Agency banking has become essential in countries where banks cannot reach or establish a traditional branch. It is transforming the accessibility to financial services by bridging the gap between traditional banking and underserved populations.

It brings an incredible opportunity for banks like you to offer your banking services to anyone around the globe. This also allows you to expand your reach and boost financial inclusion.

The same is true for agency banking in Kenya, East Africa. With financial inclusion becoming a priority for businesses in the financial sector, the future of agency banking in this country can look better than now.

Moreover, a study suggests that the number of active agent outlets per 1,000 square kilometers in Kenya was 566.47574. This suggests that the future of agency banking looks bright.

In this blog, you will explore a brief overview of agency banking, the key services it offers in Kenya, and the future trends in agency banking in Kenya.

Let’s begin with the overview!

Overview of agency banking in Kenya

Let’s look at the basics of agency banking, before diving further into the future:

What is agency banking?

Agency banking as word suggests is offering banking services via agents. These services are generally offered in unbanked, underbanked, and underserved areas, where the reach of banking services is scarce.

Agency banking allows banks like yours to partner with local businesses like retail shops in rural areas. Then these local businesses act as your banking agent, to offer basic banking services on your behalf. These agents offer digital banking in Kenya, without the need for physical branches,

These services include deposits, withdrawals, fund transfers, and more, therby enabling customers to access banking without visiting a branch.

There can be different types of agency banking in Kenya for every service. Meaning, there can be a different agency banking type for agent cash-in/cash-out, and a different one for bill payments.

A brief history of agency banking in Kenya

Agency banking was introduced in Kenya in 2010 following the Central Bank of Kenya’s regulations. Initially, adoption was slow, but with the success of pioneers like Equity Bank and KCB, the model has grown exponentially. Today, agency banking networks span across urban and rural areas.

A study by Statista says that the value of agency banking transactions in Kenya through bank agents was about 1.83tn Kenyan shillings, which is around 13bn USD.

How agency banking works in Kenya

Here’s how the system operates:

Bank appoints agents: Agents are selected from local businesses in a particular rural area, such as shops or kiosks.

Training and technology: Banks provide the necessary training and equip agents with mobile or POS devices.

Service delivery: Agents facilitate customer transactions, which are processed in real-time through secure banking systems - cash deposits, withdrawals, balance inquiry, and more.

Commission-based earnings: Agents earn a percentage decided by the bank from every transaction.

Key services offered by agency banking

Agency banking isn’t limited to deposits and withdrawals. There are various other services that banking agents can offer. Agency banking services in Kenya include:

- Account opening and KYC verification

- Loan applications and repayments

- Utility bill payments and school fees transfers

- Mobile money integration for fund transfers, and more…

The role of agency banking in financial inclusion

Agency banking plays a transformative role in improving financial inclusion in Kenya. It targets individuals who previously lacked access to formal banking services. The key benefits include:

- Convenience: Customers no longer need to travel long distances to access banking services.

- Cost savings: Reduced transportation and time expenses make banking affordable.

- Accessibility: Banks can serve remote and marginalized communities effectively.

By offering basic banking services like deposits, withdrawals, and loan access, agency banking encourages people to embrace formal financial systems. This also boosts economic growth and development in the long run.

Agency banking challenges in Kenya

There are certain challenges that come with agency banking in Kenya:

Liquidity management for agents

Agents often struggle with maintaining adequate cash flow. Banks must support agents by:

- Providing timely liquidity top-ups

- Offering training on cash management

Competition from mobile money services

Kenya’s mobile money platforms, like M-Pesa, pose a significant challenge. Banks can counter this by:

- Enhancing interoperability with mobile money

- Offering unique services that mobile platforms lack

Compliance and regulatory barriers

Strict regulations can hinder growth. Banks and agents must:

- Stay updated on compliance requirements for agency banking in Kenya

- Work closely with regulators to address challenges

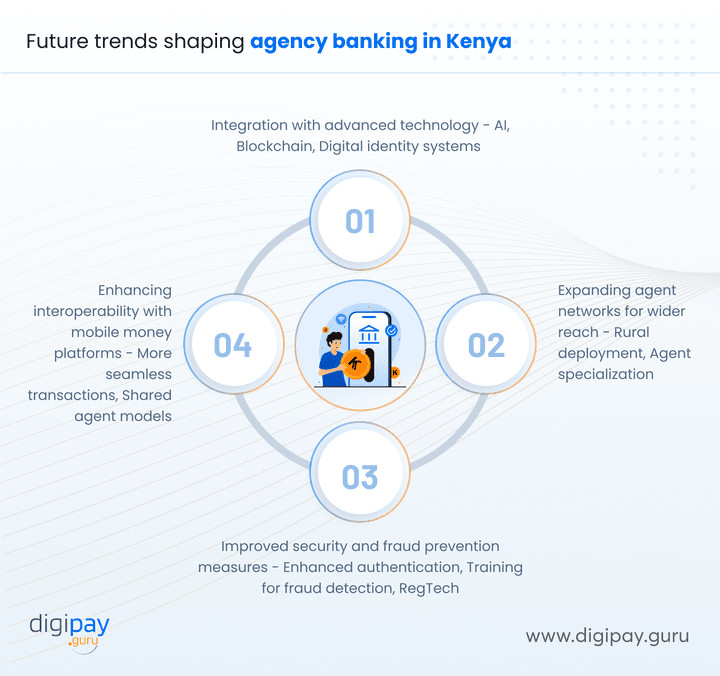

Future trends shaping agency banking in Kenya

As agency banking continues to evolve, its future in Kenya keeps becoming promising. This is driven by advancements in technology, regulatory support, and innovative strategies to address existing challenges.

