Payment acceptance has become a piece of cake for merchants today. Why? We all know the answer. It’s because of the rise of digital payments and a wide range of payment options available for acceptance, such as QR code payments, NFC payments, online banking, digital wallets, and more.

These merchants can be a small stall outside the mall or a small retail store near residences. Whichever the merchant is, all your merchants want to seamlessly accept, receive and settle payments into their merchant account.

But, what is a merchant account? And how does it work? How does the payment get processed when the customer pays them?

In this blog post, you will learn:

- What is a merchant account?

- Why are merchant accounts crucial for businesses?

- How payment processing works: a step-by-step guide

- Challenges with traditional merchant accounts

- How to choose the right merchant account provider?

- How DigiPay.Guru’s merchant acquiring solution can help

Let’s begin this blog with the meaning of merchant, its example, types, and more.

What is a merchant account?

A merchant account is one kind of bank account. But it's exclusively for businesses/merchants. This account allows merchants to accept and process payments via credit/debit card, QR code, NFC, digital wallet, and more.

It's very different from the regular bank accounts, as the merchant accounts are designed while keeping the handling of the complexities of payment processing in mind.

Merchant account example

One of the best examples of what is a merchant account would be a small retail store. Let’s suppose a small retail store wants to start accepting card payments. For accepting the card payments, this small retail store will have to have a merchant account. This account can ensure a smooth transfer of funds to the merchant bank account from the customer’s card. The account to which the fund transfers happen is a “merchant account”.

How merchant accounts are different from the regular bank accounts

The merchant bank account does not just hold funds like the standard bank account, but it also facilitates the full-fledged process of payment by:

- Transaction authorization

- Funds transfer after the verification process

- Protection of sensitive payment information

Types of merchant accounts

Different businesses have different needs, and so the type of merchant services accounts may vary based on it:

Retail merchant accounts

These types of merchant accounts are perfect for physical stores that have a point of sale pos system. The retail business merchant account streamlines in-person payment processing.

They ensure quick and secure transactions, which minimizes delays for customers and enhances their shopping experience efficiently.

Online merchant accounts

These merchant accounts are suited for e-commerce merchants as they facilitate payments through websites.

Plus, they integrate with payment gateways that enable secure card-not-present transactions and support multiple currencies, which is very critical for global online stores.

High-risk merchant accounts

These accounts are designed for industries prone to chargebacks or fraud, like travel, gaming, or adult entertainment. And a high risk merchant account offers enhanced fraud detection and chargeback management tools. These features protect both merchants and their customers, which makes sure that their business can have continuity in risk-prone sectors.

Read more: Digital wallet fraud: What is it and how to prevent it

Mobile merchant accounts

Mobile merchant accounts are perfect for merchants that operate on the move as they enable payments via mobile devices. These merchant accounts can be ultimate for food trucks, pop-up shops, or service professionals.

Plus, they provide next-level flexibility and convenience for both merchants and customers.

Why are merchant accounts crucial for businesses you cater

For businesses (your customers) aiming to stay competitive, offering flexible payment options is quintessential. A merchant account empowers them to accept various payment methods seamlessly and with very little stress of payment settlements.

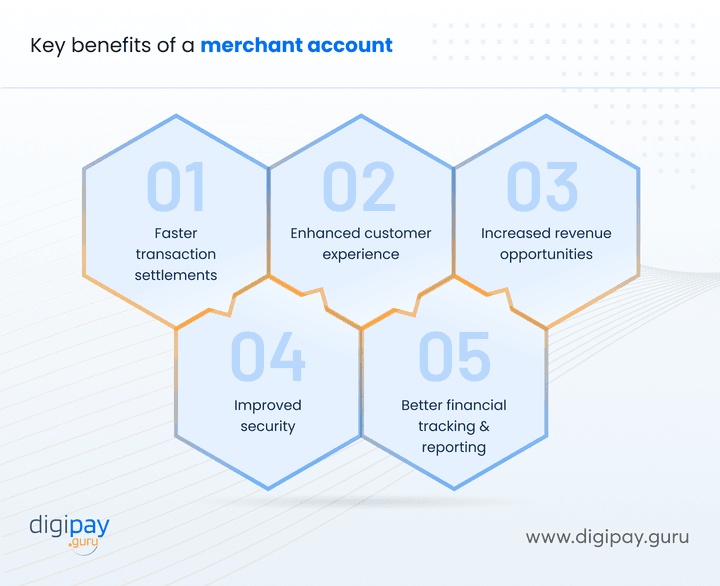

Let’s look at some of the key benefits that having a merchant account can offer:

