Financial services should be available to everyone. But for millions of individuals, access to basic banking services remains a challenge. According to the World Bank’s previous research, 1.4 billion adults still lack basic financial services and are unbanked. This has created a huge between the banked and unbanked population.

So, businesses like you have an opportunity to change this. By embracing financial inclusion, you can reach untapped, underserved, or unbanked markets, drive digital payments, and contribute to a stronger financial ecosystem.

But what does financial inclusion really mean, and why does it matter for your business? That can be a confusing concept for many. However, we have cleared the air with this blog.

In this blog, you will explore:

-

What is financial inclusion?

-

How financial inclusion works

-

Key components of financial inclusion

-

Why financial inclusion matters for your business

-

Challenges and barriers to financial inclusion

-

Future of financial inclusion and more…

Let’s begin with the basic introduction of financial inclusion.

Introduction to financial inclusion

Before we get a deeper understanding of financial inclusion. First, let’s the basics of it i.e. meaning.

What is financial inclusion?

Financial inclusion Meaning

In absolute layman's terms, financial inclusion percentage of individuals having access to basic financial and banking services, no matter in which corner of the world they reside in. This makes them financially included and this phenomenon is called financial inclusion.

Financial inclusion Definition

In professional terms, financial inclusion ensures that individuals have access to affordable financial products and services. These include financial inclusion in banking, digital payments, savings, credit, and insurance.

When businesses participate in financial inclusion, they open doors for unbanked and underbanked populations. This helps them access transaction accounts, manage finances, and build economic stability.

Examples of financial inclusion in today’s economy

The key financial inclusion examples include:

1. Mobile wallets for the unbanked

Many people in developing countries don’t have bank accounts but own mobile phones. Solutions like M-Pesa in Kenya allow users to send, receive, and store money digitally through mobile wallets without needing a traditional bank account.

Read more - How Mobile Wallets Boosts Financial Inclusion

2. Agency banking for rural areas

Banks and fintechs partner with local agents (shops, kiosks) to offer banking services in remote areas. DigiPay.Guru’s agency banking solution enables financial institutions like you to provide cash deposits, withdrawals, and account openings through local agents.

3. Digital lending for small businesses

Micro, small, and medium enterprises (MSMEs) often struggle to access credit due to lack of collateral. Platforms like Kiva and Tala use alternative credit scoring to offer small loans via mobile apps.

4. Cross-border remittances

Migrant workers send money home, but traditional remittance services can be costly. Fintech solutions like Wise (formerly TransferWise) and Ripple make international money transfers faster and cheaper.

5. Prepaid cards for the unbanked

People without bank accounts can use prepaid cards to receive salaries, pay bills, and shop online without needing a traditional debit card. Many fintechs now offer prepaid cards linked to digital wallets.

6. Biometric eKYC for easy onboarding

Many banks and fintechs now use biometric authentication (fingerprint, facial recognition) to verify customers quickly. This reduces fraud and makes it easier for people to open accounts digitally.

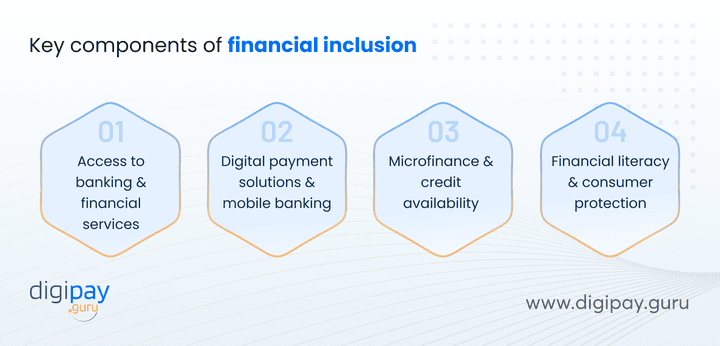

Key components of financial inclusion

You know the meaning of financial inclusion and its examples now! Next in line, you must understand the key components of financial inclusion. The components that make financial inclusion possible.

Access to banking & financial services

People need easy access to banking services, accounts, and financial products. Without it, they remain stuck in a cash-based system which is hard to keep track of. With financial inclusion, it ensures that they can open accounts, make transactions, and save their funds securely.

Digital payment solutions & mobile banking

Digital wallets, mobile banking, and online payments can help bridge financial gaps between the banked and the unbanked via agents. Even in the most unbanked areas, with smartphones, people can transfer money, pay bills, and shop online. These solutions make financial services available anywhere, anytime.

Microfinance & credit availability

Small businesses and individuals in underserved areas need access to loans to grow. Microfinance provides small loans without strict requirements, which helps businesses expand, farmers invest, and families improve their quality of life. This way, they also stay financially included.

Financial literacy & consumer protection

Financial inclusion and financial literacy goes hand-in-hand. People must understand how financial services work to be able to access them. So, education on banking, saving, and credit helps them make informed choices on what to use and what to purchase. Plus, consumer protection ensures fair treatment and prevents fraud in financial transactions.

