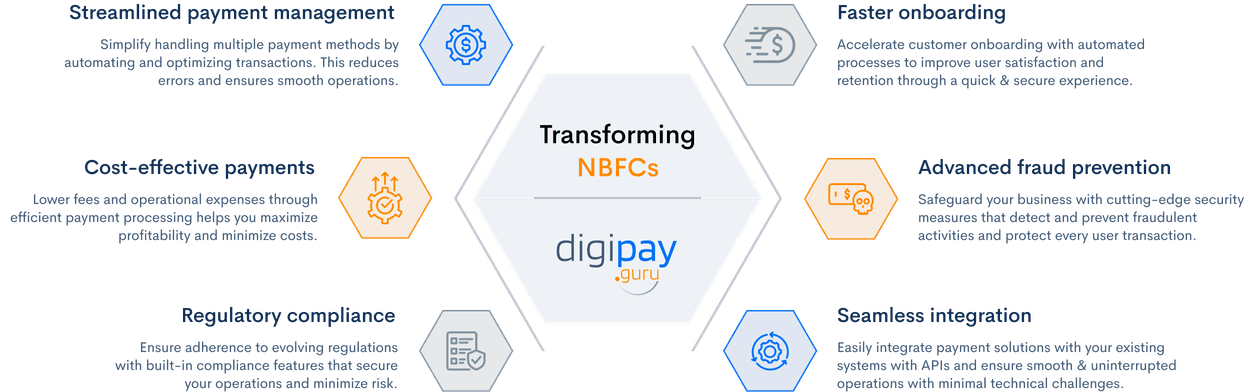

Addressing NBFC’s key challenges

Helping NBFCs win the global financial market

Transform your NBFC with our advanced digital payment solutions

Why choose Digipay.Guru’s digital fintech solutions?

Ready to transform your financial services?

Our fintech experts are ready to hear your requirements!

Schedule a demo

Look through your eyes of insight to our insightful thoughts

DigiPay.Guru is born to simplify financial transactions. We love discussing the latest finTech solutions. We write regular blogs where we cover insightful topics with our insightful thoughts to cater you with imperative informations.