Quick, secure and efficient payment processing is not a nice to have; it’s a must have. For banks and fintechs like yours looking to add more services to your portfolio, understanding merchant payment processing is key.

And if you’re looking to offer or improve merchant acquiring services this guide will explain the ins and outs of payment processing, why it’s important and the benefits.

By the end of this blog you’ll see why a good merchant acquiring solution is essential and how your business can benefit.

Let’s get started!

Merchant payment processing: The basics

Now first, let’s understand the basics, including the meaning, and the key players involved:

What is merchant payment processing?

Merchant payment processing is the system that allows businesses to accept payments from customers via various payment methods like credit cards, debit cards or digital wallets. This includes all the steps that happen from the moment a customer swipes their card (or enters their details online) to the money showing up in the merchant’s bank account.

The interesting bit is that while a payment transaction may seem instant, there’s a lot going on behind the scenes. Understanding this process will help you appreciate its importance and spot opportunities to streamline and secure the payments you process.

Who are the key players?

Before we get into how merchant payment processing works, it’s important to understand the different parties involved. They all play vital roles in ensuring a smooth and secure transaction.

-

Merchant: The business or individual selling goods or services.

-

Customer: The person making the payment.

-

Acquiring Bank (Acquirer): The bank that manages the merchant’s account and handles the transaction on the merchant's behalf.

-

Issuing Bank (Issuer): The bank that issued the customer’s credit or debit card.

-

Payment Processor: The technology provider that connects all these players and ensures the transaction moves smoothly and securely.

Each of these participants has a critical role in the process. This ensures that payments are authorized, authenticated, and settled without a hitch.

Read More : Unlock the Power of Merchant Payments: Your Ultimate Guide

How does merchant payment processing work?

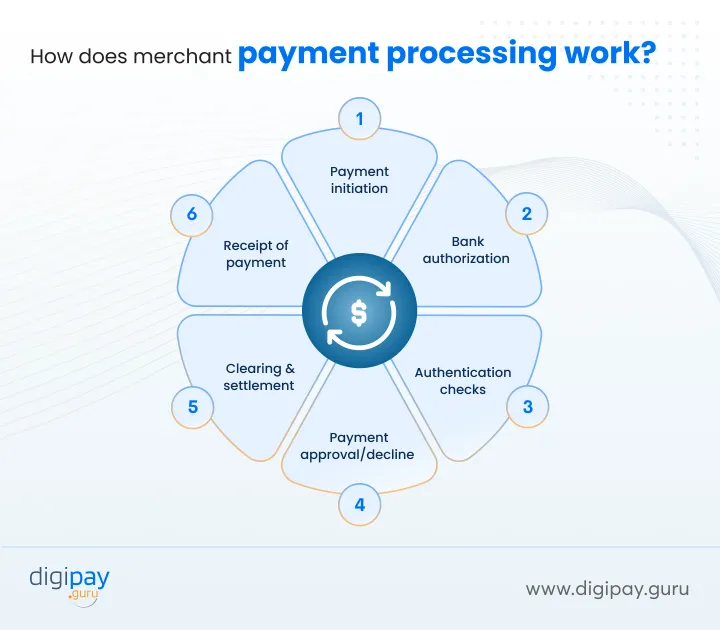

Let’s get into the nitty-gritty. The payment processing process has multiple steps, but don’t worry—it happens quickly and (ideally) without any hiccups. Here’s a simplified version of the steps involved in a typical payment transaction:

A step-by-step breakdown of the payment processing process:

Initiation: The customer initiates the transaction by providing their payment details, whether online or in person. This payment information is captured by a payment terminal or gateway, which sends the details to the merchant’s acquiring bank for authorization.

Authorization: The acquiring bank forwards the payment request to the card network (Visa, MasterCard, etc.), which then contacts the issuing bank (the customer’s bank). Here, the issuing bank checks whether the customer has enough funds to complete the transaction. If everything checks out, it authorizes the payment.

Authentication: The issuing bank may also perform additional checks to ensure the legitimacy of the transaction. These checks could include verifying the customer’s CVV code or even sending a one-time password (OTP) for additional security.

Approval or Decline: Once the issuing bank confirms the payment details, the card network sends either an approval or decline message back to the acquiring bank. If approved, the merchant gets notified that the transaction is successful.

Clearing and Settlement: After the transaction is authorized, the clearing process begins. The issuing bank sends the actual funds to the card network, which then routes the money to the acquiring bank. The acquiring bank deposits these funds into the merchant’s account, typically within a few business days.

Receipt of Payment: Finally, the merchant receives the payment in their bank account, and the customer sees the corresponding charge on their statement. Transaction complete!

Why is merchant payment processing crucial for financial institutions?

If you are a bank, fintech or financial institution, merchant payment processing is not just a service you offer. It’s the key to being in the game in today’s digital-first world. Clients – whether businesses or individual consumers—want connected, secure and fast payment experiences.

