That’s true! As with eKYC, customer onboarding, and identity verification have skipped a few decades. It has become fully automated with advanced security and uses advanced technologies to keep your customers safe & satisfied.

Be it digital banking or customer onboarding for any financial business, eKYC has eliminated the traditional ways of KYC - manual processes, human errors, and unsafe onboarding. This has given rise to the importance of E-KYC in global financial services.

In fact, the global eKYC market is projected to reach $ 2792 billion by the year 2030. This stat further emphasized how important eKYC is in the global financial sector.

In this blog post, you will discover:

- What is eKYC and its key components

- The reasons why eKYC is important

- Benefits of eKYC in financial services

- Challenges and solutions in implementing eKYC, and

- How DigiPay.Guru can help?

Let’s begin with its meaning and key components!

eKYC and its key components

Before we dive further into the reasons explaining the importance of eKYC, let’s get you a clear picture of the basics:

What is E-KYC?

eKYC is a process of digitally verifying the identities of your users. This process enables you to onboard your customers quickly and securely without the need for physical presence and documentation.

Key components of eKYC

But what exactly makes up an eKYC system? Let's break it down:

An AI-powered feature that captures live selfie videos to identify the user's identity and detect any potential identity theft or fraud through spoof attacks.

Document verification:

This process authenticates the validity of identity documents like passports, driver's licenses, or national ID cards. It utilizes OCR technology to extract necessary data accurately for comparison with the original document

Address verification:

Confirming the customer's residence through digital means, often using utility bills or official correspondence to ensure that the person you onboard is real & legitimate.

AML screening:

Checking the customer against various watchlists and politically exposed persons (PEP) lists to comply with Anti-Money Laundering regulations. And to prevent financial crimes, compliance issues & security breaches.

Biometrics:

Using unique physical characteristics like fingerprints or iris patterns for additional identity verification.

By integrating these key components, eKYC creates a robust system that significantly enhances your ability to verify customer identities accurately and efficiently.

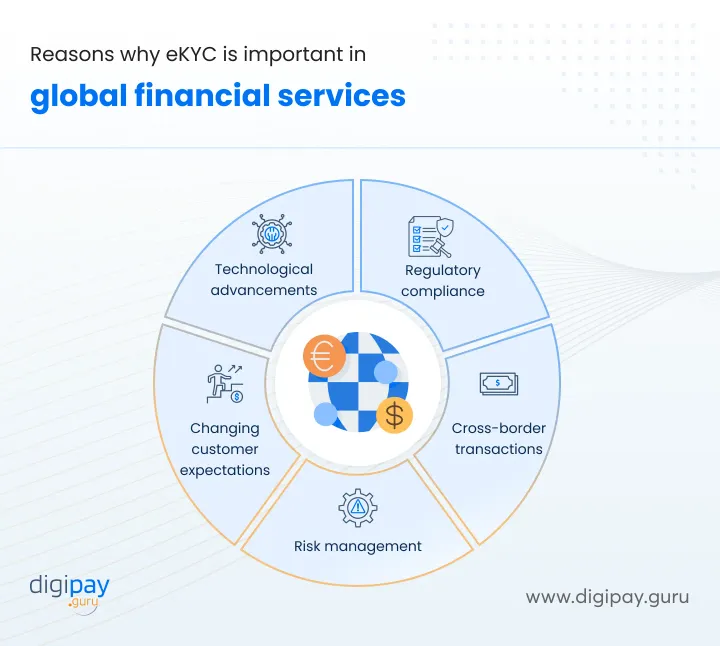

Top reasons for the increasing importance of eKYC in global financial services

Now, you are aware of the basics and the key components that make up an eKYC system. But why has it become so crucial?

Let’s explore the top reasons why eKYC solution is important in global financial services.

Regulatory compliance

Where there are financial services involved, the rules and regulations have always been stricter. And meeting all the compliance and regulation rules is tougher.

eKYC makes this complex compliance needs an easily achievable task. It helps you adhere to global regulations like AML, CTF, and KYC standards, and thereby prevent fraud.

Read More: How to prevent fraud and stay KYC & AML compliant

Cross-border transactions

As your business expands globally, eKYC becomes undeniably important. Why? Because it offers secure and efficient cross-border transactions by providing a standardized approach to eKYC verification no matter what country you expand your operations to.

This approach streamlines your operations and opens up new markets and opportunities for growth.

Risk management

With the money movement becoming digital, the risk of fraud, money laundering, and identity theft are more prevalent than ever. Here, eKYC serves as your first line of defense.

By implementing robust identity verification processes and advanced AML checks, you can protect your business and your customers from these risks and stay competitive in the market.

Changing customer expectations

A customer’s first demand is always “ speed and convenience”. They want to open accounts, apply for loans, and make transactions in just a few seconds while standing in any corner of the world.

Well, with eKYC services it's actually possible! eKYC enables you to meet these expectations by providing a smooth & digital onboarding process that can be completed in seconds.

Technological advancements

The three key technological advancements that are shaping the future of eKYC:

AI & ML:

To power advanced pattern recognition and anomaly detection in eKYC processes for faster and more accurate verification of documents and identity checks.

