Banking is no longer about just holding money. It's about creating seamless, customer-centric experiences. Customers now demand instant, secure, and hassle-free banking solutions. If banks fail to meet these expectations, customers won’t think twice before switching to fintechs or neobanks or your other competitors.

The pressure is real. But banks are fighting back with digital-first strategies, AI-powered interactions, hyperpersonalization, and more. However, to keep up with the customer expectations, they must be on their toes all the time.

With banking going digital at lightning speed, the banks are now transforming the customer experience for their customers. But, how?

This blog post will help you uncover:

-

What is customer experience in banking and the customer expectations from banks

-

The CX challenges banks must overcome to stay competitive

-

10 ways to improve customer experience in banks

-

How banks are transforming customer experience with digital payment solutions

-

Top 5 banking customer experience trends for 2025 and more…

Let’s begin with a basic understanding of customer experience in banking.

What is customer experience (CX) in banking?

The customer experience (CX) in banking refers to the overall journey a customer goes through when interacting with a bank. It’s not just about providing services—it’s about delivering a smooth, personalized, and efficient experience across all touchpoints.

This customer experience can either get better or worse depending on how the customer feels after receiving a service or along the journey.

Due to this, almost all major banks are pouring enormous resources into transforming their customer experience. But results are not always positive.

However, banks that master customer experience management in banking build loyalty, improve retention, and drive business growth. Hence, today CX is the key differentiator in an industry where competition is fierce.

What are the customer expectations from banking institutions?

Apart from a smooth service, customers expect their banks to understand their specific requirements and needs to offer them customized offers.

Regardless of the country or continent, customers expect their banks to create an experience that encourages their needs, builds trust, provides tailor-made services, and exceeds their expectations.

Below are the top customer expectations that they expect from a digital banking experience.

Easy accessibility

Regardless of the type of service or need, your customer should not feel the need to rush to the nearest bank branch. For that, your bank should offer your customers access to all services anywhere and anytime via a digital platform.

Real-time assistance

Of all industries, customers of the banking industry need more real-time assistance. Almost 72% of customers say instant customer support is vital in building customer loyalty.

You can seamlessly provide real-time assistance using chatbots, AI-ML tools, automated digital onboarding, and more to up your support game.

Personalized services

No two customers' requirements are the same. Customers always look for customized plus tailor-made services and products that match their current requirements.

By identifying the critical business drivers, you can seamlessly offer tailored support that will assist in customer experience transformation in banking.

Data security

Data security is one of the crucial aspects, especially for banks. No matter who your customers are, they want to feel secure and safe as they share sensitive information with the bank.

You need to offer robust security features like multi-factor authentication, tokenization, biometrics, and more. Plus, you should build trust to retain a healthy, long-term customer relationship.

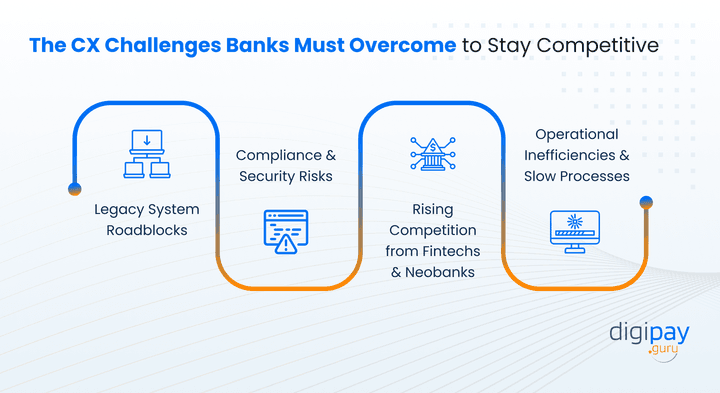

The CX Challenges Banks Must Overcome to Stay Competitive

Banks like you must address several challenges to improve the CX in banking:

Legacy System Roadblocks

Outdated banking infrastructure creates friction in digital transformation, which makes it difficult to offer fast, seamless services. Many banks still rely on decades-old core banking systems that lack flexibility.

o compete with fintechs, banks must invest in modern, agile, and cloud-based solutions that enable real-time transactions and personalized banking experiences.

