Today, online payment solutions are essential for every business, be it an enterprise or startup. This is because of the speed, convenience, and security it offers. Hence, for a small business, it is like a boon to keep up with customer expectations.

Cash is no longer the king, but it's digital payments now! So, for small businesses like yours, accepting online payments is not just a nice to have but a necessity to thrive in a competitive market.

According to a study by Business Wire, over 70% of consumers prefer businesses that offer digital payment options. This data highlights how critical it is for small businesses to adapt to modern online payment solutions or risk being left behind. By adopting online and mobile payment methods, they can simplify transactions, offer better security, and meet evolving customer expectations.

In this blog, we’ll break down:

-

Why digital payment solutions are a must for small businesses

-

How they can start accepting online payments

-

Key strategies to implement these systems seamlessly and more...

Let’s begin with the answer to “Why digital payment solutions are needed for small businesses.”

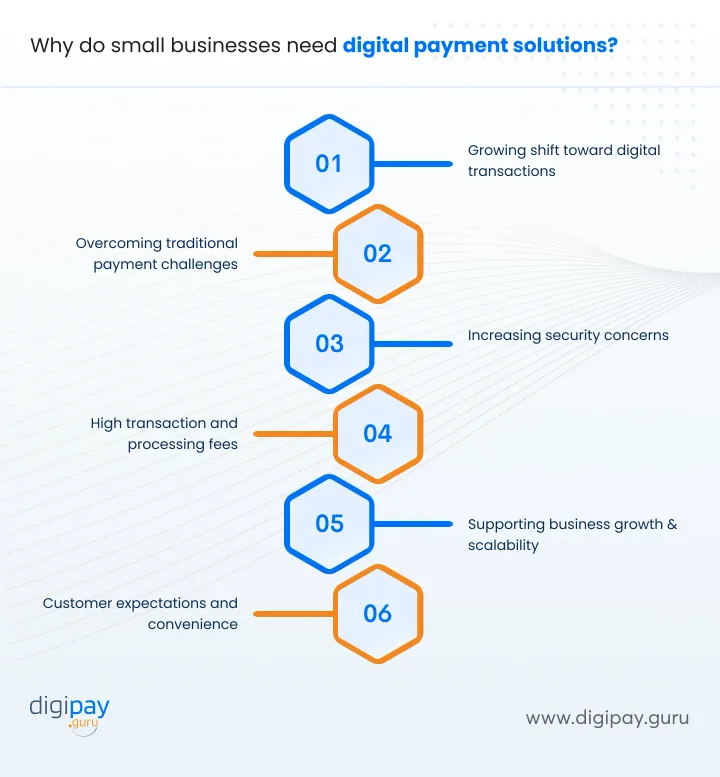

The need for digital payment solutions for small businesses

Digital payment solutions have created a highly positive impact on both customers and small businesses. More than you realize, it is a convenient tool for accepting payment that is secure, quick, and reduces the cost to the company while increasing the revenue.

The digital payment solutions are the need of the hour. Here are a few factors that define the actual reasons why digital payment solutions are needed in today’s world for your small business.

Growing shift toward digital transactions

The world is moving toward digital-first solutions, and payment methods for small businesses are no exception. Whether it’s e-commerce platforms or physical stores, customers now expect to have multiple online payment options, from credit cards to digital wallets. Small businesses that fail to offer these payment methods risk losing customers to competitors who are more digitally equipped.

Overcoming traditional payment challenges

Traditional payment methods like cash or checks come with their own set of challenges like handling large amounts of cash, balancing the register, and potential human error. Online payment methods simplify these processes, allowing businesses to streamline their operations and keep better track of finances.

Increasing security concerns

With cybercrime on the rise, security is a top priority for small businesses. Customers want to know that their transactions are secure and that their sensitive data is protected. Digital payment solutions often come with built-in security measures, such as encryption and two-factor authentication, which gives both your business owners and your customers peace of mind.

High transaction and processing fees

One concern many small businesses have is the cost of adopting digital payment solutions, particularly transaction and processing fees. However, when choosing the right platform, you can find affordable options that don’t cut too deeply into your margins. Moreover, many online payment platforms offer packages designed specifically for small businesses.

Supporting business growth and scalability

As your small business grows, you’ll need a payment system that can scale with it. Digital payment solutions are flexible and can support business growth by allowing you to serve more customers efficiently. Whether you’re adding an online store, expanding into new markets, or processing more transactions, digital payment systems can grow with your needs.

Customer expectations and convenience

Customers expect quick and seamless transactions. If your payment process is slow or outdated, customers may leave for your competitor. Offering a range of payment methods, such as credit cards, mobile wallets, or peer-to-peer payments, ensures that you meet your customer’s expectations and make it as easy as possible for them to do business with you.

How can small businesses accept online payments?

There are various ways to accept online payments for small businesses like yours. The major online payment methods for small business payment acceptance are;

Online payment service provider

If you are into a business that offers service-based or sells physical products online, then having a service provider for your online payment solution would be the standard method to accept payments from your customers.

For example, PayPal and Stripe are two of the most popular and highly used payment online payment services providers across the globe for both small and large enterprises.

Online payment solution providers also allow you to accept credit or debit card payments or via net banking, directly from your customer’s account along with the service provider to your account.

