Digital and technological advancements marked the beginning of the use of technology for finance management. In 1967, the introduction of an ATM by Barclays was a step towards justifying it. As a result, the word “financial technology” (fintech) came into existence.

Post that, the meaning of fintech kept evolving, but in a good way! The more technological advances, fintech rose to the occasion. Now, it has become a global phenomenon. It's omnipresent from banking to remittances.

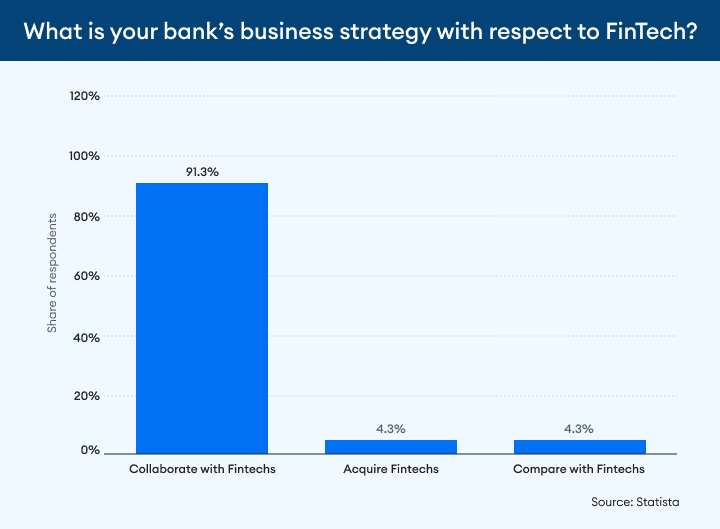

According to research by Globe Newswire, the fintech market size is expected to grow to US $16652.68 billion by 2028. This stat indicates a tremendous scope of fintech. On top of that, fintech has been a boon for banks. The banks like you have started adopting fintech in banking industry to provide the best banking services to your customers. Another study by Statista revealed that around 91.3% of the banks consider collaborating with fintech.

All in all, fintech solutions have the potential to transform the banking industry.

In this blog post, you will explore the challenges of traditional banking, the benefits of fintech solutions for banks, and the top fintech solutions that are transforming the banking industry.

So, let’s drown deep into the bank’s perspective of fintech solutions!

What is Traditional Banking?

Traditional banking is confined to its old systems, physical branches, and time-consuming processes. It’s often paper-based and involves human intermediaries for most transactions. Customers typically have to visit a branch for various services, from opening accounts to applying for loans.

These banks offer outdated and costlier services compared to the current technological discoveries. It shows limited growth and a poor customer experience which leads to unsatisfied customers.

Plus, they also have too many risk factors like poor security, high chance of data breach, and safety of money. And are finding it challenging to meet the needs of tech-savvy consumers who demand seamless, instantaneous services.

Enhance the banking experience with our advanced digital payment solutions.

What is a fintech solution in the banking industry?

Now that we know what traditional banking looks like, let’s define what is fintech in banking industry.

A fintech solution in the banking industry includes the use of technology to streamline financial services. From mobile banking to e-wallets, fintech makes banking more efficient, accessible, and user-friendly.

Fintech solutions are changing the way banks like you operate and how your customers interact with them. The ultimate goal of this is to provide faster, cheaper, and more secure banking services.

What are the Banking Issues that Led to the Fintech Revolution

Traditional banks have faced many challenges in the past. Then, fintech brought finance and technology together to make a positive change in the conventional banking sector.

Due to this, financial experts and startups started coming forward to support fintech. And hence, a revolution began in the finance and technology sector. This revolution is the “Fintech Revolution.”

With the fintech revolution, major banking issues can be resolved. And the major banking issues that led to the fintech revolution are:

High regulations on every step of banking operations

Banks are strictly regulated by their regulatory bodies. These regulatory bodies need banks to strictly follow the legal requirements & guidelines, compliance norms, and restrictions on the banking operations.

The main purpose of these strict regulations is to keep your customers’ funds and personal information secure. Hence, the banks can avoid lesser customer base, outdated customer services, and limited growth.

But with fintech, you get more agile systems which helps you stay compliant while also lowering the operational costs. Also, governments and regulators in most countries have started promoting fintech in the banking industry which indicates a better growth potential than traditional banks.

