We live in a digital age, where with ever-increasing digital payments, the demand for better customer experience and enhanced brand loyalty is constantly evolving. But do you know, there is an effective payment solution that if utilized correctly can enhance both for your brand? It is called “Virtual Cards”.

Virtual cards were born out of the digital age's rapid expansion. With their inception dating back to the early 1990s, these cards have seen an exponential rise, marking a paradigm shift in the way consumers interact with brands.

According to Future Market Insights, sales of virtual cards in 2021 were valued to be $338 Billion. The virtual cards market is predicted to reach a worth of US$ 1.3 Trillion by 2032, with 12.2% projected growth of virtual cards between 2022 and 2032. This shows how fast-paced its growth and utilization of it at the right time will definitely help better the customer experience and brand loyalty.

In this blog post, we will explore how the right utilization of virtual cards can help brands in enhancing customer experience and increase brand loyalty along with the best practices of implementing virtual cards into their business.

Basics of Virtual Cards

You might be aware of what virtual cards are, how it works, and its benefits. But, if you are not, here's a quick overview of the basics of virtual cards for a better understanding of the remainder of the blog.

What are virtual cards?

Virtual cards, also known as digital cards or e-cards, are electronic representations of traditional payment cards, such as credit or debit cards. Unlike physical cards made of plastic, virtual cards exist in the digital realm, stored within mobile apps, digital wallets, or online platforms.

Why are virtual cards becoming popular?

Some of the benefits of Virtual Cards that make them popular include

-

Convenience: Virtual cards eliminate the need for physical cards, allowing users to make purchases or transactions with just a few taps on their smartphones or computers. Also, these are prepaid card solutions in general, so the customer can plan their purchases.

-

Security: With virtual cards, sensitive card information is not exposed during transactions, reducing the risk of fraud and unauthorized access.

-

Flexibility: Virtual cards offer greater flexibility in terms of managing finances, enabling users to set spending limits, track expenses, and easily block or replace cards if needed.

-

Contactless Payments: In a world where contactless transactions are increasingly preferred, virtual cards offer a seamless and hygienic payment option.

Types of virtual cards

-

Digital Wallets: Virtual cards can be integrated into popular digital wallet solutions like Apple Pay, Google Pay, or Samsung Pay, allowing users to make secure and convenient payments using their mobile devices.

-

Mobile Apps: Some brands and financial institutions offer dedicated mobile apps that generate virtual cards for users to manage their payments and transactions.

-

Virtual Gift Cards: Virtual gift cards have gained popularity as a convenient and versatile alternative to traditional physical gift cards. They can be personalized, easily sent via email or text, and redeemed online or in-store.

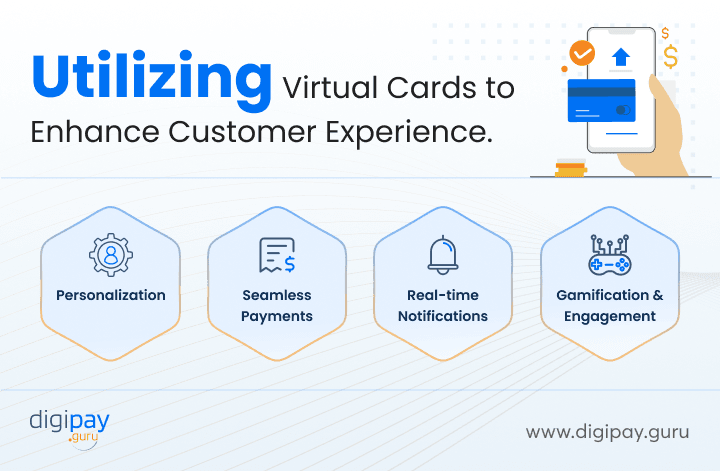

How can brands utilize virtual cards to enhance customer experience?

For creating remarkable customer experiences, brands are turning to virtual cards as a powerful tool. These cards create a world of possibilities, allowing businesses to engage with their customers in personalized, seamless, and captivating ways.

Let's explore how brands can leverage the benefits of virtual cards for customers to elevate the customer experience and leave a lasting impression.

Personalization & Customization

Virtual cards provide brands with the opportunity to tailor experiences to individual customers. By capturing valuable customer data, brands can offer personalized offers, rewards, and promotions that resonate with their target audience.

For instance, a leading e-commerce brand might send a virtual card with a customized discount on a customer's birthday, showcasing their commitment to building a personalized relationship.

Seamless Digital Payments

A virtual card is a unique digital payment solution that streamlines the payment process, making transactions effortless for customers. With just a few taps on a mobile device or clicks on a computer, customers can complete purchases securely and conveniently.

