Looking to offer a seamless, secure, and flexible payment option for your customers? A prepaid card management system may be just the solution. For businesses like yours, these systems streamline prepaid card issuance, management, and transaction tracking—all while enhancing the customer experience.

But how does it all work, and what can it do for your business? From simplifying operations to creating new revenue streams, prepaid card management software lets you meet the growing demand for contactless, fast and secure payments. In this competitive financial world, you need to know the ins and outs of this technology.

Ready to see how a prepaid card management system & software could elevate your services?

Let’s dive into the essentials with this blog. The blog will cover what prepaid card management software is, how it works, and why it's a game-changer for financial institutions like you.

Introduction to prepaid card management systems (PCMS)

A prepaid card management system is specialized software that allows financial institutions to issue, activate, manage and monitor prepaid cards. Think of it as the backbone of any prepaid card program which can handle everything from customer onboarding and KYC checks to transaction monitoring and fraud prevention.

The prepaid card management system streamlines the entire lifecycle of prepaid cards. This makes it easier to provide a fast & seamless payment experience for customers. For businesses like yours, a well-designed management system can mean fewer problems, greater efficiency, and happier customers.

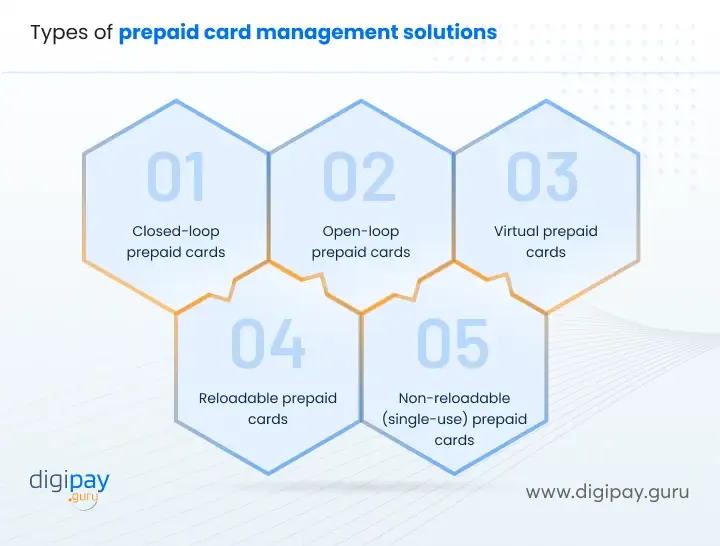

Types of prepaid card management solutions & Examples

There is no one size fits all approach to prepaid card management. You can choose from several types of prepaid card solutions, each designed for specific needs.

1. Closed-loop prepaid cards

Closed-loop prepaid card solutions are restricted to specific merchants, stores or networks. These cards cannot be used outside the designated locations or brands, which makes them perfect for internal spending, loyalty programs or rewards.

Examples: Starbucks card, Disney gift cards

2. Open-loop prepaid cards

Open-loop prepaid cards are widely accepted and can be used at any location that accepts major payment networks like Visa, MasterCard or American Express. These cards work like debit cards, which makes them ideal for everyday spending.

Examples: PayPal prepaid MasterCard, Netspend Visa prepaid card

Read more: Closed Loop vs Open Loop vs Semi-Open Loop prepaid cards: Use Cases and Predictions

3. Virtual prepaid cards

Virtual prepaid cards are digital only cards, used for online purchases. These cards offer more security as they are not tied to physical plastic and can be used for a single transaction or a set period.

Examples: Privacy.com virtual cards, Apple Pay virtual cards

Each type of card has unique benefits, and a prepaid card management system should ideally support all three.

4. Reloadable prepaid cards

Reloadable prepaid cards allow customers to add funds multiple times, which makes them perfect for ongoing use. These cards are often used as payroll cards or travel cards where funds need to be reloaded periodically.

Examples: American Express Serve card, Walmart MoneyCard

5. Non-reloadable (single-use) prepaid cards

Non-reloadable prepaid cards also known as single-use prepaid cards are loaded with a specific amount and cannot be reloaded once the balance is exhausted. These are often used for promotional or gifting purposes.

Examples: Vanilla Visa Gift Card, American Express Gift Card

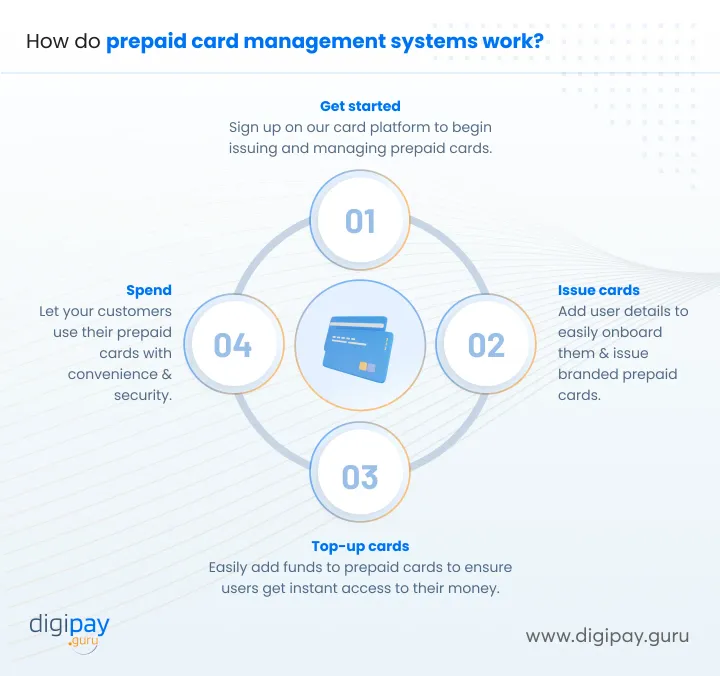

How prepaid card management systems work?

