FinTech

Bangladesh

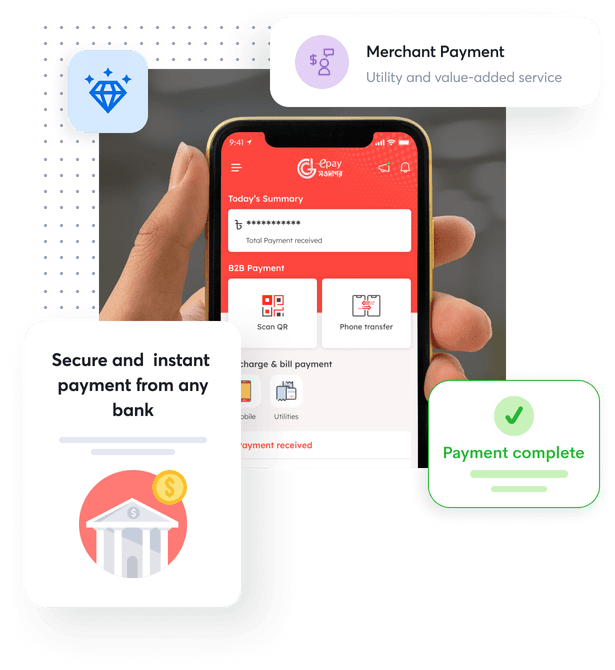

Merchant Acquiring Solution

Challenges

While setting up its merchant acquiring network, DGePay encountered several critical challenges that needed immediate resolution:

1. Fragmented payment ecosystem

Bangladesh’s digital payment landscape is highly fragmented, with users relying on different methods such as mobile banking, internet banking, credit/debit cards, and digital wallets. Hence, merchants struggled to integrate multiple payment channels, which resulted in a disjointed payment experience, increased cart abandonment, and limited customer reach.

2. Security concerns from banks

Given the sensitivity of financial transactions, banks raised concerns regarding data protection, regulatory compliance, and secure communication. Without addressing these concerns, securing partnerships with banks would be difficult.

3. Connectivity and integration challenges

Ensuring secure and reliable integration with multiple banks, especially for Core Banking Systems (CBS) and ISO8583 message formats, posed a technical challenge. Plus, the connectivity issues with MTB Bank further delayed the go-live timeline.

4. Merchant adoption and onboarding

The market was highly competitive, with existing players already dominating merchant payment services. Convincing merchants to adopt a new system required a strong value proposition, seamless integration, and attractive incentives.

5. Real-time transaction tracking and reporting

Merchants needed instant access to transaction data and analytics for better decision-making. And existing solutions were either delayed or lacked the depth of insights required for financial planning.

6. Scalability and performance

As DGePay aimed for high transaction volumes, it needed an infrastructure capable of handling traffic spikes without compromising speed, reliability, or security.

Solutions

To address these challenges, DigiPay.Guru developed a robust, scalable, and secure White Label Merchant Acquiring (WLMA) solution tailored to DGePay’s specific needs.

1. Unified payment platform

- Integrated support for popular mobile banking services (bKash, Nagad), credit/debit cards, and internet banking.

- Easy merchant integration through flexible APIs and SDKs.

- Streamlined checkout process to reduce friction and enhance customer trust.

2. Advanced security measures

- End-to-end encryption and secure communication via IPSec VPNs.

- JWT authentication for secure session management.

- Comprehensive Vulnerability Assessment and Penetration Testing (VAPT) for regulatory compliance.

- Real-time security monitoring to detect and mitigate threats proactively.

3. Reliable connectivity and integration

- Hybrid infrastructure combining on-premise and AWS cloud servers for flexibility.

- Secure IPSec VPN setup for seamless bank connectivity.

- Phased migration strategy to transition smoothly to cloud-based operations.

- Rigorous testing to ensure compatibility with Core Banking Systems.

4. Merchant onboarding & adoption strategy

- Competitive transaction fees and promotional incentives to attract merchants.

- Dedicated support team for onboarding assistance and technical training.

- White-label solutions allowing merchants to personalize their payment experience.

- Omni-channel support for both online and in-store payments.

5. Real-time transaction tracking and reporting

- ElasticSearch integration for instant transaction retrieval.

- Customizable dashboards and advanced analytics for merchants.

- Automated reconciliation processes to improve financial accuracy.

- Role-based access control for data security.

6. Scalable and high-performance architecture

- Microservices architecture with Spring Boot for modular scalability.

- Kafka messaging for efficient high-volume transaction handling.

- ElasticSearch for fast data indexing and retrieval.

- Auto-scaling and load balancing to ensure optimal performance during peak traffic.

How did it help DGePay?

- Expanded customer reach: Supporting multiple payment options attracted a diverse customer base, improving transaction success rates.

- Enhanced security & compliance: Strengthened data protection and regulatory adherence increased trust among banks, merchants, and consumers.

- Operational efficiency: Real-time transaction tracking and automated reconciliation reduced manual efforts and operational costs.

- Seamless merchant experience: A white-label and unified payment platform offered a consistent and branded payment experience.

- Scalability & reliability: High availability and fast processing ensured uninterrupted service even during peak transaction periods.

The impact

The implementation of DGePay’s payment gateway led to significant results:

Conclusion

DigiPay.Guru’s advanced merchant acquiring solution empowered DGePay to overcome critical challenges and establish itself as a leading Payment System Operator in Bangladesh.

With a secure, scalable, and user-friendly payment platform, DGePay is successfully building the country’s largest merchant payment network. This has transformed the way businesses and consumers transact digitally. As the platform continues to expand, it sets the foundation for a seamless and cashless future in Bangladesh.