Consider a fashion retailer that integrates virtual cards into their mobile app, allowing customers to store their payment details and make purchases with a single touch, creating a frictionless shopping experience.

Real-time Notifications & Updates

Virtual cards enable brands to deliver real-time notifications and updates to customers. Whether it's notifying them about exclusive offers, order updates, or account information, brands can keep customers informed and engaged.

Imagine a hospitality brand that sends a virtual card to guests, providing real-time updates on their hotel reservations, including room upgrades or special amenities, ensuring a seamless and personalized stay.

Gamification & Engagement

Virtual cards can be leveraged to infuse elements of gamification into the customer experience, enhancing engagement and fostering a sense of fun and excitement.

An example of this is a mobile gaming platform that rewards users with virtual cards for reaching certain milestones or completing challenges. These virtual cards can unlock exclusive in-game content, boosting user engagement and loyalty.

Utilizing virtual cards to increase brand loyalty

In the fiercely competitive landscape of modern business, building brand loyalty is a top priority for companies seeking sustainable growth and success. Virtual cards have emerged as a transformative tool, empowering brands to cultivate deep connections with their customers and foster unwavering loyalty.

Let's explore how virtual cards can be strategically utilized to boost brand loyalty and create a tribe of dedicated advocates.

Loyalty Programs & Rewards

-

Virtual cards seamlessly integrate into loyalty programs, allowing brands to incentivize and reward their most loyal customers.

-

By offering these cards as rewards for consistent purchases or engagement, one of the advantages of virtual cards that brands achieve is a sense of exclusivity and appreciation, motivating customers to continue their patronage.

-

Take, for instance, a popular coffee chain that offers virtual loyalty cards, tracking points earned with each purchase. These points can be redeemed for free beverages, encouraging customers to choose the brand for their daily caffeine fix.

Boost Customer Engagement with DigiPay.Guru’s Loyalty & Reward Programs

Exclusive Offers & Discounts

-

Virtual cards enable brands to offer exclusive deals and discounts to their loyal customers, fostering a sense of privilege and value.

-

By tailoring promotions specifically to virtual cardholders, brands can make customers feel special and appreciated.

-

For example, an online fashion retailer may provide virtual cardholders with early access to sales or exclusive discount codes, making them feel like VIPs and driving brand loyalty.

Social Sharing & Referrals

-

Virtual cards can serve as catalysts for social sharing and referrals, amplifying brand reach and nurturing loyalty.

-

By incentivizing customers to share their virtual cards with friends and family, brands tap into the power of word-of-mouth marketing.

-

Consider a subscription-based service that offers virtual referral cards, granting both the referrer and the new customer exclusive benefits or discounts. This not only rewards loyal customers but also expands the brand's customer base.

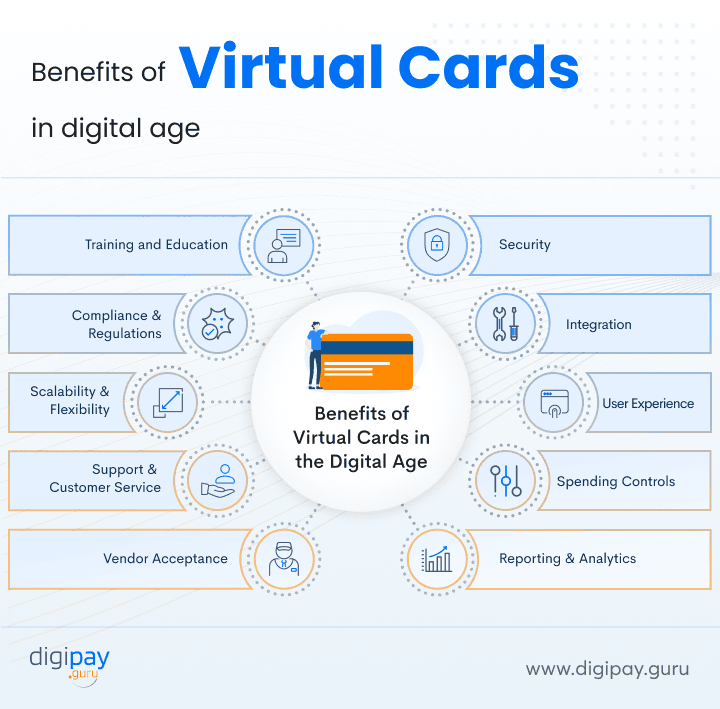

Best practices to consider as a brand planning to implement virtual cards

Implementing virtual cards as part of your brand's strategy requires careful planning and execution. To ensure a seamless and successful integration, brands must consider several best practices. virtual cards for business.

