Nearly 60% of the global population had access to mobile banking services!

YES! You heard that right. This shift is transforming the banking landscape and is making mobile banking an essential offering for banks. If your bank lacks a robust mobile banking platform, you're at risk of losing customers to tech-driven competitors.

Modern customers want instant access, seamless transactions, and top-tier security. They don’t want to visit the bank branch or stand in long queues. They want to access it all sitting at home with just a few taps.

How do you keep up with these changing customer demands? Strong mobile banking solutions are the answer!

A strong mobile banking solution helps you meet these demands while driving revenue growth and customer loyalty.

But what exactly is mobile banking, how does it work, and what challenges should you consider? Let’s break it all down in this blog.

What Is a Mobile Banking Platform?

A mobile banking platform is an app that allows banks to offer mobile banking services. It enables users to manage their bank accounts, deposit checks, pay bills, and transfer money via a mobile banking application or online banking portal.

A well-built mobile banking system ensures secure, real-time access to banking services. It integrates with core banking systems. This allows banks to efficiently manage account activity, security features, and customer transactions.

What Are Mobile Banking Solutions?

Mobile banking solutions include apps, APIs, web-based banking, and SMS banking. They allow financial institutions to provide digital banking services to customers.

A good mobile banking solution should be scalable, secure, and user-friendly. It should support real-time transactions, offer multi-factor authentication, and allow customers to manage their accounts seamlessly.

History of Mobile Banking

The history of mobile banking dates back to the late 1990s and early 2000s, when the internet was still gaining traction. Initially, it was called SMS banking, as transactions and account updates were primarily conducted through text messages.

Timeline of Mobile Banking Evolution

1999-2000 —The first SMS-based banking services were introduced. This allowed users to check balances and receive transaction alerts.

Early 2000s —Large banks like Wells Fargo and Wachovia pioneered mobile web banking. This enabled customers to access accounts via websites.

2010 —The rise of smartphones and mobile applications revolutionized banking with app-based services. This improved convenience and transactional capabilities.

2015-Present —Advancements like real-time payments, biometric authentication, and AI-powered financial insights reshaped the mobile banking landscape.

Even today, many banks continue to leverage both mobile apps and SMS banking to notify users about account activities, potential frauds, and security updates.

How Does Mobile Banking Work?

A mobile banking app connects to the bank’s core system and provides secure and real-time access to financial services.

Customers can:

-

Log in to their account securely using multi-factor authentication/biometric verification

-

Check their account balance and track account activity in real time

-

Pay bills directly from the app. They can pay instantly or schedule recurring payments

-

Deposit checks through mobile check deposit

-

Send money or transfer funds between accounts

-

Manage debit and credit cards, set spending limits, and track expenses in-app

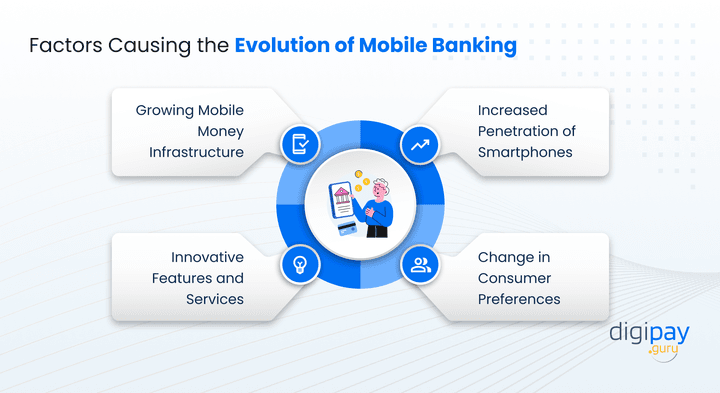

Factors causing the evolution of mobile banking

As discussed earlier, mobile banking had already become a reality in the late 90s. But after that, it saw rapid evolution and adoption due to the combination of the factors mentioned below:

Increased Penetration of Smartphones

Over 80% of banking customers use smartphones for financial transactions.

With digitalization, the use of smartphones is no longer limited to making calls. Today, we use smartphones for texting each other, sending emails, using social media, browsing the web, and performing numerous activities like banking.

So a mobile-first approach is now a necessity!

Change in Consumer Preferences

Customers demand instant and seamless banking experiences. They expect fast transactions, easy onboarding, and secure mobile banking services that fit their digital lifestyles.

Digital banking platform has increased the banking convenience for users by a manifold as they can access banking services at any time and anywhere. This top-notch convenience has made users choose mobile banking over ATMs and physically going to the bank’s branch.

Growing Mobile Money Infrastructure

With supportive regulations, fintech collaborations, and cloud banking innovations, mobile banking is growing fast—making financial services more inclusive and accessible than ever

Innovative Features and Services

Banks now offer AI-driven chatbots, voice banking, and real-time financial insights. These innovations enhance customer engagement, providing personalized and efficient banking experiences.

