Customer experience is a necessity when you offer digital payment solutions. You improve the experience and both wins. You attract more loyal customers and your business grows exponentially.

On that note, digital wallets and prepaid cards are making digital payments fast, secure, and convenient across the globe. Offering both these solutions in today’s digital world can yield profits and long-term success.

But when integrated together, they can take your business to the next level. But how? This blog will answer this question for you.

So, if you are a digital wallet service provider or a prepaid card service provider, this blog is specially curated for you. By the end, you will know:

- Prepaid cards vs digital wallets - key differences

- Key benefits of prepaid cards in digital wallets

- Top benefits of digital wallets for prepaid card users, and

- Best examples of prepaid cards and digital wallets synergy in practice

Let’s begin by understanding the key differences between the two!

Prepaid cards and digital wallets: A comparison

Prepaid cards and digital wallets have one similarity: the convenience of payments. But, how effective are they individually? Let’s understand this with a brief comparison between digital wallets and prepaid cards:

Convenience and accessibility

Prepaid cards and digital wallets are extremely convenient and accessible in providing digital payment services.

Prepaid cards offer physical plus virtual forms of making payments at the point of sale terminals and card readers. It uses a tap-and-pay system with NFC technology which enables fast, secure, and seamless payments.

Digital wallets, on the other hand, leverage the omnipresence of smartphones & internet to enable contactless payments and online transactions. This makes them very convenient. Convenient like always in the pockets of the customers.

Ensuring safe transactions with security features

Prepaid cards typically offer fraud protection features like chips and biometrics in case of virtual. Moreover, your customers can quickly block/freeze the card if lost or stolen.

Digital wallets have added security features like advanced encryption, tokenization, and biometric authentication to secure users' payment information and prevent unauthorized access.

User experience

The user experience differs between prepaid cards and digital wallets. Prepaid cards provide a simple and familiar experience just like traditional debit cards. However, in the case of virtual cards, it acts like a digital debit card on mobile.

Whereas, digital wallets offer a more tech-savvy approach, with features like real-time balance updates, transaction history, and the ability to manage multiple payment methods in one place.

Cost considerations: prepaid card fees and digital wallets

Prepaid cards often come with various fees, such as:

- Activation

- Monthly maintenance, and

- Transaction fees

Digital wallets, while generally free to use for the end users, may have associated costs for linked payment methods or premium features.

Regulatory and compliance requirements

Both prepaid cards and digital wallets are subject to regulatory oversight. However, the specific requirements can vary.

Prepaid cards often fall under traditional banking regulations like PCI DSS, while digital wallets may face additional scrutiny regarding data protection and cybersecurity like KYC, AML, GDPR, SWIFT, FAFT, etc.

Flexibility and customization

Digital wallets typically offer more flexibility and customization options compared to prepaid cards. Users can easily add, remove, or prioritize different payment methods within their digital wallet.

Prepaid cards, while more limited in this aspect, can still be customized with branded designs or specific features tailored to target demographics.

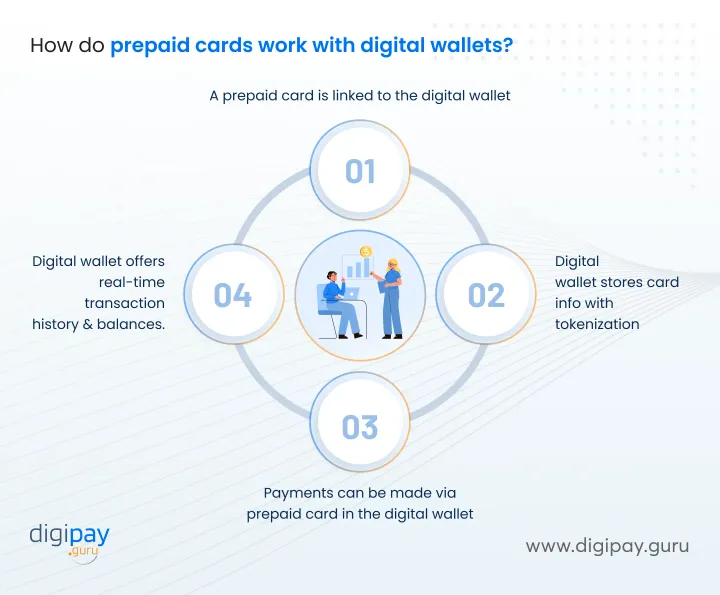

How do prepaid cards work with digital wallets?

