Every business wants to launch its solution/product in the market as quickly as possible. But, in the fintech space, it was only a dream. With solutions like white-label payment systems and SaaS solutions, it has now become possible to launch even a payment solution quickly and efficiently

A white label payment solution & platform allows you to get your payment solution ready without having to build it from scratch. It can be implemented quickly and is seamless and secure. These ready-made and customizable platforms enable you to offer branded payment services quickly and in a cost-effective manner.

In this blog post, you will learn everything these white label payment platforms stand for:

- What is a the meaning of white label payment solution and how does it work?

- What are the major features of a white label payment platform

- Benefits of choosing a white label payment solution

- Types and use cases of white label payment solution

- Key factors to consider when choosing a white label payment platform, and

- How DigiPay.Guru can help as white label solution provider

So, hold your horses, and let's dive deeper into these solutions and understand them bit by bit in detail. First, let's begin with its meaning.

What is a white label payment solution?

Before you get to learn all about a white label payment solution, you need to understand what it is exactly. So, let's begin the blog first by understanding the basics of white label payment platform.

Meaning & Definition of white-label payment solution

A white label payment solution is a digital payment software that you can customize to your brand identity. That means you can add your brand name, logo, look and feel, color theme, and more.

In short, a payment solution provider will offer their solution white labelled and you will use it as your own platform with your branding. Plus, you can deliver secure and seamless payments to your customers under your name.

How do white-label payment solutions work?

Now you know what it means but how does it actually work? White label payment solution works through a simple 3 step process:

1. Platform customization: The white label provider gives you a pre-built payment platform that can be branded to match your business. You can customize the interface, logos, and colour schemes to match your brand.

2. Seamless integration: This platform is then integrated into your existing systems. This means connecting to your website, mobile apps, or in-store payment systems to ensure smooth functionality.

3. Launch and operate: Now you’re ready to go live with your branded payment solution. You can now manage transactions, track performance and give your customers a smooth payment experience.

Key features of a white label payment solution & platform

A robust white label payment platform comes with several essential features that enhance its usability and efficiency. Let’s explore these in detail:

1. Customizable branding

A white label payment solution lets you brand the entire solution to your business. You can add your logo, choose your colors, design the UI to match your business.

This way, your customers will see and interact with a payment solution that’s yours alone. And that builds brand recognition for you.

2. Scalability and security

Your platform capabilities will grow as your business expands.Whether you’re processing 100 or 1 million transactions the platform can scale without interruption with white label payments.

And they come with advanced security features like encryption and fraud prevention to protect your customers’ sensitive payment information. This builds long term trust in your service.

3. Multiple payment methods

Your customers have different payment preferences and a white label solution lets you serve them all. The solution may support multiple payment methods like digital wallets, bank transfers, credit cards and more. This allows your customers to pay in their coice of payment method.

4. Integration flexibility

A white label payment platform can integrate with your existing systems, be it CRMs, financial tools, or other payment platforms. So you and your customers have a unified experience. No technical compatibility issues! Everything works together and it’s all simplified.

5. Real-time reporting and analytics

Your business insights are at your fingertips. With real-time reporting and analytics, you can monitor transactions, trends, customer patterns, and more to make decisions. This data-driven approach helps you optimize your services and improve customer satisfaction.

6. Fraud prevention tools

The white label platform has advanced tools to detect and prevent fraud. From AI-powered automated monitoring to multi-factor authentication, these features keep your transactions safe.

By protecting your business and your customers, you can create a trusted payment environment.

7. Mobile compatibility

With mobile payments on the rise, having a solution that works on smartphones is key. A white label solution works on all devices, so your customers can pay anytime anywhere. This ultimately increases user satisfaction, engagement, and loyalty.

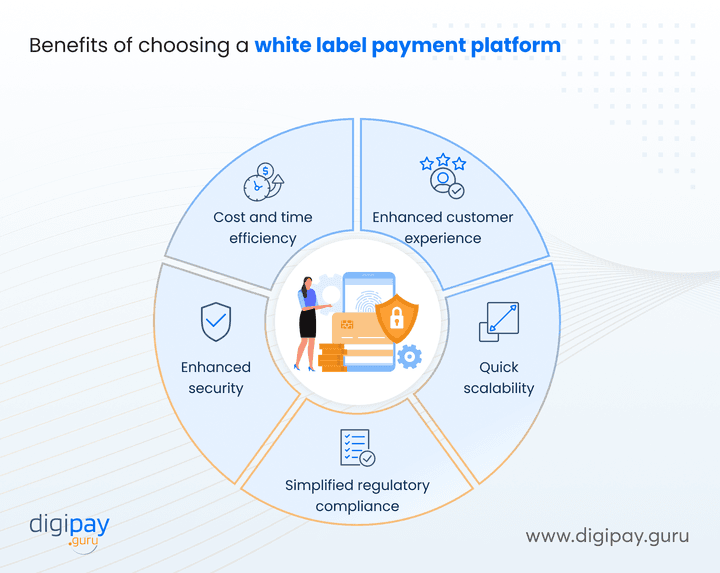

Benefits of choosing a white label payment platform

Adopting a white-label payment solution comes with so many advantages. These advantages can make your business unbeatable. They are:

1. Cost and time efficiency

Building a payment platform from scratch takes time, money, and technical expertise. A white label solution saves you all that and lets you focus on your core business.

