International remittances are becoming a must in the world of globalization. Transaction values for international remittances grew to almost $29 billion in 2023. This stat proves the above statement.

Adding to it, currency corridors are the pathway to sending money from one country to another. For remittance businesses like yours that aim to offer smooth and affordable remittance services, understanding these corridors is crucial.

However, many may find themselves confused with the concept of currency corridors and always wonder how it can even help manage these pathways efficiently. If you are one of those businesses, let's break it down for you.

In this blog post, you will explore;

- What are currency corridors in remittance?

- Why are currency corridors important?

- How do currency corridors work?

- Key features for offering multiple currency corridors

- Key benefits of using advanced money transfer software for currency corridors

- Some common challenges in currency corridors and more…

What are currency corridors in remittance?

In simple terms, a currency corridor in remittance is the path where money travels when transferring between two currencies.

Imagine each corridor as a road between two countries or currency markets. For example, a corridor between the US dollar (USD) and the Mexican peso (MXN) is the path for remittance between the United States and Mexico.

These corridors are essential for international remittances because they make the exchange process possible, but they also come with unique complexities.

Currency corridors aren’t just about getting from Point A to Point B. They involve:

- Exchange rates and fees that vary depending on the currencies and regions involved

- Regulatory requirements as each country has its own compliance rules for money transfers

- Demand patterns that can affect the availability and cost of transfers in different corridors

The value of these corridors is dependent on the volume of transactions, demand and the stability of each currency. With the right approach, your business can use these corridors to reduce costs, speed up and expand service regions.

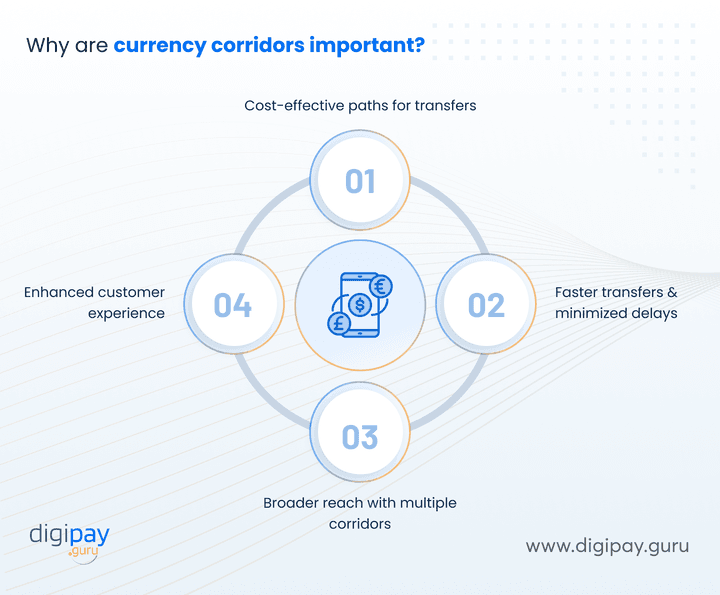

Why are currency corridors important?

Currency corridors are the foundation of international money transfers. But why should your business care? Let’s see its importance and how currency corridors impact remittances:

Cost-efficiency

By understanding currency corridors you can find the most cost effective paths for transfers. This will reduce the fees associated with foreign exchange and intermediary banks. This means you can offer better rates to your customers.

Faster transfers

When you know which cross-border remittance corridor has the fastest transfer times you can minimize delays and deliver a better customer experience. Being able to do quick transfers is a big advantage.

Broader reach

With multiple corridors, you can expand your services to new regions which means new revenue streams and a wider customer base. And being able to serve users in emerging markets with high remittance needs – that’s growth for your business.

Enhanced customer experience

In the end, customers care about receiving funds fast and affordably. By optimizing the international remittance currency corridors you can improve customer satisfaction and loyalty.

