33% of Americans have faced some attempt at identity theft!

The above statistic by Market Screener is alarming. The customers are concerned about their security. And businesses like yours are not able to offer robust security while onboarding customers.

And the majority of businesses struggle to offer foolproof security while onboarding customers. Are you also struggling with insecure customer onboarding and losing customers due to it?

Well, no more struggle now. There is a solution out there in the market. That is – the “eKYC solution”. It can change the entire game by ensuring secure customer onboarding. However, you need a robust eKYC solution that can offer advanced security features to keep your customers and business foolproof at all costs.

That’s where DigiPay.Guru’s eKYC solution comes into play as it offers everything you need for secure customer onboarding.

Read this blog to learn more about;

- The need for advanced security in customer onboarding

- Advanced security features of DigiPay.Guru’s eKYC solution

- Why choose DigiPay.Guru & more

Let’s begin by understanding the need for security in customer onboarding.

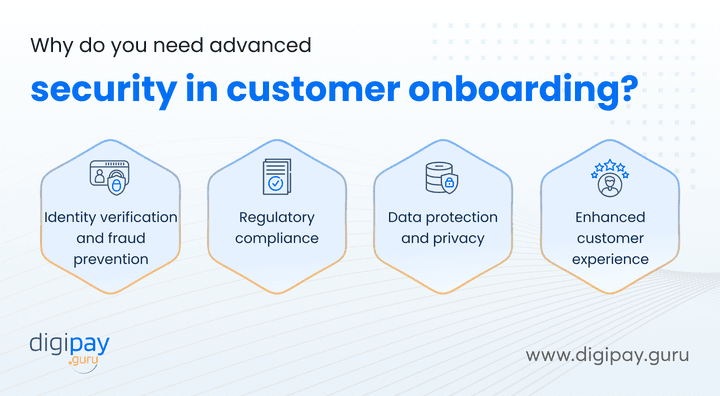

The need for advanced security in customer onboarding

During times of constant digital transformation, the importance of implementing robust security measures during the customer onboarding process can’t be overstated.

Several key factors drive this necessity. The key factors are;

Identity verification and fraud prevention

One of the primary challenges in customer onboarding is identity fraud prevention and the associated risks of financial crimes, like money laundering & terrorist financing.

Plus the traditional methods of customer identification & verification are increasingly vulnerable to sophisticated fraud tactics. This makes it necessary to adopt the advanced technologies and processes

Regulatory compliance

You need to follow quite a number of regulatory requirements like KYC and AML standards. If you fail to comply with these requirements, you may incur penalties, reputational damage, and loss of trust.

So, implementing eKYC solutions ensures that you adhere to these regulations and stay compliant at all costs.

Data protection and privacy

With digital systems in place, a large volume of sensitive data of customers is collected and processed every single day. Thus, it becomes necessary for you to prioritize data protection & privacy.

To focus on data protection and privacy, you must implement robust security measures. These measures prevent customer information from unauthorized access, cyber threats, and data breaches. This in turn protects you and your customers from serious consequences.

Enhanced customer experience

Today, customers demand more than just a customer experience. They need a seamless and convenient onboarding experience. But, traditional KYC processes are manual, time-consuming, and prone to errors. So, it can’t fulfill the customer's expectations.

However, when you leverage the advanced eKYC solutions, you can;

- Streamline your onboarding process

- Reduce friction

- Improve overall experience, and

- Boost trust & loyalty

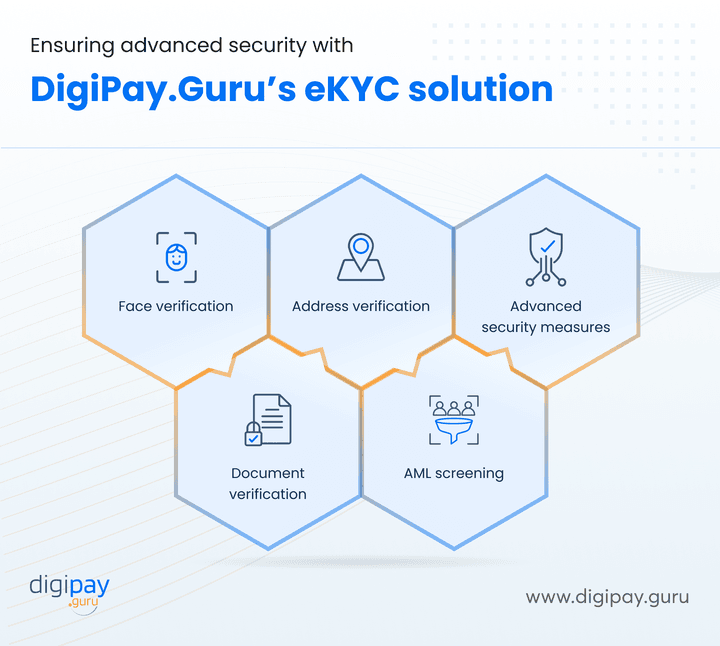

Ensuring advanced security with DigiPay.Guru’s eKYC solution

DigiPay.Guru’s eKYC solution is designed to make your business more secure so that only legitimate customers are onboarded into your system.

