Efficiency is at the core of modern financial services. Financial businesses like yours are under constant pressure to reduce costs, comply with regulations, and deliver seamless experiences to customers. Yet many organizations still struggle with outdated systems, siloed integrations, and rising compliance costs.

This is where digital wallet APIs step in. They act as the connecting link between your core banking systems, digital wallet platforms, merchants, and third-party providers. By integrating APIs into your financial ecosystem, you can accelerate product launches, simplify compliance, and scale services with far less overhead.

In this article, you will explore:

- What a digital wallet API is

- Why it matters for financial institutions

- How does it make your services more efficient

- The steps you can take to choose and implement the right solution & more…

Let’s begin with the meaning of digital wallet APIs.

What Is a Digital Wallet API?

Yes, the digital wallet API helps you achieve a financial ecosystem of seamless payment experience. But what does it actually mean?

Here’s the breakdown:

What is an API?

An API (Application Programming Interface) is a set of protocols and tools that allow different apps to talk to each other and conveniently share information or functionalities.

For example:

- You own a finance consultation app and want to have the functionality of a digital wallet for payment in your app.

- So, you will integrate a digital wallet API with data formats like JSON or XML from the best digital wallet provider, like PayPal, into your app.

- Then, your app will interact with the API for payments, which will ultimately eliminate the need to develop your own payment infrastructure.

What is an API-driven digital wallet solution?

Now that you understand the meaning of API, you can easily understand what an API-driven digital wallet solution is!

An API-driven digital wallet solution is a software platform that enables users to store, send, and receive digital money through the integration of Application Programming Interfaces (APIs).

In simple terms, API-driven digital wallet software is a solution that lets your mobile wallet app connect and communicate with other third-party apps and services via digital wallet APIs.

In the coming sections, you will explore how this digital wallet API solution makes financial services more efficient.

Before that, let’s understand why they matter for financial institutions like yours.

Why APIs Matter for Financial Institutions

APIs are not just technical tools. They are strategic enablers that transform how banks and fintechs like yours operate.

Here’s the reason why it should matter for your business:

- Interoperability: A digital wallet solution API connects core banking, mobile money, fintech apps, and third-party services into a single ecosystem.

- Speed-to-Market: Instead of spending 12 months building a wallet app, APIs allow you to launch in weeks.

- Future-Readiness: If you want to add loyalty points, cross-border payments, or merchant acquiring, an API-driven wallet can be extended without a full rebuild.

In short, APIs turn financial institutions into agile digital wallet companies, ready to adapt to changing customer needs and market trends.

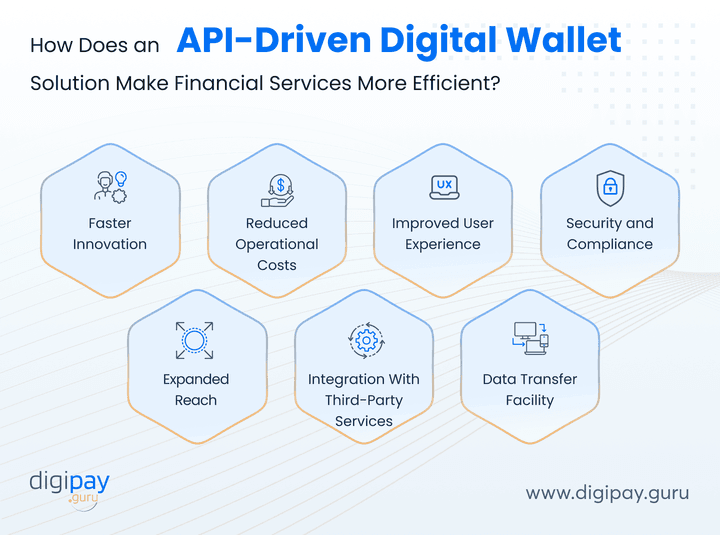

How Does an API-Driven Digital Wallet Solution Make Financial Services More Efficient?

API-driven digital wallets can transform your financial services by making them more efficient and streamlined.

Here’s how an API digital wallet solution does it:

Faster Innovation

API-driven digital wallet solutions facilitate rapid innovation by enabling faster time-to-market for new products and services.

And with a modular architecture and well-defined interfaces, you can quickly integrate new features or functionalities without disrupting your existing systems. For example, integrating a loyalty API into your digital wallet app can take days instead of months.

This openness to innovation empowers you to stay ahead of the curve and continuously enhance your offerings to meet evolving customer demands and market trends.

Reduced Operational Costs

By embracing an API digital wallet solution, you can significantly reduce operational costs associated with traditional banking infrastructure. Here’s how:

- Digital wallet API eliminates the need for complex system integrations, ultimately streamlining processes and minimizing redundant efforts.

- Digital wallet solutions often leverage cloud-based technologies that reduce the overhead costs of maintaining physical infrastructure.

