Card issuing is transforming how businesses like yours offer financial/payment services. No matter your business, understanding card issuing can open new revenue streams, improve customer engagement, and simplify payments for your customers.

But the problem is, that many businesses find card issuance a very complex process. Plus, they also find it costly and unclear. So, they might feel - is it worth it? How does it work? How will it benefit my business?

If you are among these businesses, worry no more! In this blog post, you will learn everything about card issuing, what it is, how it works and more.

Let’s begin with what is card issuing. Here it goes!

What is card issuing?

Before we dive into understanding card issuing in detail, let’s begin with a simple meaning of it. This will help you to understand the rest of the concepts easily.

The meaning

Card issuing is the process of issuing, activating, distributing, and managing payment cards for your customers. The businesses that issue a card act as an “issuing bank” or they partner with one to provide prepaid, debit, or virtual cards.

These cards enable customers to make payments, withdraw money, and manage their finances conveniently.

Types of issued cards

There are varied types of cards that can be issued. Some major types that you can issue for your customers are:

Prepaid cards: Prepaid cards let your customers load money in advance so they only spend what they have.

For example, user can get a prepaid card to manage their monthly budget without worrying about overspending.

Debit cards: Debit cards link directly to the bank account, which lets the customer spend only what is available.

For example, users can use a debit card for their daily purchases and ensure they never exceed their balance.

Credit cards: Credit cards allow your customers to borrow money up to a set limit and help build their credit history.

In simple words, they can earn rewards on their spending while paying off their balance each month.

Virtual cards: Virtual cards are digital cards designed for secure online transactions without a physical card.

For example, your customers can use a virtual card when shopping online to protect their actual card details.

Business & corporate cards: Business cards give your customers control over company spending with customizable limits and easy tracking.

For example, your customers can use a corporate card to manage their employee expenses while keeping their finances in check.

Who are the key players in card issuing?

There can be many parties involved in the process of card issuing. But the key parties are:

Card Issuing bank – The bank/institution that issues cards to its customers – basically you.

Card networks – Brands like Visa, Mastercard, and American Express that facilitate transactions.

Program managers – Companies that design and manage card programs for businesses.

Processors – Technology providers that handle transaction processing and compliance.

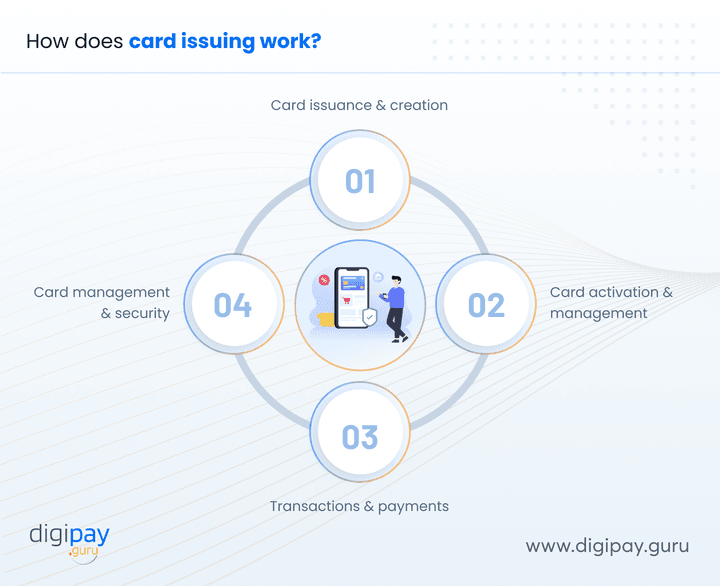

How does card issuing work?

Now that you know the basics of card issuing, it’s time to know how this actually works. This topic will remove all the doubts you may have till now in your mind.

Here’s the exact process of how card issuing works:

Step 1: Card issuance & creation

You can start by partnering with a trusted card issuing and management platform. This platform will help you design and create a card that reflects your brand.

Whether you choose a physical or virtual card issuing, you get a tailored product that meets your business needs.

This level of customization means that it would let you offer cards that carry your logo and message—right from the start. This keeps your brand in the spotlight.

Step 2: Card activation & management

The next step is for your customer to receive the card and activate it using a mobile app or web portal.

They register their details in the system, set spending limits for their prepaid card, and manage their preferences according to their needs.

This process is designed to be fast and user-friendly. Plus, it ensures that each card is securely linked to its rightful owner.

Step 3: Transactions & payments

Once activated, your customer uses the card for everyday purchases or cash withdrawals. The card network, like Visa or Mastercard, processes the transaction securely.