The incurrence of huge operational costs

Traditional banks need to have physical branches to provide their banking services to customers. This needs a huge capital requirement to set up and then maintenance & staffing costs only add up to the cost.

But, with the advent of fintech, banks do not require a physical branch to provide their services. All the banking services can be accessed just with a few taps on a mobile phone using the internet. Hence the operations are streamlined and your system becomes cost-effective.

Lack of technological advancements in the old systems

Banks are still not up-to-date with the technology and are struggling with legacy banking systems. These systems are generally following old ways of banking. And so the operations plus backend processes functioning on this system are also outdated.

The old systems restrict the bank's ability to meet the demands of modern consumers, improve its framework, and quickly deliver new services or products. This leads to inefficiencies, security vulnerabilities, and poor customer experiences.

Fintech in banking industry, on the other hand, is making banking services easily accessible for every banking customer by using the latest technologies and automation. Fintechs also help provide higher quality & secure services in less time and with fewer errors.

Increase in poor customer experience

Customers today want personalized, seamless, and instant banking services. Traditional banks are incapable of providing these services to your customers.

The reason is that it offers a poor customer experience. Here’s how:

- Customers need to be present in person

- They need to fill out large chunks of documentation

- Withdrawal and deposit is time-consuming

As a result, traditional banking systems can be less convenient for customers and may yield an unsatisfactory customer experience.

On the contrary, fintech is more accessible and flexible. They function virtually, so the need for visits and large documentation is eliminated. Hence, the customers find it a time-saving, easy-to-use, and more convenient option.

Increased concerns about data security

Traditional banks have primary concerns about security and transparency. The transactions are done by the people sitting at the bank counters. Hence, users fear money theft and loss of personal information as it is challenging to keep physical documents and cash safe.

With fintech and online banking, the documents and money are safe and the user data is secure with high-security standards. Also, there are various options for extra layer security, like two-factor authentication, data encryption, and biometric verification.

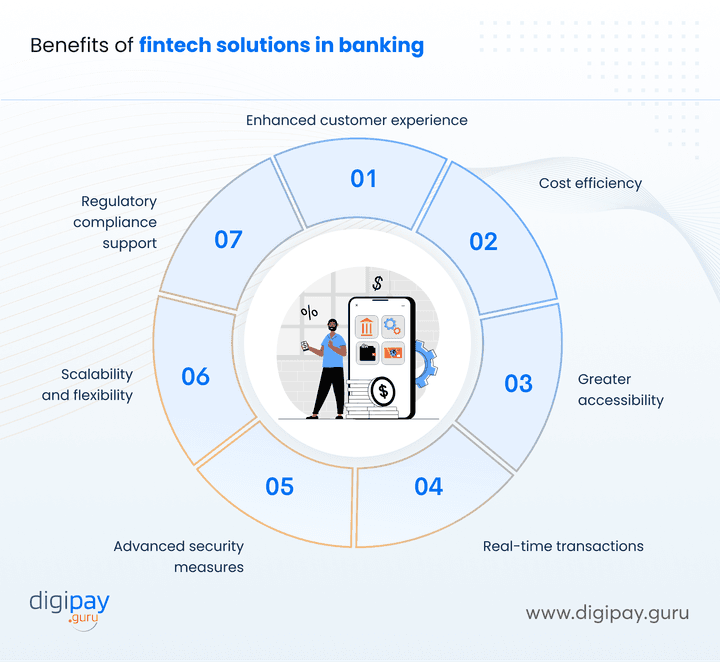

What are the advantages of fintech’s banking solutions?

Fintech is not just a word in the air now. It comes with numerous benefits that makes it the need of the hour for both your bank and your customers.

Let’s take a look at the advantages of fintech banking solutions:

Enhanced customer experience

Fintech in banking industry improves the customer experience by providing more personalized, faster, and more convenient services. With fintech, customers can access services on their phones, anytime and anywhere.

This makes banking more convenient and user-friendly. From checking account balances to making payments, everything becomes faster and easier.

Cost efficiency

Fintech reduces the high operational costs associated with traditional banking. It cut down the huge costs of running physical branches and maintenance of the legacy systems.

By leveraging technology, you can automate tasks, which saves time and money. This allows you to focus on more important services.

Greater accessibility

With financial technology solutions for banks, access to financial services is no longer limited to those who can physically visit a branch. They can access services through mobile banking apps, e-wallets, or other online platforms.

