The contactless payment market is set to attain a valuation of $ 196.18bn by 2033!

The demand for contactless payments is skyrocketing. Businesses and consumers are moving away from cash and even traditional card payments.

But here’s the challenge.

How do you enable seamless phone to phone payments without investing in expensive hardware?

Thinking? Confused? Don’t know?

Well, this is where HCE (host card emulation) technology steps in. It eliminates the need for physical cards and terminals. Plus, it also enables secure NFC-based transactions between smartphones.

And if you're a financial institution, fintech, or business looking to offer tap-to-pay capabilities, HCE is a game-changer.

But, the question is - WHAT IS HCE?

In this guide, you’ll learn:

-

What is HCE (host card emulation) technology and payments

-

How HCE enables secure phone-to-phone transactions

-

The step-by-step process to implement it

-

Key security considerations, future trends, and more.

So, roll up your sleeves and dive right into the valuable insights.

Understanding Host Card Emulation (HCE)

The way we pay is evolving fast. Payments have become cashless and digital transactions are the new norm. But for businesses like yours, scaling contactless payments without costly infrastructure is challenging.

That’s where Host Card Emulation (HCE) comes in. Let’s break it down:

What is Host Card Emulation (HCE) and HCE Payment?

Host Card Emulation (HCE) is a technology that lets mobile apps act like physical payment cards while enabling secure contactless transactions using NFC (Near Field Communication).

Introduced by Google in 2013, HCE eliminates the need for special security chips, thereby replacing them with a cloud-based system. This makes digital transactions more accessible, scalable, and cost-effective.

HCE vs. Traditional Secure Elements: What’s the Difference?

Not all contactless payment methods are built the same. Understanding the difference between HCE and traditional secure elements can help you choose the right approach:

| Feature | HCE-Based Payments | Hardware Secure Elements (SE) |

|---|---|---|

| Storage | Cloud-based | Chip-based |

| Security Control | Software-driven | Hardware-enforced |

| Cost Efficiency | Lower | Higher |

| Implementation | Easier & scalable | Requires specialized chips |

Bottom line: HCE simplifies mobile payments. This makes it an ideal solution for businesses wanting to offer contactless transactions without extra hardware.

The Role of Tokenization in Secure Transactions

As digital payments grow, so do security threats. In this scenario, how can businesses like yours protect sensitive payment data?

Tokenization is the answer! It replaces real card details with secure tokens and minimizes fraud risks.

What is Tokenization?

Tokenization replaces sensitive payment data (e.g., card numbers) with a unique, randomly generated token. This ensures that even if a transaction is intercepted, no usable data is exposed.

How Tokenization Works with HCE

-

The mobile app creates a token instead of using a real card number.

-

The token is stored in the HCE environment.

-

During payment, the token is transmitted instead of actual payment details.

-

The payment network maps the token back to the original data securely.

This approach of HCE tokenization reduces fraud risks and aligns with PCI DSS compliance standards.

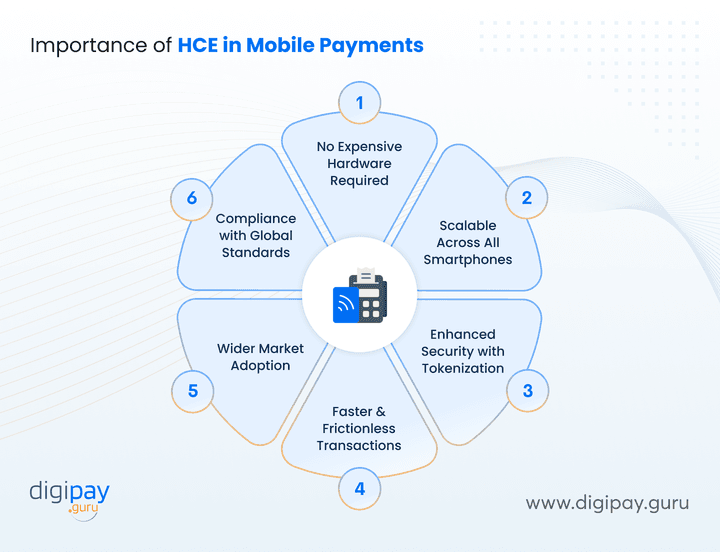

Why HCE is Important for Mobile Payments

Here’s the reality: Consumers expect frictionless payments. And carrying physical wallets is becoming outdated.

So an HCE-enabled eWallet can do wonders for both you and your customers.

