Digital wallets have become an essential part of our daily lives. And their popularity can be attributed to the increased use of mobile devices, the increase in online transactions, and the rise of the e-commerce industry. And obviously, COVID-19 has played a significant role in it.

Online payments in digital wallets have become easy and seamless. The wallet user can now conveniently make payments to anyone and anywhere with just a few clicks on the mobile screen.

Its impact is so big that even a food stall on the street accepts a digital wallet payment. Hence, digital payment solutions have been able to boost financial inclusion with mobile wallet.

A study by Juniper Research says that by 2026, 60 percent of the global population will use digital wallets. It found that digital wallet users will rise to 5.2 billion by 2026 from around 3.4 billion as of 2022. This stat represents a growth of 53%. It also said that the heavy cash-using developing countries benefit the most from these wallets.

Even with such potential growth, digital wallet solution providers keep innovating digital wallets to improve the customer experience and keep them retained and satisfied. In this light of innovations, they have come up with a new wallet solution called sub-wallets.

In this blog, we will get an insight into what sub-wallets are, their types, and why your customers need them.

What are Sub-wallets?

Marzia is having trouble saving up for the car she desires to buy for five years now. She has tried everything to keep her from overspending. But, then something comes up, and she loses her goal all over again. She discussed this matter with her best friend, Damian.

After listening to her problem, Damian advised her to use a sub-wallet in her digital wallet for the car-saving goal. She took his advice and was able to buy her dream car in just two years of using the sub-wallet. Sounds amazing, right? So, what exactly is a sub-wallet?

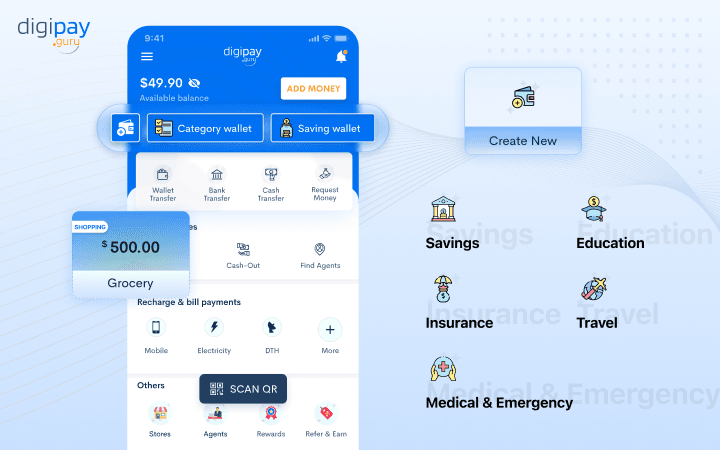

A sub-wallet is a separate wallet created within the digital wallet to keep savings or spending goals in check. It is like a subsection with a digital wallet used to store and manage specific funds. In a way, it can be also called one of the types of digital wallet.

Sub-wallet helps you set goals and add funds from your digital wallet to a sub-wallet for specific goals like savings and expenses. It helps to organize savings and set clear goals by dividing funds for various expenses such as luxury spending, holidays, savings, investments, travel, shopping, emergencies, and so on.

The customers can create as many sub-wallets as they like based on their needs. Whereas there are different types of sub-wallets provided by the digital wallet. It could be for family, savings, travel goals, and much more.

Split payment, Schedule payment, Sub Wallets: The advanced features of digital wallet

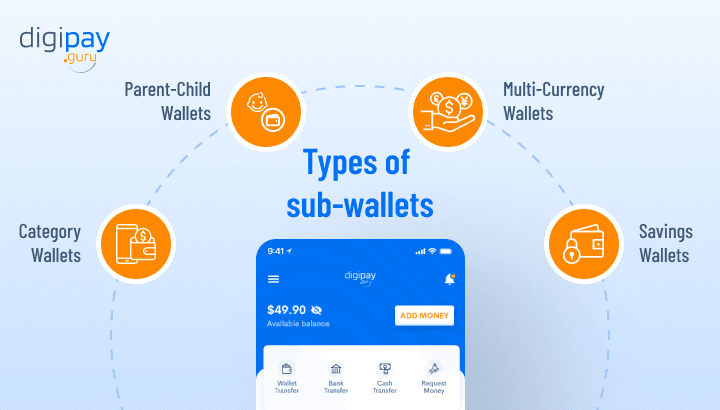

Types of sub-wallets

The sub-wallets can be used for multiple purposes. So there are various types of sub-wallet options available in digital wallets.

Category Wallets

Category wallets are sub-wallets where the customers can create multiple sub-wallets by separating them into different categories. These categories can be anything based on your preference. It could be for savings and spending.

