Many businesses like yours are offering international remittance services in the market. But, to stand out, you need to offer more than just an international remittance service, you need to offer advanced features that can make cross border payments fast, secure, and reliable for your customers.

Offering these advanced features can boost the revenue streams for your business and increase your customer base effectively. One such advanced feature is - exchange rate management. But, to understand the best money transfer exchange rate, you need to first understand what are exchange rates and how they work.

Plus, as a business, you need to be aware of finding the right providers for your platform to keep your customers coming back to use only your service.

In this blog post, we will make it all easy for you to understand exchange rates and rate providers. You will discover:

- What is an exchange rate?

- How do exchange rates work?

- Factors that influence exchange rates

- Why choosing the right rate provider matters, how to choose one, and more…

Let’s begin with the understanding of exchange rates.

What is an exchange rate?

Exchange rates play a crucial role in the international remittance process. So much so that we can call it a stepping stone to successful cross border money transfer. Let’s understand its meaning in simple words.

Remittance Exchange rate meaning

In simple words, a price at which currency of one country can be exchanged for the currency of another is known as the exchange rate.

In other words, it’s the bridge that enables cross-border transactions. For instance, if a user sends $100 to Mexico and the exchange rate is $1 = MXN 20, the recipient will receive MXN 2,000.

Definition of Money transfer exchange rate

In terms of definition, the remittance exchange rate is value of currency of one nation in relation to the another nation. Exchange rates are influenced by several factors, including market demand, economic policies, and geopolitical events.

Understanding the basics is the first step toward managing foreign exchange rates effectively.

How do exchange rates work?

The working of exchange rates is simple. Let’s look at how it works:

1 : Currency pair formation

Exchange rates are always quoted in pairs, such as USD/EUR or GBP/INR. Here, the currency of the first country is the “base” and the currency of the second country is the “quote”. The exchange rate represents how much quote currency is needed to purchase one unit of the base currency.

2 : Market determination

What would be the exchange rate is determined in the global foreign exchange (forex) market. Here the currencies are traded 24*7.

What Is the Forex?

Exchange rates are determined in the global foreign exchange (forex) market, where currencies are traded 24/7. These rates fluctuate based on demand and supply. If a currency is in high demand, its value rises. If the demand for the currency is less, its value will fall.

3 : Buying and selling rates

Banks and money transfer services typically offer two rates:

Buying rate: The rate at which they purchase foreign currency. Selling rate: The rate at which they sell foreign currency.

This difference is often the provider's profit margin.

4 : Economic and political factors

- Economic indicators like inflation, interest rates, and GDP affect a currency's strength.

- Political events or instability can cause abrupt changes in currency values.

Types of exchange rates

There are two major types of exchange rates, they are:

Fixed exchange rate

A fixed exchange rate is controlled by a country’s central bank. The government sets a stable rate against another currency, usually a strong one like the US dollar. Fixed rates offer predictability but can struggle to adjust to changing market conditions.

For example, many Gulf countries fix their currencies to the US dollar to offer stability for international trade.

Floating exchange rate

This type of rate is determined by the open market—essentially supply and demand. Most developed countries use floating exchange rates, which makes them more adaptable to economic conditions. However, they can be volatile, which means they fluctuate frequently.

Why does it matter to you?

Most international remittance platforms use floating exchange rates. This ensures your customers get competitive rates, aligned with real-time market conditions, while you stay ahead of your competitors.