Here’s why your business should care about HCE in wallet:

1. No Expensive Hardware Required

Traditional contactless payments often rely on dedicated NFC terminals, which come with high costs and infrastructure requirements.

With HCE, your business can enable tap-to-pay functionality without any additional hardware. All you need is just a smartphone. This makes it a cost-effective solution for scaling contactless payments.

2. Scalable Across All NFC-Enabled Smartphones

Unlike hardware-dependent solutions, HCE is software-based. This means it works on any NFC-enabled smartphone.

Whether your customers are using Android or iOS, they can access seamless mobile payments. This makes HCE a future-proof choice for financial institutions and fintechs like yours.

3. Enhanced Security with Tokenization

Security is a major concern in digital payments and HCE tackles this head-on with tokenization.

Instead of transmitting real card details, HCE (host card emulation) generates one-time-use payment tokens. This reduces the risk of fraud and data breaches. Even if intercepted, these tokens are useless to hackers.

4. Faster and Frictionless Transactions

The real deal is - customers today expect quick & hassle-free payments. And advanced technology like HCE enables instant transactions which significantly cuts down wait times at checkout.

With just a tap, your customers can complete their purchases. This leads to a smoother payment experience and boosted customer satisfaction.

5. Wider Market Adoption and Accessibility

HCE removes the barriers associated with traditional contactless payments. Since it doesn’t require special hardware, any business can implement it. From large banks to small fintech startups.

It also expands payment accessibility so that your customers can pay digitally without the need for a physical card.

6. Compliance with Global Payment Standards

HCE-based transactions comply with international security standards such as PCI DSS and EMVCo. This ensures secure and regulatory-approved mobile payments.

Plus, this makes it easier for businesses like yours to stay compliant while offering modern payment solutions

Simply put, HCE enables you to provide modern payment solutions without the high costs of physical infrastructure.

How HCE Facilitates Phone to Phone Payments (And How You Can Implement It)

With HCE, you can enable phone to phone payments that are secure, efficient, and scalable, thereby eliminating the need for costly POS terminals.

Here’s how you can facilitate HCE phone to phone payments:

Step 1: Input Wallet Reference ID

HCE-based payments start by linking a user’s account to a unique wallet reference ID. This ID acts as a digital representation of their payment card. And allows transactions to be processed securely without storing real card details on the device.

To implement this:

Your mobile wallet app must generate and store a unique reference ID for each user. Plus, ensure your app seamlessly integrates with an HCE-supported payment gateway to handle ID verification and mapping.

Step 2: Generate a Token for the Reference ID

Once the wallet reference ID is created, the system generates a token. ( A token is a unique, encrypted code that replaces sensitive payment information). This ensures that even if a transaction is intercepted, no real card details are exposed.

To implement this:

Your HCE integration should use tokenization APIs to generate and manage these tokens. And partner with a payment processor that supports dynamic tokenization to ensure compliance with PCI DSS and other security standards.

Step 3: Save the Token in HCE

The generated token is stored securely within the HCE environment, which allows the phone to act as a virtual payment card. Since no actual card data is saved on the device, this method enhances security and prevents fraud.

To implement this:

Configure your mobile app to store tokens in a secure HCE environment with end-to-end encryption. Regular security updates and authentication layers (such as biometrics or PIN verification) add extra protection.

Step 4: Execute Phone-to-Phone Payments

When making a payment, the user simply taps their phone against another NFC-enabled device. The stored token is transmitted securely, and just like a contactless card transaction, the payment is processed in real time.

To implement this:

Ensure your app supports NFC peer-to-peer mode, which enables devices to exchange encrypted payment data. Work with a payment provider that offers real-time transaction processing to deliver a seamless user experience.

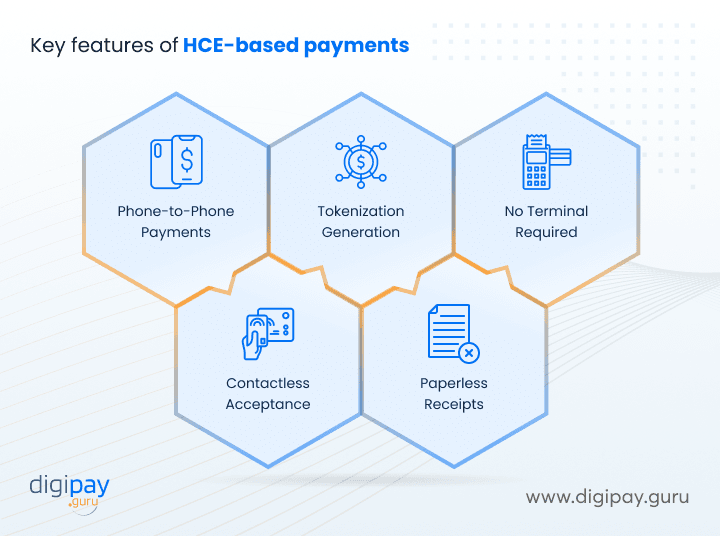

Key Capabilities and Advantages of Implementing HCE-Based Phone-to-Phone Payments

HCE doesn’t just enable phone-to-phone payments—it transforms how businesses handle digital transactions. Here’s why implementing HCE can be beneficial for your payment strategy.