- Plus, with API solutions you can quickly scale up or reduce your infrastructure resources based on demand. This helps you avoid the costs associated with over-provisioning or under-utilization of resources.

Improved User Experience

An API-driven digital wallet platform can improve the user experience for your customers so that they can trust you, stay happy and satisfied. It's possible because it offers:

Seamless payments

- Process transactions instantly

- Remove delays and

- Improve convenience

Plus, your customers can make payments anytime and anywhere. This ensures a frictionless and efficient experience for them.

Personalized Services

By leveraging customer data and transaction history, API-driven solutions can help you offer personalized services tailored to your customers’ individual preferences and financial needs.

Financial Management Tools

The financial management tools in the API-based digital wallet solutions empower customers to:

- Track spending

- Set budgets, and

- Gain insights into their financial habits

Additionally, with seamless digital wallet system API integrations, you can access various data sources. This gives you a comprehensive view of your customers’ financial patterns to innovate effectively.

Security and Compliance

API-driven digital wallet payment apps prioritize security and compliance by leveraging security measures like:

- Robust authentication mechanisms - biometrics, 2FA, 3DS & more

- Encryption protocols - data encryption & tokenization

- Adherence to industry standards - KYC, AML, GDPR & PCI SSF

Additionally, you can leverage APIs to streamline compliance processes, automate reporting, and enable seamless integration with regulatory bodies.

Expanded Reach

API integrations allow digital wallet solutions to seamlessly connect with a vast ecosystem of partners, merchants, and service providers.

This expanded reach enables your customers to perform numerous transactions and access diverse services through a single unified platform.

Furthermore, APIs’ cross-platform compatibility makes digital wallets accessible across multiple devices and operating systems. This enhances convenience and adoption even more.

Integration with Third-Party Services

API-driven digital wallet solutions thrive on seamless integration with third-party services, such as:

| Payment gateways | To facilitate secure online transactions |

| Loyalty programs | To reward and incentivize customer engagement |

| Banking services | To enable account linking and fund transfers |

| Identity verification services | To enhance security and prevent fraud |

| Mobile network operators | To support mobile payments and top-ups |

| Transportation services | To facilitate ticket purchases and transit payments |

| Retail and restaurant POS systems | To enable in-store payments |

| Peer-to-peer payment platforms | To facilitate money transfers between individuals |

| Financial management tools | To provide insights into spending habits & budgeting |

APIs act as the bridge and enable your digital wallet to connect and exchange data with these services. This creates a holistic and enriched experience for your customers.

Data Transfer Facility

APIs enable efficient and secure data transfer between digital wallet solutions and various financial institutions like yours, along with merchants and service providers.

This data transfer facility enables real-time synchronization of transactions, account balances, and other relevant financial information. This ensures accurate and up-to-date data across all connected systems.

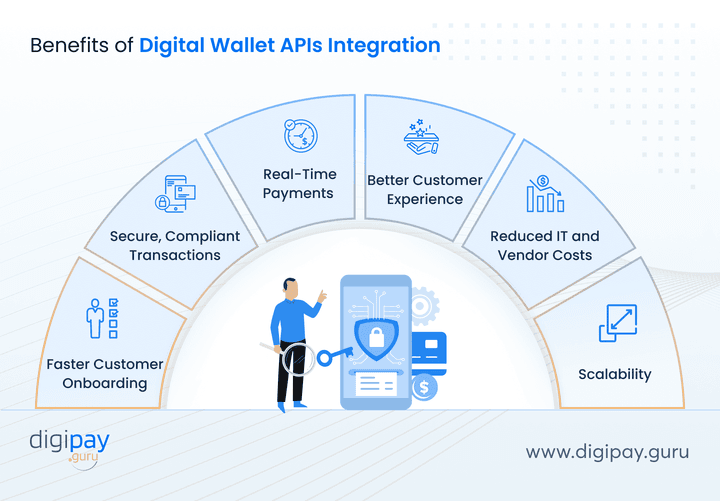

Benefits of Digital Wallet APIs

A digital wallet API does more than connect systems. It removes friction, cuts costs, and helps you deliver services that meet modern customer expectations.

Here’s how it adds measurable value for you:

Faster Customer Onboarding (eKYC, AML automation)

Manual verification slows down growth. But, with eKYC and AML APIs, banks and fintechs like yours can verify identities in minutes instead of days.

Moreover, automated checks reduce errors, save compliance costs, and help you onboard customers faster without sacrificing security.

Secure, Compliant Transactions (Fraud detection, tokenization)

Fraud can be costly for you, both financially and reputationally. To prevent them, digital wallet APIs integrate advanced fraud detection, tokenization, and encryption into every transaction.

This creates a secure payment environment that keeps both regulators and your customers confident in your services.

Real-Time Payments and Better Customer Experience

Delays in transactions can push your customers to competitors. With APIs, transfers, merchant payments, and remittances happen in real time. And these instant payments lead to smoother experiences, improved satisfaction, and higher retention.

