector compliant. Ernst & Young published a journal that showcases FinTech regulations and standards followed by APAC nations.

On the other hand, the US market is still a fragmented one when it comes to implementing a compliant Peer to Peer payment solution. It requires some coherent approach that provides FinTech firms with a legal framework to protect customers and support innovations.

For example, the mobile payments industry consists of eight federal agencies having a few oversights of finance and 50 states where each of them has their own set of rules. The new 2019 Bank Act in Canada has opened up new opportunities for open banking as well.

There may be a few disruptive technologies that would fail to get implemented appropriately without having regulatory sandbox standards in place. But, with that, it is possible to test possible peer to peer payment business model and technology compliance to gauge the financial and operational impact.

Designing a secured P2P payment app user journey

Creating a mobile peer to peer payment app, you want to enable your users to do the following:

Money transfer into P2P app’s system

The users are empowered with the ability to pull money from their card which includes PayPal, bank, and even bitcoin account into the system. The P2P app’s bank account is the actual receipt of the money. The amount in that is transferred in the computer system registers which again is monetized.

Managing system’s money

A typical user journey will enable them to transfer money between the users and the third party system. Managing such money transfer is easy and instant as it only requires the change in the app’s database.

Money withdrawal from system

System reflects money in pure digits that make it into a physical currency and a widely accepted one. Users would then withdraw that amount into their bank account or can use it to transfer it to their PayPal account and prepaid debit card.

Again, it is essential to follow standardized peer to peer payment application process, which does not naturally make any direct connection with the credit card and banking systems. Instead, it uses the API of financial services provided.

P2P payment app features that ensure security

P2P payment solutions should not solely focus on the functionality, and there shouldn’t be much to experiment in this space. The focus should be to deliver a highly secured peer to peer payment systems that ensure better user experience.

Secured digital wallet for users

It is better to integrate a secured digital wallet for users to store information on special offers, discounts cards, and other bank-card details.

P2P Transaction notification

A P2P mobile payment marks the payment initiation steps and even the completion, which then pushes live notification and update in their account or wallet. Also, the user notifications can be used to notify about the upcoming bill due dates, discounts, special offers, etc.

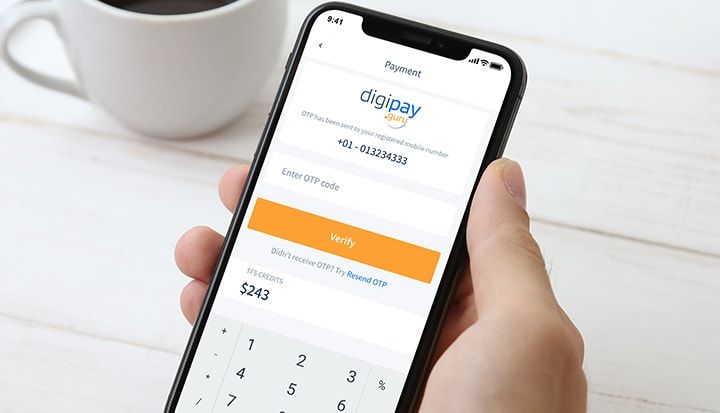

Sending unique ID/OTP

Getting a unique ID and password every time a user triggers a transaction for advanced verification is critical to ensure secured P2P mobile payment software. This is done for security reasons and users should be able to see all transaction details. Some P2P payment service providers ask for the OTP every time the app opens to ensure a higher level of security.

Sending and requesting money

It is crucial to have the send and request money feature enabled in the peer to peer payment platform. Therefore it is essential to follow three important guidelines – speed, simplicity and safety.

Billing and invoice generation

Users should be able to scan and send bills that enable payments using P2P payment app. It is also recommended to have an integrated feature to let users generate transactional invoices with the ability to store the same within the app.

Read More: Simplified top-up and bill payments with DigiPay.

Secured P2P bank transfer

Most users would often look to transfer the amount received via peer to peer payment app to their respective bank accounts. Enabling the same is a crucial part of P2P payment app development.

P2P Transaction history

This is where the business add value for users as they can check the historical data of all their previous transactions. Also, it is common amongst P2P mobile apps to have filters that let users choose the date range of transaction as well as to keep a check on payments and receivables.

Using blockchain to make it legally compliant

Centralized systems often fall short when compared to P2P networks which offer faster P2P transactions with high reliability. But since P2P payment app development requires some amount of security, implementing blockchain becomes crucial.

All the peer to peer payment systems are at high risk of compromising data transmission and storage and blending the blockchain can help developers leverage the benefits of available peer-to-peer networks for such apps.

The weakest chain in any P2P mobile app is the cross-border international transactions and to provide a feature-rich service it becomes essential to secure the same. Usually, banks are responsible for ensuring all the cross-border transactions thus enabling users to send data (no just the money) by implementing technologies like SWIFT, etc.

While blockchain is relatively a new technology to be considered to make P2P app development more reliable and compliant, it has positively received some proof of concept on TBCASoft to verify its potentiality.

It can change the way how end-to-end user communications work by having Rich Communication Services protocol (RCS) in place instead of SMS. The benefit is that it provides polling phonebook for discovering services and even transmitting in-call multimedia files.

Conclusion

While some companies may tread waters initially when plunging in P2P payment app development, it can soon be a game-changer in the FinTech industry. Contribute your best in bringing people to one platform with peer to peer payment solutions while keeping the P2P payment app robust and legally compliant.

I hope you liked this article. If you want to read more such insightful articles then keep reading this space.