DigiPay.Guru: Future-proofing South Africa’s financial ecosystem

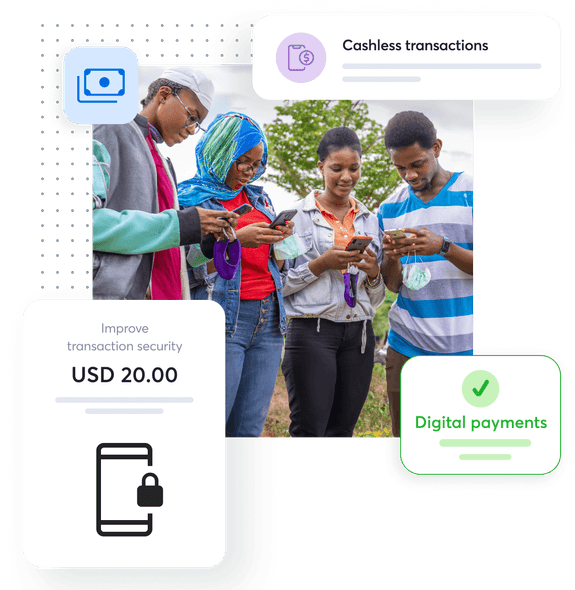

South Africa’s digital economy is expanding rapidly. With a surge in smartphone penetration and internet access, cashless payments are becoming the new norm. Businesses and banks that embrace this shift early are better positioned to attract customers, lower costs, and grow faster.

At DigiPay.Guru, we help banks, fintechs, and financial institutions in South Africa digitize their payment ecosystems. Our solutions are built to make your operations faster, safer, and more profitable.

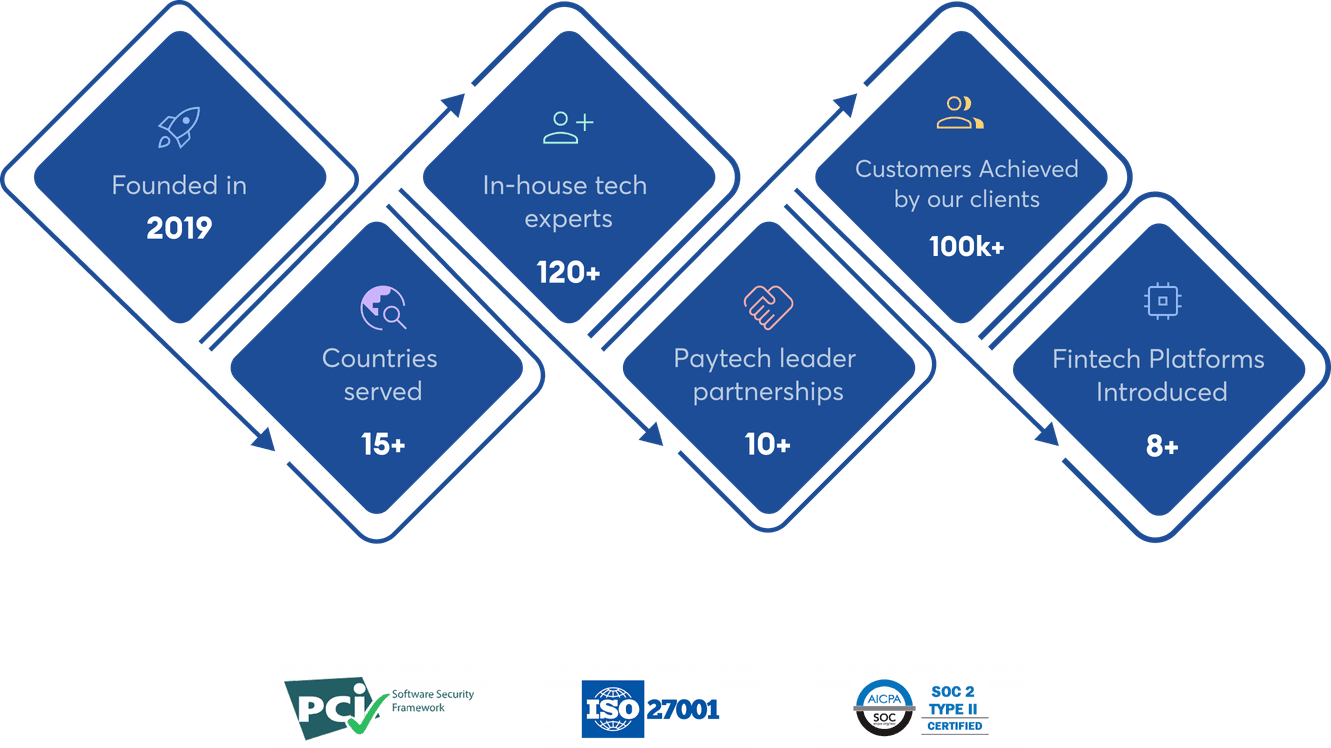

Our foundation and growth

Tap Into South Africa’s Rapidly Growing Digital Payment Landscape

South Africa is a key fintech player in Africa, with its digital payment market expanding rapidly across sectors.

Digital payment market size by 2030

Digital payment market revenue by 2030

Of the digital transactions in SA is contactless

Tailored digital payment solutions for banks & fintech companies in South Africa

Serve your customers better with powerful, scalable, and secure digital payment softwares built for South Africa’s financial ecosystem.

Mobile money solution in South Africa

Empower your users with a secure and user-friendly mobile money platform that supports wallet-to-wallet transfers, utility bill payments, and seamless agent-led transactions—even in remote areas.

Learn moreInternational remittance solution in South Africa

Simplify cross-border money transfers for your customers in South Africa with a secure, fast, and cost-effective remittance platform. Help them send and receive money globally with ease.

Learn morePrepaid card solution in South Africa

Launch, issue, activate, and manage prepaid cards seamlessly in South Africa. Provide your customers with a secure, flexible, and cashless payment experience using virtual & physical cards.

Learn moreAgency banking solution in South Africa

Expand your reach to rural and unbanked communities with a robust agency banking platform that enables secure transactions through POS devices and mobile agent apps.

Learn moreeKYC solution in South Africa

Simplify customer onboarding with AI-powered eKYC that includes face recognition, OCR document checks, and real-time AML screening—fully aligned with South African regulatory standards.

Learn moreMerchant acquiring solution in South Africa

Equip merchants with the tools to accept card, QR, and contactless payments. Streamline onboarding, settlements, and commission management from a single, customizable dashboard.

Learn moreWhy choose DigiPay.Guru’s digital payment platform in South Africa?

Trusted by leading fintech companies, banks, and digital payment players across South Africa and beyond

Start Your Digital Payment Services in South Africa Today

Talk to our expert

Frequently asked questions

Look through your eyes of insight to our insightful thoughts

DigiPay.Guru is born to simplify financial transactions. We love discussing the latest finTech solutions. We write regular blogs where we cover insightful topics with our insightful thoughts to cater you with imperative informations.