Increasing Revenue Streams

Offering merchant acquiring services isn’t just about facilitating payments—it’s also about unlocking new revenue streams for your business. You can earn through:

-

Transaction fees

-

Merchant account fees, and

-

By offering value-added services like fraud prevention or analytics tools

In essence, payment processing services provided by merchants are a double blessing: they let you do this by aiding and increasing your income in the process.

Improving Customer Retention

The payment experience is key to keeping customers happy. If a payment processing system for a merchant is slow or difficult to use, that merchant will lose sales and, ultimately, customers. For you, helping your clients (merchants) offer their customers a seamless payment experience ensures their loyalty to you and your brand as their service provider.

Benefits of using merchant services payment processing for your business

You must be thinking, “Okay, but what does all this actually do for businesses?” Here’s why it’s a game changer.

Increased Sales Opportunities

Offering multiple payment methods like credit cards, debit cards and digital wallets can help you reach more customers. The more options they have the more likely their customers will be able to complete their purchase.

Not giving customers more than one way to pay is like shooting yourself in the foot. The simpler it is to pay the more they will spend.

Fast and Secure Payments

Most of the merchant payment processing solutions are combined with high-tier encryption, tokenization, and fraud detection in order to protect both parties – the business as well as its customers.

And let's face it, when you promise secure transactions, you’re not just promising to keep the money safe. You’re also promising your customers (i.e. merchants) that you are a partner they can trust– and trust = more business.

Better Cash Flow Management

One of the biggest benefits of modern payment processing is how quickly businesses receive their money. Instead of waiting for days, many solutions offer nearly instant or same day transfers to ensure businesses have a strong and healthy cash-flow.

Global Expansion Opportunities

Because of digital payment processing, your clients (merchants) can easily accept payments from their customers from all across the globe. This is a great opportunity for small businesses that want to scale their business globally but do not want/need to open physical branches in varied countries.

Go global with the right merchant acquiring solution, just a click away.

Read more : Essential features of an ideal merchant payment solution

Things to consider when opting for merchant payment processing service in merchant acquiring

Not all merchant acquiring platforms are created equal. Choosing the right one for your business—or recommending the right one to your clients—is essential for ensuring smooth and secure payment processing. Here’s what to keep in mind.

Flexibility and Scalability

With the growth of your business, your payment solution should also grow. So, you should choose a platform that can allow you to add new payment options and expand your business into new markets without having to stop operations.

Whether you are scaling your small business or managing a global operation, you must have a flexible platform that can easily handle the upscale.

Regulatory Compliance

You must ensure that your merchant acquiring platform can adhere to the PCI-DSS standards and other necessary regulatory requirements. This will help you avoid any fines, security risks, and any possible reputational damage.

No one wants compliance complexity to become their headache, especially when it can cost you thousands—or worse, your business’s trust.

Transparent Fees

Merchant account fees can be tricky. Avoid platforms that hide their fees in the fine print. Look for a solution that offers clear, upfront pricing so you (or your clients) can budget properly. Transparency in fees means fewer surprises and fewer surprises mean happier merchants.

Seamless Integration

Your payment processing solution should easily integrate and work with your current POS tools, bookkeeping software, and online stores. The more seamless the integration, the better the overall experience from a merchants perspective and the consumer’s perspective as well.

How DigiPay.Guru can transform your payment processing

At DigiPay.Guru, we specialize in providing merchant acquiring solutions designed to simplify and optimize payment processing for banks, fintechs, and financial institutions. Our platform supports multiple payment methods, from credit cards to digital wallets which ensures that your business can cater to a wider customer base.

With advanced fraud detection, seamless integration, and real-time analytics, we offer a solution that enhances security and boosts operational efficiency. Whether you're looking to expand globally or streamline local transactions, DigiPay.Guru is your partner for secure, scalable, and future-proof merchant payment processing.

Let us handle your payments, so you can focus on growing your business.

Conclusion

Merchant payment processing is more than just a back-end service—it’s a critical component of a successful business. For banks, fintechs, and financial institutions, offering merchant acquiring solutions gives your clients (merchants) the tools they need to manage payments efficiently, boost revenue, and create seamless customer experiences.

Investing in the right merchant acquiring platform isn’t just a smart business move—it’s a necessity for staying ahead of the curve. As the old saying goes, “You can’t manage what you don’t understand.” So, make sure your clients (merchants) understand the value of merchant payment processing, and help them choose the right solution.

Because in the end, a streamlined payment process doesn’t just move money—it moves your business forward.

FAQ's

A merchant in payment processing refers to any business or individual that sells goods or services and accepts payments, typically via credit cards, debit cards, or digital payments. Merchants rely on payment processing systems to complete these transactions securely.

A merchant is the business that accepts payments, while a payment processor is a third-party service provider that handles the transaction between the merchant, customer, and the banks involved. The payment processor ensures that funds are transferred securely and efficiently.

An example of a merchant payment is when a customer buys a product online using their credit card. The payment is processed through a payment gateway, and the funds are transferred from the customer's bank to the merchant's account.

A merchant service provider is a company that offers services to businesses for accepting and processing payments. These services include setting up merchant accounts, providing POS systems, and facilitating card transactions for both online and in-person sales.