The global remittance market is expected to reach $ 913 billion by 2025!

This stat by Statista signifies that the world has become a village with the power of technology as people migrate easily to earn and provide better lifestyles to their loved ones. Hence, international remittances have increased significantly.

And for this technological era, the traditional remittance system is both – inefficient and costly. The expectations of the customers are evolving consistently. Customers need remittance to be done at speed and with security.

And it is possible only with the help of advanced money transfer software solutions. This is why businesses like yours offering remittance services have started adopting money transfer software to stay relevant and competitive in the market.

The core aim of the software is to empower you to offer international remittance services to your customers fast, secure, affordable, and convenient.

But the question is – how?

Plus, you might have several other questions, like, Which money transfer solution should I choose? How to identify the best software for my business? How can advanced money transfer software help my business? And more…

To help you out, we have curated this blog combining all the queries businesses like yours have and face these days.

In this blog, you will explore:

- The role of technology in modernizing remittance services

- Key features of advanced money transfer software

- Benefits of implementing money transfer software for remittance businesses

- How to choose the right money transfer software for your business and more

Let’s begin!

The role of technology in modernizing remittance services

Technological advancements over the last few decades have shaped the world digitally. And with global digital transformation, remittance services have also seen an upward trajectory. Let’s see how!

Digital transformation in financial services

For the remittance sector, the shift from traditional to digital methods has been revolutionary. Here are some ways that technology is changing this industry:

The shift from traditional to digital

Traditional methods: In recent times, remittances were processed through physical agents and banks. This used to require time-consuming paperwork and face-to-face interactions. This led to delays in payments, high fees, hidden costs, security risks, and inefficient operations.

Digital solutions: Today, digital platforms have replaced many traditional methods. This allows your users to send and receive money via mobile apps and online services. This transition has made remittance services more accessible, efficient, fast, secure, and reliable.

Which international money transfer is best?

The factors that determine the selection of the best transfer method include; the speed of the transfer, the cost of the transfer, and the convenience of the transfer. Digital solutions like money transfer software for cross border transactions tend to be faster and cheaper than traditional bank transfers.

Also read: Proven strategies to reduce remittance costs for providers and customers

All about money transfer software

Money transfer software has become integral in the global remittance market. Let’s understand what is it and how it works:

What is remittance software?

Remittance software or money transfer software is a technology solution to the transfer of money across borders.

This software can:

- Automates the remittance process

- Enables faster transactions

- Offers more security, and

- Is cost-effective.

These systems have powerful features to facilitate real-time tracking, fraud detection, and compliance.

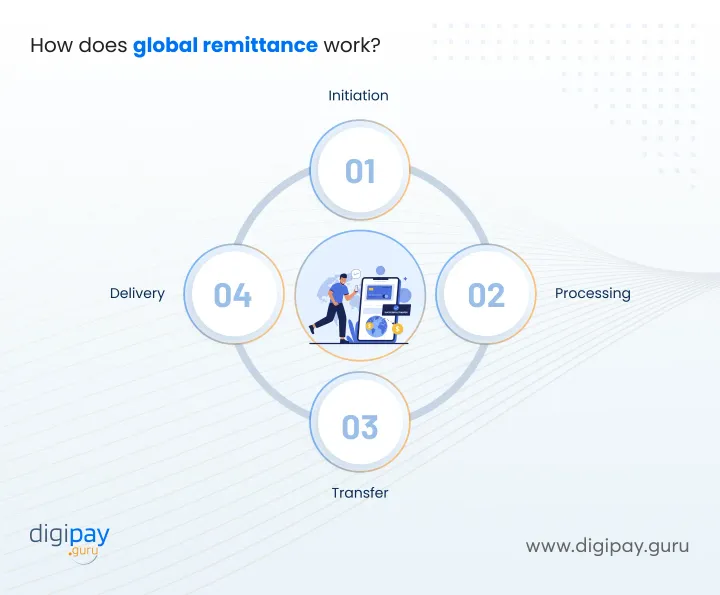

How does global remittance work?

Global remittance involves several steps:

Initiation: The sender uses a platform or service to initiate the transfer.

Processing: The remittance software processes the transaction, converting the currency if needed.

Transfer: The funds are transmitted through secure channels to the recipient's account.

