Over 70% of consumers now prefer digital banking services over traditional methods. This shift has created immense pressure on traditional banks to adapt and go digital too. So as a bank, you must innovate quickly to stay relevant and compete with digital-first players like neobanks, and fintechs.

However, creating a robust digital banking platform from scratch takes time, money, and technical expertise. Here is where white-label digital banking solutions come into play.

A white label digital banking solution & platform is a pre-built & customizable platform that empowers your business to offer branded banking services without starting from zero. Branded services mean that you get a ready-made solution, which you can customize - logo, design, UI/UX, colors, and look and feel. Now it becomes your solution to offer to your customers.

In this blog post, you will get a complete insight into what a white-label digital banking solution is, its benefits, its types, how to choose the right one, and more.

Let’s learn them all step by step, starting from their meaning.

What is a white-label digital banking solution Platform?

A white-label digital banking solution is a pre-designed platform created by leading digital banking solution providers. It allows your bank to rebrand and customize it as its own platform. This also means that with minimal effort, you can launch a fully operational digital banking platform under their brand name.

Think of it like private-label retail products. Just as a store can rebrand and sell products made by another company, a bank can offer a white label banking app built by a white-label provider.

Why it matters:

- It simplifies the process of entering the digital banking market.

- It provides a cost-effective alternative to building a platform from scratch.

- It ensures financial institutions stay competitive in a digital-first world.

Examples of white-label in fintech:

Firstly the example of white-label app would be - let’s say you want a digital wallet solution for your business. So you opt for a digital wallet solution provider that offers a ready-made digital wallet solution.

All you need to do is customize and add your brand name, logo, design, & theme colors to it. And that’s it! Here’s your white label digital wallet app. Same is the case with white label digital banking solution & platform.

Some other examples are:

- Digital wallets to offer seamless payment services

- eKYC solutions for quick onboarding

- Mobile banking app for personalized user experiences

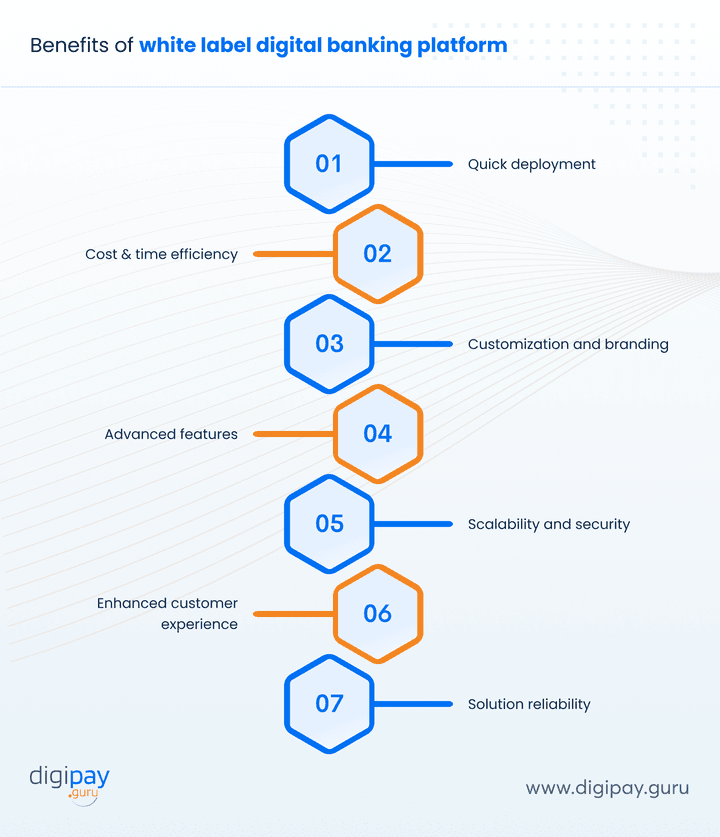

What are the main benefits of a white-label banking platform?

Now you must be clear with the meaning of a white label banking app. Next, let’s explore why you would need a white-label digital banking software, to begin with.

Well. There are numerous benefits of opting for a white label digital banking solution for your bank. The key digital banking advantages are as under:

Quick deployment: launch faster

Speed is essential with so many instant digital payment platforms already in the market. A white-label platform allows your bank to quickly roll out your digital banking services without waiting for long development cycles.