1. Phone-to-Phone Payments

With HCE, payments happen directly between smartphones. This eliminates the need for physical cards or POS terminals. Plus, the users simply tap their NFC-enabled devices, which makes transactions instant and frictionless.

To implement this,

-

Ensure your app supports NFC peer-to-peer mode and integrates with a secure payment gateway.

-

Real-time transaction validation is key to delivering a seamless experience.

2. Tokenization Generation

HCE replaces sensitive card details with unique, encrypted payment tokens. Even if intercepted, these tokens are useless to hackers which significantly reduces fraud risks.

Also, use a tokenization API that dynamically generates and refreshes tokens for each transaction. This ensures compliance with PCI DSS and enhances payment security.

3. No Terminal Required

Forget expensive payment terminals—HCE turns any NFC-enabled smartphone into a virtual POS. This NFC host card emulation system makes it easier for small businesses and merchants to accept contactless payments.

To implement, you can integrate NFC payment acceptance into your app and partner with an acquiring bank that supports HCE transactions. This removes hardware costs and expands payment accessibility.

4. Contactless Acceptance

HCE-powered payments work just like tap-to-pay cards but with added flexibility. Users can pay anytime, anywhere, using their smartphones.

You can ensure your app is optimized for fast NFC detection and supports multiple authentication layers. This enhances usability while maintaining security.

5. Paperless Receipts

Transactions are logged digitally, which reduces the need for paper receipts. Users can instantly access transaction history, which makes record-keeping effortless.

Plus, you can enable in-app receipts and email confirmations for every transaction. This improves transparency and enhances customer experience.

Integrating HCE into Your eWallet Solution

To integrate HCE into your eWallet solution, follow these key and simple steps:

-

Choose an HCE-enabled payment gateway that supports tokenization.

-

Develop or update your mobile wallet app to incorporate HCE features.

-

Implement strong security protocols like encryption, tokenization, and fraud detection.

-

Test across multiple devices to ensure smooth compatibility.

-

Comply with PCI DSS standards for secure payment processing.

Security Considerations and Measures

Security isn’t just a feature in digital payments, it’s the foundation. As transactions shift to phone-to-phone payments, you must ensure airtight security.

Here’s what you need to know to protect every transaction.

1. Encryption Protocols

Every HCE transaction is encrypted end-to-end, which makes it nearly impossible for hackers to access sensitive data. This ensures that even if someone intercepts the transmission, they get nothing useful.

To implement strong encryption:

-

Use AES-256 or end-to-end TLS encryption for data in transit.

-

Plus, regular security audits help ensure that your encryption standards stay ahead of emerging threats.

2. Tokenized Transactions

Instead of storing real card details, HCE uses tokens. So, even if stolen, tokens are useless without the original mapping system.

To integrate tokenization, work with a PCI DSS-compliant tokenization provider that refreshes tokens dynamically. This adds an extra layer of security while keeping transactions seamless.

3. Multi-Factor Authentication (MFA)

One layer of security isn’t enough. So, adding biometric authentication or PIN-based verification ensures that only the rightful owner can approve a payment.

In addition, you can implement MFA by combining fingerprint, facial recognition, or OTP verification before processing payments. This significantly reduces fraud and unauthorized access.

4. Compliance with Global Standards

Regulations like PCI DSS, EMVCo, and GDPR set strict security requirements for digital payments. So, following these standards is non-negotiable if you want to avoid breaches and legal penalties.

You must ensure compliance by:

-

Regularly updating security protocols

-

Conducting penetration testing, and

-

Working with certified payment processors.

This not only protects user data but also builds trust.

Future Trends in Mobile Payments with HCE

The way we pay is evolving faster than ever. With HCE-powered phone-to-phone payments, the future of digital transactions is frictionless, secure, and widely accessible.

Here’s where things are headed.