Here are the key trends shaping its trajectory:

Integration with advanced technology

Technology is revolutionizing agency banking by introducing efficiency, security, and scalability. The top technologies whose integration we will be seeing in future for agency banking are:

Artificial intelligence (AI):

- AI-powered tools help banks analyze customer data, predict transaction patterns, and prevent fraud

- Chatbots and virtual assistants enhance customer experience by providing instant support

Blockchain technology:

- Ensures secure and transparent transactions

- Minimizes fraud and tampering through decentralized ledgers

- Facilitates cross-border transactions with reduced costs and faster settlement times

Digital identity systems:

- Biometric verification and digital IDs simplify customer onboarding

- Enhance regulatory compliance by eliminating fraudulent activities

Expanding agent networks for wider reach

Banks are focusing on growing their agent networks to penetrate untapped rural markets.

Rural deployment:

- Strategically placing agents in remote areas to maximize outreach

- Offering incentives like higher commissions for agents in underserved regions

Agent specialization:

- Training agents to handle complex services such as loan disbursements and financial literacy programs

- Encouraging agents to adopt multi-service models, catering to diverse customer needs

Improved security and fraud prevention measures

As cyber threats grow, banks are prioritizing security to maintain trust and safeguard transactions.

Enhanced authentication:

- Two-factor authentication (2FA) and biometrics ensure secure access

- Real-time fraud detection tools monitor unusual activities

Agent training programs:

- Educating agents on spotting potential fraud attempts

- Strengthening protocols for cash handling and digital transactions

Regulatory technology (RegTech):

- Automates compliance monitoring, ensuring adherence to regulations

- Reduces manual errors, improving efficiency and security

Enhancing interoperability with mobile money platforms

Collaboration between agency banking and mobile money providers is unlocking new opportunities.

Seamless transactions:

- Customers can transfer funds between bank accounts and mobile wallets effortlessly

- Agents can facilitate services like paying bills or topping up mobile wallets

Shared agent models:

- Allow agents to operate for both banks and mobile money platforms, increasing their income streams

- Foster greater customer convenience by offering integrated services

Read more - Future of agency banking: Trends and opportunities

Opportunities for banks in the future of agency banking

The future of agency banking in Kenya holds immense potential for banks to innovate and expand their services. By tapping into unbanked and underserved populations, banks can leverage agency banking to drive financial inclusion and enhance their market presence.

Leveraging data analytics for better services

Data analytics is becoming transformative for banks in agency banking. By analyzing customer transaction patterns, banks can better understand the needs of rural and underserved customers.

This insight enables them to tailor products like microloans, savings plans, and insurance services, ensuring they meet specific customer demands effectively.

Partnering with fintechs for enhanced solutions

Collaborations between banks and fintechs open doors to innovative financial solutions. Fintechs bring technological expertise, while banks offer established infrastructure, This creates a synergy that benefits both parties.

These partnerships allow you to offer advanced services such as instant payments, mobile-based lending, and digital wallets, which then, gives you a competitive edge in the market.

Creating sustainable commission structures for agents

Agents play a critical role in the success of agency banking. And so you must ensure they are motivated. Developing sustainable commission structures ensures agents are fairly compensated for their services. This approach improves agent satisfaction and increases loyalty which leads to more efficient and reliable banking services in rural and remote areas.

Offering diversified financial services through agents

Expanding the range of services offered through agents helps you attract and retain your customers. Beyond deposits and withdrawals, agents can provide loans, insurance, bill payments, and account opening services.

Offering diversified financial products makes your banking services more accessible and enhances customer trust. This strengthens your position in the market.

Strengthening community relationships

Agency banking provides you with an opportunity to build stronger relationships within communities. By employing local agents, you can foster trust and credibility among your customers. These relationships help you gain deeper insights into community needs and create services that truly resonate with your target audiences.

Driving financial inclusion goals

Agency banking allows your business to play a pivotal role in promoting financial inclusion in Kenya. By reaching populations that lack access to traditional banking, you can create long-term value for both your customers and your business.

Plus, expanding banking services to rural areas boosts profitability and helps achieve national economic development goals.

