The digital payment landscape is evolving rapidly. This has increased the demand for digital wallets significantly. The transaction value of digital wallets is expected to reach $17tn in 2029! And this stat proves this.

This brings a huge opportunity for a business like yours to launch a digital wallet for your business. This will skyrocket your business, and you will generate revenues by 10X!

So, now if you are thinking of launching your own digital wallet, then you are also likely exploring how you can integrate digital wallet services into your business.

But the question is, "How can I set up a digital wallet for my business? The good news is that setting up a digital wallet isn’t as hard as it seems, especially when you use a ready-made solution.

In this blog, you will explore what a digital wallet is, why your business needs one, and how to easily implement it with the right tools.

Let’s begin!

What is a digital wallet?

A digital wallet is a software application that enables your customers to make online payments. It is a wallet that does not store customer funds. But it stores your customers’ payment information in a secure and encrypted way. This enables them to make payments online or in person with just a few clicks on their phone.

A digital wallet app comes with a wide range of payment options, such as:

-

Credit and debit card details

-

Bank account information

-

Cryptocurrency wallets

-

Loyalty cards

-

Gift cards and vouchers

The beauty of the best digital wallet app is the convenience and versatility it offers. Your customers can use this app to make payments for goods and services, transfer funds, and even earn rewards.

How digital wallet works?

The functioning of a digital wallet is as simple as making your bed. Here’s how it generally works:

-

Storing payment information: First, the user downloads the app and stores his payment details in the wallet. This information is encrypted and includes details like card details and bank account numbers.

-

Tokenization: The card details are then converted into tokens in the wallet via a process called tokenization. This means that your sensitive information becomes a unique and encrypted token, which adds an extra layer of security.

-

Authentication: Before the payments go through, the users need to authenticate their identity. This is done through biometric authentication like fingerprint or facial recognition or via PIN.

-

Transaction approval: Once the authentication process is complete, the wallet shares data ahead to the payment processor or merchant system to authorize the transaction. The payment then gets processed, and users receive a confirmation notification.

The entire process takes only a few seconds which makes digital wallets one of the most efficient digital payment methods available.

Why should your business offer a digital wallet?

If you’re still on the fence about offering a digital wallet, here are a few solid reasons why it’s a no-brainer:

Customer expectations: Today, customers expect convenience. If your business doesn’t offer fast & easy digital payment services, you could be losing out on potential revenue. Think about it: Would you rather fumble with cash and cards or just tap your phone?

Customer retention: Many digital wallets are designed to integrate with loyalty programs which allows you to offer rewards to repeat customers. A little incentive in the form of loyalty points can go a long way in keeping customers coming back.

Cost efficiency: Traditional payment methods can come with hefty transaction fees. With digital wallets, particularly those integrated into mobile platforms, you can cut down on processing costs while offering a seamless customer experience.

Business growth: Digital wallets allow you to expand your reach. Whether it’s through mobile payments or digital wallet payment options for eCommerce, a digital wallet gives your business flexibility and scalability.

All in all, offering a digital payment system via a digital wallet is a win-win for your business and your customers.

Are digital wallets safe?

When it comes to digital payment solutions, security is one of the top concerns for both your business and customers. The idea of storing sensitive financial information on a mobile app might be a concern, but the truth is that digital wallets are highly secure.

Here’s why:

Encryption and tokenization: As mentioned earlier, tokenization ensures that actual payment data is never shared with merchants or payment processors. Encryption secures the data both at rest (when stored) and in transit (during a transaction). This prevents unauthorized access.

Multi-factor authentication (MFA): Many digital wallet apps require multi-factor authentication, such as biometric verification (fingerprint or face ID) in addition to a password or PIN. This adds a robust layer of protection against unauthorized access.

Zero liability protection: Most digital wallet software providers offer zero liability protection for unauthorized transactions. This means that if a customer’s wallet is compromised, they won’t be held responsible for any fraudulent activity.

Compliance with financial regulations: Leading digital wallet companies are required to comply with financial regulations like PCI DSS (Payment Card Industry Data Security Standard) and KYC (Know Your Customer) to prevent fraud and money laundering.

In short, digital wallets are as safe—if not safer—than traditional physical wallets.

How to set up a secure digital wallet for your business

Setting up a digital wallet may seem complex at first, but with the right approach, it’s a simple process.

Here’s a step-by-step guide to help you get started.

Choose a reliable digital wallet provider

The first step in setting up a digital wallet is to choose the right provider. Not all digital wallet companies are the same, and selecting a reliable provider like DigiPay.Guru can save you a lot of headaches. A good provider will offer:

-

Easy integration with your existing systems

-

Customizable solutions for your business model

-

High security and compliance with regulations

-

Support for multiple digital payment methods, such as NFC, QR codes, and online payments

When choosing a provider, ensure they can scale with your business and handle future expansions. The last thing you want is to have to switch providers mid-growth because your current system can't handle the load.

Decide on the type of digital wallet

There are several types of digital wallets, and the type you choose will depend on your business needs. The three main types are:

-

Closed wallets: These are specific to your business and can only be used for transactions within your ecosystem. For instance, Starbucks uses a closed wallet for its loyalty program and payments.

-

Semi-closed wallets: These wallets can be used at specific partner merchants. They offer more flexibility but are still somewhat restricted.

-

Open wallets: These wallets are linked to a user’s bank account and can be used for any kind of transaction, including transfers and withdrawals.

Deciding on the right type of wallet involves considering your customer base and what they’re likely to use. If you're looking to offer a broader range of digital payment options, an open wallet may be the best choice.