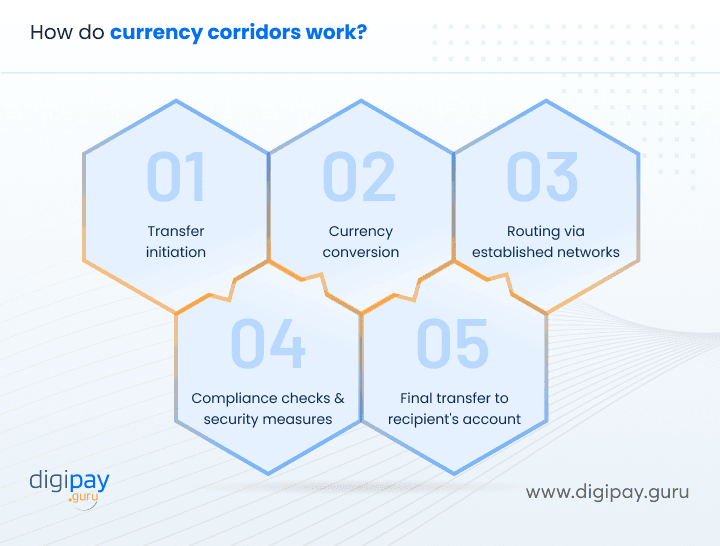

How do currency corridors work?

Currency corridors work in a structured process that enables the movement of money between countries. Here’s the breakdown of how currency corridors work in remittance:

1. Transfer initiation

The sender selects an amount and a target currency. For example, a user in the US sends USD to a recipient in Mexico who will receive MXN.

2. Currency conversion

The transfer service converts the sender’s currency (USD) into the recipient’s currency (MXN) based on the foreign exchange rate in the chosen corridor. Using corridors with better Money transfer exchange rates reduces costs.

3. Routing through established networks

The transfer follows a fixed path, often through established networks within the currency corridor. This may include banks, financial intermediaries or transfer companies that simplify the process along popular routes.

4. Compliance checks and security measures

Regulatory checks are done to ensure compliance with both countries’ laws and anti-money laundering (AML) regulations. Advanced money transfer software automates this step so compliance doesn’t slow down the process.

5. Intermediary handling (if needed)

If there’s no direct route the funds may pass through intermediary banks or institutions. However, choosing a corridor with minimal intermediaries reduces costs and speeds up delivery.

6. Final transfer to recipient’s account

The converted funds are then deposited into the recipient’s bank or digital wallet in their local currency. With currency corridors, transactions are done quickly and affordably.

Each of these steps is streamlined within a currency corridor, which offers predictable routes, reduced costs, and efficient currency conversion—making it ideal for businesses looking to provide fast and low-cost remittance services to their customers.

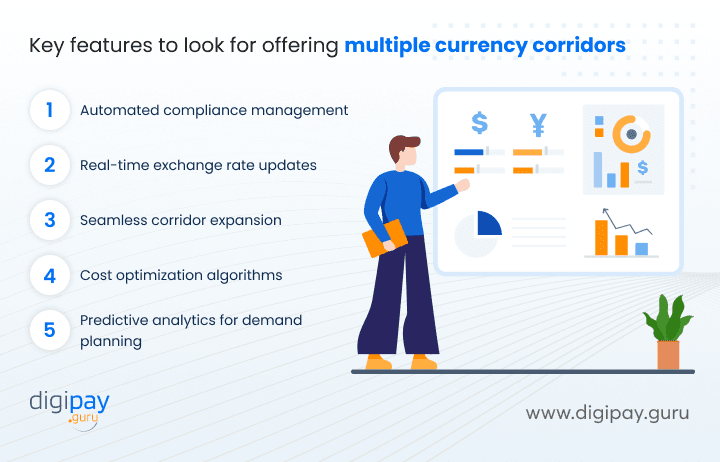

Key features of advanced remittance software for offering multiple currency corridors

Many businesses are unsure how to expand their currency corridors to new regions. However, offering multiple corridors is simpler with the right support.

Here are the key features you must have in your remittance platform to ease this process and let you unlock new opportunities:

1. Automated compliance management

Regulations differ by country, so compliance management is one of the biggest challenges in managing multiple corridors. With automated compliance features, modern remittance solutions ensure each transaction meets the required standards so you don’t have to.