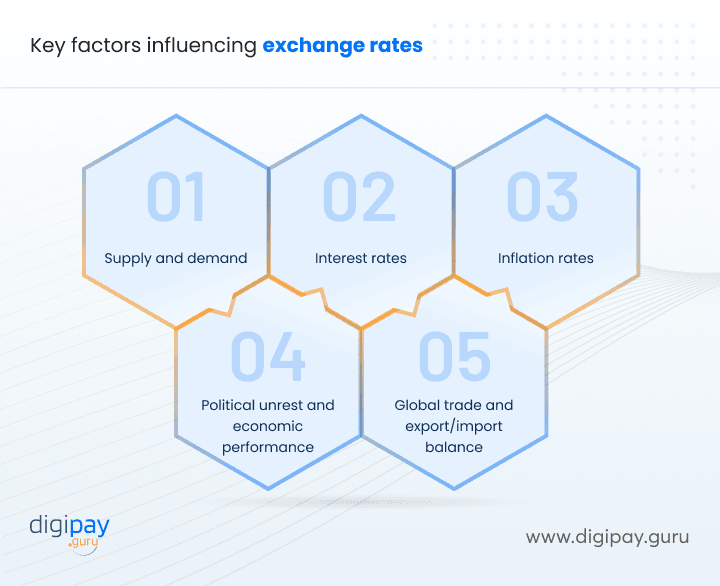

How exchange rates fluctuate?

Understanding what drives exchange rates is key when offering international remittance services. Exchange rates don’t just change randomly—they respond to several factors that shape their value.

Knowing these factors helps you offer competitive remit exchange rates and ensures your platform provides the best value to your customers.

1. Supply and demand

How Do Exchange Rates Affect the Supply and Demand of Goods? The FX rates are largely influenced with the economic terms of supply and demand:

-

When demand for a currency increases (e.g., more people or businesses want US dollars), its value rises.

-

If supply exceeds demand (e.g., more dollars are available than needed), the currency weakens.

This is why rates fluctuate throughout the day. A strong economy or high demand for exports often increases a currency's value.

2. Interest rates

A country's interest rates directly impact its currency's value:

-

Higher interest rates attract foreign investments, which boosts the currency's demand and value.

-

Lower interest rates make the currency less attractive, which reduces its value.

For example, if the US Federal Reserve raises interest rates, the USD might strengthen. This will make foreign exchange rates less favorable for those sending money abroad.

3. Inflation rates

Inflation eats away at a currency's value.

-

Low inflation rates indicate a stable economy which helps the currency hold its value.

-

High inflation rates weaken the currency, as purchasing power decreases.

When offering international remittance services, low-inflation currencies tend to offer better foreign currency exchange rates for your customers.

4. Political unrest and economic performance

Would you trust a currency from a country facing political unrest? Probably not, and your customers feel the same.

-

Political stability fosters confidence in a nation’s economy, which then boosts the currency’s strength.

-

On the other hand, instability, wars, or corruption weaken trust in the currency.

Stable countries often enjoy the best currency exchange rates, which is why they are attractive for money transfers.

5. Global trade and export/import balance

A country’s trade activities influence its currency demand:

-

Nations that export more than they import often have stronger currencies due to higher demand.

-

Import-heavy countries may see their currency weaken as they exchange more for foreign goods.

For instance, if your customer is transferring money to a country with a strong export economy, their remittance might result in a better money exchange rate.