Then, the funds are debited or credited in real-time. This ensures a smooth payment experience for both you and your customer.

Step 4: Card management & security

Your card issuing platform monitors transactions continuously. You receive real-time alerts for any unusual activities.

Plus, you can quickly freeze or adjust card settings to protect your customer’s funds.This step is crucial for maintaining security and preventing fraud.

Bottomline: Each step in the card issuing process is designed to be clear, smooth, and secure. By following these steps, you can provide a reliable payment solution that builds customer trust and drives your business forward.

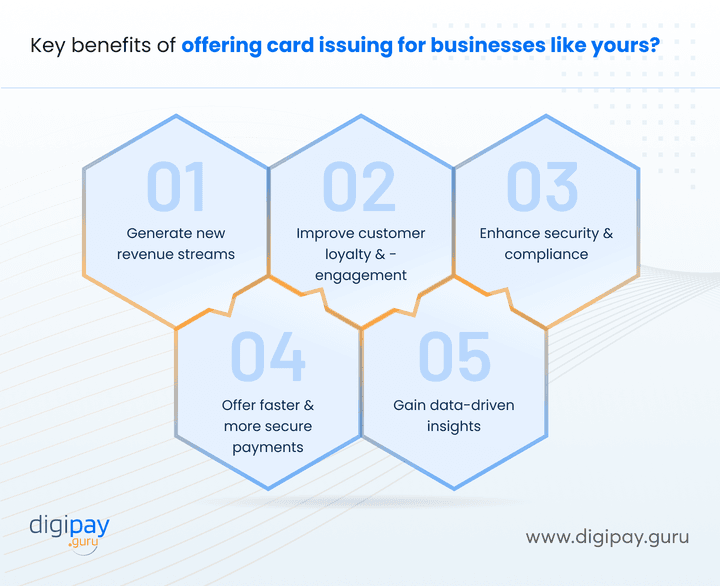

Key benefits of offering card issuing for businesses like yours?

Offering card issuing can bring a range of advantages to your business. Here are the key benefits of card issuing for businesses like yours – each explained in detail:

Generate new revenue streams

The transactions that happen through your platform become a source of new income because you earn fees on each transaction. These fees can include interchange fees, monthly fees, and other charges that add up over time.

Your business generates new opportunities for revenue with each swipe, tap, or click a customer makes on your platform, which leads to a consistent and expandable source of earnings.

Improve customer loyalty & engagement

A branded card program lets you build direct contact with your customers. Customers use your branded payment card for all their daily transactions, thus keeping your brand constantly visible to them.

A well-designed card program establishes customer trust as it strengthens the relationship between you and your customers. This provides a seamless financial experience to your customers and creates a valuable feeling of appreciation in them.

Enhance security & compliance

A robust card issuing solution equips you with advanced fraud detection and risk management tools. Through this solution, you can monitor transactions in real-time to spot any unusual activity and prevent fraud.

Moreover, a prepaid card solution helps you meet regulatory requirements like PCI DSS, AML, and KYC. And with enhanced security, your customers and your business are better protected.

Offer faster & more secure payments

By offering card issuing, you empower your customers with quick, reliable, and secure transactions. The system processes payments in real-time, which reduces delays and improves satisfaction.

Whether it is a physical or virtual card, the focus remains on speed and security. This results in a frictionless payment experience that benefits everyone.

Gain data-driven insights

Each card transaction provides valuable data that you can use to understand customer behavior and analyze spending patterns to tailor your services accordingly.

These insights help you optimize marketing strategies and refine risk management. Plus, data-driven decisions lead to improved performance and smarter business strategies.

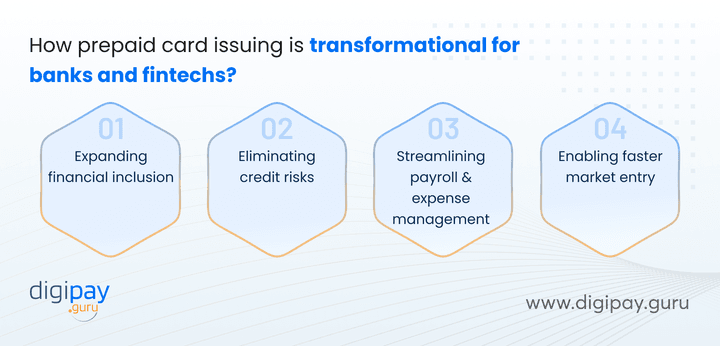

How prepaid card issuing is transformational for banks and fintechs?

