The fintech industry keeps evolving, just like social media algorithms. What worked yesterday may have become of no use now. One day, it is digital wallets. The next day, it is AI. This shows that the fintech industry trends are very dynamic.

Here’s the deal: The global fintech market is expected to reach $556.58 bn by 2030. Looking at its huge potential, businesses like yours are struggling to keep up with the market trends. Because if you don’t, your customers will quickly switch to your competitors.

And let’s be honest… customers aren’t just asking for better banking. They demand faster payments, invisible yet secure identity verification, and AI-powered investment insights that know what they need before they do.

So, what’s next?

The latest fintech trends 2025 are here to become your guiding light to stay relevant and competitive this year.

In this blog post, you will learn the top 15 fintech industry trends for 2025 that will make a strong impact on the industry.

Let’s look at them, one by one.

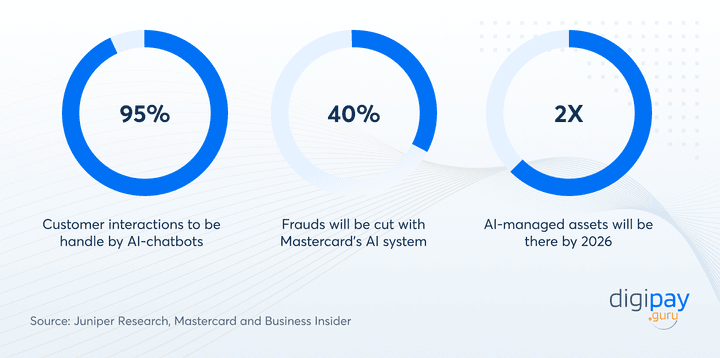

1. AI and Machine Learning Take The Finance World

Artificial intelligence (AI) and machine learning are no longer futuristic concepts. They’re already redefining financial transactions, from fraud detection to hyper-personalized banking.

In 2025,

-

AI-driven chatbots will handle 95% of customer interactions

-

Mastercard’s AI system cut fraud by 40%.

-

AI analyzes spending behavior for real-time loan approvals.

-

AI-managed assets will double by 2026

-

Banks that don’t embrace AI risk falling behind and will struggle to keep up with customer expectations.

Banks that don’t embrace AI risk falling behind and will struggle to keep up with customer expectations.

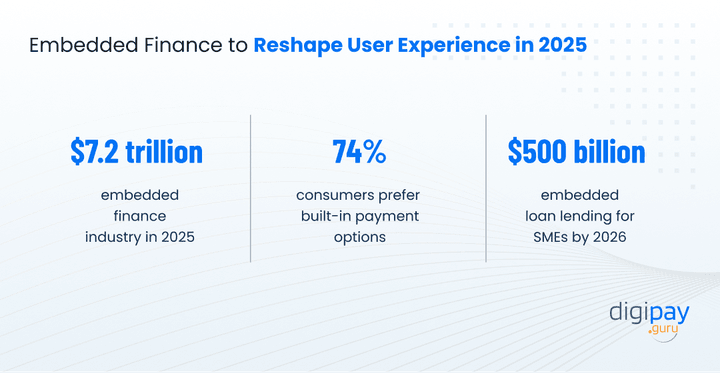

2. Embedded Finance to Reshape User Experience

Your customers don’t want to visit banks anymore. They want financial services where they already are—inside their favorite fintech apps, marketplaces, and e-commerce platforms. Embedded finance will dominate bank payments, lending, and insurance services.

From in-app payments to instant loans, financial services are moving into everyday platforms.

By 2025:

-

Embedded finance was expected to be a $7.2 trillion industry

-

74% of consumers prefer built-in payment options

-

Embedded lending will drive $500 billion in SME loans by 2026

The future? Banking happens where you already are.

3. DeFi and open banking to expand access

Decentralized Finance (DeFi) and open banking are set to redefine financial services in 2025.

DeFi (Decentralized Finance) is a blockchain-based system that removes intermediaries from financial transactions. In 2025, DeFi and open banking will disrupt traditional finance with blockchain-based lending, automated smart contracts, and real-time payments.

Financial institutions that embrace open banking APIs will enable third-party fintech companies to offer better fintech apps, fintech payments, and credit services. This shift will promote financial inclusion and make banking easily accessible to underserved populations.