Compliance & Security Risks

Striking a balance between regulatory compliance and a seamless CX is a challenge for banks. While strict regulations protect customers, they often lead to lengthy verification processes and complex onboarding.

Banks must adopt AI-driven compliance tools and eKYC solutions to ensure security while offering a frictionless customer journey.

Rising Competition from Fintechs & Neobanks

Fintechs and neobanks are rapidly transforming the banking landscape by offering faster, digital-first services with a superior user experience. Their agility allows them to innovate quickly, which leaves traditional banks struggling to keep up.

To compete, banks must embrace digital transformation, streamline processes, and deliver hyper-personalized services.

Operational Inefficiencies & Slow Processes

Long processing times, outdated workflows, and manual intervention create frustration for customers. But consumers expect instant loan approvals, quick fund transfers, and seamless account management.

So, banks must integrate automation, AI-powered decision-making, and real-time processing to enhance efficiency and reduce bottlenecks.

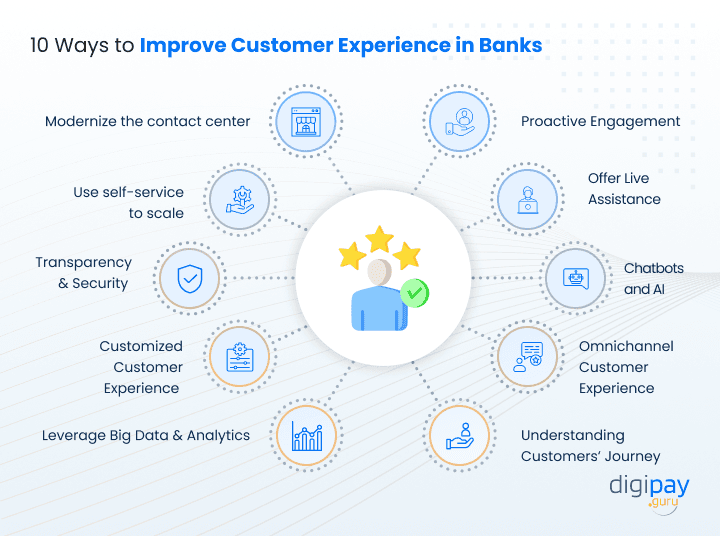

10 Ways to Improve Customer Experience in Banks

Offering a top-notch digital banking customer experience is no cakewalk, especially in today’s modern era. Customer experience is more than enabling customers to open a savings account.

So what should banks do to improve the customer experience?

Here are 10 ways to improve customer experience in banks:

Proactive engagement for improved financial management

Instead of providing customers with the same old location-based offers, you should be able to assist customers with compelling insights so that they can avail products and services faster than ever.

But how to help customers with proactive customer engagement?

Educate customers: Educate your customers on your comprehensive range of products and services and what makes them different and better from your competitors.

Notify customers: Let your customers know their loan status, credit card application, or any other related service. Keep them up to date about all their banking transactions.

Questionnaires and surveys: Collect time-to-time feedback and reviews to identify and understand the gaps between expected service and perceived service.

Offer live assistance

Providing support in real time is a fantastic way to get an in-depth understanding of your customer’s experience. One example of live assistance is video KYC. Real-time assistance can help you in:

-

Identifying even the most minor and insignificant issues

-

Understanding how to enhance the customer journey

-

Finding the pain points of customers and issues they are facing with the bank

-

Knowing your customers better: patterns, services, and more.

Understanding the customers’ experience through their journey can help you identify the touchpoints and provide better customer support consistently. You can offer live assistance to via cutting-edge tools like AI chatbots to solve most of their problems right then and there.

Utilization of chatbots and Artificial Intelligence

Your customers can forget anything, but not the assistance they received in real time. A study suggests that by 2026, chatbot interaction success rates in the banking sector are projected to exceed 90%

Lately, the usage of chatbots and AI is found not only on the digital banking platforms but also in numerous businesses across the globe.

A chatbot is the best and most effective medium that you can deploy to streamline and automate your simple tasks. Such as , mobile banking, checking savings account balance, last three transactions, credit card bill payments, digital money transfers, etc.