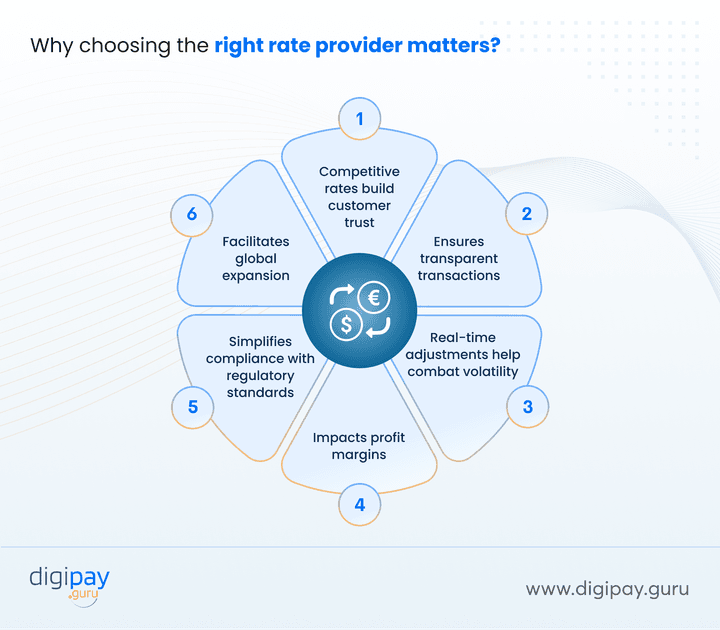

Why choosing the right rate provider matters

Selecting the right exchange rate provider is more than just finding a good deal. It directly impacts the success of your international remittance services, your customers’ satisfaction, and your overall profitability. Here’s why this decision is so critical:

1. Competitive rates build customer trust

Your customers are always looking for the best money transfer exchange rate to ensure their recipients get the most value. A reliable provider with competitive rates helps you:

-

Offer attractive send money rates that appeal to customers.

-

Reduce complaints about hidden fees or poor conversion rates.

-

Position your platform as the go-to option for money transfers.

When customers feel they’re getting the best currency exchange rates, they’re more likely to stay loyal to your service.

2. Ensures transparent transactions

Transparency in exchange rates builds trust. A good provider:

-

Displays real-time remittance exchange rates today so customers know exactly what they’re paying.

-

Avoids hidden markups or additional charges.

-

Helps maintain your brand's reputation as a reliable and fair service.

Customers value platforms that are upfront about costs and don’t surprise them with lower-than-expected payouts.

3. Real-time adjustments help combat volatility

Currency markets are highly volatile, with rates fluctuating due to demand, political events, or economic news. The right rate provider offers:

-

Dynamic exchange rate management that ensures your rates are updated in real-time.

-

Protection against losses caused by delayed rate updates.

-

A competitive edge by offering customers timely and accurate foreign exchange rate options.

4. Impacts profit margins

Every exchange rate comes with a margin—the difference between the market rate and what your provider offers. Choosing the wrong Exchange rates are heavily influenced by the classic rule of demand and supply:provider can:

-

Erode your profit margins with high spreads.

-

Reduce the amount recipients receive, which can drive your customers away.

A provider offering the best money exchange rate app or platform minimizes your costs while maximizing your profits.

5. Simplifies compliance with regulatory standards

International money transfers must comply with various regulations, including AML and KYC guidelines. A reliable rate provider:

-

Ensures compliance with global standards.

-

Provides documentation to meet regulatory requirements.

-

Reduces risks of penalties or legal issues.

6. Facilitates global expansion

As your business grows, you’ll need rate providers who can support transactions across multiple currencies and regions. The right partner should:

-

Offer comprehensive coverage for global foreign currency exchange needs.

-

Provide consistent rates across different markets.

-

Scale with your business as you expand into new territories.

This allows you to offer a seamless experience, no matter where your customers are sending money.

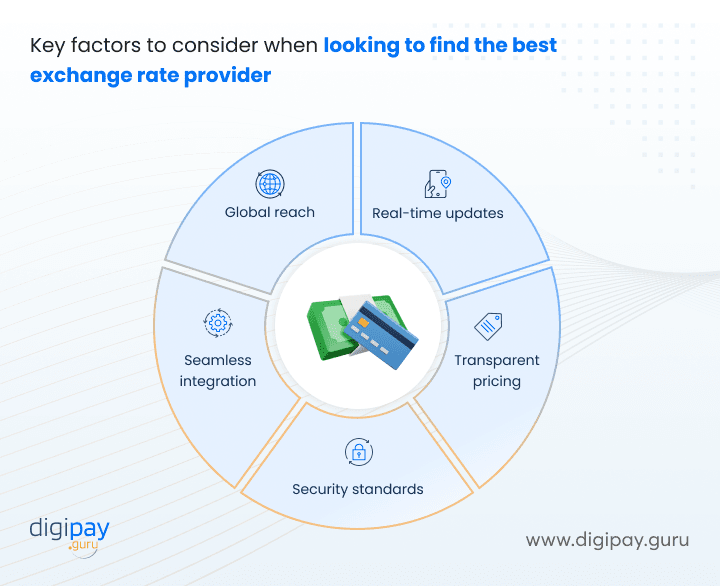

How do you find the best exchange rate provider?