2. Real-time exchange rate updates

Currency corridors are subject to exchange rate changes that can affect transfer costs and fees. With software that has real-time rate updates, you can offer customers accurate pricing and avoid losses due to market changes.

3. Seamless corridor expansion

Adding new corridors doesn’t have to be a long and painful process. With modular software, you can add corridors quickly. This gives you flexibility and agility in a fast changing market.

4. Cost optimization algorithms

Advanced money transfer platforms use algorithms to select the cheapest route for each transaction. By minimizing fees where possible these algorithms allow you to offer competitive rates to your customers and make your services more attractive.

5. Predictive analytics for demand planning

Software with predictive analytics can forecast transaction volumes across different corridors. This is useful in managing demand for popular corridors so your system can handle peak times without sacrificing speed or efficiency.

The role of currency corridors in lowering remittance transfer fees

Currency corridors are essential in keeping remittance costs low. Here’s how you can achieve low-cost remittance corridors in international remittance.

High-volume corridors lower costs

Some corridors, like those between the U.S. and Mexico or Europe and India, are well-traveled due to high remittance volumes. This increased demand encourages competitive pricing among providers, often resulting in lower transfer fees for remittances for these specific routes.

Reduction of intermediary costs

For corridors with established infrastructure, there’s often less need for multiple intermediary banks, which can reduce associated fees. Less reliance on intermediaries means a more direct, less costly route for each transaction, which can directly benefit the end-user.

Stable exchange rates and predictable fees

Currency corridors that involve stable currencies and countries often maintain consistent remittance currency exchange rates. Predictable rates allow financial institutions to offer transparent, lower fees, as they aren’t compensating for unpredictable currency fluctuations.

Streamlined regulatory compliance

Corridors between countries with clear & cooperative regulatory policies simplify compliance. This saves the time and effort needed to go through numerous legal requirements and rules. This means lower costs that could be passed to the customer in the form of cheaper service fees.

Read more: Key strategies to reduce remittance costs

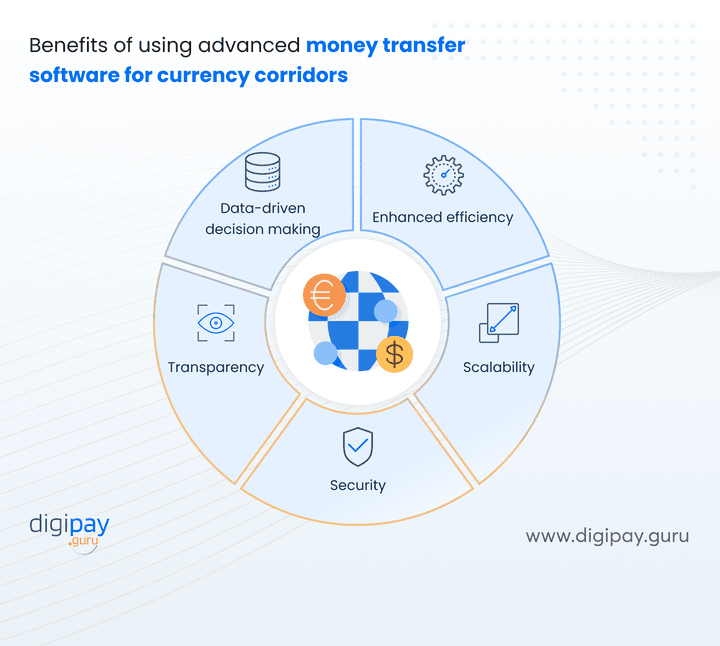

Benefits of using advanced money transfer software for currency corridors

Here’s why modern money transfer software can revolutionize the way you manage currency corridors:

- Enhanced efficiency: It eliminates manual processing and focuses on automated solutions that minimize human error.

- Scalability: Expand your remittance service reach without a significant increase in workload or risk.

- Security: With compliance and security built into the software, you can confidently handle high-value, cross-border transactions.

