Sending money across borders has become a necessity for numerous people worldwide. So offering a robust international remittance platform can be a big advantage for you as a remittance business.

However, cross-border fees can make or break your remittance service. How? Well, high fees feesand complex processes can frustrate your customers. This can impact your credibility and profitability plus can create a barrier to financial inclusion.

Hence, understanding how cross-border fees in remittance work, how they work, and how to optimize them is crucial for staying competitive in the remittance industry.

In this blog, you will learn:

- What are cross border fees?

- How are cross-border fees calculated? -The impact of high fees on global remittances and your business

- How to optimize cross-border fees and more…

Let’s first by understanding the basics of cross-border fees.

Understanding cross border fee in remittance

Before we dive deeper into the importance of cross border fees, let’s first understand what it means, fee calculation, and who charges them.

What are cross-border fees & Charges in remittance?

Cross border fee meaning

Cross-border fees refer to charges applied when processing international transactions. These fees cover the costs of transferring funds between different countries and financial systems. They can include processing fees, foreign transaction fees, and currency exchange fees.

How are cross-border fees calculated?

Cross-border fees calculate keeping several factors in mind. such as:

Transaction amount – Higher amount transfers often have percentage-based fees.

Payment network charges – Companies like Visa, Mastercard, and SWIFT charge processing fees.

Currency exchange costs – Fluctuating exchange rates impact the final amount.

Compliance costs – Security checks and regulations add extra charges.

Each of these factors contributes to the total remittance cost. This affects both you and your customers. Keeping these fees low is key to staying competitive.

Who charges cross-border fees?

There are multiple intermediaries and parties involved, so multiple entities charge cross-border fees, which include:

- Issuing banks that process international transactions.

- Payment networks like Visa and Mastercard.

- Currency exchange providers.

- Payment processors and intermediaries and more.

The impact of high fees on global remittances and your business

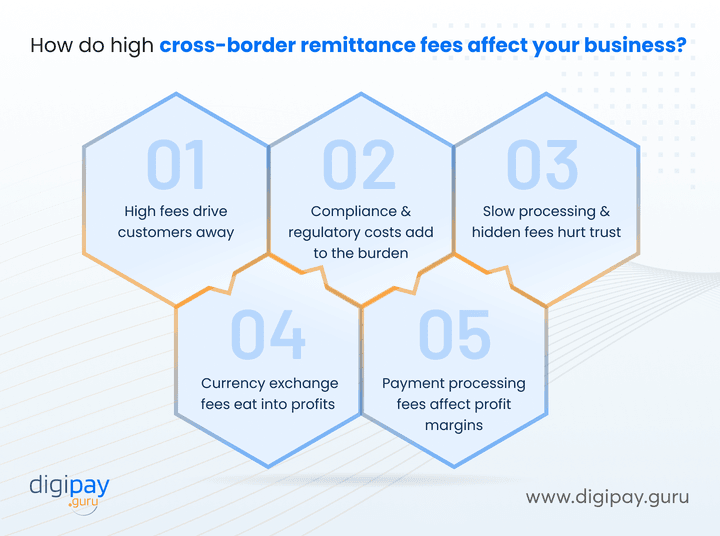

High remittance fees don’t just affect your revenues and profits, they directly impact your customers as well as business growth. If fees are too high, customers will look for alternatives, transactions slow down, and profitability takes a hit.

Here’s how high cross-border fees impact your business:

High fees drive customers away

Customers want affordable remittance options. If your remittance fees are too high, your customers won’t think twice before switching to a competitor offering lower fees.

This can lead to:

- Lost revenue as customers choose other providers.

- Reduced trust in your service.

- Lower transaction volumes, thereby impacting long-term growth.

Hence, affordability matters and high costs drive users toward alternative payment methods or informal channels.

Compliance and regulatory costs add to the burden

Meeting global compliance regulations like KYC and AML increases operational costs. While necessary for security, these high operational costs lead to high cross-border fees. This makes it challenging to offer competitive pricing.

Slow processing and hidden fees hurt trust

Customers value transparency and speed. And delays due to compliance checks, inefficient processing, or hidden fees frustrate users and make it difficult for the customers to trust your remittance platform.

If they don’t trust your pricing, they won’t use your platform again and will look elsewhere for better service.

Currency exchange fees eat into profits

Unfavorable cross border remittance rates for exchange and high conversion fees mean your customers receive less than expected. If your platform cannot curb these currency exchange limitations, cross border fees will increase.

Plus, if exchange rate markups are excessive, customers lose trust and hesitate to use your service again. This is not good for your business’s long-term success.

Payment processing fees affect profit margins

Every transaction goes through multiple financial institutions, each taking a cut. Plus, Visa, Mastercard, and other payment networks impose assessment fees that affect your revenue. Hence, if processing fees are high, they can reduce your profits, especially on frequent or small transactions.