Read more :- Core strategies to build effective digital wallet solution

Integrate the wallet with your payment system

Once you’ve selected a provider and chosen the type of wallet, it’s time to integrate it with your existing payment system. This is where a lot of businesses hesitate, fearing complex integration processes. But with a ready-made solution like DigiPay.Guru, the integration is seamless.

Here are some things to keep in mind:

-

API integration: Your wallet provider should offer an API that allows your existing systems to “talk” to the digital wallet. This ensures a smooth transaction process for your customers.

-

POS integration: If you have physical locations, ensure that your digital wallet is compatible with your point-of-sale (POS) systems. Many digital wallet examples show success in stores where your customers can simply tap their phones to make payments.

-

Multiple payment options: Your wallet should support all major digital payment platforms and digital payment methods. This includes mobile payments, online payments, and even cryptocurrency if needed.

The easier it is for your customers to use your digital wallet, the more likely they are to adopt it.

Focus on user experience

When it comes to setting up a digital wallet online, user experience (UX) is everything. Even the best digital wallet app will fall flat if the interface is difficult to use. Make sure your wallet offers:

-

A simple interface: Your customers should be able to navigate your wallet app intuitively. If it takes more than a minute to figure out how to add a payment method or make a transaction, you’re in trouble.

-

Fast transactions: No one likes waiting around for payments to process. The faster your digital wallet operates, the happier your customers will be.

-

Seamless integration: Whether your customers are making payments online or in-store, the experience should feel the same. Aim for a wallet that offers a unified experience across all platforms.

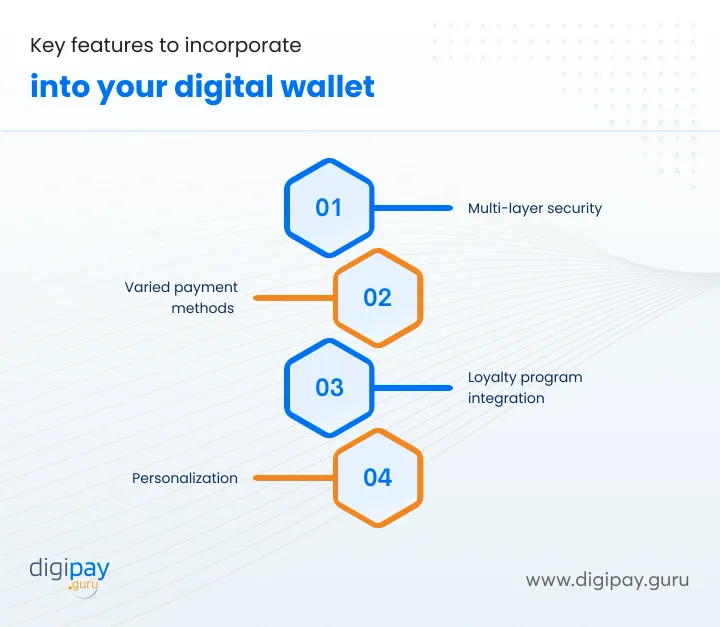

Key features to incorporate into your digital wallet

To ensure your digital wallet is a hit with users and provides the best experience, there are some key features you must include:

Multi-layer security: Your customers need to trust that their money is safe. Make sure your wallet includes multi-factor authentication, encryption, and regular security updates.

Wide range of payment methods: The more digital payment options you offer, the better. This includes mobile, online, and even in-person payments.

Loyalty program integration: Offering rewards through your digital wallet can keep customers engaged and coming back for more.

Personalization: A great digital wallet tailors the experience to the individual users offering them payment options and services based on their habits.

These features enhance customer satisfaction and improve engagement with your digital payment services.

Why DigiPay.Guru is your best bet for a digital wallet solution?

At DigiPay.Guru, we understand that setting up a digital wallet should be simple, secure, and scalable. Our digital wallet solution is designed to meet the needs of your business by offering everything from basic online wallet apps to advanced digital payment processing platforms.

We make it easy for you to integrate a digital wallet into your existing systems while ensuring that your customers enjoy a smooth and secure payment experience.

The key features of our digital wallet solution include:

-

P2P & P2M payments

-

Utility bills & airtime top-up

-

Referrals and rewards

-

Advanced security

-

Varied modes of payments

-

Bulk payments and schedule payments

-

Flexible fee structure and access controls

-

Vast agent network

Conclusion

In the world of digital payment solutions, setting up a digital wallet isn’t as complex as it might seem. With the right provider and a clear strategy, you can offer your customers a solution that’s fast, secure, and easy to use.

For businesses like yours, there’s never been a better time to integrate a digital wallet solution like DigiPay.Guru into your business. It offers you everything needed to offer the best digital wallet services to your customers. From security, speed, and reliability, to API efficiency.

The future of payments is here. Are you ready to take the plunge?

FAQ's

- Security: Ensure they offer top-tier encryption, tokenization, and compliance with regulations like PCI DSS.

- Integration: The provider should easily integrate with your existing systems via APIs.

- Customization: Look for flexible solutions that fit your business model.

- Support: Reliable customer service and tech support are essential for smooth operations.

- Scalability: Choose a provider that can grow with your business.

Yes, you can have multiple digital wallets. Users often maintain different wallets for specific purposes, like one for personal use and another for business. Each wallet can store a variety of payment methods, and some wallets even allow users to link multiple bank accounts or cards. However, managing multiple wallets means keeping track of different apps, passwords, and payment methods.