Here's a step-by-step guide to how these systems work, which ensures a smooth experience for both you and customers.

Step 1: Get started

Begin by signing up on a prepaid card management platform. This platform will be your central hub for issuing cards, managing programs, and ensuring compliance with security standards. It's quick to integrate and gives you full control over card issuance.

Step 2: Issue cards

Once you’re set up, easily add user details to the platform. Issue branded prepaid cards with customizable designs that reflect your business identity. Whether physical or virtual, the system ensures swift and accurate card issuance.

Step 3: Top-up cards

Next, add funds to the prepaid cards and give your customers immediate access to their money. Funds can be added through direct deposits, bank transfers, or other payment methods, thereby allowing for quick and easy top-ups.

Step 4: Spend

Finally, let customers use their prepaid cards for purchases. With secure payment features, customers can shop online, in-store, or withdraw cash, all with confidence and ease. The system ensures every transaction is safe and seamless.

Why does your business need a prepaid card management system?

Offering prepaid cards without a robust management system is like trying to sail without a compass. Here’s why you should consider this investment.

Simplifying card issuance and activation

The process of issuing and activating prepaid cards can be complex and time-consuming. A prepaid card management system automates this and allows you to:

- Issue cards in real time, which reduces waiting times

- Activate cards quickly, which enables your customers to start using them right away

- Manage card limits, status, and usage settings with ease

Ensuring compliance and security

Regulatory compliance is a constant concern in the financial sector. The rules around prepaid cards—such as KYC and Anti-Money Laundering (AML) requirements��—are stringent. A prepaid card management system helps you:

Automate KYC and AML checks, thereby reducing the risk of non-compliance Stay updated with changing regulations without major operational changes Securely store and manage sensitive customer data

Boosting customer experience

Today’s customers expect seamless and digital-first service. A prepaid card management system supports:

- Instant card issuance and activation, whether physical or virtual.

- A self-service portal for card management, so customers can check balances, view transactions, and more.

- 24/7 customer support options, which makes it easier to resolve issues quickly.

Read more: How Does a Prepaid Card Solution Boost Customer Loyalty and Security for Your Retail Business?

Key features of a prepaid card management system

A prepaid card management system offers various features that simplify card program management and enhance service delivery.

Card issuance and activation

From issuing cards to activating them, the software does it all. Whether physical or virtual, you can issue cards on demand with custom branding. You can also activate cards fast through mobile apps or online portalss, set usage limits and track card activity in real time.

Compliance and fraud prevention

A robust system ensures compliance with KYC, AML, and other regulations. Key capabilities include:

- Automated KYC checks, which streamline the onboarding process

- Transaction monitoring to detect suspicious activities and prevent fraud

- Real-time alerts for unusual transactions, helping prevent financial losses

Transaction management

Tracking and managing card transactions is a key feature. The system allows:

- Real-time tracking of card transactions that gives greater control over financial data

- Detailed reporting and analytics which enable you to spot trends and make data-driven decisions

- Multi-currency support, which is ideal for customers who need flexibility in foreign currencies

Integration with existing systems

For smooth functionality, the software should integrate with other banking systems. This includes:

- Seamless integration with bank accounts and payment networks

- Easy linking with financial services systems, thereby improving data flow and reducing manual errors

- Compatibility with other card programs like debit and credit cards

Robust security to protect customer funds & data

Security is paramount in any prepaid card solution. You can protect customer funds and sensitive data with robust fraud detection and prevention measures such as

- Encryption

- Real-time monitoring, and

- Two-factor authentication

Complete spending control

The prepaid card system allows you to set spending limits and control where and how prepaid cards can be used. This is especially useful for businesses with payroll cards or government assistance programs as it ensures funds are used only for approved expenses. With full spending control you can offer prepaid solutions for varied needs.

Customizable & configurable capabilities

No two businesses are the same and a flexible prepaid card management system knows that. Customizable settings allow you to change card design, spending categories and transaction restrictions to suit different customer segments. These features will ensure your prepaid offerings match your brand and functional requirements.

Rewards and loyalty programs

Adding a rewards or loyalty program to your prepaid cards will increase customer engagement and satisfaction. You can offer points, cashback or other incentives to encourage repeat usage and loyalty. Rewards programs will also differentiate your product so your prepaid cards are more attractive and competitive in the market.

