REMITTANCE MANAGEMENT SOFTWARE

DigiPay.Guru - A reliable cross-border payment platform to empower international money transfer businesses

Whether you're a startup or a large enterprise, our platform offers everything you need to run a seamless money transfer business. With trusted solutions for online, agent, and mobile remittance, we eliminate the complexity of your business by simplifying global compliance, customer management, and market-specific configurations.

Contact our expert teamBanks

Enable your bank to deliver fast and affordable remittance services to your customers. Expand into new corridors, automate FX, & gain an extra edge.

NBFCs

A customizable platform designed for NBFCs meets unique needs, ensures compliance, efficiency, and cost-effectiveness. Disburse payments instantly & reap our banking relationships.

Fintechs

Grow your fintech business by offering global money transfers in a secure & compliant way. And scale effectively with our flexible API integrations.

MTOs & SMEs

Empower your business with our user-friendly platform & competitive pricing to delight your customers and effectively compete in the global remittance market.

REMITTANCE MARKET

Tap into the remittance market potential

$86bn

Total global remittance flows in 2023

$669bn

Global remittance flows to LMICs - 2023

$990bn

Global remittance market growth by 2028

$318mn

Raised by cross-border payment companies in 2024

63%

Global consumers use RTP services - 2024

$887bn

Global P2P remittance market growth by 2024

INTERNATIONAL REMITTANCE SOFTWARE

Discover the power of a perfect international remittance platform to transform the financial landscape

Multi-currency corridors & exchange rates

Enhance your customers' cross-border payment experience with our multi-currency corridors and dynamic exchange rate management. Offer flexible and cost-effective options for various currencies. And enable your customers to send and receive money with greater flexibility and efficiency.

This feature boosts your global reach and ensures your customers get efficient, transparent, and affordable international payments.

- Support multiple currency corridors

- Dynamic exchange rate management

- Transparent fee structures & FX rates

International P2P remittances

Streamline peer-to-peer transactions across borders with our seamless international P2P remittance services. We offer a user-friendly experience for sending and receiving money globally, with fast processing times and competitive fees.

This enables your customers to enjoy secure, reliable, and cost-effective transfers. This enhances their ability to connect and transact effortlessly, no matter where they are.

- Simplified cross border transactions

- Real-time money transfers

- Multiple modes of payment

Streamlined reconciliation in any currency

Streamline your remittance operations with our unified reconciliation feature. No matter the mix of payment methods or currencies, our solution consolidates all transaction data into a single and comprehensive report, which simplifies your reconciliation & accounting process, reduces manual errors, and saves time.

This makes it easier for your remittance business to manage and reconcile transactions efficiently across global operations.

- Seamless multi-currency reconciliation

- Consolidated transaction reporting

- Efficient payment settlement

AML sanction screening

Secure your remittance business with our AML sanction screening. Our tool efficiently scans and flags transactions involving high-risk individuals or entities to ensure compliance with AML regulations.

By integrating real-time screening into your operations, you can protect your business from financial crime and regulatory issues. This enhances the safety and reliability of your cross-border remittance services.

- Automate AML checks

- Real-time flags to avoid fraud

- Meet KYC and AML compliance

Agent network module

Enhance your international remittance service reach with our Agent Network Module. Effortlessly manage cash pickups and agent activities while ensuring secure and efficient cross-border payments.

Our intuitive system simplifies agent onboarding, commission management, and performance tracking. This empowers your business to expand your services globally and improve your network's efficiency.

- Streamlined cash handling and pickups

- Automated agent onboarding and commissions

- Real-time performance tracking and insights

Price-based smart routing

Enhance your international remittance service efficiency with price-based smart routing. Automatically identify the most cost-effective transfer routes by comparing fees and exchange rates from multiple providers.

This ensures faster, more affordable, and more efficient payments. And allows you to deliver optimal value to your customers while streamlining your cross-border transactions.

- Optimized partner availability for global payments

- Automated selection of cost-effective transfer routes

- Improved transfer speed with real-time routing

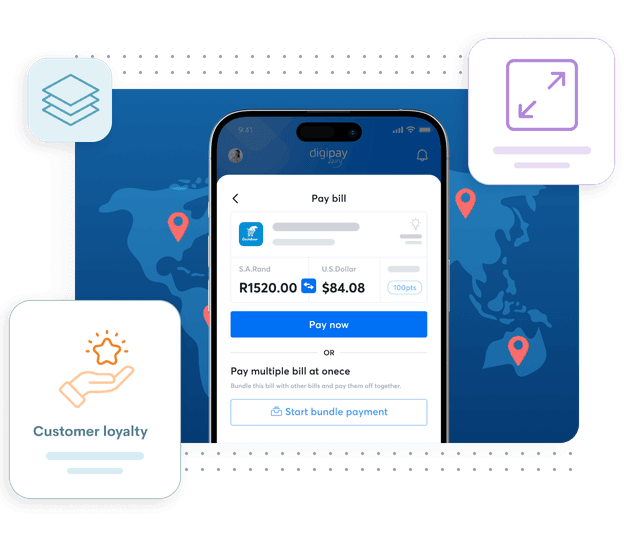

Cross-border bill payments

Empower your customers to pay bills across borders for loved ones living abroad with ease and efficiency. Offer seamless payments for utilities, telecom, wifi, and more, while eliminating geographical barriers.

Boost your revenue while adding an extra layer of convenience to your international remittance services. Ensure instant, secure, and efficient cross-border transactions and bill management.

- Support multiple bill types

- Enhanced customer loyalty

- Expanded service reach

CROSS BORDER REMITTANCE

We offer features beyond your expectations!

Commitment to ensure robust security and compliance

- AML screening

- PCI SSF compliant

- Strong authentication

- Periodic web pentesting

- Anomaly detection & prevention

- Advanced encryption algorithm

- Periodic SAST, DAST, SCA scans

- Straight forward authorization rules

- Secure data capture

- Robust 256-bit encryption

- Parameter-level validation

- Stringent data retention policies

- Periodic VAPT to the web server

- URL copy prevention

- Session Management

- Malware Protection

Flexible deployment models designed for you!

License model

Get complete control and flexibility! Easily deploy the international remittance solution within your own infrastructure. Enjoy the benefits of a one-time licensing fee and customize the solution to your specific needs.

SaaS model

Get the SaaS version of the solution with a cloud-based remittance-as-a-service. Experience rapid implementation, automatic updates, and cost-efficient scalability, all with no infrastructure maintenance on your end.

Why DigiPay.Guru is the perfect solution for your business.

Get everything you need to grow as an international remittance business brand. A solution designed to make your business shine and customers satisfied.

Frequently asked questions

Our international remittance solution supports multiple currency corridors, which allows you to handle transactions across various currencies seamlessly.

You can customize the corridors according to your business needs and market demands, thereby ensuring that you can offer flexible and efficient remittance services to your customers in any region.This feature allows you to easily configure rates and add as many rate providers as you want so that your business can remain profitable even when currency values change.

This flexibility helps you control profitability and offer competitive rates to your customers while maintaining your desired profit margins.

This streamlines the reconciliation process, reduces manual errors, and simplifies accounting while making it easier to manage and track transactions across various currencies.

Read our insightful blogs!

Stay updated with the latest trends and innovations in finTech with our insightful blogs.