Key benefits include:

- Faster time-to-market: Skip the lengthy development process

- Early customer engagement: Start serving your customers sooner

- Minimal downtime: Ensure a seamless transition to digital services

Cost efficiency: save resources

Developing a digital banking platform from scratch requires significant investment in time, costs a lot of money, and advanced technical expertise. On the other hand, white-label solutions offer a cost-effective alternative to it. This helps you save resources while maintaining quality.

Cost-saving highlights:

- Lower development costs: Avoid expensive software development

- Reduced maintenance expenses: Benefit from a ready-made & reliable platform

- Predictable budgeting: Enjoy transparent pricing models

Customization and branding: make it yours

A white label banking platform lets you add your personal touch to your banking solution. You can tailor the design of the app, its colors, and features to match your brand identity and create a cohesive plus seamless customer experience.

Customization advantages:

- Seamless branding: Use your logo, themes, and colors

- Flexibility: Adapt features to meet your customer needs

- Enhanced trust: Strengthen customer confidence with consistent branding

Advanced features: stay ahead

White-label platforms come packed with cutting-edge features across various aspects of the platform to keep you ahead in the market. These features can enhance customer satisfaction and streamline operations.

- Security and compliance - Comprehensive security framework including MFA, biometrics, fraud detection, and regulatory compliance (KYC/AML).

- Core banking infrastructure - Fully customizable backend architecture supporting real-time multi-currency transactions and automated reconciliation.

- API integration - Open banking APIs and webhooks supporting third-party integration and custom development.

- Analytics and reporting - Advanced business intelligence and real-time analytics for data-driven decision making.

Scalability and security: future-proof your business

Scaling up without compromising security is essential. And when your business starts growing with time, it will need to be expanded seamlessly. Good news is – a white-label solution supports your growth while safeguarding your data and operations.

Scalability and security perks:

- Elastic scalability: Handle growing user demand effortlessly

- Top-tier security: Protect against cyber threats with advanced encryption

- Regulatory compliance: Meet industry standards seamlessly

Enhanced customer experience: delight your users

Providing an intuitive and user-friendly digital banking experience can set you apart from your competition. The best thing is that the white-label platforms are designed with the end-user in mind. So they are user-friendly and easy to navigate for your customers.

Customer experience highlights:

- Simple interfaces: Offer easy-to-navigate platforms

- 24/7 accessibility: Allow users to bank anytime and anywhere

- Personalized services: Meet individual customer needs with tailored solutions

Solution reliability: build confidence

Reliability is the backbone of any banking service. A proven white-label platform ensures consistent performance and builds trust with your customers.

- Robust infrastructure: Minimize system downtimes

- Consistent updates: Keep the platform up-to-date with the latest features

- Proven track record: Gain confidence from a trusted solution provider

Time efficiency: focus on your core business

White-label solutions save you time for almost everything. Less time in development, less time in customization plus less time in launching. This allows you to focus on growing your business instead of worrying about the technical complexities of platform development.

Efficiency benefits:

- Operational ease: Free up resources to focus on strategy

- Quick integration: Connect seamlessly with existing systems

- Simplified management: Reduce the need for extensive in-house expertise

By embracing a white label digital banking solution & platform, you equip your business with all the essential tools to succeed in the modern financial landscape. These benefits streamline your operations and enhance your ability to deliver exceptional digital banking services to your customers.

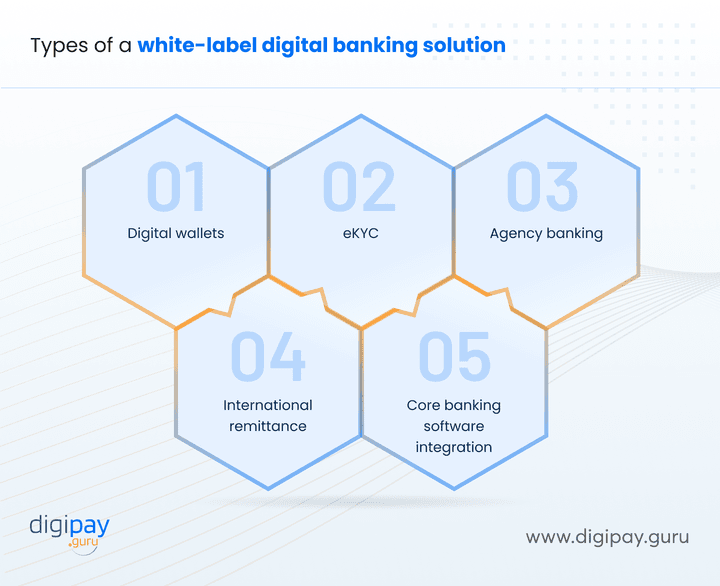

Types of a white-label digital banking solution

White-label banking services come in various forms. You can customize and add as many digital banking services you can. This will only make your platform a compressive solution for their payments and banking. Each service addresses a specific need for your banks.

