In an era where the digital landscape continues to expand at an unprecedented pace, ensuring secure and streamlined customer onboarding has become an absolute necessity for businesses. However, electronic Know Your Customer (eKYC) solutions—are a game-changer in the quest for efficient and compliant identity verification.

According to the study by Polaris Market Research, the global e-KYC market, with a valuation of USD 447.53 Million in 2021, is projected to witness a significant growth rate of 22.0% throughout the forecast period until 2029.

So, it's pretty clear that organizations worldwide are recognizing the transformative power of these cutting-edge solutions. But with a plethora of options available, how do you choose the right eKYC solution that aligns perfectly with your business goals?

In this comprehensive guide, we will discuss eKYc solutions, their types, and factors to consider while choosing an eKYC solution and demystify the process of choosing it. So let’s spill the beans.

Understanding eKYC Solution

So before we start and get deeper into understanding the factors for choosing the right eKYC solution for your business, let's clear the basics and the importance of eKYC.

What is an eKYC Solution & How Does It Work?

Simply put, an eKYC solution is a digital system that enables businesses to verify the identities of their customers electronically. It eliminates the need for cumbersome paperwork and physical presence, making the process faster and more convenient for both businesses and customers.

The eKYC process typically involves the following steps:

- Customer Data Capture: The customer provides their personal information digitally, which may include government-issued ID details, biometric data, or other relevant documents.

- Data Extraction: The e-KYC solution employs advanced algorithms to extract and validate the information from the provided documents.

- Document Authentication: The system verifies the authenticity of the submitted documents by comparing them against trusted databases or using advanced verification techniques such as optical character recognition (OCR) and facial recognition.

- Risk Assessment: The solution analyzes the customer's data and assigns a risk score based on predefined parameters and compliance requirements.

- Decision Making: Based on the risk assessment, the system approves or rejects the customer's application, allowing businesses to make informed decisions swiftly.

Importance of Implementing eKYC Solution

I believe that eKYC solutions have revolutionized the way businesses verify customer identities. The seamless integration of technology and compliance measures has streamlined processes and enhanced customer experience. -John Smith, Chief Technology Officer at Osttra

The quote above defines, how important it is to implement an eKYC solution. It brings numerous benefits of eKYC solution to businesses, including:

- Enhanced Customer Experience: By eliminating the need for physical paperwork and in-person verification, eKYC significantly speeds up the onboarding process, reducing customer frustration and abandonment rates.

- Improved Security: eKYC solutions utilize advanced encryption and security protocols to protect sensitive customer data, reducing the risk of identity theft and fraud.

- Regulatory Compliance: As governments tighten regulations related to customer due diligence and anti-money laundering measures, eKYC solutions help businesses stay compliant and avoid hefty penalties.

- Cost and Time Savings: Automating the identity verification process saves businesses substantial time and resources that would otherwise be spent on manual verification, data entry, and storage.

To illustrate the benefits, consider the example of a fintech startup. By implementing an eKYC solution, they were able to onboard customers remotely in a matter of minutes, resulting in a 40% increase in customer acquisition and a significant reduction in operational costs. This shows that the role of eKYC in financial industry has become significantly more important than before.

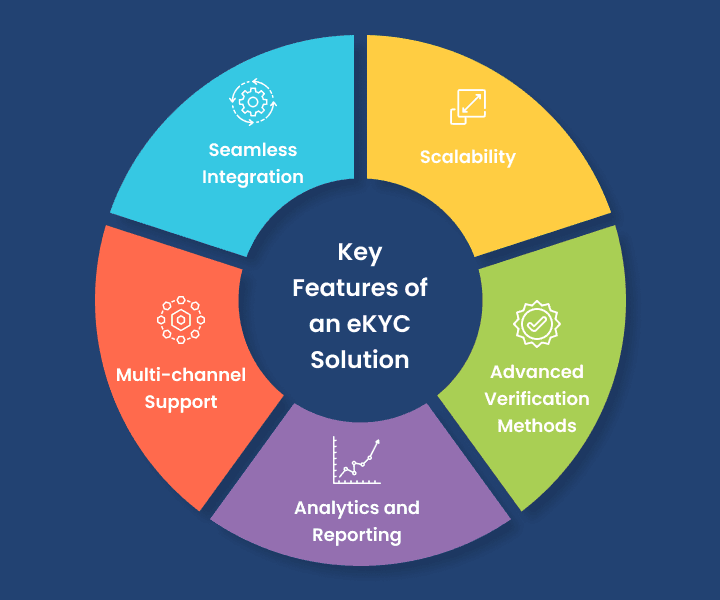

Key Features of an eKYC Solution

Not all eKYC solutions are created equal. When choosing the right one for your business, it's important to consider key features such as:

- Seamless Integration: One feature of eKYC solution says that an effective eKYC solution should integrate smoothly with your existing systems, including customer relationship management (CRM) platforms, onboarding workflows, and compliance databases.

- Scalability: As your business grows, the eKYC solution should have the flexibility to handle increasing transaction volumes and accommodate expanding user bases without compromising performance.

- Multi-channel Support: Customers today expect a choice of channels for onboarding. Look for an eKYC solution that supports multiple channels like mobile, web, and kiosks for a seamless customer experience.

- Advanced Verification Methods: The solution should employ a range of verification methods, including document-based checks, biometric recognition (such as facial or fingerprint recognition), and video-based verification to ensure the highest level of accuracy and security.

- Analytics and Reporting: Comprehensive analytics and reporting capabilities enable businesses to gain valuable insights into their customer onboarding processes, identify bottlenecks, and optimize their operations.

Types of eKYC Solutions

When it comes to electronic Know Your Customer (eKYC) solutions, businesses have a range of options to choose from. Each type of eKYC solution offers unique advantages and caters to different verification needs.

Let's explore the various types of KYC solutions in electric form available in the market, empowering you to make an informed decision.

Document-based Verification

- Document-based eKYC solutions rely on the verification of official government-issued identification documents, such as passports, driver's licenses, or national identification cards.

- These solutions capture the customer's document details, perform authenticity checks, and extract relevant information for verification.

- Document-based eKYC is widely used and provides a convenient and familiar process for customers to verify their identities.

Biometric Verification

- Biometric eKYC solutions utilize unique physiological or behavioral characteristics to authenticate an individual's identity. This can include fingerprint scanning, facial recognition, iris scanning, or voice recognition.

- By capturing and comparing biometric data, these solutions provide a high level of accuracy and security.

- Biometric verification adds an extra layer of protection against identity fraud and is particularly useful in industries where stringent security measures are required.

Read More: Biometric Technology - Enhancing Ease and Security in Digital Payments

Video-based Verification

- Video-based eKYC solutions leverage live or recorded video sessions for identity verification. Customers engage in a video call with a verification agent or an automated system.

- During the session, the agent may ask the customer to perform specific actions, answer questions, or display their identification documents.

- Video-based verification adds a human touch to the process, allowing businesses to verify identities remotely while ensuring a higher level of trust and accuracy.

Hybrid Solutions

- Hybrid eKYC solutions combine multiple verification methods to create a comprehensive and robust identity verification process.

- These solutions leverage a combination of document verification, biometric recognition, and video-based verification to enhance accuracy, security, and user experience.

- Hybrid solutions are often preferred by businesses that require a highly customizable and adaptable eKYC process.

Industry-specific Solutions

- Some eKYC solutions are tailored to specific industries, addressing their unique compliance and verification requirements.

- For instance, the financial sector may require additional features such as fraud detection algorithms, transaction monitoring, and enhanced due diligence.

- These industry-specific solutions ensure regulatory compliance while meeting the specific needs of the respective sector.

Factors to Consider When Choosing eKYC Solution

Selecting the right electronic Know Your Customer (eKYC) solution is a critical decision for businesses seeking efficient and secure identity verification processes. To make an informed choice, it's essential to consider several key factors.

Let's explore these factors as key considerations for choosing eKYC solution that perfectly aligns with your business requirements.

Compliance and Security

Ensuring compliance with regulations and maintaining robust security measures is paramount. Look for an eKYC solution that adheres to industry standards and complies with data protection regulations such as GDPR or KYC norms. Choose a solution that employs encryption, secure data transmission protocols, and strong access controls to protect sensitive customer information.