Selecting the right exchange rate provider is crucial to ensure your international remittance services are reliable, competitive, and secure. When evaluating potential providers, keep these key factors in mind:

Real-time updates

Exchange rates fluctuate constantly. A provider offering live updates helps you stay competitive by ensuring your rates are always live and current for customers. This reduces the risk of unexpected rate changes.

Transparent pricing

Look for rate providers who offer clear & upfront pricing without hidden fees. This builds trust with your customers and ensures they know exactly what they’re paying for and what recipients will receive.

Security standards

Choose rate providers that comply with global security regulations. Protecting sensitive financial information is essential. And secure providers give your customers peace of mind while making transactions.

Seamless integration

Your exchange rate provider should easily integrate with your platform, particularly if you use a white label payment solution. This prevents delays, reduces errors, and streamlines your operations.

Global reach

Ensure your FX rate provider supports a wide range of currencies and corridors. A provider with global reach helps you offer competitive exchange rates, no matter where your customers are sending money.

Read More - What Are Currency Corridors in Remittance: A Complete Guide

How can DigiPay.Guru help?

DigiPay.Guru offers a robust and secure international remittance solution that comes with a feature called “dynamic exchange rate management”.

With dynamic exchange rate management, you can offer real-time & competitive exchange rates to your customers. This feature monitors foreign exchange rate fluctuations across multiple corridors and updates rates instantly on your platform.

By integrating this functionality, you can:

-

Minimize losses caused by volatile foreign currency exchange markets.

-

Offer the best currency exchange rates to boost customer satisfaction and loyalty.

-

Provide transparency with live rate updates and ensure trust in transactions.

Additionally, this feature supports multi-currency operations, which enables you to expand your services globally without hassle. With DigiPay.Guru, you’ll stay ahead of the competition and enhance your remittance offerings effortlessly.

Conclusion

Understanding what is an exchange rate and how to manage it effectively is crucial for any business offering international remittance services. With the right rate provider and features like dynamic exchange rate management, you can simplify operations, enhance customer satisfaction, and drive growth.

Delivering the best money transfer exchange rate isn’t just a service—it’s a promise to your customers. And DigiPay.Guru fulfills this promise at all levels with its advanced and reliable cross border remittance software. So don’t hold back, take the next step toward reliable and profitable remittance services today!

FAQ's

An exchange rate system refers to the method used to determine the value of one currency in terms of another. It can be floating, where market forces like supply and demand set the rate, or pegged, where a currency’s value is fixed to another currency or a basket of currencies.

For your remittance services, understanding this system helps you choose the best provider to offer competitive rates.

An FX (foreign exchange) rate is the price at which one currency can be exchanged for another. For example, how many Euros you get for one U.S. Dollar. Offering accurate FX rates in real-time is crucial for ensuring your customers get value in international remittance services.

The spot exchange rate is the rate at which currencies are exchanged immediately, usually within two business days. It reflects the current market value. In remittance services, using a reliable spot rate ensures your customers get accurate & up-to-date values when transferring money.

A pegged exchange rate, also known as a fixed exchange rate, ties a currency’s value to another currency, like the U.S. Dollar, or a group of currencies. This system reduces volatility, which makes it easier to predict transfer costs.

Exchange rate volatility refers to frequent and unpredictable fluctuations in currency values due to market factors like economic changes or political instability. High volatility can impact remittance payouts. A dynamic exchange rate management feature helps you manage this risk by updating rates in real-time.

Exchange rate stability means that a currency’s value remains relatively constant over time. Stable rates make it easier to predict costs and offer consistent services to your customers. Using reliable money remittance software ensures you maintain stable & transparent rates that build customer trust.