Staying competitive: How to optimize cross-border fees

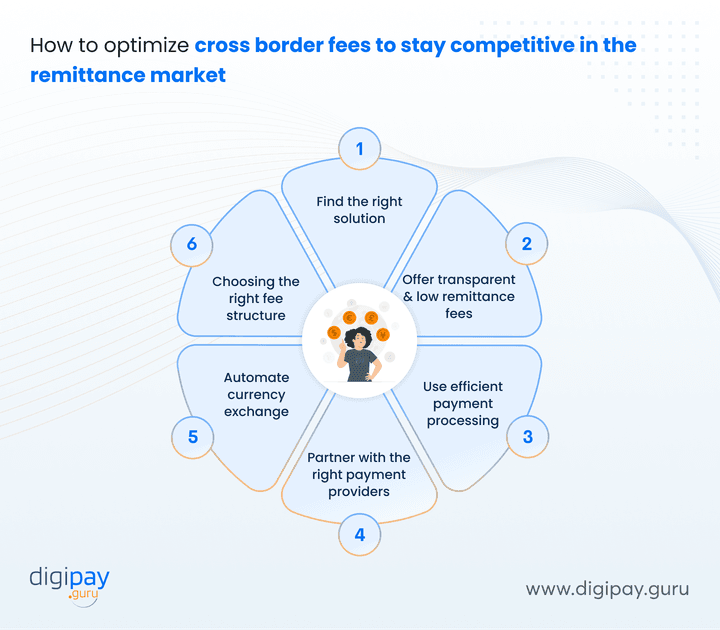

Cross-border fees can impact your business’s profitability and customer retention. To stay ahead, you need a strategy that reduces costs while maintaining efficiency.

Here’s how you can optimize cross-border fees and provide better value to your customers:

Avoid high cross-border fees with the right solution

Choosing the right payment provider helps you lower fees and speed up transactions. This is because a reliable remittance solution ensures minimal hidden cross border charges.

It also ensures competitive exchange rates with multiple rate provider partnerships and clear fee structures. The right provider can make your services more attractive to your customers.

Offer transparent and low-cost remittance fees

Customers prefer services that clearly outline costs without surprises or any extra hidden fees. So, you must show upfront pricing and fee structures plus avoid any hidden processing charges.

Moreover, providing fair exchange rates and removing unnecessary fees builds trust and increases customer loyalty.

Use efficient payment processing to reduce costs

A strong payment infrastructure can reduce cross border transaction fee and speed up transfers. Hence, using local payment networks instead of costly international routes helps lower processing fees effectively.

Moreover, advanced automation can help further optimize costs and improve the efficiency of your international remittance services.

Partner with the right payment providers

A good payment provider ensures low fees, quick transactions, and adherence to complex compliance standards and regulations. Choosing the right partner helps you scale operations without adding unnecessary costs. So, you should look for providers that offer flexible pricing and global reach.

Automate currency exchange to reduce conversion costs

Manual currency conversion often adds unnecessary fees and complexity to the process. Automating this process of currency exchange helps you secure the best exchange rates in real time. This reduces costs and provides better pricing for your customers.

Choose the right cross-border fee structure

The right pricing model ensures profitability while keeping your services affordable. Flat fees work well for frequent low-value transfers, while percentage-based pricing is better for high-value transactions. Hence, a hybrid approach can balance out the cost and competitiveness.

All in all, it’s in your hands to provide the best cross-border fees to your customers.

Read more - DigiPay.Guru's Cross Border Payment Platform: Cost-effective, Flexible, and Scalable

How DigiPay.Guru helps you stay competitive in cross-border remittance

DigiPay.Guru offers a robust international remittance solution, which helps you provide cost-effective, transparent, secure, interoperable, and efficient cross-border payment services. These key capabilities of our solution help your business optimize your cross-border fees effectively.

Moreover, we offer:

- Transparent fee structures & FX rates

- Simplified cross border transactions

- Optimized partner availability for international payments

- Automated selection of cost-effective transfer routes and more

All these capabilities help in offering the best and most competitive cross-border fees to your customers.

In addition to this, we offer varied advantages like:

- Low remittance fees to maximize affordability.

- Real-time payment processing to speed up international transactions.

- AI-driven currency exchange optimization to offer the best FX rates.

- Seamless integration with multiple payment networks to reduce intermediary costs.

Our advanced platform ensures that your business stays competitive by reducing unnecessary charges while maintaining fast and secure transactions.

Conclusion

Cross border fees are one the most important aspects of making cross-border remittance payments for your customers. Unnecessary, complex, and unclear cross border fees can make them your competitors’ customers. This is why cross-border fees significantly impact your business’s ability to attract and retain customers.

High fees will drive your customers away, make the transactions slow, and reduces profitability. But, by offering low-cost, transparent, and efficient international remittances fees, businesses like yours can gain a competitive edge in the remittance market.

With DigiPay.Guru’s robust cross border payment solution, your business can optimize cross border fees in remittance, increase revenue, and improve customer satisfaction. Plus, you can automatically identify the most cost-effective transfer routes by comparing fees and exchange rates from multiple providers.

Bottom line: The future of cross-border payments is cost-effective, secure, and seamless. Are you ready to stay ahead?

FAQ's

A international transaction fee is what you pay when processing international payments. It covers compliance, processing, and intermediary costs. As a remittance business, keeping these fees low helps you offer competitive pricing and attract more customers.

No, they are different. Cross-border fees apply when you send or receive money across countries, while foreign transaction fees are charged when your customers make purchases in a foreign currency. When you handle global payments, understanding both helps you minimize unnecessary costs.

No, cross-border fees cover the cost of processing international transactions, while currency exchange fees apply when converting money from one currency to another. If you're not careful, these fees can add up and impact your margins. Hence, choosing a provider with transparent pricing helps you control costs.

You can reduce fees by working with a payment provider that offers low-cost international transfers. Plus, using direct payment networks instead of expensive intermediaries saves money. Also, automating currency exchange and selecting the right fee structure ensures you're not overpaying for transactions.