Delivery: The recipient receives the funds in their local currency, often in

What are the driving forces behind the growth of the global remittance & money transfer software market?

The key factors that drive the growth the global remittance via money transfer software include:

Increasing global migration

Rising migration: The more the people migrate, the more the number of individuals who require to transfer money to their countries of origin. This increases the need for remittance services.

Family support: People always need to transact money to support their families back home, making the remittance market to grow continuously.

Increasing adoption of mobile and digital payments

Smartphone use: Widespread smartphone adoption makes mobile-based money transfers more popular and accessible.

Digital payments: Customers prefer using digital wallets and online payment systems for their convenience and speed.

Globalization and cross-border trade

International transactions: Various business types doing trade at a global level increase the demand for international transactions. Which generates the need for an efficient money transfer solution.

Remote work: Many individuals and businesses are now doing remote work. This has created a need for reliable international remittance payment systems for freelancers and businesses.

Increasing financial inclusion

Expanding access: With digital remittance solutions and its vast global network, it's becoming possible to extend financial services to unbanked and underserved populations.

Affordable services: With the real time exchange rates and transparent processes the money transfer services are now affordable.

Also read: The role of cross-border payment system in boosting financial inclusion

Regulatory and compliance developments

Stricter regulations: The regulatory requirements in the global scenario are increasing, so remittance software adhering to all these needs is a must.

RegTech: Technologies like AI, ML, cloud computing, & blockchain streamline compliance and help you meet regulations efficiently.

Consumer demand for faster and cheaper transactions

Instant transfers: Consumers expect fast transfers, and this is the main reason why money transfer software comes into the picture.

Lower fees: With increasing competition, remittance service providers are offering low-cost transactions, and so you need to do it too.

Enhanced security and fraud prevention measures

Advanced security: Robust security features like encryption and biometric authentication improve security and reduce fraud.

Regulatory compliance: Enhanced security measures help meet regulatory standards and build trust.

Now, you know the driving forces behind the adoption of money transfer software.

In the next section, let's explore the key features that make up advanced money transfer software.

These features will make you understand what you can offer if you implement this software for your remittance business.

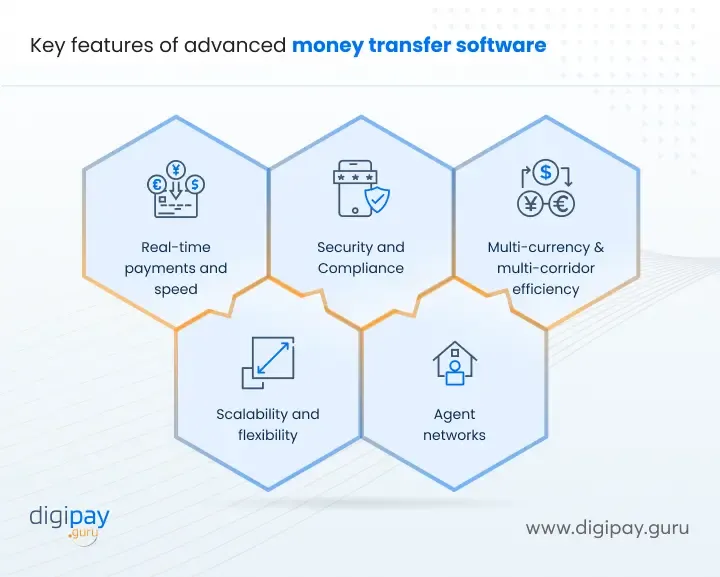

Key features of advanced money transfer software

The top features that make money transfer software advanced include:

Real-time payments and speed

One of the advanced features that come with the latest money transfer software is the real-time processing of transactions. This makes certain that the funds are transferred within the blink of an eye between the countries. Plus, this feature helps to satisfy the customers by providing them with fast and reliable remittance services.

Security and compliance

A robust international remittance software offers advanced security features and measures like encryption, fraud detection, two-factor authentication, tokenization, biometrics, 3DS, and more. This keeps every transaction happening through your remittance platform extra secure. It also protects the payment data of the customers.

Compliance with regulatory standards like PCI- SSF, GDPR, KYC, and AML ensures that your remittance business meets legal requirements and builds customer trust.

Multi-currency & multi-corridor efficiency

Effective money transfer software solution offers multi currency support and can handle multiple corridors seamlessly. This means that your customers can pay in any currency to any country and receive funds from any country.