You can launch your payment services in half the time and at half the cost with a ready made platform.

2. Enhanced customer experience

Consistency in branding gives a seamless customer experience. A white label solution means your customers interact with a platform that looks and feels like your brand and that builds trust and loyalty. And a user friendly design and smooth functionality too.

3. Quick scalability

As your business grow, so does your platform’s transaction volumes grow. And white label platforms scale easily so you can handle more transactions without interruption. Locally or globally, these solutions mean you’re always ready for customer demand.

4. Simplified regulatory compliance

Navigating payment regulations like PCI DSS, AML, & KYC compliance can be overwhelming and resource-intensive.

A white label payment provider handle these requirements and give you a compliant platform from day one. This saves you time and protects your business from potential legal and financial risks.

5. Enhanced security

Security is a top priority in digital payments, and white-label solutions come with advanced measures like encryption, tokenization, two-factor authentication, and fraud detection.

These features protect sensitive data and reassure your customers that their transactions are safe. This strengthens your brand's reputation.

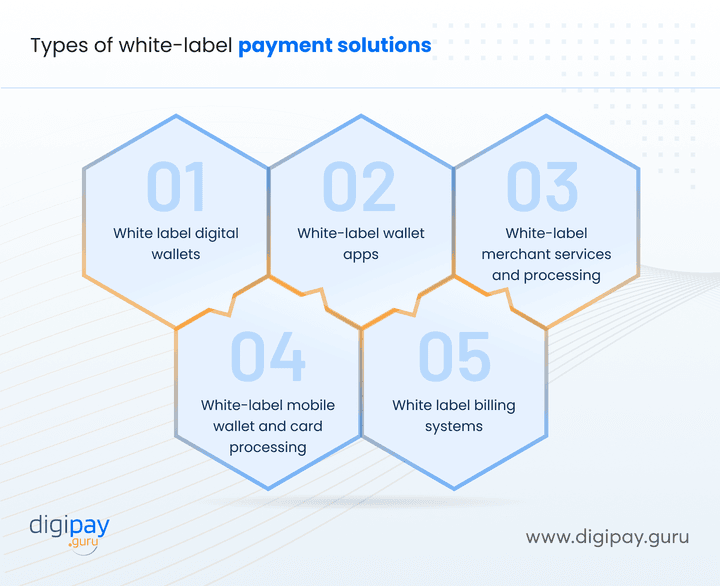

Types of white-label payment solutions

Not all white label payment platforms are the same. Here’s a breakdown of the most popular types of white label payment platforms:

- White label digital wallets

Digital wallets are a payment tool that allows your customers to storre varied payment methods and make payments hassle-free. A white label digital wallet solution ensures these features are branded and tailored to your business.

- White-label wallet apps

These while lable wallet apps have the power that takes convenience offered by digital wallets to the next level. This alloes your customrrs to topup funds, manage payments, check balances, and more.

- White-label merchant services and processing

You can offer merchants the ability to accept payments with ease, whether it’s online or in-store.

- White-label mobile wallet and card processing

With mobile wallets and card processing capabilities, your customers can make payments using their smartphones or physical cards.

- White label billing systems

This systems simplifies bill payments for your customers with branded payment solutions that offer real-time tracking and automation.

Use cases of white-label payment solutions

1. Banks offering digital wallets

Banks implement white label digital wallet solutions to offer digital wallet services that let their customers manage payments, transfer money, and store loyalty cards in one place.

For example, Barclays Bank launched the "Barclays Pingit" app using white label digital wallet technology to enable seamless mobile payments under their branding.

2. Fintechs enabling cross-border remittances

Fintech companies leverage white-label platforms to enable fast and cost-effective international remittance services.

For instance, TransferWise (now Wise) used white label payment solution to build its cross-border payment capabilities. This app offers customers the ability to send money abroad with low fees and transparent exchange rates.

3. Merchants adopting branded wallet apps

Retailers use white-label wallet apps to provide their customers with a convenient and branded payment experience.

Starbucks (US) is a prime example, with its mobile app functioning as a white-label wallet. The app allows users to load money, make payments in-store, and earn loyalty rewards, all under the Starbucks brand.