This is made sure by our advanced security features for identity verification. These features include;

Face verification

Face verification is an AI-powered feature that captures live selfie videos to identify the user's identity and detect any potential identity theft or fraud through spoof attacks.

Leveraging advanced biometric technologies, DigiPay.Guru’s face ID verification feature ensures that the person being onboarded is physically present and matches the provided identity documents. This enhances the overall security of the onboarding process.

Document verification

Document verification is an advanced feature that ensures document validity with set standards. It utilizes OCR technology to extract necessary data accurately for comparison with the original document.

This feature aims to help mitigate the risks associated with forged or counterfeit documents and ensure the integrity of the customer data.

Moreover, the document verification service employs advanced algorithms and machine learning to validate the authenticity of identity documents. The identity documents include passports, driver's licenses, and other government-issued IDs.

Address verification

Address verification is a robust feature that focuses on verifying the user address to ensure that the person you onboard is real & legitimate.

It cross-checks the provided residential address in the identity document against authoritative databases. The aim is to ensure the accuracy of customer information and minimize the risk of address fraud.

Its main functions include;

- Verify user address by extracting data strings

- Check the validity & expiration of the documents

- Ensure the user address is not fake

AML screening

AML screening is the process of reliable screening to ensure a secure & compliant onboarding. This keeps your system safe from financial crimes, compliance issues & security breaches.

The major functions include;

- AML sanction screening integration

- Automated compliance checks for fraud prevention

- Screening against the global database (OFAC, FAFT, HMT)

Advanced security measures

Apart from these main features, DigiPay.Guru’s e-KYC solution offers advanced security features like;

2FA - Multi-factor authentication to ensure an extra layer of security as the user has to go through two different authentications.

eIDV - Real-time digital verifications with the financial data accessed by integration with banking apps.

Dynamic consent verification - Constantly verifies and updates user consent throughout the transaction process to ensure ongoing authorization.

Enhanced due diligence - Implements thorough checks and assessments to identify and mitigate potential risks associated with customer transactions.

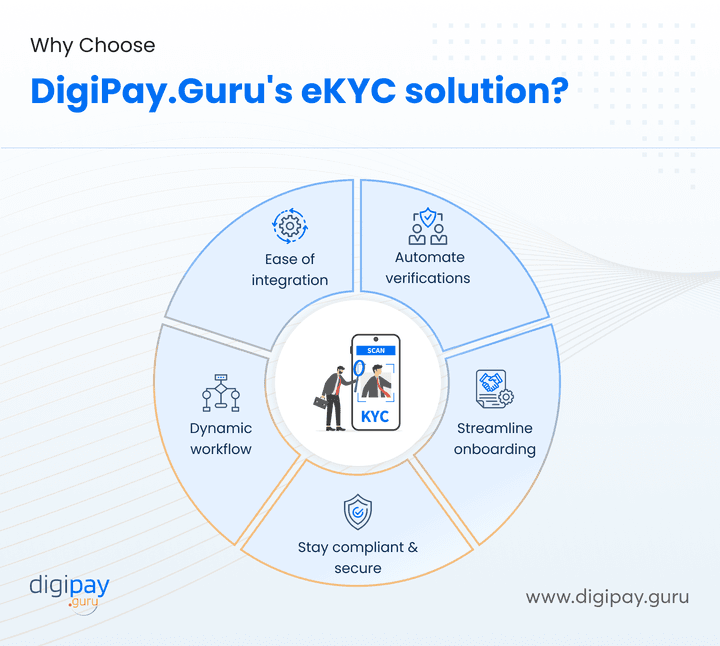

Why choose DigiPay.Guru?

DigiPay.Guru’s digital KYC solution sets itself apart from the competition with its advanced capabilities and commitment to serve you with only the best.

Here’s why you should choose DigiPay.Guru, when looking for an eKYC solution for your business:

Automate verifications

Real-time accurate verifications with automated processes to reduce fraud risks and save costs & time.

Streamline onboarding

Seamlessly handle high volumes of requests & simplify processes to offer a smooth onboarding journey.

Stay compliant & secure

Adhere to AML & KYC compliances and ensure secure onboarding with advanced security features.

Dynamic workflow

Get the power to design a workflow based on your specific business requirements and compliance needs. Seamlessly configure the steps of onboarding!

Ease of integration

Seamlessly integrate into your existing systems and infrastructure. Minimize technical barriers, streamline the implementation process, and elevate customer onboarding.

Conclusion

DigiPay.Guru is a digital fintech solution provider that focuses on helping you set up automated, effective, and affordable digital payment services for your customers. With the eKYC solution, we empower your business to onboard only legitimate customers. Plus, we empower your customers to experience fast, secure, and seamless onboarding

So, if you are a business looking for guaranteed security while onboarding your customers, this solution is for you! Let’s collaborate and multiply your business revenue and customer base together!