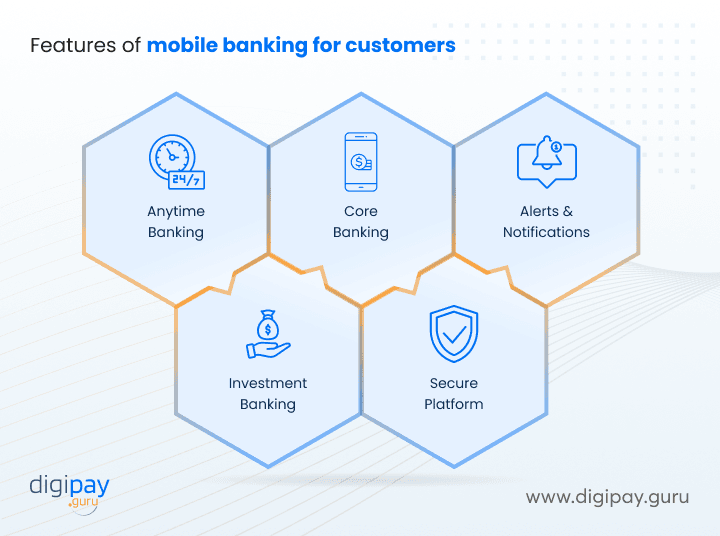

What Features Do Mobile Banking Solutions Offer Customers?

Customers expect more than just basic banking from their mobile apps. The right features can enhance their experience while increasing engagement and retention. Here’s what a modern mobile banking solution offers:

Anytime Banking

Customers can access their accounts 24/7 from anywhere. They can make transactions, check balances, and manage their finances at their convenience from their home. This eliminates the need for branch visits.

Whether at home or on the go, banking is now just a tap away.

Core Banking Integration

A seamless connection with the bank’s core system ensures real-time updates. This allows users to view transactions, transfer funds, and access financial products effortlessly.

What it means: No integration delays. Enhanced user experience. Improved banking efficiency.

Alerts & Notifications

Automated alerts and notifications keep customers informed about account activity, low balances, bill due dates, and potential fraud. This ensures they stay updated without needing to check their accounts constantly.

Investment Banking Access

With mobile banking solutions, users can track and manage their stocks, mutual funds, and retirement plans directly from their mobile banking app.

This allows them to monitor performance and make informed decisions. Plus, this gives them greater control over their investments—all from a single platform.

Secure Platform

Mobile banking apps ensure transactions and sensitive financial data remain protected against cyber threats with:

-

Biometric authentication

-

AI-driven fraud detection, and

-

Advanced end-to-end encryption protocols

Result? You get an extra secure banking experience!

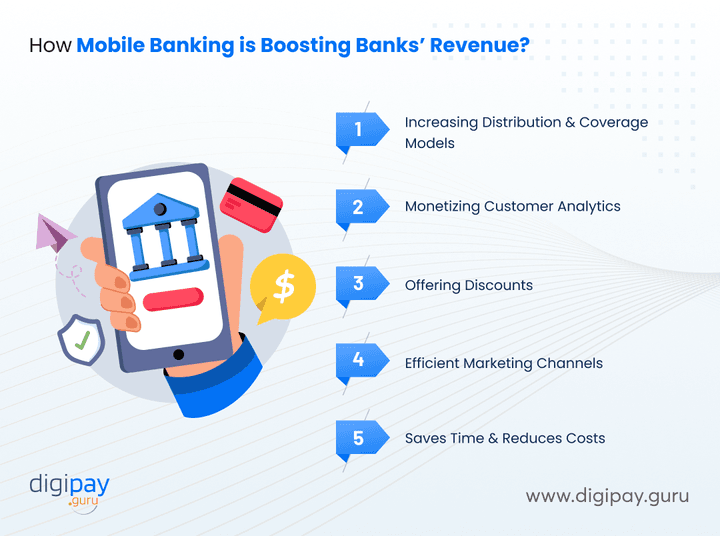

How Mobile Banking is Boosting Banks’ Revenue?

Mobile banking has unlocked several revenue-generating opportunities for banks. Moreover, it also enables them to reduce their overall costs and increase their user base.

Let’s have a look at these benefits of mobile banking solutions one by one.

Increasing Distribution and Coverage Models

With mobile banking in place, banks are no longer restricted to geographical constraints. Banks can leverage mobile banking to increase their geographical footprints by up-selling and cross-selling products to their existing customers.

This has increased customer acquisition and engagement. Plus, banks that have implemented mobile banking in their system have experienced a profound impact on the nature of the bank-customer relationship.

Monetizing Customer Analytics

With mobile banking, you gain access to vast amounts of customer data that can be leveraged to drive revenue. Understanding user behavior helps you in offering personalized services and targeted financial products.