For example, a financial institution requires an eKYC solution that complies with Anti-Money Laundering (AML) regulations. The chosen solution must have built-in AML checks and automated fraud detection mechanisms to ensure compliance while safeguarding customer data.

User Experience

A seamless and user-friendly experience is crucial for customer satisfaction. Opt for an eKYC solution with an intuitive interface, clear instructions, and minimal steps required for verification. Mobile-friendly options are also important, as they cater to the growing number of customers accessing services via smartphones.

Let’s say for example, a telecom company wants to onboard new customers swiftly and effortlessly. One of the best practices for e-kyc solution is implementing it with a user-friendly mobile application, customers can easily upload their identification documents and complete the verification process within minutes.

Integration and Scalability

Consider the compatibility of the eKYC solution with your existing systems. It should seamlessly integrate with your customer relationship management (CRM) platform, compliance databases, and other relevant software. Additionally, ensure that the solution can scale to accommodate your future growth and increase verification volumes.

For instance, an e-commerce platform experiences rapid growth and needs an eKYC solution that can handle a surge in customer verifications without compromising performance. The chosen solution integrates seamlessly with their CRM and scales effortlessly to meet the growing demand.

Automation and Efficiency

Look for an eKYC solution that offers automation and real-time verification capabilities. Automated processes reduce manual intervention, minimize errors, and accelerate the verification turnaround time. Real-time verification enables immediate decisions, enhancing the overall customer experience.

The digital lending platform requires instant verification to provide quick loan approvals is one such example. By implementing an eKYC solution with automated processes and real-time verification, the platform can offer customers instant loan decisions, resulting in faster and more efficient services.

Reliability and Accuracy

Accuracy in identity verification is crucial to prevent fraud and maintain trust. Choose an eKYC solution that relies on reliable data sources, advanced verification techniques, and strong algorithms to ensure accurate results. Consider the solution's track record and reputation for reliability.

For example, an online marketplace wants to verify the identities of sellers to ensure a safe and trustworthy platform. They opt for an eKYC solution with a reputation for accuracy, leveraging AI-powered algorithms and extensive data sources to validate seller identities.

Cost and Pricing Models

Consider the cost implications of implementing an eKYC solution. Evaluate different pricing models, such as per-transaction or subscription-based pricing, to determine the most cost-effective option for your business. Take into account both upfront costs and long-term expenses.

For instance, a startup with a limited budget needs an eKYC solution that offers a flexible pricing model to match its growing customer base. They choose a solution with a subscription-based model, allowing them to scale their verifications without incurring excessive costs.

The Geographic Coverage

Consider the geographic coverage of the eKYC solution. Ensure that it supports the regions where your business operates or intends to expand. Verify if the solution can handle diverse identification documents and verification requirements specific to different countries or regions.

For instance, an international financial institution requires an eKYC solution that can verify identities across various countries. They choose a solution that supports a wide range of identification documents and verification processes specific to each country, ensuring seamless global coverage.

Vendor Evaluation

Evaluate the reputation, experience, and customer reviews of the e-KYC solution provider. Consider their expertise in the industry, customer support capabilities, and commitment to research and development. A reliable and trusted vendor is crucial for a successful eKYC implementation.

Let’s say a healthcare organization selects an eKYC solution provider with extensive experience in the healthcare sector. The chosen vendor has a proven track record of successfully implementing eKYC solutions for similar organizations, ensuring a smooth and tailored implementation process.

How to Choose the Right eKYC Solution Provider for Your Business

In today's fast-paced digital world, the importance of efficient and secure identity verification cannot be overstated. Electronic Know Your Customer (eKYC) solutions have emerged as a vital tool for businesses seeking streamlined customer onboarding and regulatory compliance.

With numerous eKYC solution providers in the market, selecting the right one can be a daunting task. This guide aims to simplify the process by outlining the key steps to consider when choosing an eKYC solution provider.