This is especially helpful for customers in remote areas or those with limited access to banks, as it makes financial services accessible anytime, anywhere.

Real-time transactions

Gone are the days of waiting for days to complete transactions. Fintech allows for real-time transactions. Your customers can send and receive funds instantly which improves efficiency for both your bank and your customers. This fast service builds trust and satisfaction with your customers.

Advanced security measures

Fintech solutions are built with advanced security measures, such as encryption, multi-factor authentication, tokenization, and more.

These security features and tools help you protect sensitive data and prevent fraud. By using digital banking services, powered by fintech, your customers feel secure.

Scalability and flexibility

Fintech solutions for banks are scalable and flexible. This allows you to quickly adapt to changing market demands.

Plus it also allows you to easily add new services/features or expand to the new markets. This flexibility makes it easier to meet customer needs and adapt to changes in the industry.

Regulatory compliance support

Fintech solutions help you adhere to complex regulations and compliance standards. This ensures you can stay compliant while reducing the burden of manual processes.

Plus, with tools like RegTech, you can also automate compliance tasks and avoid hefty penalties.

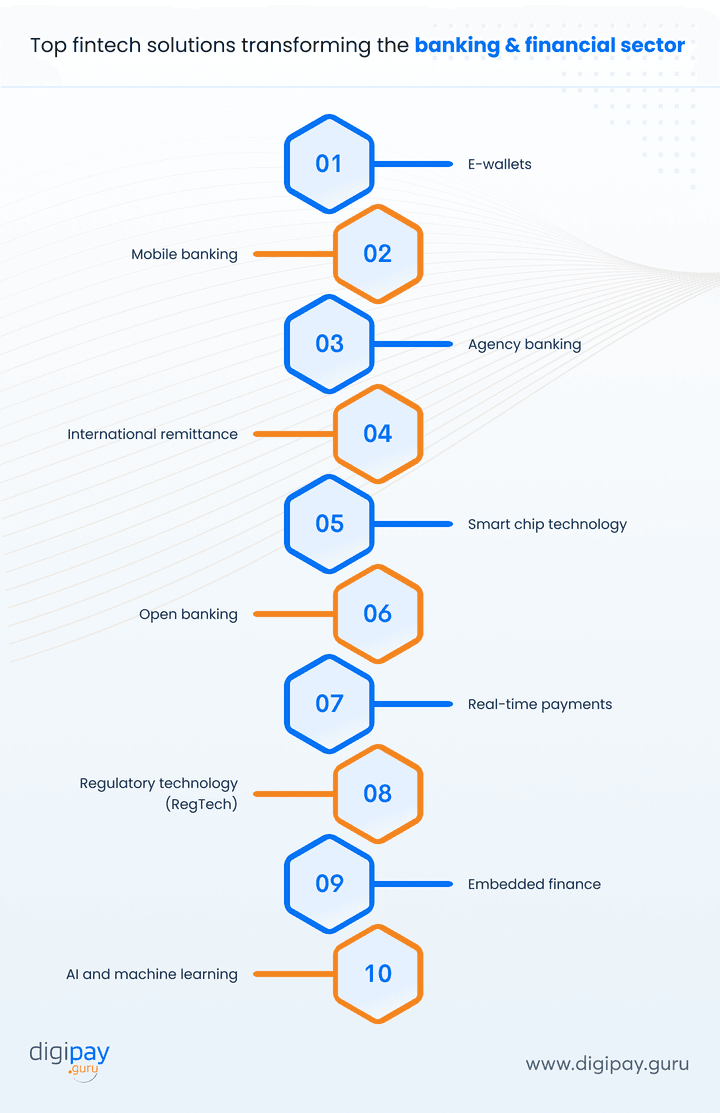

Top fintech solutions transforming the banking & financial sector

Now, you know how top fintech solutions are beneficial for your banking services. Let’s discover which are the top fintech solutions that are transforming the banking and financial sector:

E-wallets

E-wallets are one of the most popular fintech solutions. E-wallets are electronic wallets used to make online payments with a smartphone. The user can link their bank accounts by adding the card details to the wallet to enjoy its services.

Apart from that, e-wallets are gaining immense popularity in financial services. This indicates a major growth potential for banks. So, it is a must-have fintech solution for banks.