This is because the analytics feature of the mobile banking solution allows you to:

-

Identify spending patterns for cross-selling opportunities

-

Help tailor loan and credit offers

-

Enhance fraud detection and risk management, and

-

Improve customer segmentation for better marketing strategies

Offering Discounts

By collaborating with merchants, your bank can offer exclusive discounts and cashback rewards. For example: 10% off on grocery purchases or extra cashback on fuel payments. These discount offers:

-

Encourages frequent transactions through mobile banking

-

Strengthens partnerships with retail and e-commerce businesses

-

Boosts customer loyalty and app usage

-

Generates additional revenue through merchant commissions

Read More: How to cash in with customer loyalty programs on your mobile wallets

Efficient Marketing Channel For Targeted Campaigns

Mobile banking can be used as an alternative yet effective marketing channel.

Your bank can inform customers about your new offerings, like insurance packages, new types of savings accounts, and cashback directly from the mobile banking apps. You can also use push notifications to inform users about your new products and offers.

You can also use mobile banking to conduct highly targeted marketing campaigns for your users. For instance, you can simply pinpoint the physical location of shoppers for your customers along with relevant offers.

Moreover, you can use a mobile banking interface as a real-time engine to compile campaigns as per customers’ shopping preferences.

Saves Time

Implementation of mobile banking helps your bank to save a lot of time. It’s because people can manage their accounts directly on mobile banking apps.

This decreases the number of users coming to the bank branches, thus helping the bank employees to assist those people who need more personal attention.

With fewer customers visiting the bank branch, you can improve your overall workflow and offer a better customer experience.

Reduces Costs

Mobile banking helps you to reduce your operational costs. With mobile banking, your bank gets an opportunity to go paperless, thus eliminating the cost of printing.

Also, banks can utilize the mobile banking platform for advertising their products and services, thus saving their advertising costs.

Moreover, mobile banking solutions help banks cut costs by minimizing the need for physical infrastructure and manual processing.

Major Challenges in Mobile Banking

While mobile banking offers numerous advantages, banks face several challenges in implementing and scaling their solutions. Here are some key challenges to consider:

Unawareness and Scepticism

Many customers, especially in developing regions, hesitate to adopt mobile banking due to security concerns and a lack of awareness.

Your bank must actively educate users on the security and benefits of mobile banking while ensuring a smooth onboarding process.

Platform Scalability

As mobile banking adoption grows, platforms must handle increasing transactions without compromising speed or security. But this can be a big concern, as not all solutions can support it.

So, investing in cloud-based infrastructure and optimizing app performance is essential to sustain long-term scalability.

Complex Integration

Integrating mobile banking solutions with existing banking systems can be challenging and complex at the same time.

You need to leverage a robust API-driven mobile banking solution and collaborate with fintech partners to streamline integration while ensuring compliance with security standards.

Partnership Model

Many banks depend on third-party providers for mobile banking solutions, which can create challenges in service management.

So, establishing clear agreements, choosing reliable partners, and maintaining strong oversight are crucial for success.

Conclusion

Mobile banking has been evolving behind the scenes for nearly two decades. Now, it stands on the brink of a major transformation. The rapid growth of the telecommunications industry has paved the way for mobile banking to redefine the banking experience forever.

However, banks must first overcome key challenges before unlocking the full potential of mobile banking. Partnering with a trusted mobile banking solution provider is the way forward. This will help you build a next-generation solution equipped with the latest features and technologies.

DigiPay.Guru empowers banks and financial institutions with cutting-edge FinTech solutions that shape the leaders of tomorrow. If you're looking to transform your banking operations with an advanced mobile banking solution, DigiPay.Guru is your ideal partner.

Ready to partner with us and see your bank soar?

Mobile banking refers to the use of a mobile app or web-based platform that allows customers to access banking services from their smartphones or tablets. It enables users to check account balances, transfer money, pay bills, deposit checks, and manage finances anytime, anywhere—without visiting a bank branch.

Banks and financial institutions like you use mobile banking solutions to enhance customer convenience, improve security, and stay competitive in the digital era.

A mobile banking app serves as a digital gateway to financial services, which offers secure, real-time access to banking operations. With a mobile banking app, customers can:

- Send and receive money instantly.

- Pay bills and recharge mobile phones without hassle.

- Monitor account activity and manage expenses efficiently.

- Apply for loans, open new accounts, or block lost cards in a few taps.

- Receive fraud alerts and security updates for safe banking.

Yes, mobile banking apps are highly secure when used correctly. Banks implement advanced security measures like multi-factor authentication, biometric logins, end-to-end encryption, and AI-driven fraud detection to safeguard user data.

To ensure safety while using mobile banking apps:

- Download apps only from official sources (Google Play Store/App Store).

- Enable biometric authentication for an extra layer of security.

- Avoid using public Wi-Fi for financial transactions.

Many customers hesitate to adopt mobile banking due to a lack of awareness or security concerns. Banks can boost adoption by:

- Offering user-friendly onboarding with guided app tours

- Educating customers on security measures and benefits

- Providing multilingual support for diverse customer bases

- Integrating AI-powered chatbots for instant assistance

Mobile banking platforms increase revenue opportunities through:

- Cross-selling and upselling of financial products

- Transaction-based fees for fund transfers, bill payments, and remittances

- Loyalty programs that boost engagement and retention

- Data-driven insights that enable targeted financial offers