Benefits of a merchant account

Faster transaction settlements

Funds are transferred very fast and settled in a merchant bank account. This improves cash flow and ensures merchants have access to their earnings on time. This level of speed can help your customers (merchants) to manage operational costs effectively. Plus, it reduces financial concerns during peak seasons.

Enhanced customer experience

Accepting payments via multiple payment methods allows your merchants to make their customers’ payment experience smooth and extremely convenient.

Whether their customers prefer to make payments via cards, mobile wallets, or contactless options, this flexibility boosts customer satisfaction and loyalty. And it also gives them a competitive edge in the market.

Increased revenue opportunities

When you offer a wide range of payment options and preferences, the merchants are likely to attract more customers than ever. These customers may include tech-savvy individuals and those who rely solely on digital payment methods.

With all kinds of customers’ payments accepted, it often results in higher sales volume and enhanced revenue growth.

Improved security

Modern merchant accounts come with advanced fraud detection, security, and encryption technologies like tokenization, secure sockets layer (SSL) and transport layer security (TLS), advanced encryption standard (AES), and more. All these techniques protect sensitive customer payment information as well as funds.

Moreover, these security measures can build customer trust, which then encourages them to shop confidently and frequently from your merchant.

Better financial tracking and reporting

Most of the merchant bank account providers offer a monthly transaction report and analytics. Such information is valuable to the merchants since it enables them to track the sales density and peak selling periods.

Plus, it enables merchants to make the right decisions regarding the stock inventory and staffing.

Read More : Unlock the Power of Merchant Payments: Your Ultimate Guide

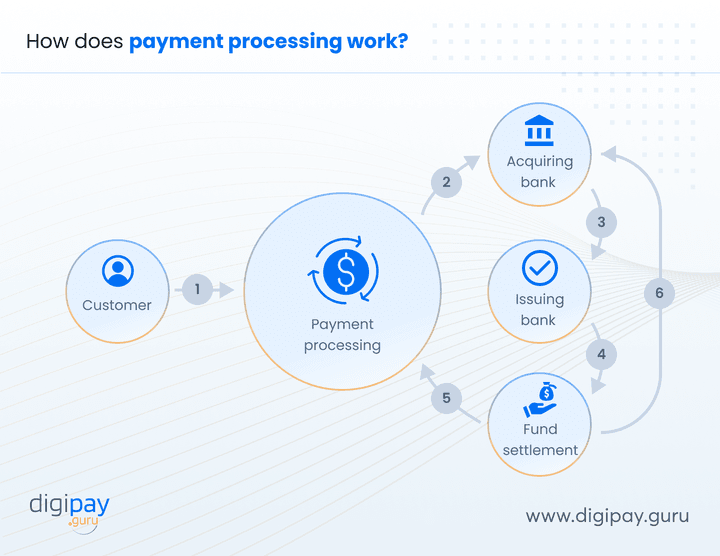

How payment processing works: A step-by-step guide

Payment processing may seem complex, but it follows a structured flow that ensures secure and efficient transactions. Let’s break it down:

1. Authorization

The customer will first initiate the payment against their purchase. It can be either through a card swipe or by using their preferred payment mode. The payment gateway captures the data and sends it to the acquiring bank for approval.

2. Authentication

Next, the acquiring bank forwards the details to the card network (Visa, MasterCard, etc.), which verifies the information with the issuing bank.