1. Digital wallets

Digital wallets are essential for modern banking. They enable secure, seamless, and versatile payment methods.

It facilitates various payment services:

- P2P payments allow customers to transfer money directly to others without hassle.

- Bill payments streamline paying for utilities, subscriptions, and other services.

- Fund transfers offer fast and reliable movement of money between accounts.

Benefit: You can provide customers with an all-in-one payment solution that enhances convenience and satisfaction.

2. eKYC

eKYC solutions revolutionize customer onboarding by automating the identity verification process. These tools ensure compliance with regulations while improving the user experience.

- Minimize paperwork and manual verification efforts.

- Enhance security through biometric and digital verification methods.

- Speed up the approval process for new accounts or services.

Benefit: Reduce operational costs and time while maintaining a secure and compliant onboarding process.

3. Agency banking

Agency banking allows traditional banks to extend basic banking services to rural, underserved, and unbanked regions with the help of agents. It empowers agents to perform banking transactions on behalf of your bank - withdrawal, deposit, balance inquiry, and more.

- Equip agents with mobile-based banking tools to serve rural or remote areas.

- Offer services like deposits, withdrawals, and bill payments through local representatives.

- Bridge the gap in financial accessibility.

Benefit: Grow your customer base and promote financial inclusion, especially in areas with limited banking infrastructure.

4. International remittance

International remittance services make cross-border money transfers simple, fast, and secure. These services are critical for global financial connectivity.

An international remittance service feature in the solution is an added advantage for your bank.

- Provide real-time transfer capabilities for individuals and businesses.

- Ensure competitive exchange rates and low transaction fees.

- Maintain transparency and reliability in international transactions.

Benefit: You can tap into the growing demand for global remittance services and boost customer loyalty plus revenue streams.

5. Core banking software integration

Integration with core banking software ensures that white-label solutions work seamlessly with your existing systems. This ensures efficiency and consistency across all channels.

- Synchronize digital banking services with backend operations.

- Enable smooth data flow between digital banking systems to reduce operational errors.

- Maintain a unified view of customer interactions and transactions.

Benefit: Enhance operational efficiency and provide a cohesive banking experience for your customers.

Why your business needs white-label solutions

Traditional banks face challenges in keeping up with digital-first competitors. Customers now expect personalized and seamless digital experiences. The key challenges that traditional banks face due to which they need white label solutions are:

Key challenges:

- Limited resources for building digital platforms.

- High costs associated with development and maintenance.

- Difficulty in meeting customer demands quickly.

How white-label solutions help:

- Enable smaller institutions to compete effectively.

- Provide access to modern technology without starting from scratch.

- Address the needs of tech-savvy customers with advanced features.

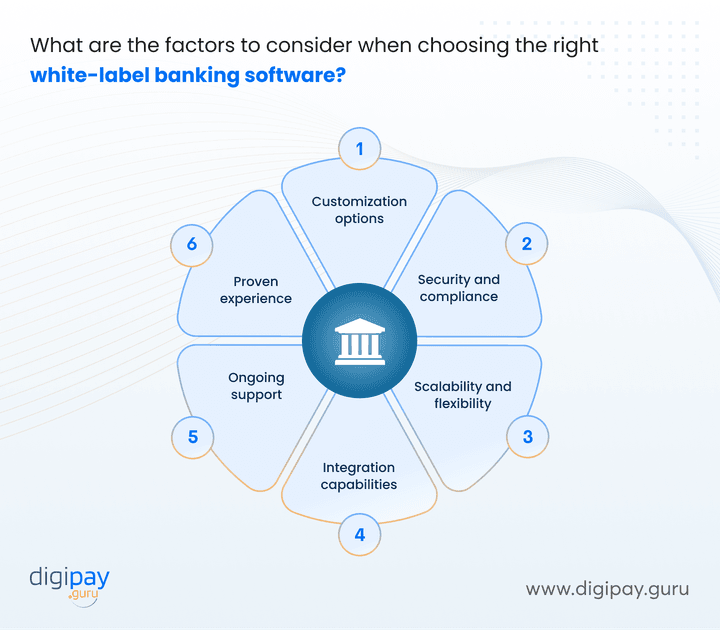

Choosing the right white-label banking software

Selecting the right white-label digital banking solution can determine your success in the digital landscape. It’s more than picking a platform—it’s about finding a partner who aligns with your vision and growth strategy.

