Sending $200 internationally costs nearly 6.4% - twice the sustainable development goal target of 3%.

This stat by the World Bank is enough for you to consider making your international remittance services more affordable. Why? Because that’s what customers are feeling -they are finding sending money to their loved ones too costly.

To overcome this challenge, many remittance businesses like yours are starting to adopt cross border payment software. These solutions have the power to reduce costs and provide a fast, seamless & secure money transfer experience.

However, deciding the right solution for you and effective strategies to ensure cost-efficiency are still needed. That’s where this blog will help you.

In this blog post, you will discover:

- The factors that drive remittance costs

- Proven strategies for reducing remittance costs for both your business and your customers

- Innovative pricing models and their impact on costs

Let’s begin!

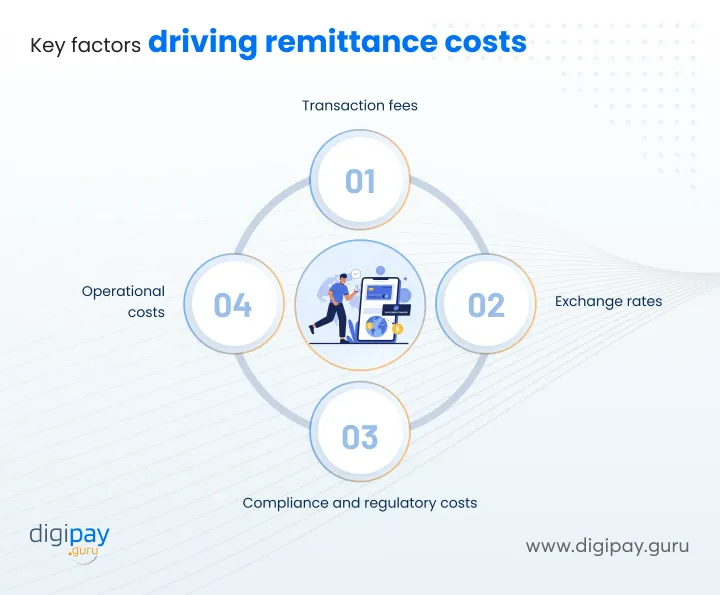

Key factors driving remittance costs

Before we get to know the proven strategies for cost reduction in remittances, it's essential to understand the main factors that drive remittance costs.

Knowing these factors will help you to make informed decisions when you plan to improve your cross border money remittance solution to make it more affordable and profitable.

The key factors that can drive the cost of remittances:

Transaction fees

Transaction fees are one of the major reasons for cross border remittance costs. Generally, there are so many parties involved in the remittance process. From the bank where the fund is deposited, to middlemen, to international processing, to the bank where funds are received, all parties have their associated fees.

All these costs add up, and ultimately the remittance costs become higher for both - you and your customers.

Below is the breakdown of all costs associated with the remittance process:

Sending fees: Charges applied when initiating a transfer

Receiving fees: Costs associated with collecting funds at the destination

Third-party fees: Charges from intermediary banks or payment processors

Read more - Why cross border fee in remittance matters for market competitiveness?

Exchange rates

Exchange rates can be a complex and major factor affecting remittance costs. These rates can vary from country to country and can incur a huge expense for the customers.

Even a small margin on the exchange rate can add up, especially for large transactions. So, you must understand how these margins affect your bottom line and your customers' wallets and look for ways to minimize them.

Compliance and regulatory costs

As the transactions are all international, there are two countries involved and so the compliance and regulatory requirements of both countries will affect the remittance costs.

Plus, compliance involves adhering to AML laws, KYC regulations, and other local & international rules. These processes require substantial investment in technology and manpower.

Trying to keep up with these costs can accumulate into huge expenses in the end.

Operational costs

Your day-to-day operational costs like technology, infrastructure, staffing, and administrative expenses are essential in determining your overall remittance costs. Analyzing these areas can reveal opportunities for optimization and cost reduction.

