FinTech

Haiti

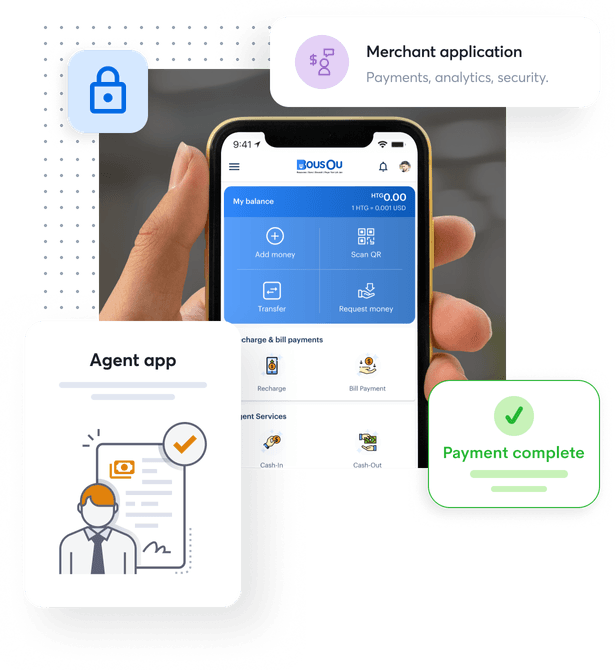

eWallet solution

Challenges

BOUSOU had a strong vision, but they were held back by serious operational and technical challenges:

1. Complex Bank API Integration

Haitian banks used outdated technology and inconsistent API standards, which made integration difficult. Plus, limited documentation caused delays, and the tight project timeline added pressure to resolve technical roadblocks efficiently.

2. Merging Agent and Merchant Functions

NatPay had separate apps for merchants and agents. But in Haiti, many merchants also act as agents. This dual-app structure caused confusion and led to operational inefficiencies. The client needed a seamless, unified experience.

3. User Onboarding and KYC Compliance

Low digital literacy and limited identity documentation made onboarding difficult. BOUSOU needed to meet KYC compliance while ensuring a smooth registration process. But, collecting and verifying valid identity proofs efficiently was a major challenge.

4. Payment Security

Ensuring transaction security while maintaining ease of use was critical. BOUSOU required strong encryption and real-time fraud monitoring to prevent unauthorized access and financial risks.

5. Infrastructure Limitations

Haiti’s inconsistent internet connectivity, especially in rural areas, created challenges. BOUSOU needed to support low-bandwidth conditions and provide offline functionality to ensure seamless financial transactions.

Solutions

DigiPay.Guru delivered a tailored eWallet solution to overcome BOUSOU’s core challenges:

1. Seamless Bank API Integration

- We developed custom middleware to bridge the gap between BOUSOU and the banks’ legacy systems. Plus, close collaboration with bank teams and an agile development approach ensured smooth and timely integration.

2. Unified Merchant and Agent App

- We combined merchant and agent functionalities into a single app with role-based access. This eliminated the need for separate platforms, simplified management, and improved user experience.

3. Improved User Onboarding and KYC Compliance

- We implemented automated KYC with real-time identity verification using document scanning and facial recognition. An offline registration mode allowed users in low-connectivity areas to onboard seamlessly.

4. Enhanced Security

- We integrated end-to-end encryption, multi-factor authentication (MFA), and real-time fraud monitoring. This safeguarded user data and ensured secure financial transactions.

5. Optimized Performance and Offline Support

- A lightweight app architecture enabled low-bandwidth functionality. Plus, offline transaction logging allowed users to continue transacting with automatic syncing when connectivity was restored. This improved the load balancing system performance during peak usage.

How did it help BOUSOU?

- Faster and more secure payments with direct API-driven bank integration

- Increased user engagement due to a unified merchant and agent experience

- Higher trust levels with improved security and KYC compliance

- Reduced onboarding time with automated verification and simplified workflows

- Expanded market reach, including rural areas, through offline and low-data support

The impact

The BOUSOU platform made a measurable impact in its first year:

Conclusion

BOUSOU is more than an app. It’s a catalyst for financial change in Haiti. With DigiPay.Guru’s eWallet solution, NatPay transformed challenges into real-world success. From outdated banking systems to offline rural payments, BOUSOU overcame every hurdle. The result? A trusted digital platform driving financial inclusion, security, and growth.

Reason? Our tailored eWallet solution enabled NatPay to launch a secure, efficient, and widely accessible platform. So, if your organization is ready to lead the future of digital finance, we’re ready to help you get there.