Prepaid card issuing is reshaping the financial industry by enabling banks and fintechs like you to offer innovative payment solutions. Here’s how:

Expanding financial inclusion

With prepaid cards, you can offer financial services to unbanked and underbanked customers, which provides them with a reliable way to make digital payments. This helps you tap into new customer segments while fulfilling financial inclusion initiatives.

Additionally, governments and businesses are increasingly using prepaid cards for salary distribution and aid disbursement. This gives you an opportunity to serve a broader market.

Read more - How mobile wallets boost financial inclusion

Eliminating credit risks

Unlike credit cards, prepaid cards are pre-funded. This means there’s no risk of unpaid debts or chargebacks. Your business doesn't need to conduct extensive credit checks, which makes card issuance faster and more accessible.

Plus, customers can only spend what they load onto their cards, which helps them manage their finances while ensuring your business remains risk-free.

Streamlining payroll & expense management

For your payroll or employee expenses, prepaid cards offer an efficient way to distribute funds. You can issue prepaid cards to employees for travel, allowances, or business expenses to ensure controlled spending.

This reduces reliance on cash transactions and simplifies accounting, as all transactions are recorded in real time, which makes financial management easier.

Enabling faster market entry

Building your own card issuance infrastructure from scratch is complex and costly. By leveraging a white-label prepaid card issuing solution, you can launch your branded card program quickly without the need for heavy investment.

This solution allows you to focus on growing your customer base while the technical and compliance aspects are handled by your trusted solution partner like DigiPay.Guru.

How DigiPay.Guru can help with card issuing?

DigiPay.Guru offers a robust and reliable prepaid card issuance and management software that allows you to effortlessly issue, activate, and manage prepaid cards while offering your customers a fast, seamless, contactless payment experience.

With DigiPay.Guru, the card issuing process is extremely simple and of only 4 steps :

Step 1: Get started

Sign up on our card platform to begin issuing and managing prepaid cards.

Step 2: Issue card

Add user details to easily onboard them & issue branded prepaid cards.

Step 3: Topup - card

Easily add funds to prepaid cards to ensure users get instant access to their money.

Step 4: Spend

Let your customers use their prepaid cards with convenience & security.

In addition to this, our solution can offer varied features and benefits such as:

- Contactless transactions with tokenization

- Advanced analytics & reporting

- Robust security to protect customer funds & data

- Complete spending control

- Enable card payments in seconds

- Offer all - issuance, activation, & management

- Integrate seamlessly with the existing systems

- Dashboard to manage & monitor prepaid cards

- Streamline card management tools

- Dedicated technical assistance

- Customizable & configurable capabilities

- Rewards and loyalty programs and more…

Conclusion

Card issuing is key for businesses looking to attract more loyal customers, boost their profits, and expand their services. Plus, how the card issuing process works is extremely important to understand so that you can leverage the right card issuing and management solution for your business.

Because, whether you’re looking to launch a prepaid card program, offer virtual cards, or streamline business payments, the right card issuing solution can make all the difference.

With DigiPay.Guru’s world-class prepaid card issuance and management software you can launch your own physical/virtual prepaid card program within a few clicks and configurations. DigiPay.Guru is here to simplify the process and help you build a future-ready card program.

FAQ's

Card issuing is the process where you, as a business like you provide prepaid, debit, credit, or virtual cards to your customers. These cards allow users to make transactions while you manage everything from compliance to security.

You partner with a card issuing platform to create and manage your card program. Customers activate their cards via an app or portal, load funds, and use them for transactions. The platform handles authorization, compliance, and fraud prevention, all while ensuring a secure and smooth experience.

Card issuing enables you to increase revenue through transaction fees, expand financial inclusion, reduce credit risks, and streamline payroll and expense management. It also helps you offer a white-label solution without the burden of building your own infrastructure.

Prepaid cards provide unbanked and underbanked individuals access to digital payments. Your business can use them to distribute salaries, government benefits, and aid programs, thereby making financial services accessible to those without traditional banking.

Prepaid card issuing ensures security through AI-driven fraud detection, real-time transaction monitoring, instant card freezing, and compliance with KYC, AML, and PCI DSS regulations. This protects both your business and your customers.

Your business can generate revenue from interchange fees, transaction charges, card issuance fees, and premium account features. Additionally, prepaid cards improve customer retention, increasing overall engagement with your financial services.

DigiPay.Guru provides a white-label prepaid card issuing solution, which allows you to launch branded prepaid cards without building complex infrastructure. We handle regulatory compliance, security, integration with card networks, and fraud prevention so you can focus on scaling your business.