Here are some key factors to focus on when making your decision about choosing the right white label digital banking software:

1. Customization options

Your software should feel like it’s built just for your brand. For that, you must ensure the digital banking software provider offers extensive customization. This allows you to tailor everything from the design to the features.

Ask yourself these questions when thinking of customization options:

- Can you integrate your logo, brand colors, and UI preferences?

- Are features adjustable to cater to your customer base?

- Does it align with the services you want to offer, such as digital wallets or agency banking?

2. Security and compliance

Customer trust depends on secure systems. The more secure your platform, the more trust in you. Plus, your platform should be compliant with all the security standards and local & international regulations.

Think about the below questions to ensure the platform is secure and compliant.

- Is the white label solution you opt for GDPR, PCI DSS, or ISO compliant?

- Does it use advanced security measures like two-factor authentication, encryption, tokenization, biometrics, or fraud detection?

- How regularly are security patches and updates applied?

3. Scalability and flexibility

Your digital banking platform should grow with your business. The more your business expands, the solution should have the capacity to handle the growing transactions and increasing user demand without compromising performance.

Asking yourself the below question might help:

- Can the software support thousands or millions of users as you expand?

- Does it offer modular capabilities to add or remove features as required?

4. Integration capabilities

A seamless banking experience across all channels is essential. Check whether the software integrates smoothly with your core banking systems and third-party services.

- Does it work well with your existing backend systems?

- Can you add APIs for services like payment gateways, remittances, or KYC verification?

- Does it support cross-platform functionality for web and mobile?

5. Ongoing support

Reliable support can save time and resources in the long run. The provider should offer comprehensive support for implementation and beyond.

- Is there 24/7 customer service or technical assistance?

- Do they provide training resources for your team?

- How responsive are they to resolving technical issues?

6. Proven experience

The right provider will have a track record of delivering successful projects. Research their expertise and case studies to gauge their capabilities.

- How long have they been in the industry?

- What do their existing clients say about them?

- Have they worked with institutions similar to yours?

Read More - What is a white label payment solution & platform: Explained

Conclusion

White label digital banking solutions are like a backbone for banks who want to launch their digital platform and services in the market. This not only gives them the freedom to customize their solution based on their brand identity but it also attracts new customers and existing ones.

With DigiPay.Guru being the best-in-the-world white label digital banking solution is highly secure, scalable, fast to market, cost efficient, and can be easily integrated into your existing system. Means, it's designed to help you succeed.

FAQ's

A white-label digital bank is a banking platform or service that is developed by one company but rebranded and offered by another. You, as busines, can use these pre-built banking services under your own brand, without having to create everything from scratch.

White-label banking works by providing ready-to-use banking infrastructure, including digital wallets, payment solutions, and other financial services. You can integrate these services into your existing system or offer them directly to your customers while keeping your brand identity intact. The main provider handles the technology and compliance, so you focus on customer engagement and growth.

The main difference is that white-label banking lets you offer banking services without operating a physical bank or managing complex back-end systems. In traditional banking, the bank owns and manages everything, including branches and customer service. With white-label banking, you leverage existing infrastructure, which cuts down costs and time-to-market.

White-label banking provides several advantages:

Cost-effective: You save on the cost of building and maintaining infrastructure.

Faster time-to-market: You can launch your services faster with ready-made solutions.

Flexibility: You can easily customize the services to fit your brand and business needs.

Focus on growth: You focus on customer acquisition and service, while the technology is handled for you.

White-label fintech is perfect for banks, fintechs, and other financial institutions that want to offer digital banking services quickly without dealing with the complexities of technology and compliance. It's also great for businesses looking to enter the fintech space or expand their product offerings without heavy investment in tech development.

The implementation time for a white-label fintech solution can vary, but generally, it takes between a few weeks to a few months. The process depends on how customizable the solution is and the complexity of integration with your existing systems. However, it’s much faster than building a solution from the ground up.