4. Bank as a Platform (BaaP) Will Gain Momentum

Banks are no longer just banks. They’re turning into platforms that allow fintech companies to build services on top of their infrastructure. BaaP enables banks to offer fintech products without having to build them from scratch.

For example, BBVA offers APIs that let fintechs integrate banking services directly into their apps.

This means that, instead of competing with fintech industry trends, banks will collaborate with them. So, you can expect to see more fintech-bank partnerships to deliver better customer experiences and innovative financial solutions.

5. Sustainable and Green Fintech for Innovation

Sustainability is no longer a word just thrown out to sound intelligent in the conversation. It’s a priority. In 2025, green fintech will drive the trends in fintech industry.

Banks and fintech firms will focus on sustainable investments, carbon tracking, and climate-conscious lending models.

Expect fintech companies to launch ESG (Environmental, Social, and Governance) financial services. This will give customers insights into their carbon footprint and help businesses invest in sustainability-focused portfolios.

For example, Aspiration, a UK-based challenger bank, offers green banking solutions that help users offset their carbon footprint with every transaction.

6. Advancements in Digital Identity Solutions

As fraud rises, the need for identity verification will evolve. Facial recognition, behavioral biometrics, and blockchain-based identity verification will make financial transactions more secure.

Financial institutions will shift toward passive ID verification, which will reduce friction and enhance security. In fact, the global passive authentication market is expected to reach $10.6 billion by 2033.

This means customers won’t have to enter passwords or OTPs every time—they’ll be verified through behavioral patterns and facial recognition. Fintech industry trends like this will redefine authentication in 2025.

7. WealthTech to Revolutionize Investment Strategies

Investment management is about to get a tech-driven facelift. WealthTech solutions powered by AI, big data, and automation will provide hyper-personalized investment advice.

For example, Betterment, a digital investment, retirement, and cash management services provider, uses AI-driven robo-advisors to automate investments and optimize portfolios based on individual financial goals.

Retail investors will gain access to automated portfolio management, robo-advisors, and blockchain-driven smart contracts. Banks and financial firms that fail to integrate WealthTech into their offerings will risk losing investors to tech-first platforms.

8. Buy Now, Pay Later (BNPL) Continues to Dominate Payments

The Buy Now, Pay Later (BNPL) model isn’t going anywhere. Consumers love it, and businesses profit from it. In 2025, BNPL will expand beyond retail and will enter various industries like healthcare, travel, and education.

Expect stricter regulatory compliance for BNPL services, as governments aim to protect consumers from accumulating excessive debt. BNPL fintech companies must balance growth with responsible lending practices.

9. Central Bank Digital Currencies (CBDCs) to Shape the Future of Money

Governments worldwide are developing Central Bank Digital Currencies (CBDCs). These digital currencies will bridge the gap between traditional banking and fintech digital payments.

One of the fintech examples for CBDCs is China. China’s digital yuan (e-CNY) is already in use for retail payments, with millions of transactions processed through pilot programs.

CBDCs will enhance real-time payments and cross-border transactions while ensuring monetary stability. Plus, financial institutions that prepare for CBDC adoption will stay ahead of the curve.

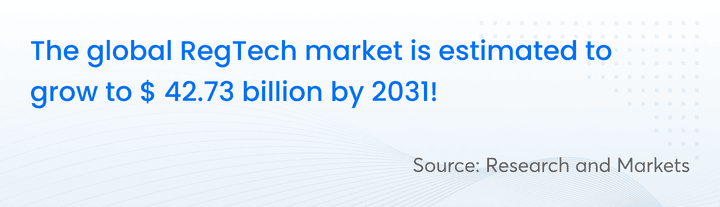

10. RegTech to Simplify Compliance for Banks

Regulatory compliance is complex for banks and fintech firms. RegTech (Regulatory Technology) uses AI and automation to simplify compliance reporting and risk assessments.

In 2025, expect RegTech solutions that reduce manual processes, enhance fraud detection, and ensure seamless compliance with global financial regulations.