Omnichannel customer experience

From websites to mobile applications, modern-day customers prefer varied channels to connect with banks and perform banking operations. Studies say that 3.6 billion people worldwide use online banking services in 2025.

Whether offline or online, banks should provide superior customer service across all channels and at all times.

Offering an omnichannel customer experience is all about making the same services and products available to customers regardless of the platform or channel.

Understand the customers’ journey

When will you be able to offer unparalleled customer service? Only when you know what your customers go through throughout their journey. And how to provide a superior customer experience? The answer is an end-to-end customer journey.

Every customer interaction – whether it’s opening an account, applying for a loan, or making a payment. Each of them forms part of their overall banking journey. You must map out this journey, identify pain points, and eliminate friction to create a smooth experience.

This will help you identify the areas of improvement and improve customer service, therefore, better customer experience.

Leverage big data and analytics

Data don’t lie. But it's not just about collecting information. Enhancing your customers’ banking experience requires understanding what they want and their expectations. For this, banks like you need to gather as much information as possible.

With the help of big data analytics and AI, you can gain actionable insights. These insights can bifurcate customers, evaluate opportunities, and analyze current models to improve interactions and enhance the customer experience.

Customized customer experience approach

A one-size-fits-all approach no longer works in banking. Customers have diverse financial needs and preferences, and you must cater to them with tailored solutions. Offering personalized loan rates, savings plans, or investment options based on a customer’s history increases engagement.

Banks can leverage customer segmentation and behavioral insights to provide customized financial advice, product recommendations, and targeted promotions. The more personalized the experience, the stronger the customer-bank relationship.

Transparency and security as ultimate CX tools

Trust is non-negotiable in banking. Customers demand full transparency regarding fees, policies, and security measures. Hidden charges, confusing terms, and lack of clarity can erode trust and lead to customer dissatisfaction.

At the same time, security breaches can destroy a bank’s reputation. Implementing robust fraud detection, biometric authentication, and end-to-end encryption ensures customers feel safe while banking. A transparent and secure approach builds lasting trust.

As a result, your customers will turn into brand ambassadors to recommend your products and services to others.

Read More: Strengthening data and payment processing security

Use self-service to scale

Many customers prefer solving their banking issues independently rather than waiting for assistance. Your bank must offer user-friendly self-service options such as mobile banking apps, AI-powered FAQs, and automated loan calculators to empower users.

A well-designed self-service ecosystem enhances customer satisfaction and reduces operational costs. Plus, simple, intuitive, and efficient self-service tools make banking faster and more convenient.

Modernize the contact center to create more revenue-driving opportunities

Traditional contact centers are often slow and inefficient, which can lead to frustrated customers.

You need to upgrade your customer service operations with:

-

AI-driven call routing

-

Real-time sentiment analysis, and

-

Voice recognition technology

Modern contact centers predict customer needs, reduce resolution times, and provide proactive support. And a fast and responsive support system significantly enhances the overall customer experience.

How Banks Are Transforming Customer Experience with Digital Payment Solutions

Digital payment solutions are reshaping how banks interact with customers. This has made transactions faster, safer, and more convenient.

From AI-driven fraud detection to seamless cross-border payments, banks are leveraging cutting-edge technology to enhance customer experience.

Here’s how digital payment innovations are driving this transformation:

1. Digital Wallets & eWallets: Enabling Seamless Transactions

Mobile-first banking has revolutionized transactions and made payments, peer-to-peer transfers, and online purchases instant and effortless.

Digital wallets enhance the banking experience by integrating features like loyalty rewards, bill payments, and contactless transactions. By reducing dependency on cash and physical cards, they drive convenience and financial inclusion.

2. AI-Powered Fraud Detection & Enhanced Security

Banks are leveraging AI to detect and prevent fraudulent activities in real time. This has ensured a safer digital banking experience.

Machine learning algorithms analyze transaction patterns while flagging suspicious activities before they escalate. This proactive approach enhances security and strengthens customer trust and confidence.

3. International Remittance: Faster, Cheaper, & Compliant

Traditional cross-border payments were slow and costly, but digital payment solutions have made them faster, cheaper, and more transparent.