If a prepaid card is integrated into a digital wallet, it can create a powerful combination and can boost your revenue by 10X. Here’s how it works:

-

Users can add their prepaid card information to link it to their preferred digital wallet app.

-

The digital wallet securely stores the card information with tokenization for enhanced security.

-

Users can then make payments using their prepaid card funds via digital wallet. The payment can be made both online and at contactless payment terminals.

-

The digital wallet provides real-time updates on transaction history and current balances & more which, in turn, offers improved visibility and control over prepaid card usage.

This seamless integration allows your customers to enjoy the benefits of both prepaid cards and digital wallets simultaneously.

Benefits of using prepaid cards in digital wallets

There are numerous benefits of using prepaid cards in digital wallets for your customers. And benefits for customers equals extra benefits for your business - you can have loyal customers for life.

Let's explore these prepaid card benefits in detail:

Enhanced prepaid card security with digital wallets

Digital wallets are made with robust security in mind. And with prepaid card integration into the digital wallets, you can offer your customers an extra security layer.

It is because digital wallets typically employ security features like:

- Biometric authentication

- Face verification

- Tokenization & encryption

- Periodic web pentesting

- Anomaly detection & prevention

- Advanced encryption algorithm

- Periodic SAST,DAST,SCA scans

- Straightforward authorization rules

These features can help protect sensitive card information from potential security breaches. This enhanced security can lead to increased customer trust and reduced fraud-related losses for your business.

Increased convenience

Digital wallets make it easier than ever for customers to use their prepaid cards. With just a tap or a click, they can make payments without having to physically present their card. This convenience can lead to increased usage and customer satisfaction which, in turn, potentially driving more revenue for your business.

Reaching the unbanked to boost financial inclusion

The combination of prepaid cards and digital wallets can be particularly appealing to unbanked or underbanked populations. By offering a simple, accessible way to manage money without a traditional bank account, you can tap into this significant market segment and provide valuable financial services to those who may have been previously excluded.

Budgeting and expense control

Digital wallets often come with built-in budgeting and expense-tracking features. When combined with prepaid cards, this can provide your customers with powerful tools to manage their spending and improve their financial health. By offering these value-added services, you can differentiate your institution and foster long-term customer relationships.

Loyalty and reward programs

Integrating prepaid cards with digital wallets opens up new possibilities for implementing and managing loyalty and reward programs. You can offer personalized rewards, cashback, or points directly through the digital wallet interface. This creates a seamless and engaging experience for your customers.

Compatibility with multiple payment methods

Digital wallets allow users to store and manage multiple payment methods in one place. By ensuring your prepaid cards are compatible with popular digital wallets, you can position your offering as part of a broader and more flexible payment ecosystem.

Reduced fees and transaction costs

For financial institutions, the integration of prepaid cards with digital wallets can lead to reduced transaction costs. Digital transactions are often more cost-effective to process than traditional card-present transactions. This potentially improves your bottom line.

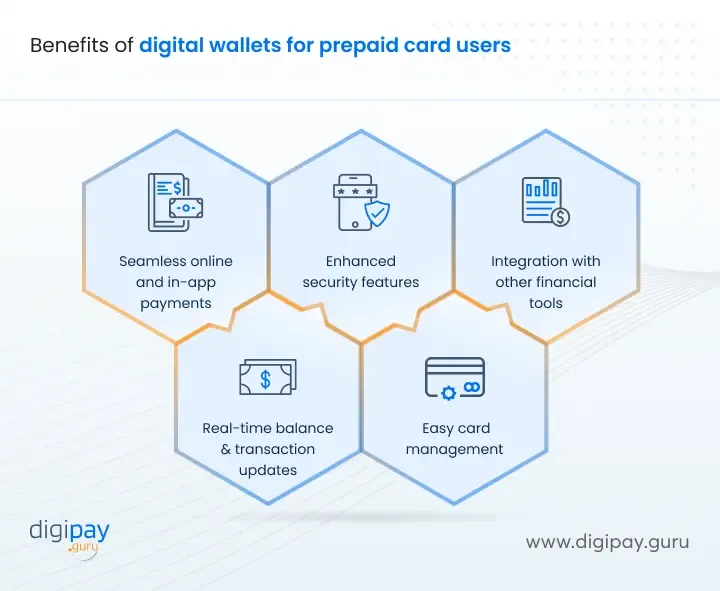

Benefits of digital wallets for prepaid card users

Using prepaid cards in digital wallets has numerous benefits. Similarly, there are numerous digital wallet benefits for prepaid card users. Such as;

Seamless online and in-app payments

With digital wallets, prepaid card users can easily make purchases within the apps and on websites. This eventually expands the usefulness of their cards.

