An average privileged person enjoys several banking instruments like depositing/withdrawing money in a savings account, using ATM facilities and making digital transactions at grocery stores & mall, and many more. However, not everyone around the world enjoys these perks.

According to the World Bank, around 1.7 billion people in this world don’t have any access to the banking facilities. Yes, it might come as a surprise to many readers but a huge chunk of the global population is still unbanked. But why is it so? Let’s have a look.

Why people are unbanked?

To understand this situation let’s take the example of the United States of America. According to a survey by FDIC, around 7% of the American households are unbanked. This is significant as it amounts to 9 million households that have no access to a savings account or checking account.

They don’t have any credit cards or direct deposits too. In simple words, these people don’t utilize any mainstream financial services. In some parts of the country, the percentage of unbanked people rises to as much as 40%.

Since these people have no bank relationship, they have poor credit history and scores. Moreover, their lack of trust in banking compels them to go for title loans, payday loans, and other low-quality and expensive financial products. There are many reasons as to why a person is unbanked, some of these reasons are:

- Lack of trust in mainstream banking

- Poor credit history

- Lack of steady income

- Convenience and access

- Unemployment

- Bankruptcy

And it’s important to notice that the survey took place in America, you can imagine what the situation would be like in a less developed place like that of Asian and African countries. This presents a grim reality, however, there’s a hope of ray.

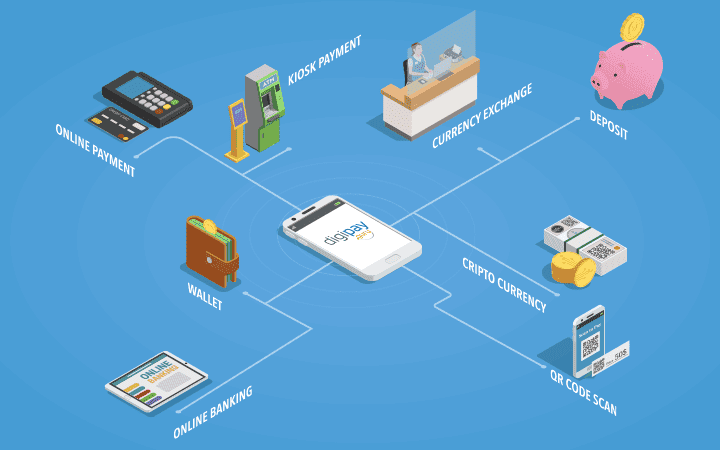

Over the years, technology has helped us to solve and eradicate issues which were earlier thought to be impossible. Even this issue can be solved with the help of technology. And that technology is of digital transactions via of mobile wallets. Yes, mobile wallets can prove to be an effective tool to eliminate the unbanked population in the world. But how? Let’s see.

How mobile wallets boost financial inclusion

Mobile wallets are a perfect solution for those people who want to access bank-like services without actually having a bank account in the first place. Big names like American Express have started to offer mobile wallet services with its products like Serve and Bluebird. Moreover, startups like Due have also joined the race.

Mobile wallets work like a bank account in several ways. It enables a customer to make payments, store funds, and transfer money to other user’s financial accounts. Bluebird also enables its customers to write checks.

Digital wallets are quite similar to regular accounts; however, there are some key differences between both. For unbanked people, these differences don’t really matter. Digital wallets provide consumers with the convenience and ease of a debit card to an unbanked person.

Today, millions of people use mobile money and mobile wallet services across the world. As per a report by GSMA’ 2014 State of the Industry, there were an estimated 103 million active mobile money accounts in the year Dec. 2014.

Out of this, bKash and M-PESA had the most registered subscribers with 16 million and 15 million respectively. Many other services like Beam Money were also rapidly scaling with more than 2 million registered users.

Mobile wallets improving financial inclusion results

Mobile wallets have considerably reduced the customers’ dependency on cash which has resulted in enhanced financial security. Moreover, it has also decreased risks associated with cash handlings like fraud, loss, and theft. In many countries, mobile wallets have eliminated the need for middlemen for money transfer thus increasing the overall transparency.

Mobile wallets also make trade easier. People can use mobile wallets to pay and receive payments for various services and goods. According to a study by FITZ Tanzania, around 20 per cent of users use mobile money for their business. They use it to make transactions between retailer and supplier.

Participation of women is very essential when it comes to large scale financial inclusion. This is where mobile money and mobile wallets come into play as these services have a very strong appeal among women.

According to research in East Africa, around 85% of women received their income via mobile wallets and mobile money. This percentage accounted on average of 33% of their total income. Whereas, not many men received payments in this way. Even if the ones who did only received just got 4% of their income.

There is also evidence that mobile money and mobile wallet services are enabling wide-scale access to education and healthcare services. For instance, people can seek immediate treatment as mobile wallets enable them to receive and send emergency funds for medical bills and transport.

Similarly, in regions of East Africa, children are sent home due to lack of fees, with digital wallet services, these families can immediately pay the fees.

Mobile wallet services and mobile money require massive distribution networks which also provides huge employment and entrepreneurship opportunities to thousands of unemployed people in urban as well as in rural areas.

This is quite evident from the fact that M-PESA has more than 40,000 employees only in Kenya. Similarly, bKash in Bangladesh has around 30,000 personnel.

Role of government and public policy in financial inclusion

Governments across the world have started to recognize the significance of mobile wallet services in enhancing financial inclusion in their countries. That’s the reason why governments are setting up regulatory frameworks that enables these services to flourish. Let’s have a look at them.

Providing a level playing field to mobile wallet services

Governments are setting-up regulations that offer an open and level-playing field to all the mobile wallet services and non-bank mobile money providers to operate in the market without any restrictions. In most of the rapidly growing models, the MNOs and banks offer mobile money services.

Ensuring the safety of customer’s money in mobile wallets

Regulations framed by the authorities to ensure the safety of the customer’s fund in the countries where non-bank providers are given license to offer mobile money and mobile wallet services.

The total stored funds of customers have to be often pooled. These funds are also helped by a bank by the name of the service provider. Sometimes, providers also have to establish a fiduciary agreement, in which the funds are under the name of the clients.

Flexible due diligence

Usually, unbanked users don’t have a permanent address and other official identification. This is the reason why regulators have to permit some leeway on usually strict KYC guidelines.

Lighter regulation on third-party agents

Regulators have realized that agent networks are very crucial to the success of financial inclusion. That’s why regulators try their best not to impose too many requirements and documentation on the mobile money agents who perform functions like cash-in and cash-out points for customers.

Allowing interoperability by working with providers

According to GSMA 2014, State of the industry states that “allowing interoperability will accelerate transaction growth and enhance the customer experience by making it easier for consumers and businesses to send money across networks.”

However, one must not forget that there are few risks associated with interoperability like KYC rules, ensuring compliance, and many more. This makes it crucial that regulators work with mobile wallet providers to obtain the required results.

Conclusion

Mobile wallets have emerged as an effective way to drive financial inclusion across the globe. The convenience, speed, and security offered by it attracts many unbanked people who usually don’t have trust in mainstream banking. That’s why we can also say that mobile wallets act as a bridge between these unbanked people and the banking services which they are deprived of.

Moreover, the immense support of government and authorities makes things quite easier for mobile wallet service providers and hence ensures that their impact is widespread resulting in maximum financial inclusion.

This is just a start and in coming years, we might see new innovations and developments in the market of mobile wallets which will further make banking simpler, fast, secure, and easily accessible to the masses.