3. Approval or Decline

The issuing bank can now either approve or decline the transaction. This is done based on factors like available funds or fraud potentials.

4. Settlement

Once approved, the funds are transferred to the merchant’s account, minus any transaction fees or processing charges.

Key players in payment processing

The payment processing process is made possible and complete with 4 major parties involved in the process. They are:

- Payment gateway: Ensures secure data transmission.

- Acquiring bank: The bank that processes transactions in place of the merchant.

- Payment processor: Handles transaction routing and settlements.

- Issuing bank: The customer’s card-issuing bank that approves or declines the payment.

Challenges with traditional merchant accounts

While merchant accounts are essential, traditional setups come with their fair share of challenges:

- Lengthy onboarding: The old merchant bank account services entail the filling of many papers and waiting for long hours or even days for approval.

- High transaction fees: Adding charges that are hidden and variable fees can impact your merchants’ margins negatively.

- Settlement delays: Business cash flow can be affected by delayed fund transfers, if they haven't chosen a good merchant payment acceptance service provider.

- Security and fraud risks: With inadequate protection, a merchant’s business continues to be at risk of being subjected to data breaches and chargebacks.

These challenges highlight the need for advanced solutions like a merchant acquiring solution that offers streamlined processes and enhanced security.

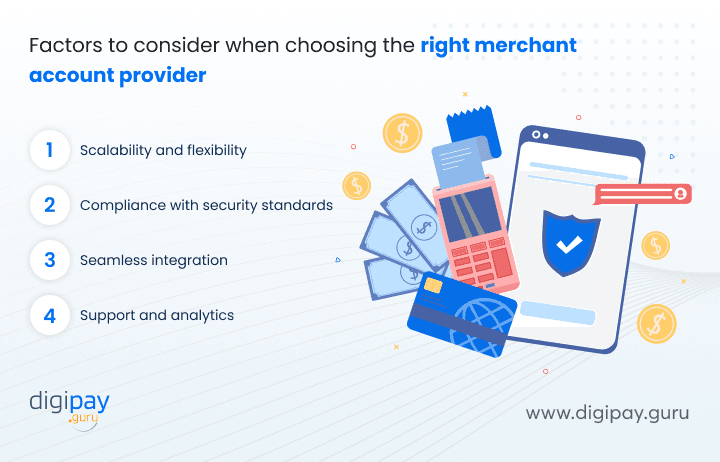

Choosing the right merchant account provider

Now that you know about a merchant bank account and more, you should understand how you can offer the best merchant payment processing services to your merchants. For that, you need to integrate the right merchant account provider in your system.

For banks and fintechs like you, selecting the right merchant account provider is critical to offering a competitive and reliable solution.

Here’s what factors to consider when choosing the right merchant account provider :

1. Scalability and flexibility

A good merchant account provider should offer solutions that can scale with your business growth. Whether you’re catering merchant account for small business or large enterprises, the platform should adapt easily.

Plus, the provider should offer flexibility to support various payment methods, like digital wallets, QR codes, and international payments, which ensures you meet diverse merchant needs.

2. Compliance with security standards

Security is non-negotiable in payment processing for merchants. Choose a provider that complies with advanced security standards like PCI DSS (Payment Card Industry Data Security Standard) to ensure safe transactions.

Additionally, advanced security features like encryption, tokenization, multi-factor authentication, and fraud detection tools are essential to protect merchants and customers.

3. Seamless integration

The solution should integrate effortlessly with your existing systems, which will minimize the technical disruptions during implementation.

These disruptions include compatibility with POS systems, e-commerce platforms, back-office tools, and more. It enables a smooth transition for your business and merchants.

4. Support and analytics

Robust customer support is vital for addressing merchant queries and resolving issues promptly. Additionally, real-time analytics and reporting capabilities help you and your merchants gain insights into transaction patterns, customer behavior, and revenue trends.

These insights become very valuable when the merchants or your business need to make data-driven decisions.