Advanced remittance platforms ensure compliance with global regulations while reducing transfer fees. Customers now enjoy seamless international transactions with real-time tracking and lower exchange rate fluctuations.

4. Merchant & Financial Services: Expanding Financial Access

Banks are expanding their reach by offering digital merchant solutions. Through this, they are enabling seamless transactions for businesses of all sizes.

Digital payment solutions help merchants accept payments via multiple channels, which enhances their revenue streams. Additionally, value-added services like instant settlements and analytics improve financial decision-making.

5. Open Banking & API-Driven Integration

Through open banking, banks collaborate with fintechs and third-party providers to create seamless, integrated financial experiences.

Plus, APIs facilitate secure data sharing for personalized banking solutions and faster service delivery.

This innovation:

-

Fosters competition

-

Improves financial accessibility, and

-

Empowers customers with greater control over their banking data

Top 5 Banking Customer Experience Trends for 2025

The banking industry is evolving rapidly, with customer experience (CX) at the center of innovation. To stay competitive, banks like yours must embrace digital-first strategies, AI-driven insights, and hyperpersonalization.

Here are the top customer experience trends in banking that shape CX for 2025:

Hyper-Personalized Banking Becomes the Norm

One-size-fits-all banking is dead. AI and big data will power hyperpersonalized financial products. This will offer customers tailored insights, spending recommendations, and predictive financial planning.

Cross-Border Payments Go Real-Time

Waiting days for international transfers will feel prehistoric. Banks will adopt blockchain and next-gen payment rails to enable instant, cost-effective global transactions.

Conversational AI Replaces Call Centers

By 2025, chatbots won’t just answer FAQs—they’ll act as virtual financial advisors. AI-powered banking assistants will provide real-time support, automate transactions, and offer proactive financial tips.

Super Apps Take Over Banking

Why switch between apps when everything can be in one place? Banks will integrate deeper into e-commerce, ride-hailing, and social platforms, while making financial services seamless and invisible.

AI Enhances Efficiency, But Humans Still Matter

AI will handle routine banking tasks, but trust still requires a human touch. Banks will blend automation with real relationship managers to ensure a seamless yet personalized experience.

How DigiPay.Guru Helps Banks Lead the Transformation

DigiPay.Guru empowers banks to stay ahead in the rapidly evolving digital financial landscape through its cutting-edge fintech solutions.

By streamlining operations and enhancing customer experiences, it enables banks to lead digital transformation effectively.

-

End-to-End Digital Banking Solutions: DigiPay.Guru offers comprehensive platforms, including mobile money, digital wallets, agency banking, and card management, which helps banks digitize services seamlessly.

-

Financial Inclusion: By supporting agent banking, agent networks, and offline access, DigiPay.Guru enables banks to reach unbanked and underbanked populations, especially in rural and remote areas.

-

Faster Time-to-Market: With ready-to-deploy, customizable fintech solutions, banks can rapidly launch new digital services, which reduces development costs and time.

-

Omnichannel Experience: Customers enjoy a consistent, secure, and user-friendly interface across mobile, web, and USSD platforms.

-

Regulatory Compliance & Security: Built-in compliance with global banking standards and robust security features ensure safe and reliable operations.

-

Data-Driven Insights: Advanced analytics and reporting tools enable smarter decision-making and personalized customer engagement.

DigiPay.Guru acts as a strategic fintech partner, which equips banks with the tools and agility they need to transform, grow, and thrive in a digital-first economy.

Closing thoughts

Customer experience in digital banking is the future. Providing a great customer experience is not a destination; it’s a continuous journey. Banks must adopt digital-first solutions to remain relevant.

Banks with advanced technologies—AI-driven personalization, real-time payments, embedded finance, and more can minimize the gap between customer expectations and reality.

However, technology alone won’t be enough—human-centric service will remain key. Banks must blend automation with personalized interactions to build trust and loyalty.

But to truly lead the change, they need the right technology partner. DigiPay.Guru empowers banks with cutting-edge digital payment solutions to elevate CX and drive growth.

Ready to transform your banking experience? Let’s connect!