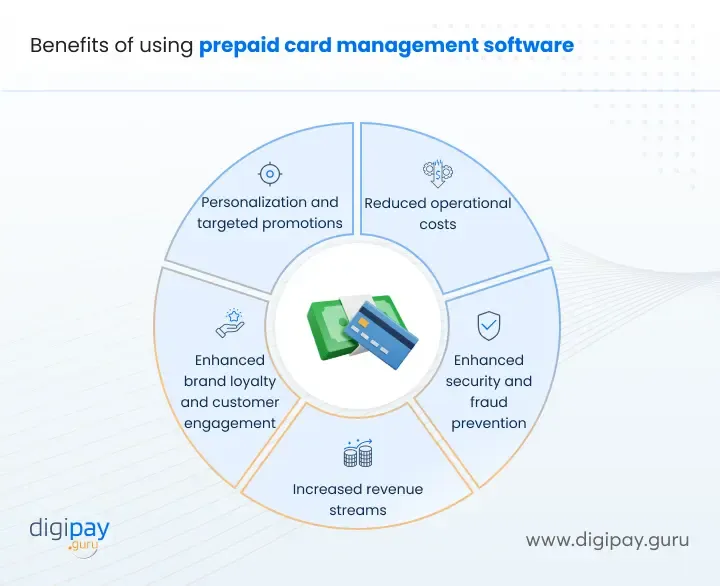

Benefits of using prepaid card management software for financial institutions

A prepaid card management system offers numerous benefits that contribute to both customer satisfaction and your business's bottom line.

Reduced operational costs

With automation in card issuance, compliance, and fraud detection, you can cut down on:

- Manual processes, prone to errors and delays

- Compliance costs, since the system keeps track of regulatory updates

- Staffing needs for routine operations, which frees up employees for more complex tasks

Enhanced security and fraud prevention

A management system helps protect against fraud by:

- Flagging suspicious transactions in real time

- Enabling you to set limits on high-risk transactions

- Offering multi-layered security features, such as biometric authentication

Increased revenue streams

A prepaid card management system opens new opportunities for you to generate revenue through:

- Transaction fees, applied to prepaid card transactions

- Interchange fees received from merchants whenever customers use the card

- Service fees, like card replacement fees or inactivity fees

These small fees, multiplied across thousands of users, can contribute a steady stream of additional income for your business.

Enhanced brand loyalty and customer engagement

Prepaid cards allow you to provide customized card designs and loyalty programs, fostering customer loyalty and engagement. Through a prepaid card management system, you can:

- Offer branded cards, thereby reinforcing brand recognition

- Partner with merchants to create rewards programs for cardholders

- Use loyalty features, such as cashback, points, or discounts, to encourage card usage

These features help retain existing customers and attract new ones, boosting the bank’s customer base over time.

Personalization and targeted promotions

With access to rich customer data, you can use prepaid card management software to offer personalized experiences through:

- Customized rewards and promotions for targeting specific customer segments

- Tailored notifications and alerts, such as spending summaries or cashback offers

- Exclusive benefits for frequent users or high-spenders to incentivize usage

Personalization increases customer satisfaction and engagement, thereby helping to strengthen customer relationships.

Read more: Everything you need to know about Prepaid Cards: A Comprehensive Guide

How to choose the right prepaid card management system

With so many options available, finding the best prepaid card management software can be overwhelming. Here are a few factors financial institutions should consider:

- Compliance Features: Look for software that includes AML and KYC automation.

- Security: Ensure the system has real-time fraud detection and secure transaction monitoring.

- Customization: Opt for a platform that allows for branded card issuance.

- Integration: The software should connect seamlessly with your existing banking systems.

Support for Multiple Card Types: Ideally, the software should support open-loop, closed-loop, and virtual prepaid cards.

DigiPay.Guru’s advanced prepaid card management system is here!

DigiPay.Guru has the solution for your prepaid card needs. Our prepaid card issuance and management software will let you issue, activate and manage prepaid cards and offer your customers a fast, seamless, and contactless payment experience.

The key features of our solution includes:

- Contactless transactions with tokenization

- Advanced analytics & reporting

- Robust security to protect customer funds & data

- Complete spending control

- Enable card payments in seconds

- Offer all - issuance, activation, & management

- Integrate seamlessly with the existing systems

- Dashboard to manage & monitor prepaid cards

- Streamline card management tools

- Dedicated technical assistance

- Customizable & configurable capabilities

- Rewards and loyalty programs

With DigiPay.Guru, you can revolutionize your business and become a business leader in your space.

Conclusion

For financial institutions like yours, adopting a prepaid card management system is a powerful step forward. This software not only simplifies card issuance and activation but also boosts compliance, security, and customer satisfaction. Whether you are providing an international multi-currency traveling card or launching a closed loop loyalty card program, a prepaid card management system helps you ensure secure, efficient, and convenient card offering for your customers.

In an industry where time is money and customers demand excellence, a prepaid card management system is an investment that can deliver long-term benefits, from operational savings to improved customer loyalty.

If you are looking to implement prepaid card management software into your business, DigiPay.Guru is your ideal solution. It empowers businesses like yours to offer prepaid cards, manage the prepaid cards effectively & securely, and boost loyalty and customer engagement at all times.