This convenience enables users to send money across various regions without complications. This feature is essential for global operations.

Also read: How effective remittance software transforms cross-border payments?

Scalability and flexibility

Each and every international remittance software that boasts of being the best in the market, would definitely have scalability and flexibility. This implies that the software provides cloud infrastructure to help the business manage the increasing transactional demand as well as the dynamic market conditions.

How effective right? It practically scales as you grow your business. This adaptability ensures that the software can support expansion and evolving market demands.

Agent networks

Advanced money transfer software comes with a vast network of agents. That's how they are able to tap into the markets that were impenetrable before - rural, underserved, unbanked, the agent network covers all.

Moreover, a well-integrated agent network enhances the reach and accessibility of international money transfer services. It allows your customers to conduct transactions through various physical locations and agents.

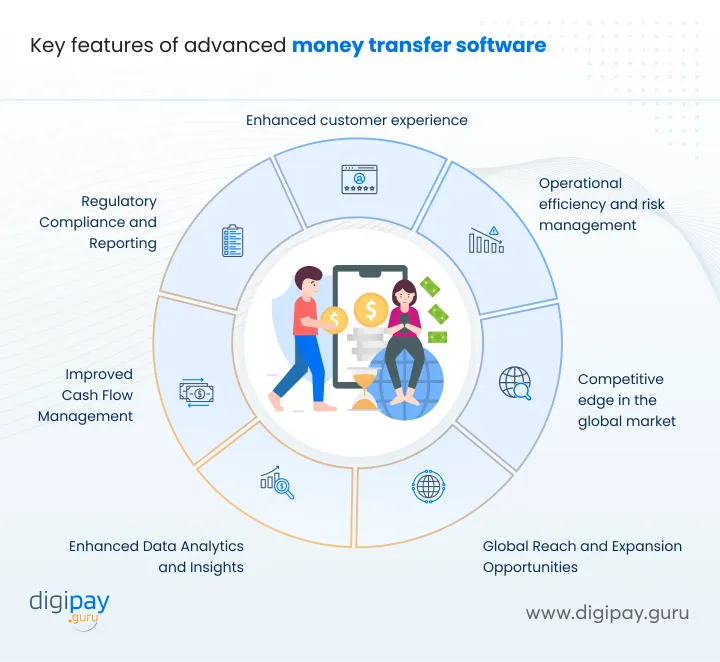

Benefits of implementing money transfer software for remittance businesses

Apart from the above-mentioned amazing features, there are numerous benefits of implementing an advanced global remittance transfer software into your remittance business. They are:

Enhanced customer experience

The use of cutting-edge money transfer software enhances customer satisfaction by providing quicker, more dependable, and more convenient services. The higher level of satisfaction is a result of enhanced support and Interface.

Operational efficiency and risk management

Operational efficiency is increased and manual errors are decreased through automation and streamlined operations. Risks associated with fraud and compliance are reduced by advanced risk management tools.

Competitive edge in the global market

Using cutting edge software gives you a competitive edge by providing superior services than you could with more conventional approaches. Staying ahead of technological trends ensures a strong market position.

Global reach and expansion opportunities

Cutting-edge remittance software facilitates market expansion and allows for global reach. For businesses looking to expand globally, this capability is essential.

Enhanced data analytics and insights

Advanced analytics solutions offer valuable insight into customer behavior and transaction trends. This data helps in informed decision-making and service optimization.

Improved cash flow management

Efficient money transfer remittance software solution facilitates improved cash flow management through accurate transaction processing and real-time tracking. This feature helps in effective money management and liquidity management.

Regulatory compliance and reporting

Ensuring compliance with regulations and facilitating accurate reporting are made easier with comprehensive compliance features. This feature guarantees efficient operations and lowers the risk of penalties.

How to choose the right money transfer software for your business

Selecting the right money transfer software is crucial for optimizing your remittance operations. Here’s a concise guide to help you make the best choice:

Assessing your needs and objectives

Define your goals

Clarify your business objectives. Are you aiming to expand into new markets, increase transaction volumes, or enhance customer experience? Align the software features with these goals.

Evaluate transaction volume

Consider the volume and types of transactions you handle. Ensure the software can manage your transaction load efficiently and supports the types of transfers you need.

