Your fintech business is likely to be at financial risk! You read that right! According to the 2023 fraud and financial crime report, more than USD 800 billion are laundered globally every year. This statistic would’ve now made you believe it.

With this excruciating painful truth in front of your eyes, it becomes your core responsibility to prevent your business from money laundering, fraud, financial crimes, or data breaches. When you keep your company fully equipped with KYC and AML compliance, your business will never see a day of risk!

After reading this blog post, you will be able to put all your KYC and AML compliance fraud risks away and will be able to prevent your fintech business fraud at all costs! Let’s begin by understanding the major reasons that arise for the need for KYC and AML compliance.

The need for KYC and AML compliance for your business

Your fintech business is in dire need to follow the latest KYC and AML compliance practices for identity fraud prevention in fintech and to stay ahead of the competition in every aspect. The importance of AML and KYC can be understood from the following points:

Why is KYC and AML compliance critical for your fintech business?

Prevent money laundering and financial crimes

As a fintech company, you have a responsibility to protect your services, customer data, and processes from possible fraud and suspicious activities. This is where the importance of AML and KYC plays a role. A robust KYC implementation and strict adherence to anti-money laundering measures and standards can help prevent such activities or fraud from happening in your financial system.

Build trust and credibility with customers and regulators

When you make KYC and AML compliance a top priority for your business to follow, it will help you gain the trust and credibility of the customers as well as regulators. The customers will feel safe sharing their personal and financial information.

The regulators will stay satisfied with your business practices and the robust system adhering to all the fintech compliance standards. This will result in sustainable growth and skyrocketed profits for your business.

Avoid heavy fines for non-compliance

The penalties for KYC and AML non-compliance can be very hefty and unreasonable. Deloitte says that the sum amount of AML fines has reached around $5 billion, as of 2022. This means that even a small mole in the KYC and AML procedures can lead to big fines your company is not ready to bear. So, KYC and AML compliance is a must for you.

Regulatory requirements

Know Your Customer (KYC) rules

The KYC fintech regulations require them to identify the customers thoroughly before onboarding them. The KYC process requires database and legitimacy checks. Robust KYC fintech policies and procedures are essential to ensure regulatory compliance for fintech to confirm who their customers are, plus monitor their activities to detect suspicious transactions.

Anti-Money Laundering (AML) regulations

Fintech AML regulations aim to prevent unlawful funds from entering the financial system. Anti-money laundering measures for compliance require transaction monitoring, suspicious activity reporting, and risk-based controls.

Fintechs must implement robust eKYC systems to monitor transactions for unusual activity in the identity verification process that may indicate money laundering or terrorism financing.

Unlock next-level security in identity verification for seamless customer onboarding

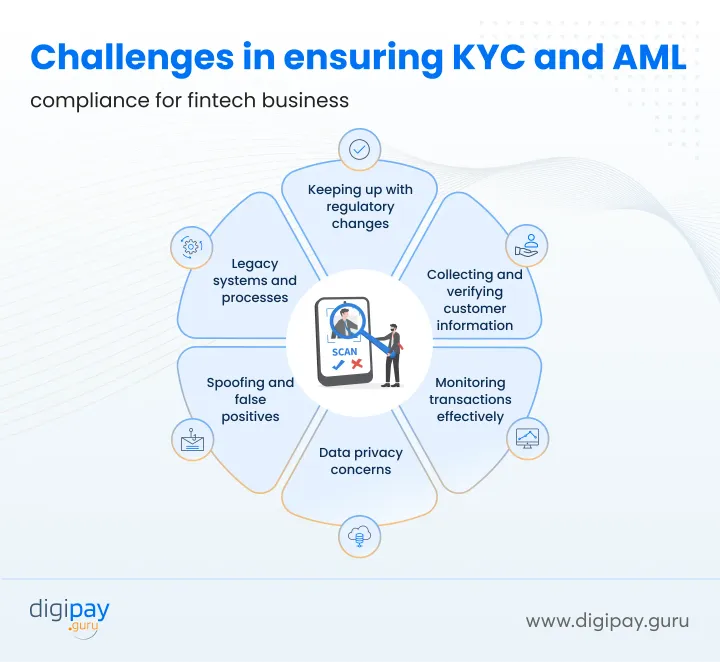

Challenges in ensuring KYC and AML compliance for fintech businesses

Keeping up with regulatory changes

The KYC and AML regulations keep changing. Due to this evolving landscape, new security risks can emerge, leading to lost credibility, compromised systems, and possibilities of fraud. Hence, continuously monitoring and adapting to the changing compliance rules is necessary.

Collecting and verifying customer information

Thoroughly vetting customers is time-consuming and complex. You must collect identifying information, confirm its authenticity, and validate documents.

Digitizing documentation and correlating data from various sources is difficult, and decentralized operations and customers in multiple countries compound challenges. Insufficient customer due diligence leaves your business exposed to financial crime risks.

Monitoring transactions effectively

Analyzing customer activity to detect suspicious patterns requires advanced capabilities that fintechs often lack. With large transaction volumes and limited resources, traditional monitoring methods are inadequate. So, effective transaction monitoring remains a major challenge.

Data privacy concerns

Collecting the customer data necessary for KYC and AML compliance raises data privacy issues if not managed carefully. Fintechs must gather personal information cautiously and keep it very secure to avoid compliance gaps or breaches of data protection regulations. However, with KYC and AML compliance not in place, data privacy risks can persist in your business.