11. Cybersecurity and Fraud Prevention

As digital transactions rise, cyber threats also increase. Hackers are getting smarter, and traditional security measures are no longer enough. So AI-driven fraud detection tools and real-time risk assessment will become critical for financial institutions in 2025.

Expect AI-based security systems to detect and prevent fraudulent transactions in milliseconds to reduce financial losses. Multi-factor authentication and AI-based fraud prevention will enhance customer trust and data security. Expect new compliance regulations focused on cybersecurity readiness in 2025.

12. Behavioural Biometrics Driving Shift to Passive ID Verification

Passive biometric authentication will replace traditional security measures. Behavioral biometrics, such as typing speed, gait analysis, and touchscreen interactions, will also help prevent fraud in real time.

Financial institutions will leverage this technology to enhance user security while reducing friction in banking transactions. This will improve customer experience and fraud prevention in digital finance.

13. Financial Super Apps to Redefine Banking

Super apps are changing the way people manage their money. Instead of using multiple apps for banking, payments, investments, and insurance, users want everything in one place. Financial super apps are the answer.

Companies like Revolut, WeChat Pay, and Alipay have already proven their success. In 2025, more banks and fintech firms will launch their own all-in-one financial ecosystems. This can increase engagement and customer retention.

Bottom line: The future of banking isn’t just digital; it’s supercharged with convenience.

14. Quantum Finance Comes with New Possibilities

The rise of quantum computing is set to disrupt the fintech industry. Quantum finance will revolutionize areas like risk analysis, portfolio optimization, and fraud detection by processing vast amounts of data at speeds unthinkable with traditional computing.

Financial institutions like JPMorgan and Goldman Sachs are already exploring quantum algorithms for faster and more accurate financial modeling.

In 2025, you can expect early adopters to leverage quantum technology for real-time financial decision-making and advanced cryptographic security.

15. Generative Financial Planning with AI

AI is no longer just about automation—it’s now shaping financial strategies. Generative financial planning is one of the latest fintech trends in 2025. Generative AI will provide hyper-personalized financial planning by analyzing individual spending patterns, financial goals, and market trends in real time.

A recent report states that AI-driven financial services could generate up to $1 trillion in additional value for banks annually. Expect AI-powered fintech apps to offer customized savings plans, automated wealth management, and even AI-generated investment strategies tailored to user preferences.

Conclusion

The above-mentioned 15 financial technology trends in 2025 are going to have a huge impact on the financial sector, especially for banks, fintech, and financial institutions like yours. So, if you are a business looking to expand your services or to gain a competitive edge, these trends will definitely help you.

We can say that “These trends are the future of finance.”

And what if I tell you that there’s a solution that can help you stay ahead of the growing and evolving financial market? It’s DigiPay.Guru!

With DigiPay.Guru’s advanced and future-ready digital payment solutions, you can offer your customers the best digital payment services. Not only this, these services are fast, secure, reliable, interactive, innovative, intuitive, and can be launched quickly in the market.

So, what’s holding you back? Let’s partner and grow together in the evolving financial landscape!

FAQ's

You can expect AI-driven banking, embedded finance, and CBDCs to reshape the financial landscape. AI will automate fraud detection and customer interactions, while embedded finance will bring banking into everyday apps. Plus, with central banks launching digital currencies, traditional payments will see a major shift.

The biggest fintech trends include open banking, financial super apps, BNPL beyond retail, and green fintech. Open banking will drive API-based innovations, super apps will combine banking, payments, and investing in one place, and sustainable finance will attract ESG-conscious customers.

The fintech industry is set to grow at a CAGR of over 20%, with AI, blockchain, and embedded finance leading the way. By 2025, global fintech investments could exceed $400 billion, driven by digital banking adoption and increasing demand for frictionless financial services.

AI-powered chatbots, biometric authentication, behavioral biometrics, and quantum computing are revolutionizing fintech. Banks and fintechs are integrating AI to personalize customer experiences, while biometrics are replacing passwords for enhanced security. Quantum computing is also being explored for fraud detection and risk modeling.

Fintech in 2025 will be faster, more secure, and more embedded in daily life. You’ll see seamless financial services integrated into eCommerce, ride-hailing, and even healthcare. Cybersecurity and regulatory compliance will become more automated with RegTech, ensuring safer transactions in a fully digital ecosystem.