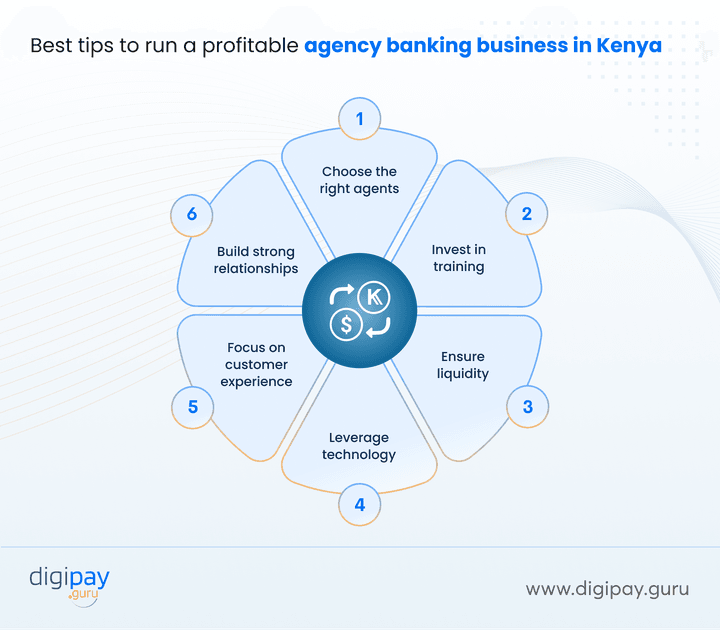

Best tips to run a profitable agency banking business in Kenya

Now you know what the future looks like for agency banking in Kenya. You should now think about doing business in Kenya.

Let’s look at some of the best tips to run a profitable banking business in Kenya.

Choose the right agents: Select trustworthy and reliable partners who understand local needs.

Invest in training: Equip agents with the knowledge and tools they need to deliver quality services.

Ensure liquidity: Monitor and manage cash flow effectively to avoid service disruptions.

Leverage technology: Use digital tools for seamless operations and enhanced customer experience.

Focus on customer experience: Prioritize quality service to build loyalty and trust among customers.

Build strong relationships: Engage with agents regularly to address challenges and encourage long-term partnerships.

How agency banking differs from mobile money services?

While agency banking and mobile money services are pivotal in Kenya's financial landscape, they serve different purposes and operate under distinct frameworks. Understanding their differences is essential for you who is aiming to maximize the benefits of each service.

Key differences

| Feature | Agency banking | Mobile money services |

|---|---|---|

| Core objective | Provides comprehensive banking services, including deposits, loans, and withdrawals. | Facilitates quick money transfers and payments. |

| Regulation | Overseen by the Central Bank of Kenya. | Regulated by the Communications Authority. |

| Customer focus | Targets rural and underserved populations with banking needs | Appeals to individuals needing fast and mobile-friendly payment solutions. |

| Trust level | Supported by the trust in established banks. | Dependent on the reputation of mobile operators. |

| Infrastructure | Relies on agent networks equipped with bank-authorized tools. | Operates through mobile platforms accessible via phones. |

The synergy of both services

Though distinct, agency banking and mobile money services complement each other in significant ways. Together, they enhance financial inclusion and convenience for Kenyans.

Integrated financial ecosystem: Agency banking can collaborate with mobile money platforms to offer seamless cash-in and cash-out services. For example, your customers can deposit money into their bank accounts via agents and transfer it to mobile wallets instantly.

Shared networks: Banks can leverage mobile operators' extensive networks to expand their agent reach, while mobile operators can use banking systems to provide more robust services, such as savings accounts or microloans.

Enhanced accessibility: Combining the strengths of both systems ensures your customers in rural and urban areas have access to a wider array of services.

This synergy ensures that Kenya’s financial sector continues to innovate while making services more inclusive and efficient.

Conclusion

The future of agency banking in Kenya is bright. It bridges the gap between traditional banking and underserved populations, ensuring no one is left behind. By addressing challenges and embracing innovation, you can revolutionize how financial services are delivered to rural and underserved populations.

DigiPay.Guru’s advanced agency banking solution can empower your business to offer reliable, secure, and cost-effective banking services to every corner of the world, unbanked or banked. Plus, it lets you boost financial inclusion, enhance your customers’ experience, reduce your operational costs & boost your revenues for you & agents.

Calling out to all banks who want to serve the Kenyan population, now is the time!

FAQ's

The main purpose of agency banking is to help banks like yours extend financial services to rural, unbanked, underbanked, and underserved areas without the need for costly physical branches. By partnering with agents, you can bring essential banking services closer to customers, and increase accessibility as well as financial inclusion.

Agency banking allows you to bridge the gap between your bank and communities with limited access to traditional banking. By placing agents in strategic locations, you provide convenient and affordable banking services like deposits, withdrawals, and loan access. This empowers people to save, invest, and improve their financial well-being.

Agency banking focuses on offering a wide range of banking services like deposits, withdrawals, account opening, and loans through agents authorized by banks. Mobile money services, on the other hand, are run by mobile operators and primarily handle money transfers and payments. While mobile money services are quick and convenient, agency banking offers deeper financial solutions backed by banks.

Yes, agency banking is safe when you implement robust security measures just like DigiPay.Guru does. By equipping your agents with secure tools like biometric authentication and encrypted systems, you can protect customer transactions. Regular monitoring and training of agents further ensure that services remain reliable and trustworthy. Prioritizing these measures will build customer confidence and loyalty.