The user can create category (sub) wallets like travel expenses, Christmas shopping, purchasing a house, paying school fees, planning the next holiday, and medical emergencies. They can also create categories for saving money for things like buying an iPhone, investments, and many more.

One of the best examples of a category wallet is Current, which has the feature of a sub-wallet where users can create different pods(categories), and set limits & save money in them.

In this category wallet, the user’s limited amount of funds (as decided by the user in amount or percentage) are automatically deducted from the digital wallet and transferred to different categories created by them.

Parent-Child Wallets

A parent-child wallet is a sub-wallet specially designed for parents to manage the funds and spending of a child. Through this wallet, the parents can allocate pocket money to their kids and allow them to make responsible spending while paying for various expenses like food, drinks, shopping, entertainment, gaming, and so on.

The parents have full control over this type of wallet. They can keep a track of the daily and monthly spending so that the child doesn’t spend without thinking and learn to be economical with the funds they have.

The parent can also set up tasks and make payments to kids when they finish them successfully. This way, the kids stay enthusiastic about the money and learn its importance. While the parents feel a strong boost of customer satisfaction.

The best example of a parent-child wallet is the GoHenry and Spriggy app. The kids can learn money-saving habits and spend mindfully using these apps. And the parents can keep track and help kids become responsible towards money.

Multi-Currency Wallets

Lauren is going on a solo trip to New York from Africa and is very excited. When she reaches the airport, she feels hungry. She had planned to get the money exchanged, but the immediate need for food was quintessential for her.

She pulls her smartphone out and opens her digital wallet app. She then goes to her multi-currency wallet, adds funds in US currency, and buys a burger without any trouble whatsoever.

Multi-currency wallets, as the name suggests, are sub-wallets that can store multiple currencies simultaneously. The user can effectively manage funds (hold, save, exchange) and expenses in multiple currencies.

The multi-currency wallets allow users to send or receive funds in any currency without thinking of the exchange hassles. It is very useful for frequent travelers, businessmen, and expatriates. The best example of multi-currency wallets is Wallex and Transfy.

Savings Wallets

Savings Wallets are the sub-wallets used specifically to target your savings goals and come with the features of pre-planning for financial savings for any goals they want to achieve. It could be weddings, school fees, buying an asset, investments, and so on.

It helps users set goals for savings, keeps them on auto-pilot, and forget about them till the desired savings amount is achieved. They can even earn interest on such savings. It helps the user stay organized, keep their funds in check, and lead a carefree abundant life.

Some examples of savings wallets are NerdWallet, Qapital, Fi Money, and Current.

Why do your customers need sub-wallets?

Now that we are clear on what sub-wallets are, their types, and their uses, let’s understand the main reasons behind learning about them i.e. customers. Why would your customers want to use a sub-wallet? Here are major reasons to highlight.

The convenience of use

The sub-wallets are within the digital wallet and can be used to create multiple sub-wallets with just a few taps on the hand-held devices. This makes it convenient to use for your customers. Also, anytime they need to organize their funds and manage them, sub-wallets provide the most smooth and easy process.

Budgeting and tracking

These wallets allow your customers to create pots or sub-wallets with different fund capacities and different goals on a beforehand basis. This helps them plan their budgets effectively and spend only on what is very important to them and won’t shake their long-term goals.

The customers can keep track of where their funds are going and change their spending habits from their analysis.

Mindful spending

The sub-wallets, with their storage, saving, and limited spending features, help your customers to be mindful of their spending. They can set budgets of spending for their merchants, suppliers, vendors, and customers.

The customers can also set usage and control limits, ultimately helping to multiply the funds and investments. This way, they can upgrade their business, services, or personal lives at the right time, with just the right amount of funds on hand.

Saving goals

With the help of sub-wallets, your customers can easily achieve their savings milestones such as saving 2500 dollars before launching a new product and saving 5000 dollars for marketing needs for the next quarter.

Setting the saving milestones makes them feel more secure about their future goals. These wallets will also help them stay economical and live a placate life at the same time. Hence, they are a complete savings package.

Conclusion

Sub-wallets are a great add-on to digital wallets and the online payment system for your customers. It has come as a boon for anyone who wants to stay more organized towards their funds and wants to avoid unnecessary costs and expenses. The users can even create as many sub-wallets as required.

With their multiple types of wallet options and amazing benefits, sub-wallets have created an imprinting image among digital wallet users. Sub-wallets are innovative, cost-effective, and convenient for savings and investments.

So, without a doubt, it can be said that sub-wallets essentially increased the demand and usage of digital wallets, making them a very important and in-demand feature of it. Thus, you must build an digital wallet solution with a sub-wallet feature in it.