How DigiPay.Guru’s merchant acquiring solution can help

DigiPay.Guru’s merchant acquiring solution is designed to address the pain points of banks & fintechs like you. As a bank/fintech, you can cater to varied sectors with our robust merchant-acquiring solution and enjoy the benefits of growth & success.

Here’s how:

1. Quick and seamless onboarding

With DigiPay.Guru, the onboarding process is streamlined, which allows merchants to get started in minutes rather than weeks. The platform’s intuitive interface guides merchants through the setup process, which minimizes delays and ensures a hassle-free experience.

2. Support for multiple payment methods

DigiPay.Guru enables merchants to accept a wide range of payment options, including credit card transaction, debit cards, digital wallets, QR-based payments, and even cross-border transactions. This versatility helps merchants cater to diverse customer preferences and expand their reach.

3. Advanced security and fraud prevention

Our solution incorporates state-of-the-art security measures, such as PCI DSS compliance, encryption, tokenization, 2FA, 3DS, and AI-driven fraud detection. These features ensure that transactions are secure and reduce the risk of chargebacks.

4. Real-time reporting and analytics

Merchants benefit from real-time dashboards that provide insights into transaction volumes, settlement statuses, and customer behavior. These analytics empower merchants to make informed decisions, optimize operations, and identify growth opportunities.

5. Scalability and customization

DigiPay.Guru’s solution is built to scale, which makes it suitable for businesses of all sizes. Additionally, it offers customization options to align with the unique branding and operational needs of your business, which ensures a tailored experience.

6. Cost-effective solutions

By offering competitive pricing and reducing hidden charges, DigiPay.Guru helps banks and fintechs like you to improve their margins while providing merchants with cost-effective solutions.

7. Enhanced merchant retention

With its robust features, transparent processes, and exceptional support, DigiPay.Guru ensures higher merchant satisfaction and retention. And, happy merchants are more likely to stay loyal, which boosts long-term partnerships.

Conclusion

Merchant accounts are an integral part of any merchant payment acceptance process. They are different from regular bank accounts as they can seamlessly accept and settle payments received by merchants.

All you have to do is offer the best payment acceptance services to your merchants. And for that, you yourself need a perfect merchant acquiring solution for your business (bank & fintech).. Moreover, the payment processing via merchant bank account is very smooth and fast if done via the best merchant payment solution provider.

DigiPay.Guru empowers businesses like yours with a robust and secure merchant acquiring solution by enhancing and simplifying payment acceptance for merchants. We enable you to ensure secure transactions, boost revenue potential, and instill confidence in your customers.

We offer fast onboarding, multiple payment options, and advanced security to keep your merchants and your business always ahead of your competitors. As the digital payments landscape evolves, partnering with DigiPay.Guru ensures your business stays ahead of the curve.

FAQ's For Merchant Accounts

A merchant account is a type of bank account specifically designed for businesses to accept payments through credit cards, debit cards, and electronic payment methods. It acts as a bridge between the merchant, the customer’s bank, and the merchant’s bank, facilitating secure and efficient payment processing.

When a customer initiates a payment, the transaction details are sent to the merchant account for verification and approval. Once the issuing bank authorizes the payment, the funds are temporarily held in the merchant account before being transferred to the merchant’s business bank account, usually within 1-2 business days.

1. Retail merchant accounts: For brick-and-mortar stores with physical POS systems.

2. Online merchant accounts: For businesses operating in e-commerce.

3. High-risk merchant accounts: For industries prone to chargebacks, such as gaming or travel.

4. Mobile merchant accounts: For businesses that accept payments via mobile devices on-the-go.

Merchant accounts use advanced security protocols like encryption, tokenization, and fraud detection systems. Additionally, they comply with PCI DSS (Payment Card Industry Data Security Standard) to safeguard sensitive data and reduce the risk of fraud and chargebacks.

Merchant account charges typically involve several fees, including:

Transaction fees: A percentage of each transaction processed.

Monthly fees: Fixed charges for maintaining the account.

Setup fees: One-time fees for account creation.

Chargeback fees: Penalties for handling disputed transactions.