- Transparency: Offer customers a clear view of fees, transfer times, and exchange rates, thereby building trust and satisfaction.

- Data-driven decision making: Leverage analytics to identify profitable corridors, understand customer preferences, and refine your offerings.

Read more: Transparency, Speed & Security Role in Cross-border Payments

Some common challenges in currency corridors

Working with currency corridors in money transfer is not without its hurdles. Here’s a look at some common challenges and how a strong remittance solution can address them:

Regulatory compliance

Every transfer must meet local as well as international regulatory standards, which is extremely challenging. Advanced money transfer software takes care of this with an automatic monitoring system and alerts. This allows you to focus more on growth.

Volatile exchange rates

Exchange rate volatility can quickly turn profitable corridors into costly ones. Real-time rate tracking tools within the software help mitigate these risks, so you’re always one step ahead.

High operational costs

Managing corridors can be expensive, especially when using outdated methods. The software’s cost-optimization algorithms reduce fees and administrative costs. This lets you deliver value to customers while maintaining profitability.

Read more: Overcoming the challenges of cross border remittance

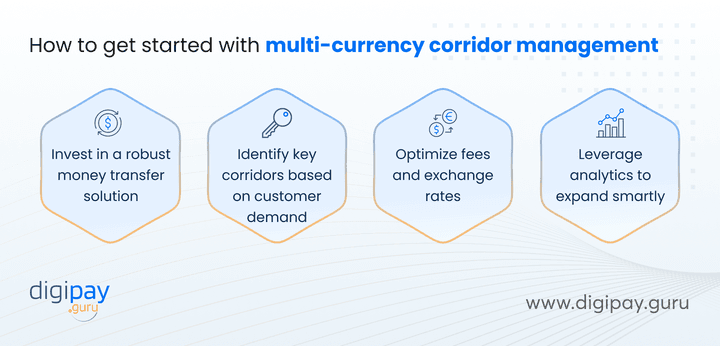

How to get started with multi-currency corridor management

If you’re ready to step up your remittance game, here are a few strategies to consider:

Invest in a robust money transfer solution

Look for a platform that can handle multiple corridors, with compliance features, real-time rates and analytics.

Identify key corridors based on customer demand

Focus on the regions where your customers are already active or where remittance needs are growing. Knowing the demand patterns will help you prioritise which corridors to launch first.

Optimize fees and exchange rates

Competitive fees and accurate exchange rates will help you stand out in the market. The right software can automate this for you so you can balance affordability and profitability.

Leverage analytics to expand smartly

Data will help you make better decisions. Analytics will show you the high potential corridors and customer behaviour so you can grow without taking unnecessary risks.

Read more: A glimpse into DigiPayGurus cross border payment platform

Conclusion

Understanding and leveraging currency corridors can be a game-changer for businesses in the remittance space. Currency corridors reduce transfer fees, speed up transactions, and ensure secure compliance with cross-border regulations. This helps you deliver a better experience to customers. But to truly unlock their potential, you need the right tools.

With DigiPay.Guru’s multiple corridors and exchange rate management feature in the international remittance solution, you can manage a wide range of currency corridors with ease.

Our advanced platform enables precise exchange rate management, optimized currency conversion, and streamlined compliance—all crucial elements for efficient cross-border transactions. By integrating DigiPay.Guru’s solution, you can boost your remittance services, lower costs, and reach more customers with a seamless and efficient transfer experience.

FAQ's

Remittance corridors are specific pathways that money takes when sent from one country to another, usually between two currencies. They impact the cost, speed, and efficiency of international money transfers, thereby helping you reduce fees and streamline cross-border transactions for your customers.

Shifts in remittance corridors can affect economic stability and currency strength in both sending and receiving countries. For receiving countries, increased remittances contribute to economic support, while for sending countries, these flows may influence exchange rates and financial relationships.

Changes in corridors impact pricing, competition, and regulatory requirements for service providers. Providers must adapt to new patterns and customer expectations, often by leveraging advanced software to manage multiple corridors and exchange rates, thereby ensuring competitive and efficient services.