Read More: Everything you need to know about electronic payments

E-wallets can be used for opening bank accounts, instant cash-ins, and cash-outs, bill payments, top-ups, P2P transfers, split payments, balance inquiries, booking tickets, scheduling payments, and so on.

Mobile Banking

Mobile banking is banking done with the help of an app on a smartphone. Traditional banks must adopt mobile banking as almost every customer uses a smartphone and the internet.

The app allows the bank to provide banking services just like the traditional bank, but right through the mobile banking app. Mobile banking apps help users with convenient and seamless banking transactions. It also helps the banks in acquiring more customers in less time.

Read More: How Mobile banking Transforming banks across the globe

Agency Banking

Agency banking allows you to extend your banking services without needing to set up a bank branch in the unbanked, underserved and rural areas, with the help of authorized agents. Agency banking is a fintech solution that bridges the gap between banked and unbanked customers.

Through agency banking, your banks can improve customer experience and generate more customers and revenue channels. Also, agency banking helps your customers perform various transactions like cash deposits, cash withdrawals, balance inquiries, top-ups, loan repayments, bill payments, utility bills, taxes, and government fees.

International Remittance

International remittance is a cross-border money transfer that allows your customers to make quick and easy money transfers from one country to another. This service is cost-effective for both - the sender and banks. It also increases customer satisfaction, which in turn plays a vital role in retaining customers.

And, with the growing trends of international migrations, your bank must have an international remittance service in your banking system. This service will help you as an added advantage in increasing financial inclusion, satisfying existing customers, and acquiring new customers.

Empower your business with best-in-class cross-border payment solutions

Smart Chip Technology

Smart-chip technology is a smart-chip embedded ATM card that minimizes security risks and unnecessary misuse. This smart chip functions on One Time Password (OTP) for every transaction. This password is valid for only a single transaction, which makes it more secure than the old magnetic stripe cards.

By adopting smart-chip technology, you can make your customers feel more secure and satisfied while building a sense of trust and responsibility in them.

Open Banking

Open banking is the process of using APIs to share financial data and services with third parties. An open banking platform allows the banks to securely and easily share the user's banking data with third-party businesses via an API.

Also, an open banking platform is a key element connecting your bank with popular fintech apps like peer-to-peer payments, cryptocurrencies, investments, finance management and more.

Real-time payments

With real-time payments, funds are transferred instantly, which ensures that both your bank and your customers can complete transactions without delays. This is essential as these are the demands of modern customers.

Regulatory technology (RegTech)

RegTech solutions help your bank comply with regulations and other regulatory standards by automating tasks like reporting, risk management, and fraud detection. This reduces human error and ensures compliance with minimal effort.

Embedded finance

Embedded finance refers to integrating financial services into non-financial products. For example, buy-now-pay-later options on e-commerce platforms are a form of embedded finance. This allows banks like yours to reach customers where they already are

AI and machine learning

AI and machine learning are transforming the banking industry by automating tasks, predicting trends, and personalizing services. These technologies help you understand customer behavior, improve fraud detection, and enhance customer support.

Fintech: Future of Banking

Today, fintech and banking can co-exist. So, the banks are in a transition stage and are transitioning from traditional banking to advanced technological ways of banking. This has become possible because of the fintech revolution.

And, once these banks fully transform and completely adopt the fintech environment, their future is going to be brighter than ever. The future of banking holds financial inclusion, advanced security frameworks, big data & cloud technologies, APIs, AI ML financial management, 5G-powered financial services, and much more.

The Conclusion

The fintech revolution has transformed the banking industry in unprecedented ways. Today, fintech is more of a facilitator or a partner rather than a competitor for banks. They aim to work in synergy to bring a positive difference in the financial ecosystem.

With its ability to improve customer experience, reduce operational costs, enhance security, and ensure regulatory compliance, fintech offers enormous benefits for you. The above-discussed top fintech solutions are not just trends—they’re essential tools for staying competitive in a rapidly changing industry.

Moreover, the partnership between the banks and fintech will resolve all the issues faced by traditional banks. Thus, banks and fintech together will create a big impact on both fintech and banking industry as a whole.

So, you are a bank, looking to embrace fintech solutions, DigiPay.Guru is just the right place for you. We, at DigiPay.Guru, offer the best-in-class digital fintech solutions for banks. You can transform your banking operations with our innovative digital fintech solutions for a seamless, secure, and efficient payment experience.