Blockchain technology:

Decentralized and tamper-proof ledger for storing and sharing verified KYC data to enhance security and enable seamless data sharing.

Biometrics:

Uses unique physical characteristics like fingerprints or facial features for identity verification to add an extra layer of security to the eKYC process.

Benefits of eKYC solution for financial businesses like yours

With an understanding of the importance of eKYC for your business. Now you need to think about implementing an eKYC solution.

This implementation can transform your business and bring numerous benefits that can give you a competitive edge in the market.

Let's explore how eKYC can positively impact your business:

Seamless onboarding

With eKYC, the need for traditional and lengthy paperwork is eliminated. It offers digital onboarding that is quick, reliable, and can be done in a few simple steps.

So, your customers can complete the verification process in seconds or minutes. This leads to a seamless onboarding experience for the customers, higher conversion rates, and customer satisfaction.

Cost efficiency

The automated KYC process reduces the manual work and so reduces the operational costs associated with it. This leads to savings on:

- Paperwork & storage

- Staff time spent on manual checks

Improved customer experience

Customers appreciate speed and convenience. eKYC allows them to open accounts or access services quickly and easily with a user-friendly interface and automated processes. This enhances your customers’ overall experience with your solution and business.

Scalability & flexibility

As your business grows, the eKYC platform grows with you. It's easily scalable to handle increasing volumes of verifications and transactions without compromising on speed or accuracy. Plus, it's flexible enough to adapt to changing regulations and market conditions.

Simplified compliance

eKYC automates many compliance processes and follows AML screening and checks to ensure compliance at all costs. This, in turn, reduces the risk of human error and ensures consistent application of verification standards.

Operational efficiency

Automating the KYC process frees up your staff to focus on more value-added tasks. This leads to improved productivity and better resource allocation within your business.

Enhanced competitive advantage

By offering a frictional digital customer onboarding experience, you can outshine your competitors. The eKYC features like face verification, document verification, and address verification add extra value to your eKYC system with - security and speed.

This can help you attract and retain tech-savvy customers who value convenience and innovation.

Global reach and expansion

eKYC facilitates easier expansion into new markets by providing a standardized approach to customer verification across different regions and jurisdictions.

Data accuracy and consistency

Digital KYC and its robust capabilities ensure that customer data is captured accurately and consistently. And so verification is done with zero errors. This improves the quality of your customer database and enables better decision-making and risk assessment.

Challenges and solutions in implementing eKYC

While the benefits of eKYC are clear, implementing such a system comes with its own set of challenges. However, you can overcome these challenges effectively, with the right solutions.

Let's explore some common challenges in implementing eKYC and their potential solutions by DigiPay.Guru:

Data privacy and security

Challenge: Ensuring the protection of sensitive customer data against breaches and cyber attacks.

Solution: Implement advanced encryption techniques, secure data storage protocols, and regular security audits.

DigiPay.Guru’s eKYC solution prioritizes data security, using robust encryption techniques, and following best practices in data protection to keep your customers' information safe.

Integration with legacy systems

Challenge: Difficulty in integrating eKYC solutions with existing legacy systems and infrastructure.

Solution: Utilize API-driven solutions and middleware to enable seamless integration.

Our eKYC platform at DigiPay.Guru is designed with flexibility in mind. It offers robust APIs that can easily connect with your existing systems.

Regulatory variations

Challenge: Keeping up with different regulatory requirements across various jurisdictions (countries).

Solution: Employ a flexible, modular eKYC platform that can be customized to meet regional regulatory standards.

DigiPay.Guru's eKYC solution is built to be adaptable to varied regulatory standards. Hence it allows you to configure the system to comply with different regulatory environments.

User adoption and experience

Challenge: Ensuring a user-friendly experience that encourages customer adoption of eKYC processes.

Solution: Design intuitive interfaces and provide clear guidance throughout the eKYC process.

Our platform focuses on user experience while offering a smooth & step-by-step verification process along with a user-friendly interface that your customers will find easy to navigate.

High implementation costs

Challenge: The initial investment required for implementing eKYC solutions can be high.

Solution: Evaluate and choose scalable solutions that offer a good balance between cost and functionality.

DigiPay.Guru offers flexible pricing models and a phased implementation approach to help manage costs effectively. We also offer a SaaS version of the eKYC solution to save up by paying for only what you use.

Technical expertise

Challenge: Lack of in-house technical expertise to implement and maintain eKYC systems.

Solution: Partner with experienced eKYC solution providers and consider training programs for internal teams.

At DigiPay.Guru, we provide the advanced technologies needed for building an eKYC solution. And offer comprehensive support and training to ensure your team can effectively manage the eKYC system.

Conclusion

eKYC solution is not just a domestic need, but a global phenomenon now! You can leverage the power of a robust eKYC solution to ensure reliable and secure identity verification while onboarding your customers.

Its growing importance can also be attributed to how it streamlines the entire eKYC process and makes it smooth as silk for your customers. It automates verifications, streamlines onboarding, and ensures security & compliance every step of the way.

DigiPay.Guru offers an automated eKYC solution to make your business fast, reliable & safe for your customers. It offers advanced features like face verification, document verification, address verification, AML screening, 2FA, EDD, eIDV, and more, so that you can rule the global financial services.