Proven strategies to minimize the remittance costs for your remittance business

Now that you are familiar with key drivers of remittance costs in your business, you must focus on reducing these costs strategically.

To make it easy for you, we have discovered proven strategies to minimize the remittance costs for your business. They include:

Leveraging digital solutions

Embracing technology is crucial for reducing remittance costs and improving efficiency. By implementing digital platforms, you can;

- Streamline transactions

- Automate processes, and

- Minimize manual interventions

You can consider various digital solutions to implement in your business:

- Mobile apps for easy and convenient transactions

- API integrations for seamless connectivity with partners and service providers

- Blockchain technology for secure and cost-effective cross-border transfers

Strategic partnerships

Forming strategic alliances with local banks and financial institutions can be a key strategy in reducing remittance costs. These partnerships allow you to tap into existing infrastructure and leverage local expertise. This ultimately leads to cost savings.

Benefits of strategic partnerships include:

- Shared infrastructure costs

- Access to local payment networks

- Enhanced compliance capabilities through combined resources

By collaborating with the right partners, you can expand your reach while keeping costs in check.

Bulk remittance services

Offering bulk remittance services in your cross border payments software can be a profitable strategy to reduce costs and attract high-volume customers. You can process large transactions in bulk at competitive rates. This helps you offer affordable remittance services.

Key advantages of bulk remittance services include:

- Lower per-transaction costs

- Streamlined processing and reduced administrative overhead

- Opportunity to serve corporate clients and expand your customer base

Dynamic pricing models

Offering innovative and dynamic pricing models can help you optimize revenue for your business and offer competitive rates to your customers.

By implementing dynamic pricing strategies, you can adapt to market conditions and customer needs in real-time.

The dynamic pricing models can be:

Tiered pricing based on transaction volume or frequency Subscription models for frequent remitters Time-based pricing that adjusts rates during peak and off-peak hours

We will discuss these pricing models in detail, later in this blog.

Efficient payment networks

Having efficient payment networks is crucial for faster and cheaper transactions and to avoid unnecessary middlemen in the process.

By leveraging efficient payment rails, you can minimize cross-border transaction costs and improve processing times.

The best ways to enhance payment networks are:

- Utilizing regional payment networks to reduce reliance on costly international systems

- Implementing real-time gross settlement (RTGS) systems for instant transfers

- Exploring emerging technologies like distributed ledger systems for cost-effective settlements

By continually refining your payment network strategy, you can achieve significant cost savings and improve your service offerings.

Key strategies to reduce remittance costs for your customers

The above-mentioned strategies to reduce remittance costs for your business will definitely make a difference. Plus, you also need to focus on reducing the remittance costs for your customers.

Here are the key strategies to do so:

Transparent fee structures

The best way to build trust and loyalty with your customer is to be transparent about the fee structures your cross-border remittance system follows.

When you are transparent about the costs your customers will have to incur they will not fear any hidden charges and will have peace of mind.

Here’s how you can enhance fee transparency:

- Provide detailed breakdowns of all fees associated with each transaction

- Offer cost comparison tools to help customers understand your competitive advantage

- Educate your customers on ways to minimize fees through optimal transaction methods

Competitive exchange rates

By offering competitive exchange rates, you can attract and retain more customers. Plus, it will differentiate your services effectively and increase customer satisfaction in the process.

To maintain competitive exchange rates:

- Implement real-time rate updates to reflect current market conditions

- Offer rate alerts to help customers decide their time for transactions optimally

By focusing on exchange rate competitiveness, you can position your business as a value-driven option in the remittance market.

Convenient payment options

Offer your customers convenient payment options so that they can decide on whichever is more suitable for avoiding extra costs on international money transfers.

The payment options that can enhance convenience in global remittances for your customers are:

- Digital wallets

- Mobile payments

- Bank transfers & more

To further reduce the costs, you can consider implementing:

- Integration with popular digital wallets and payment apps

- QR code-based payments for quick and easy transactions

- Direct bank transfer options to minimize intermediary fees

Read More: Key features to gain international remittance success for banks

Customer loyalty programs

Implementing loyalty programs can be an effective way to reward frequent remitters and reduce overall costs for your most valuable customers. These programs can help you build long-term relationships and increase customer lifetime value.