Geographic reach

Check if the software supports multiple currencies and regions. It should facilitate seamless transactions across the geographical areas where you operate or plan to expand.

Required features

List essential features such as real-time payments, multi-currency support, fraud detection, and compliance tools. Prioritize those that address your specific needs.

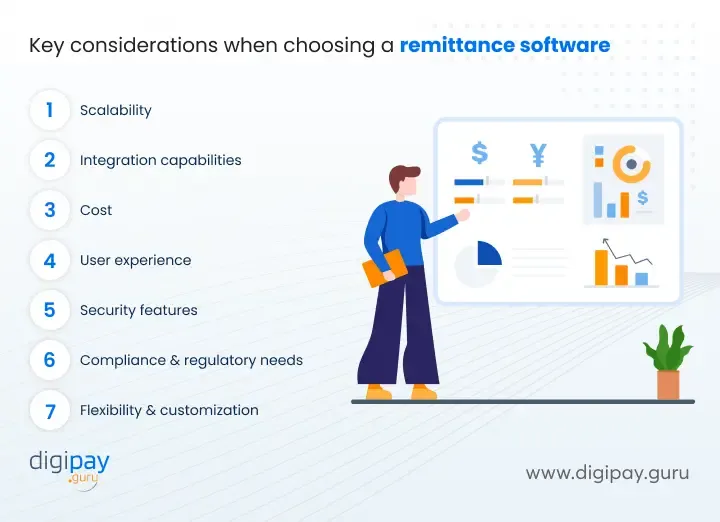

Key considerations in software selection

The major factors to consider when choosing a software for your business are:

Scalability

Choose software that can grow with your business. It should handle increased transaction volumes and adapt to evolving market demands.

Integration capabilities

Ensure that the remittance software should have easy integration capability. This means that the software should easily integrate with your existing systems to avoid operational disruptions.

Cost

Consider the cost of licensing as well as the costs associated with hardware and software maintenance and support. This way you can compare various choices to see which one can offer the best value for money.

User experience

Choose the software that will be easy for customers with no IT background to navigate as well as for employees. User experience contributes to operational effectiveness and improved customer satisfaction.

Security features

Look for robust security measures like encryption, multi-factor authentication, and fraud detection to protect against cyber threats and ensure compliance.

Compliance and regulatory requirements

Verify that the software meets regulatory standards for the regions you operate in, including AML and KYC requirements. It should support accurate reporting and compliance management.

Vendor reputation and support

Choose a reputable vendor with positive reviews and a strong track record. Assess the level of support offered, including training and technical assistance.

Flexibility and customization

Opt for software that offers customization options to tailor its features to your specific needs, ensuring it fits your unique business requirements.

Integration and Implementation

Plan integration

Develop a comprehensive plan for integrating the new software, including data migration and system integration. Work with the vendor to ensure a smooth transition.

Provide training

Ensure your team receives thorough training on the new software to maximize its benefits and address any issues effectively.

Monitor performance

After implementation, regularly monitor the software’s performance and gather user feedback to make necessary adjustments and optimize operations.

By carefully evaluating these factors, you can choose the right money transfer software to enhance your remittance services and support your business growth.

How DigiPay.Guru can help?

DigiPay.Guru offers a robust international money transfer software solution tailored for remittance businesses like yours. We enable you to offer faster, affordable, interoperable, and transparent cross border remittances to your customers with our end-to-end international remittance solution.

Our solution provides:

- Real-time transactions for swift and efficient transfers

- Multi-currency support to facilitate global transactions seamlessly

- Robust security features including encryption and fraud detection

- Scalability to grow with your business needs

- Compliance management to meet regulatory requirements

Partner with us to leverage our expertise and enhance your global money remittance services.

Conclusion

Leveraging advanced money transfer software can transform your business effectively with its advanced features like real-time process, cost-effectiveness, security, scalability, and more. Plus, it offers numerous benefits that can make you a business leader. And helps you keep your customers happy & peaceful so that you attract more customers and your existing customers keep coming back to you.

By choosing the right remittance software, you can easily enhance your business operations, boost profitability, and stay ahead of the competition. With DigiPay.Guru’s advanced cross-border payment solution you can offer your customers everything they need to be able to make fast, secure, and cost-efficient remittances across borders.