Spoofing and false positives

Identity spoofing looking exactly similar for a particular person can hamper the entire AML KYC procedure. And the legacy systems also tend to show up false positives, thereby rejecting even legitimate customers. So, creating a balance of strict vetting of the customers and minimizing friction is very complex.

Legacy systems and processes

Around 28% of banks and businesses still carry out 41-60% of tasks manually. There are many fintech businesses that are still operating on the legacy systems. Integrating siloed data and upgrading capabilities is difficult due to the constraints on resources and time.

Moreover, transitioning to flexible, consolidated systems for scalable KYC and AML represents a major obstacle. This can be still achieved with the right KYC AML providers for your fintech.

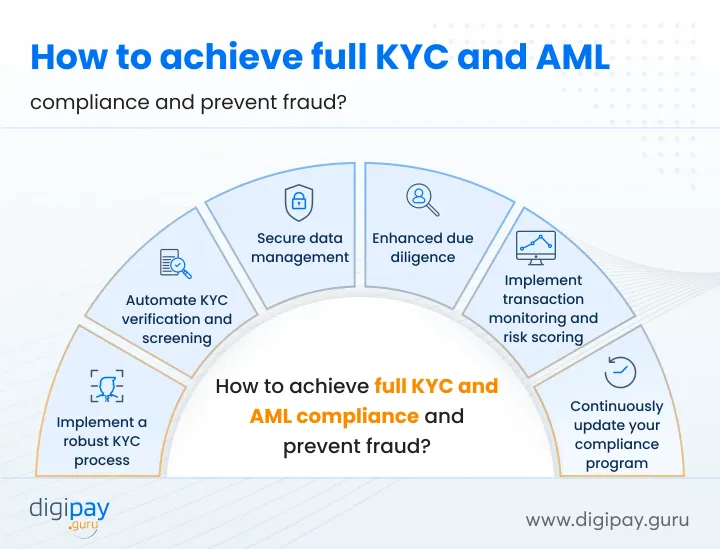

How to achieve full KYC and AML compliance and prevent fraud?

Implement a robust KYC process

A strong KYC framework is the foundation of achieving complete regulatory compliance for fintech

It allows to:

- Document identity verification requirements and data collection procedures.

- Screen customers against watchlists and sanction lists.

- Set risk-based customer acceptance policies aligned with your risk appetite.

- Conduct ongoing reviews to keep customer data current.

Automate KYC verification and screening

- Leverage AI, machine learning, and robotic process automation to accelerate KYC and AML checks and identity verification processes.

- Automate data extraction from documents and cross-referencing across databases with OCR technology.

- Use biometrics and digital footprints for identity corroboration and robust security.

- Automation makes onboarding seamless, fast, and secure while improving compliance.

Secure data management

Safely managing sensitive customer data is crucial.

To do so, you can:

- Encrypt data end-to-end and implement role-based access controls.

- Conduct regular audits and vulnerability testing.

- Implement biometrics, tokenization, and MFA methods to add extra layers of security.

- Maintain airtight data security to protect customers and maintain trust.

Enhanced customer due diligence

It's necessary to stay alert at all times. For that, the customer due diligence process needs to be perfect and improved. Enhanced diligence reduces exposure to potential money laundering.

Enhanced due diligence is only possible if you:

- Take extra precautions for high-risk customers like foreign PEPs.

- Gather more extensive background information and probe the source of funds/wealth.

- Conduct periodic reviews of activity.

Implement transaction monitoring and risk scoring

Transaction monitoring and risk scoring are crucial for detecting suspicious activity and high-risk clients. By analyzing transactions and assigning risk scores, financial institutions can identify potential money laundering, terrorist financing, and other financial crimes. The right KYC AML provider for these KYC and AML procedures can protect the integrity of the financial system.

Implementing transactional monitoring and risk scoring requires you to:

- Analyze transactions using AI and machine learning to detect suspicious patterns in real time.

- Score transaction risk to focus on high-threat activity. Expert rules and scenario modeling identify known typologies.

- Real-time monitoring and intelligence enable a rapid compliance response.

Continuously update your compliance program

Staying on top of evolving fintech compliance standards and regulations, risks, and smarter tech keeps KYC and AML sharp. You must continuously enhance detection, processes, and controls to show your committmment towards compliance. Maintaining cutting-edge and agile compliance is essential as new threats emerge.

Follow these strategies to always stay on top of compliance updates:

- Regularly review policies against the latest regulations and emerging risks.

- Look for process improvements and technology opportunities. Conduct audits to identify gaps.

- Provide compliance training to employees.

How DigiPay.Guru can help?

DigiPay.Guru offers a robust eKYC solution that ensures KYC and AML compliance and also adheres to various other important security standards like GDPR and PCI SSF. Moreover, it comes with KYC automation processes and implemented security and fraud prevention features like biometric authentication, liveness detection, OCR technology, tokenization, AML screening, database checks, and much more.

It provides you with benefits like:

- Seamless customer onboarding

- Accurate and fast KYC and AML checks

- Automated KYC verifications

- Regulatory KYC and AML compliance

- API-driven efficiency

- Robust security

Conclusion

KYC and AML compliance is the backbone of a fintech company that intends identity fraud prevention in fintech. When you are fully compliant with KYC and AML standards, any suspicious or terrorist activities are detected right in the AML KYC procedure and can be flagged to avoid any such activity in the future.

DigiPay.Guru offers a robust eKYC solution that aims to keep your business fully secure from fraud by following KYC and AML practices as their core capability in the customer onboarding and identity verification process. It's fast, secure, automated, and compliant.