By following these guidelines, you can maximize the effectiveness of virtual cards and unlock their full potential. Let's explore the key best practices to consider as a brand planning to implement virtual cards.

Security

-

Prioritize the security of customer data by implementing robust encryption measures and adhering to industry best practices.

-

Regularly monitor and update security protocols to protect against potential threats and breaches.

-

For instance, a financial institution offering virtual debit cards ensures the highest level of security by employing multi-factor authentication and encryption technology to safeguard customer transactions and personal information.

Integration

-

Seamless integration of virtual cards into your existing infrastructure is crucial to provide a smooth user experience.

-

Collaborate with experienced developers or technology partners to ensure compatibility with your payment systems, mobile apps, or digital platforms.

-

A retail brand seamlessly integrates virtual cards into its e-commerce website, enabling customers to easily access and utilize their virtual cards during the checkout process.

User Experience

-

Prioritize user-friendly interfaces and intuitive navigation to ensure a positive customer experience.

-

Optimize the virtual card experience across various devices, such as mobile phones, tablets, and desktops.

-

For example, a travel company designs a mobile app with a user-friendly interface that allows customers to make use of virtual cards effortlessly along with managing them while on the go.

Spending Controls

-

This amazing feature of virtual prepaid cards allows users with flexible spending controls and management features, allowing them to set limits or restrictions on their virtual cards.

-

Empower customers to monitor their spending, track transactions, and receive alerts for suspicious or unauthorized activities.

-

A budgeting app incorporates spending controls into virtual cards, enabling users to allocate specific amounts for different expense categories and receive real-time updates on their spending habits.

Reporting & Analytics

-

Implement robust reporting and analytics capabilities to gain insights into customer behavior, transaction patterns, and card usage.

-

Leverage data-driven insights to refine your marketing strategies and tailor offers or rewards based on customer preferences.

-

A retail brand analyzes virtual card usage data to identify popular product categories among customers, enabling targeted promotional campaigns and personalized recommendations.

Vendor Acceptance

-

Ensure wide acceptance of virtual cards by collaborating with a network of vendors, merchants, and partners.

-

Expand the list of participating businesses that honor virtual card payments, enhancing customer convenience and increasing opportunities for card usage.

-

A virtual payment platform establishes partnerships with a diverse range of online and offline merchants, allowing customers to make purchases using their virtual cards across various industries.

Support & Customer Service

-

Provide reliable and responsive customer support channels to address inquiries, resolve issues, and provide assistance related to virtual cards.

-

Offer multiple communication channels, such as live chat, email, or phone support, to cater to customers' preferences.

-

A customer-centric brand assigns a dedicated support team to handle virtual card-related queries promptly, ensuring a seamless customer experience.

Scalability & Flexibility

-

Plan for future growth and scalability by choosing a virtual prepaid card solution that can accommodate increased user demand and transaction volumes.

-

Seek flexibility in expanding features, functionalities, and integrations as your brand evolves.

-

An e-commerce platform selects a virtual card solution provider that offers scalable infrastructure, enabling them to handle a surge in customer demand during peak shopping seasons.

Read more: Virtual Prepaid Cards: The Future of Digital Payments

Compliance and Regulatory Considerations

-

Stay abreast of legal and regulatory requirements related to virtual cards, ensuring compliance with applicable laws, such as data protection and privacy regulations.

-

Partner with reputable payment service providers that prioritize compliance and possess industry certifications.

-

An international brand operating in multiple regions ensures adherence to local regulations regarding virtual cards, safeguarding customer data, and maintaining compliance with regional laws.

Training and Education

-

Provide comprehensive training and educational resources for both internal staff and customers to ensure they fully understand the features, benefits, and usage of virtual cards.

-

Conduct regular training sessions or create informative guides to empower employees and customers to maximize the potential of virtual cards.

-

A financial institution conducts training sessions for its staff members to enhance their knowledge of virtual card products and assist customers effectively.

Conclusion

In today's digital landscape, virtual cards have emerged as a powerful tool for brands to enhance customer experiences and foster unwavering loyalty. By leveraging virtual cards, brands can personalize offerings, streamline payments, and provide real-time updates, creating seamless and engaging interactions with customers.

To implement virtual cards successfully, it is crucial to consider best practices such as security, integration, user experience, and vendor acceptance. As your brand goes to embrace virtual cards, DigiPay.Guru’s, advanced prepaid card management solutions are the answer to your easy journey. Our expertise and innovative solutions can help your business harness the full potential of virtual cards, driving customer satisfaction and loyalty to new heights.