Key elements of successful loyalty programs include:

- Tiered rewards based on transaction volume or frequency

- Exclusive rates or fee waivers for loyal customers

- Referral bonuses to encourage customer acquisition

Plus, by investing in customer loyalty, you can reduce churn and create a stable base of repeat customers.

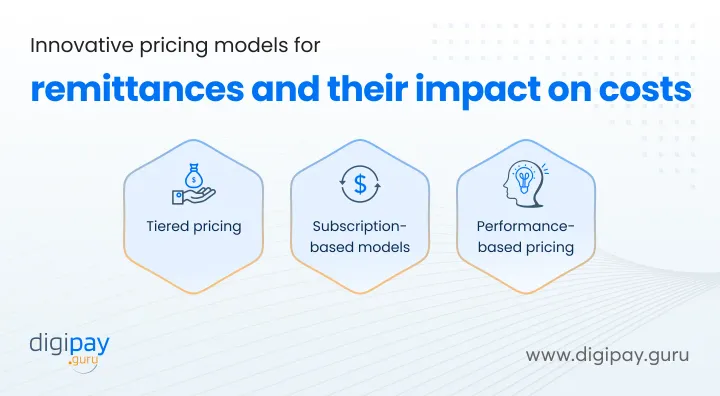

Innovative pricing models and their impact on costs

As discussed earlier, the dynamic pricing models when used innovatively can have a significant impact on the cost of remittances.

The pricing models include:

Tiered pricing

Tiered pricing is a pricing model, where you can decrease the per transaction price based on the number of transactions your user performs. The more the number of transactions, the better rate you can offer to them.

Benefits of tiered pricing include:

- Incentivizing larger transactions – leading to improved economies of scale

- Attracting high-volume customers with competitive rates

- Simplifying fee structures for easier customer understanding

By implementing a well-designed tiered pricing model, you can create a win-win situation for both your business and your customers.

Subscription-based models

In the subscription-based pricing model, you charge a fixed fee for a set period of time. The transactions can be unlimited or fixed in number during the set period.

This is an ideal model for customers making frequent international remittances. Plus, when you offer a fixed fee for high-volume transactions, you attract more loyal customers.

While subscription models may not be suitable for all customer segments, they can be a powerful tool for serving high-frequency remitters.

Performance-based pricing

In this type of pricing model, the cost of the transaction is closely related to how your remittance business performs. This means that the customers have to pay according to how well a service performs.

Key aspects of performance-based pricing include:

- Offering fee refunds or discounts for delayed or unsuccessful transactions

- Providing premium service levels with guaranteed delivery times

- Implementing customer satisfaction scores as a factor in pricing

How DigiPay.Guru can help?

With DigiPay.Guru’s cross border remittance solution offers everything your business needs to cut down costs for both - you as a provider and your customers.

The key features of our solution that significantly help you are:

- A fast, reliable, secure cross-border money transfers

- Support multiple currency corridors

- Multiple modes of payment

- Dynamic exchange rate management

- Transparent fee structures & FX rates

- Faster bill payments

- Easy currency conversions

All these features can significantly reduce your remittance costs and allow you to offer cost-efficient international remittance services to your customers.

Read More: DigiPay.Guru's Cross Border Payment Platform: Cost-effective, Flexible, and Scalable

Conclusion

Yes, it's possible to reduce remittance costs for both providers and customers. All you need is the right strategies and a robust cross-border remittance solution. All the above-mentioned strategies are proven & tested and hence will help your business grow, reduce costs, and increase revenue & customers.

With DigiPay.Guru, you can easily implement all the strategies and become the first choice of your customers. And ultimately, the global leader in the remittance industry. Our cross-border payment platform enables you to offer faster, affordable, interoperable, and transparent cross-border payments to your customers with our end-to-end international remittance solution.