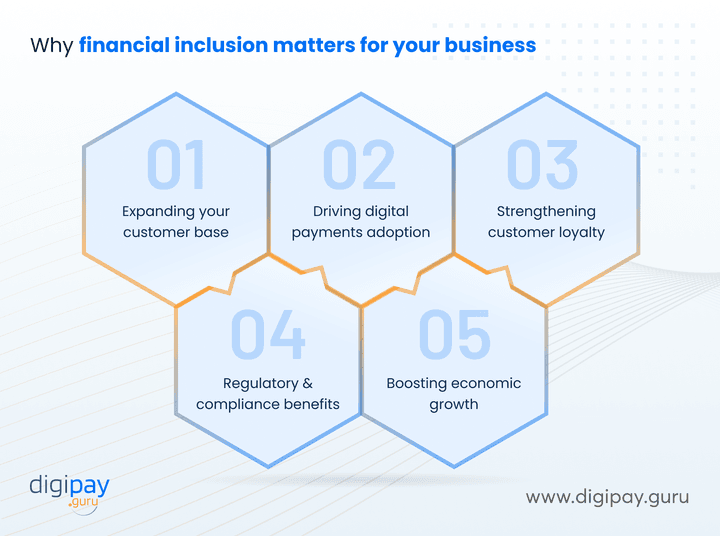

Why financial inclusion matters for your business

With the key components of financial inclusion, you must have got a little idea of the importance of financial inclusion. But, let’s explore the key reasons why financial inclusion actually matters for your business.

Here’s why:

Expanding your customer base

Reaching unbanked and underbanked customers means tapping into a larger market. Financial inclusion means more customers using financial services. This leads to increased transactions and revenue opportunities.

-

More customers, more sales – The more people can access financial services, the more they can engage with your business.

-

Stronger market presence – Financial inclusion allows you to expand into underserved regions and gain a competitive edge.

Driving digital payments adoption

Financially included customers prefer secure and digital transactions. When they have access to banking and mobile wallets in their resident city/village, they’re more likely to use digital payments instead of cash.

-

Increase in cashless transactions – Digital payments mean faster, safer, and more efficient transactions for your business.

-

Better customer experience – Offering multiple payment options ensures smooth, hassle-free purchases for your customers.

Strengthening customer loyalty

Customers stay with businesses that offer accessible and convenient payment options for all. Providing seamless financial services in all corners of the world with or without a physical branch builds trust and leads to long-term relationships.

-

Trust builds retention – When customers find a reliable payment method, they are more likely to stick with your business.

-

Convenience encourages repeat purchases – Digital payment options make it easier for customers to return for future transactions.

Regulatory & compliance benefits

Governments worldwide promote financial inclusion with policies and incentives. Hence, offering inclusive financial services can help you meet regulations & compliance standards, and access government-backed benefits.

-

Avoid legal penalties – Compliance with financial regulations keeps your business safe from fines and restrictions.

-

Access to government programs – Many financial inclusion initiatives provide funding or incentives for businesses offering inclusive services. For example, Africa Digital Financial Inclusion Facility (ADFI)aims to address systemic barriers to digital financial solutions, particularly for women and small businesses.

Boosting economic growth

A financially inclusive economy leads to more spending, investment, and business growth. By supporting financial inclusion, your business contributes to a stronger and more sustainable financial ecosystem.

-

Stronger local economies – When people have financial access, they spend more, boosting businesses like yours.

-

More investment opportunities – A financially stable customer base creates new opportunities for innovation and business expansion.

Challenges and barriers to financial inclusion

Financial inclusion is a boon for businesses looking to expand their customer base and profits effectively. However, there are several challenges associated with it:

Lack of infrastructure & banking networks that limit access

Many regions still lack banking infrastructure and reliable internet access. Without these, people cannot access digital payment solutions or digital financial services. This aspect can be a problem.

Regulatory policies & compliance complexities that create barriers

Complex regulations often make it hard for businesses like you to offer financial services to underserved communities. Plus, licensing requirements and compliance costs can slow down financial inclusion efforts.

Financial literacy & consumer awareness that affects adoption

Many people don’t understand how financial services work or distrust banks. Without financial education, they struggle to make informed decisions about savings, loans, and digital payments. This problem is solvable yet persistent.