No matter what business you are into, anyone can create an account with payment service providers, and they charge no extra fee for that. For every transaction, you will need to pay a fee of around 3%, depending on the platform.

ACH transfer

ACH, also known as Automated Clearing House, is a network that transfers money digitally between bank accounts in the US. In other words, this is the method usually you get paid if the customer makes a direct deposit. And to accept payments through ACH transfer, there aren’t any special criteria to be met.

All you need to do is give your customers your bank account information, which typically will include the account holder’s name, account number, bank branch name, etc.

At times, banks, for a cancelled or voided cheque, cross-verify the account details, such as account number, bank branch, etc., or authorization from the bank itself. Mostly, a simple voided cheque will do.

It’s up to the customer who is making the payment, as they are required to have the needed information, including an ACH payment service provider such as Stax or Gusto.

In addition to that, the customer or client will also pay the fee for an ACH transfer, just like a credit card transaction where the customer covers the extra charge as a fee for the recipient.

Mobile payments

With the rise of mobile payments, small businesses can now offer payment options via mobile devices. Mobile money solutions like Apple Pay, Google Pay, and even QR codes allow customers to make payments with their smartphones. This creates a faster and more convenient transaction process.

Invoicing & billing

Whether it is a service-based business or product-based, you can make it easier and simpler for your customers to pay for what they received via a bill payment solution or invoicing platform that enables one-click payments right from their email.

Some of the popular invoicing platforms are Xero, QuickBooks, and Zoho. All these platforms provide integration with all popular payment service providers. You can simply send the bill to your customers via email, and the platforms create messages that include payment buttons to encourage them to pay right away.

Peer-to-peer payments

Peer-to-peer (P2P) payment solutions like Venmo and Zelle have become increasingly popular, especially for small, local businesses. These services enable direct payments between the customer and the business, often with lower fees and faster transaction times.

Payment gateways

A payment gateway is essential for any small business looking to accept online payments. It acts as the bridge between the customer’s bank and your business account, securely processing transactions. Payment gateways are easy to integrate into your website, which allows you to offer seamless online checkout experiences.

Benefits of accepting online payments for small businesses

Earlier, regardless of what business you are into, small businesses could easily accept payments that are not at all digital or online.

Businesses used to send a bill and wait for a cheque in the mail. Even now, you can follow the same method. However, you would be missing out on a lot of opportunities and convenience it adds to your business.

No matter what you sell your customers, you can reap benefits from the features of digital payment solutions. The key benefits include:

Expanded customer reach

Offering digital payment software solutions opens up your business to a wider audience, including customers who may prefer to shop online or use mobile payments.

This can expand your customer base beyond your local area and help you tap into new markets & grow your business.

Improved convenience with speed

Online payment methods are fast. They allow you to process transactions in real-time. This reduces the time spent waiting for payments to clear. This level of speed and convenience can help improve your cash flow and ensure that you receive payments on time.

Enhanced customer experience

By offering multiple payment options, you create a better experience for your customers. They can choose the payment method that works best for them. This makes it more likely they’ll return to do business with you again. In today’s world, convenience is king, and online payments provide just that.

Read More: Tips to make digital payments user-friendly and effective

How is the security of online payment systems for small businesses?

Security is often the number one concern for businesses considering digital payment solutions. Fortunately, most online payment platforms come with advanced security features such as encryption, tokenization, and fraud detection.

These systems ensure that your business and your customers are protected from cyber threats. Additionally, complying with industry standards such as KYC, AML, and PCI-DSS can help your business maintain secure transactions while building trust with your customers.

Read More: How to secure your online payment system?

Key strategies for implementing online payment solutions

Now that you know why your small business needs a digital payment solution, its benefits, and how to accept online payments, let's now understand how to implement it into your business.

The key strategies include;

Understand customer preferences

Knowing what your customers prefer in terms of payment methods is essential. Conduct surveys or analyze transaction data to see which options are most popular and make sure you’re offering them.

Choose the right payment gateway

Not all payment gateways are created equal. Look for a payment gateway for small business that integrates well with your business systems, offers strong security features, and has low transaction fees. This will ensure that your payment process is smooth and cost-effective.

Prioritize security measures

Security should be at the forefront of your payment solution strategy. Implement fraud prevention tools, use encryption, and ensure that your payment system complies with data protection regulations.

Provide training and support

Once you’ve implemented an online payment solution, ensure your team is trained on how to use it. This includes both the technical aspects and how to handle customer inquiries or issues with the payment process.

Test and optimize payment processes

Before fully rolling out your payment system, test it thoroughly. Make sure it works smoothly, integrates with your existing tools, and provides a seamless experience for your customers. Regularly review and optimize the system as needed.

Conclusion

In today’s competitive market, adopting digital payment solutions is no longer optional—it’s a necessity for small businesses looking to thrive. By offering secure, fast, and convenient payment methods, you can meet customer expectations, improve your operations, and position your business for future growth.

With DigiPay.Guru’s advanced digital payment solutions, your small business can become the leader of your industry. We offer a range of solutions, including a digital wallet, eWallet, merchant acquiring, international remittance, card issuance and management, eKYC, and more.

All these solutions are fast, secure, and reliable and make digital payments as easy as a walk in the park. So what are you waiting for? The time to act is now—choose a digital payment solution that fits your business needs and watch your small business flourish in the digital age.