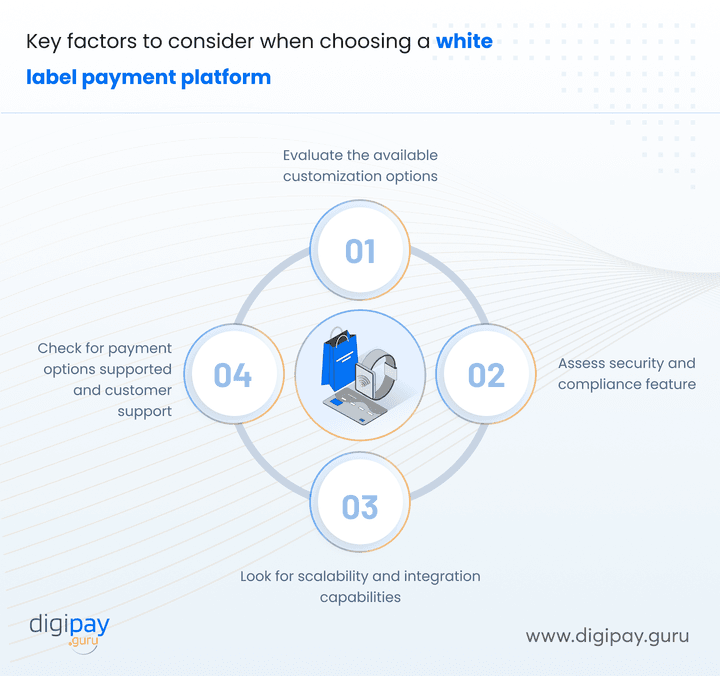

Key factors to consider when choosing a white label payment platform

1. Evaluate the available customization options

Ensure the platform allows you to fully customize the branding, interface, and features to match your business identity. Your customers should feel like the platform is uniquely yours to enhance trust and engagement.

2. Assess security and compliance features

Look for a platform that prioritizes security with features like encryption and fraud detection. Compliance with regulations like PCI DSS ensures your platform is safe, legal, and reliable for handling transactions.

3. Look for scalability and integration capabilities

Choose a white label solution that has the capability of growinng with your expanding business. The platform should integrate seamlessly with your existing tools like CRMs or financial systems. This will ensure a smooth operation as your needs expand.

4. Check for payment options supported and customer support

Ensure the platform supports diverse payment methods, such as digital wallets and credit cards, to cater to your customers’ preferences. Reliable customer support is crucial to resolve issues quickly and keep your operations running smoothly.

DigiPay.Guru: Your trusted white label payment provider

If you’re a bank, fintech, or financial institution ready to transform your digital payment services or want to launch a new digital payment platform, DigiPay.Guru has got you covered.

With our customizable white label payment platform, you can offer varied digital payment solutions, without the need to build them from the scratch. We offer you a ready made solution which we rebrand it for you with your logo, brand, color scheme and feel.

Our white label digital payment solutions include:

- eWallet solution

- White label digital wallet solution

- Agency banking solution

- International remittance solution

- Prepaid card management platform

- Merchant acquiring solution and more…

Our solutions are designed to help your business deliver superior payment experiences without the hassle of building from scratch. Explore the possibilities with DigiPay.Guru today!

Conclusion

White label payment platforms offer a powerful way to meet customer demands while saving time, money, and effort. Whether you’re a bank, a fintech, or a merchant, these solutions provide the tools you need to stay competitive.

You should evaluate your business needs, consider the benefits of white label platforms mentioned above, and make an informed decision about whether you want to opt for a white label solution in your business.

DigiPay.Guru is a white label digital payment provider that allows your business to implement a ready-made digital payment solution without any development hassle and set-up costs. All you need to do is pay for the solution, ask for customizations you need, and launch your digital payment platform for your customers. This platform will be with your brand name and theme.

FAQ's

A white-label payment platform is a ready-made payment solution that you can customize with your branding. It allows you to offer seamless payment services without building the platform from scratch.

An example of a white-label platform is Barclays Pingit, a digital wallet app that was branded and customized for Barclays. It provided their customers with seamless mobile payment services while being built on a white-label solution for efficiency and scalability.

Yes, white-label payment platforms are built with advanced security protocols, including rencryption, fraud detection, and tokenization. They also comply with global standards like PCI DSS, which ensures your customers’ sensitive payment data is always protected.

The cost depends on the level of customization, features, and provider. While building a payment platform from scratch can be expensive, white-label solutions are more cost-effective and provide faster implementation, saving both time and money.

Yes, you can fully customize a white-label payment platform to match your brand’s look and feel. This includes your logo, color schemes, and features to ensure that your customers enjoy a consistent and personalized experience.

Setting up a white-label payment platform typically takes between a few weeks to a few months, depending on the provider and the level of customization. This is significantly faster than building a platform from the ground up.

Yes, most white-label platforms support a variety of payment methods, including credit and debit cards, digital wallets, bank transfers, and QR codes. This ensures your customers have the flexibility to pay the way they prefer.

Absolutely. Many white-label solutions are designed to handle international transactions, including cross-border payments and currency conversions. This feature is particularly beneficial for businesses with a global customer base.

Yes, compliance with regulations like PCI DSS is necessary to ensure secure payment handling. However, white-label providers typically handle these compliance requirements for you. Rhis saves you the effort and ensures your platform meets all necessary standards.

A white-label payment platform enhances the customer experience by offering a seamless interface, diverse payment options, and consistent branding. Customers trust and appreciate a secure and easy-to-use payment process while improving loyalty and satisfaction.

A white-label billing system is a branded solution that automates and manages billing processes for businesses. It allows you to offer a professional and efficient billing experience while ensuring accuracy and a streamlined process for your customers.