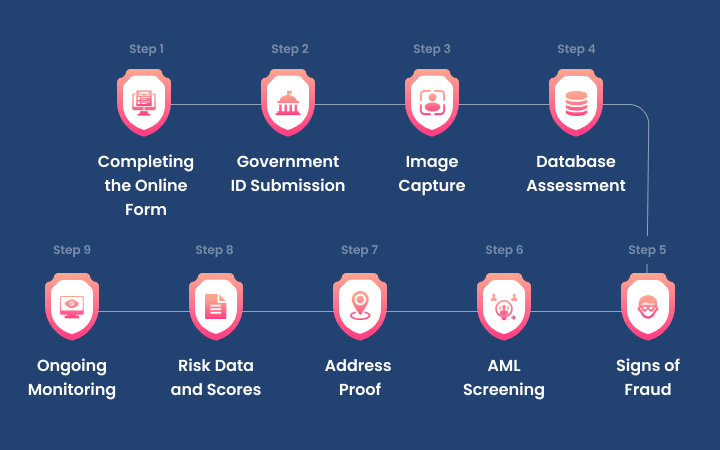

Step 1: Completing the Online Form

The first step in the eKYC process is the completion of an online form. A user-friendly and intuitive interface that guides applicants through the form submission is crucial.

Look for a solution provider that offers customizable forms to align with your specific requirements and branding, ensuring a seamless and professional user experience.

Step 2: Government ID Submission

The eKYC process requires individuals to submit their government-issued identification documents. An effective eKYC solution provider should support a wide range of document types and possess advanced OCR (Optical Character Recognition) technology.

This technology ensures accurate data extraction from the uploaded documents, eliminating manual errors and enhancing the overall efficiency of the verification process.

Step 3: Image Capture

To prevent impersonation and ensure a higher level of security, the inclusion of a selfie in the eKYC process is essential. The solution provider should have robust facial recognition capabilities to compare the individual's face with the photo on the submitted ID. This step adds an extra layer of authentication and protects against fraudulent activities.

Step 4: Database Assessment

An ideal eKYC solution provider should have access to comprehensive databases for real-time verification. They should conduct thorough checks against trusted sources, such as government databases, to verify the authenticity of the submitted information. This step aids in identifying any discrepancies and ensures the accuracy of the verification process.

Step 5: Signs of Fraud

A reliable eKYC solution provider should employ advanced algorithms and machine learning techniques to detect potential fraud signals. They should have sophisticated fraud detection mechanisms in place to identify suspicious patterns, anomalies, or inconsistencies in the submitted data. This proactive approach helps prevent fraudulent activities and safeguard your business.

Step 6: AML Screening

Compliance with Anti-Money Laundering (AML) regulations is crucial for businesses across various sectors. An eKYC solution provider should offer robust AML screening capabilities, which involve checking individuals against global watchlists and sanction databases. This step ensures compliance with regulatory requirements and helps mitigate the risk of engaging with individuals involved in illicit activities.

Step 7: Address Proof

Verifying an individual's address is another crucial aspect of the eKYC process. The solution provider should support the submission and verification of proof of address documents, such as utility bills or bank statements. This helps establish the credibility of the applicant and ensures compliance with address verification requirements.

Step 8: Risk Data and Scores

A competent eKYC solution provider should possess a vast repository of risk data and provide risk-scoring capabilities. By utilizing risk pools, which consist of historical data on fraud patterns and suspicious activities, the solution provider can accurately assess the risk associated with each applicant. This enables businesses to make informed decisions and identify potential risks before they escalate.

Step 9: Ongoing Monitoring

Choose an eKYC solution provider that offers ongoing monitoring capabilities beyond the initial verification process. Continuous monitoring of customer profiles and activities helps detect any changes in risk profiles over time. By employing an automated monitoring system, businesses can stay updated on any potential threats or changes in customer behavior.

Conclusion

Choosing the right eKYC solution for your business is a critical decision that can greatly impact your operations, customer experience, and overall success. By understanding the importance of eKYC solution, exploring the types of solutions available, and considering key factors such as compliance, user experience, integration, automation, reliability, cost, and vendor reputation, you can make an informed choice that aligns with your specific needs.

At DigiPay.Guru, we offer an advanced eKYC solution designed to streamline your identity verification process. With our robust features, including document verification, biometric recognition, video-based verification, and comprehensive compliance checks, we provide a seamless and secure verification experience for your customers. Our solution is scalable, integrates seamlessly with your existing systems, and ensures regulatory compliance.