1. Phone-to-Phone Payments Beyond Retail

Right now, most tap-to-pay transactions happen in retail. But what if you could split a bill, pay a freelancer, or send money to a friend—just by tapping phones? That’s where HCE is going.

As businesses and fintechs integrate peer-to-peer (P2P) and business-to-business (B2B) payments. Expect HCE to power everyday transactions without the need for terminals or cards.

2. AI-Powered Fraud Detection

Fraudsters are getting smarter, but so is security. AI-driven fraud detection will analyze spending patterns, detect anomalies, and block suspicious transactions in real-time before fraud even happens.

To stay ahead, financial institutions will integrate machine learning algorithms that adapt to new fraud tactics. This will make HCE transactions more secure than ever.

3. Global NFC Expansion

Not long ago, NFC payments were a luxury. Now, they’re becoming the standard. With smartphone adoption soaring worldwide, even developing markets are embracing contactless transactions.

As more countries mandate NFC support in mobile devices, HCE-powered payments will become the go-to solution for fast, secure, and universal digital payments.

4. Integration with Super Apps

The rise of super apps (where banking, shopping, and payments happen in one place) is changing consumer behavior. Imagine tapping to pay for groceries, booking a ride, and sending money—all from a single app.

Banks and fintechs will embed HCE technology into their digital wallets. This will make contactless payments a seamless part of the broader financial ecosystem.

How DigiPay.Guru can help you offer phone-to-phone payments with HCE?

With DigiPay.Guru, you get a ready-to-deploy HCE-enabled eWallet solution that makes it easy to offer secure, contactless transactions without the heavy lifting.

Our platform comes with built-in HCE integration, tokenization for top-tier security, and seamless APIs to get you to market faster. No expensive infrastructure, no long development cycles—just fast, secure, and scalable tap-to-pay payments.

Want to enable frictionless payments? Let’s make it happen.

Conclusion

HCE technology is transforming how businesses enable contactless payments. With phone-to-phone transactions, you eliminate hardware costs, enhance security with tokenization, and offer the seamless experiences customers now expect. This means the shift to digital-first payments isn’t coming—it’s already here.

If you’re looking to integrate HCE-powered tap-to-pay into your eWallet platform, DigiPay.Guru has you covered. Our secure, scalable, and ready-to-deploy eWallet solution with HCE tech helps you launch next-gen contactless payments in no time. Let’s build the future of payments together.

FAQ's

Host Card Emulation (HCE) is a technology that allows mobile apps to act like physical payment cards, enabling secure, contactless NFC transactions without requiring a hardware-based Secure Element (SE). Instead of storing card details on a chip, HCE leverages the cloud and software encryption to process payments.

For businesses, this means they can enable tap-to-pay functionality without investing in expensive infrastructure. This makes digital payments more scalable, cost-effective, and widely accessible.

HCE eliminates the need for traditional card terminals by allowing smartphones to communicate directly via NFC. Instead of swiping a card or scanning a QR code, users can simply tap their phones together to transfer payment data securely.

When a transaction is initiated, the HCE system generates a token, which is then encrypted and sent between devices. The payment is processed in real-time, thereby ensuring a fast, frictionless checkout experience.

HCE-based payments provide a hardware-free, scalable solution that works on any NFC-enabled smartphone. This removes the dependency on expensive card terminals, making it a cost-effective choice for businesses.

Additionally, HCE transactions are tokenized and encrypted, reducing fraud risks and ensuring secure processing. With instant, tap-to-pay functionality, businesses can offer customers a frictionless and modern payment experience.

Yes. HCE payments are built with multi-layered security to prevent fraud. Each payment is tokenized, meaning the actual card details are never exposed—only a one-time-use digital token is shared.

On top of that, HCE uses encryption, authentication protocols, and real-time fraud monitoring, ensuring that transactions remain secure, even if a device is lost or stolen.

To implement HCE mobile payments, businesses need:

- A mobile app that supports HCE functionality

- Integration with an HCE-enabled payment gateway

- A secure tokenization system to protect user data

- Compliance with PCI DSS and EMVCo security standards

Once these components are in place, businesses can enable seamless phone-to-phone payments for their customers.

The integration process involves:

- Choosing an HCE-supported payment processor that enables tokenized transactions.

- Updating the mobile wallet app to support NFC-based payments.

- Implementing strong encryption protocols to ensure secure transactions.

- Testing across multiple devices to ensure smooth functionality.

Once integrated, businesses can offer tap-to-pay experiences without requiring additional hardware, unlocking a frictionless, secure payment method for their customers.