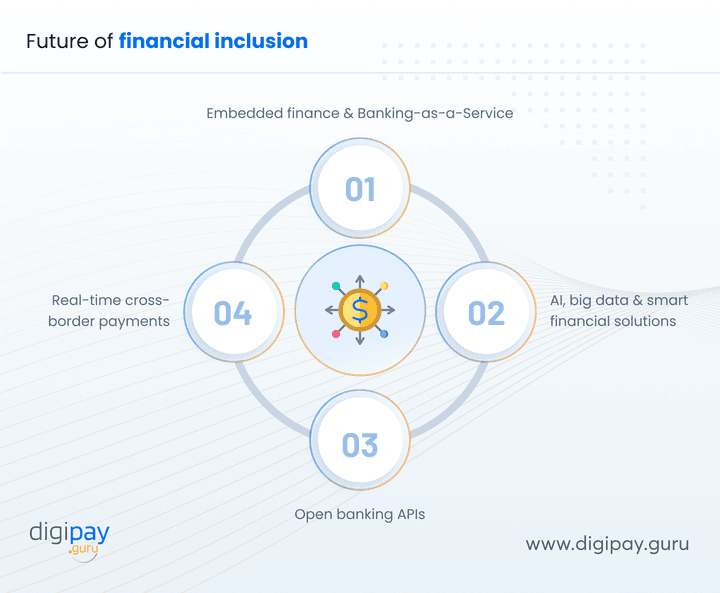

Future of financial inclusion: Trends & innovations

Despite a few challenges in financial inclusion, the future still looks brighter for financial inclusion with advanced digital solutions coming in practice via agents. And its going to expand with upcoming innovations.

Let’s see what the future holds:

Embedded finance & Banking-as-a-Service that enable new opportunities

Businesses are integrating financial services into non-financial platforms. BaaS enables companies to offer banking, payments, and lending solutions without building complex infrastructures, which makes financial inclusion more scalable.

AI, big data & smart financial solutions that improve accessibility

AI-driven credit scoring and fraud detection enhance financial inclusion. Plus, big data analytics help businesses like yours understand customer behavior. This enables the design of better financial products that cater to underserved markets.

Open banking APIs & financial connectivity that foster innovation

APIs connect different financial platforms across the globe which enables seamless transactions. Whereas, open banking encourages competition and innovation, which enables businesses to offer more inclusive and customized financial solutions.

Real-time cross-border payments that enhance financial access

Instant cross-border transactions via digital payment systems improve financial inclusion for global businesses and enhance financial access. This means even the rural population can send money abroad without having to visit a bank branch located far.

Plus, digital payment platforms reduce transaction costs, enhance accessibility, and facilitate seamless international remittances.

How digital payment solutions by DigiPay.Guru can bridge the financial inclusion gap

DigiPay.Guru offers advanced digital payment solutions that can seamlessly bridge the financial inclusion gap. And help you boost financial inclusion, increase the customer base, and multiply the profits.

The key solutions that can boost financial inclusion include:

- eWallet solution

- Agency banking solution

- International remittance solution, and

- Prepaid card issuance and management software

But how?

Well, our eWallet and agency banking solutions go hand-in-hand. This means that the eWallet solution has the agency banking feature where banks can extend their banking services to the rural, unbanked, underbanked, and underserved regions around the world. This boosts financial inclusion, attracts more customers, and brings in profits.

The same thing goes for international remittance solution and Prepaid card issuance & management software.

Moreover, DigiPay.Guru boosts financial inclusion in the following ways:

Expanding access to digital payments: DigiPay.Guru helps you offer secure digital wallets, mobile banking, and seamless payment options. This allows more customers to access financial services easily.

Driving cashless transactions: With DigiPay.Guru, you can encourage digital payments, which reduces reliance on cash. This improves financial accessibility and boosts customer convenience.

Enabling secure & scalable solutions: DigiPay.Guru provides you with a secure and scalable payment platform. This helps you serve more customers and drive financial inclusion effectively.

Conclusion

Financial inclusion is not just about banking access. It’s about creating opportunities, driving growth, and ensuring financial security for everyone. When more people have access to financial services, businesses like yours gain more customers, increase revenue, and contribute to a stronger economy.

By offering secure and seamless digital payments, you can make financial services accessible to more people. With DigiPay.Guru, you get the right tools to bridge the financial gap and scale your business. Almost every solution of ours is financial inclusion friendly - mobile money, agency banking, international remittance, prepaid card management and more.

Bottom line? The future of finance is inclusive. Are you ready to be a part of it?

FAQ's

Financial inclusion drives economic growth by increasing access to financial services for underserved populations. When more people can save, invest, and transact digitally, businesses grow, jobs are created, and overall economic activity strengthens. It also reduces income inequality and fosters financial stability.

Governments create policies, regulations, and infrastructure to support financial inclusion. They encourage digital payments, promote eKYC for seamless onboarding, and collaborate with fintechs and banks like you to expand access. Regulatory frameworks also ensure security and consumer protection.

While financial inclusion offers many benefits, risks include cybersecurity threats, fraud, and over-indebtedness. Without proper digital literacy, users may fall victim to scams. You must implement strong security measures, risk assessments, and consumer education programs.

Emerging trends include AI-driven financial services, blockchain-based payments, and biometric authentication for secure transactions. Plus, open banking and embedded finance are making services more accessible, while digital wallets and mobile banking continue to bridge gaps for the unbanked.