Real-time balance and transaction updates

Digital wallets allow users to instantly check their prepaid card balance and recent transactions via the digital wallet interface.

Enhanced security features

Digital wallets come with an extra layer of security with advanced security measures like biometric authentication, tokenization, encryption, and more. This adds an extra layer of security for prepaid card usage.

Easy card management

With digital wallets, your users can seamlessly update card information and report lost or stolen cards. Plus, it enables users to manage multiple prepaid cards all within the digital wallet app.

Integration with other financial tools

Digital wallets can offer so many financial tools that can be easily integrated into the digital wallet system. The tools may include:

- Budgeting tools

- Savings features

- Financial insights and more…

These tools can help prepaid card users to manage their funds better.

Top prepaid cards and digital wallets in the market

When thinking of making prepaid cards and digital wallets a combination to offer to your customers, you must know the ones that are already the best in the market.

Let’s explore some of the top prepaid cards and digital wallets below:

Best prepaid cards for digital wallets

The popular prepaid cards for digital wallets are:

| Prepaid card | Digital wallets supported | What it offers |

|---|---|---|

| American Express Serve | Digital wallets like Apple Pay, Google Pay, and Samsung Pay. | Offers cashback rewards and no hidden fees. |

| PayPal Prepaid Mastercard | Integrates with PayPal.Can be added to digital wallets like Apple Pay and Google Pay. | Offers direct deposit and easy money transfers. |

| Bluebird by American Express | Compatible with Apple Pay, Google Pay, and Samsung Pay. | Low fees and access to MoneyPass ATMs. |

| Netspend Prepaid Mastercard | Supports Apple Pay, Google Pay, and Samsung Pay. | Reloadable, no activation fees, rewards, budgeting tools, and direct deposit. |

| Chime Visa Debit Card | Compatible with Apple Pay, Google Pay, and Samsung Pay. | No hidden fees, early direct deposit, or automatic savings features. |

Top digital wallets for prepaid card users

Some of the most popular digital wallets include:

| Digital Wallet | Key Features | Benefits for Prepaid Card Users |

|---|---|---|

| Apple Pay | Contactless payments, prime users, and advanced security. | Easy & secure payments at many retailers. |

| Google Pay | Simplified payments with no funds storage and strong security | Manage multiple prepaid cards easily. |

| Samsung Pay | NFC and MST compatibility plus rewards. | Works with most card readers, even non-NFC. |

| PayPal | Fast and secure online payments globally | Safe online shopping with prepaid cards. |

How DigiPay.Guru can help?

DigiPay.Guru is the answer to your question of “Prepaid cards and digital wallets: A perfect match?”. Why?

Well, DigiPay.Guru offers both solutions - a digital wallet solution and a prepaid card solution for your business. Plus, with our API-driven efficiency, we can integrate both with each other, based on your business needs. Meaning, if you provide a digital wallet service, we can integrate prepaid cards into your system. And if you are offering a prepaid card service than we can integrate a digital wallet into your system.

Besides, we also offer advanced digital wallet features like

- P2P & P2M payments

- Utility bills & airtime top-up

- Referrals and rewards

- Advanced security - biometric, encryption & more…

And robust prepaid card features like

- treamline card management tools

- Advanced analytics & reporting

- Robust security to protect customer funds & data

- Complete spending controls

- Customizable & configurable capabilities

- Rewards and loyalty programs and more…

Conclusion

Prepaid cards and digital wallets together are a perfect synergy. Offering both solutions in one platform can attract customers and offer numerous benefits for you and your customers. Convenience, security, speed, cost savings, and enhanced business efficiency are some of the extraordinary benefits. And the top prepaid cards and digital wallets mentioned above are proof that both solutions can seamlessly work together.

With DigiPay.Guru you can become a busines leader by offering both solutions under one platform. You can attract customers from both markets across the globe and stay afloat with your and your customers’ needs at all times. Take the first step towards this synergy with our advanced solutions that are made with security and convenience as a priority.