Reduced IT and Vendor Costs

Managing multiple vendors and custom integrations is resource-heavy and costly. Hence, a single wallet API suite replaces fragmented systems, thereby lowering IT maintenance costs.

This streamlined approach gives your teams more time to focus on innovation rather than patchwork support.

Scalability: Quick Rollout of New Features or Corridors

Expanding into new markets often requires fresh features and compliance layers based on the market needs.

With APIs, you can scale by simply adding new modules, whether that’s remittance corridors, loyalty programs, or merchant acquiring. As they integrate seamlessly into your existing system, you can grow step by step without rebuilding your infrastructure.

How to Choose the Right Digital Wallet API

Picking the right wallet API shapes how fast you scale, how secure your services are, and how much value you deliver.

Here’s what you should look for:

Security & Compliance: Choose digital wallet solution providers that offer APIs that are PCI-certified, GDPR-compliant, and AML-ready. This keeps your business safe from fraud and aligned with global regulations.

Modularity: Go for a suite that includes wallet, remittance, eKYC, and merchant acquiring. This gives you the flexibility to start small and expand as your needs grow.

Scalability: Make sure the system can handle millions of transactions without downtime. Because scalability ensures you keep serving your customers smoothly as demand rises.

Proven Deployments: Check for real-world success in markets like Africa, Asia, or Latin America, as a proven track record shows the solution works under diverse conditions.

Vendor Expertise & Support: Pick a provider that offers 24/7 technical and compliance support. This is because ongoing guidance ensures you focus on growth while they handle complexities.

Read more - Digital Wallet Setup Guide For Your Business

Practical Steps to API Integration in Your Digital Wallet

Integrating a digital wallet API doesn’t need to be too complex. By following a step-by-step approach, you can reduce risks and ensure a smooth rollout.

Here it is:

Assess Business Goals

Start by defining what you want to achieve. Whether it’s launching a prepaid card wallet, enabling cross-border payments, or building a merchant-focused electronic wallet app.

Evaluate Compatibility

Check if the API aligns with your core banking system and digital payment infrastructure. Seamless compatibility prevents delays and costly rework.

Pilot with One Module

Begin small to test stability and adoption with a pilot on one module. For instance, integrate an eKYC API first before expanding into payments or remittance.

Scale Gradually

Add new modules step by step, such as peer-to-peer payments or remittance APIs, and then the next one. This staged approach keeps costs under control while supporting steady growth.

How DigiPay.Guru Enables API-Driven Wallet Solutions

At DigiPay.Guru, we don’t just provide APIs; we deliver a complete framework for financial institutions to build, scale, and future-proof their digital payment system.

Here’s how we make it possible.

Modular API Suite: You get access to a full suite covering wallets, eKYC, remittance, and merchant acquiring. This modular approach lets you launch quickly and expand as your business grows.

Global Deployments: Our solutions are already powering banks, fintechs, and telcos across Africa, Asia, and the Caribbean. Each deployment adds to our experience in handling diverse regulatory and market conditions.

Compliance-First Architecture: Every API we provide is built with PCI, AML, and KYC compliance in mind. So you can launch new services confidently while meeting global security and regulatory standards.

White-Label Flexibility: We design APIs that adapt to your brand and your market. This is possible with our while-label capabilities for every solution we offer.

Expertise You Can Trust: With years of experience in delivering robust digital wallet solutions, we’re more than a digital wallet technology vendor; we’re your partner in building a scalable and profitable digital payment platform.

Conclusion

Providing efficient financial services is a must for you to stay ahead of the curve and keep your customers coming back to you.

With API-driven digital wallet solutions, your business can achieve this by offering faster innovation, reduced costs, improved experience, security & more.

The good news is: DigiPay.Guru’s advanced digital wallet API solution can help you expand your business reach and maximize revenue without the need to build your digital wallet service from scratch.

Plus, we offer a white label digital wallet solution mobile-money-payment-solutions, which means we make it for you, and you begin quickly offering it as your own with your brand vision and touch.

FAQs

A digital wallet API is a set of tools that connects your wallet application with banks, merchants, and payment processors. It enables features like peer-to-peer transfers, merchant payments, and cross-border remittances without building everything from scratch.

An API wallet is a digital wallet powered by APIs that allow it to communicate with multiple systems. Instead of being a standalone app, it becomes a connected platform that can handle payments, loyalty points, eKYC, and more through seamless integrations.

You should look for strong security and compliance (PCI, AML, GDPR), modularity (wallet, remittance, eKYC in one suite), scalability for high transaction volumes, proven deployments in similar markets, and a vendor who offers 24/7 technical and compliance support.

You can launch a new digital wallet app, enable peer-to-peer transfers, offer cross-border money transfers, integrate loyalty programs, connect merchants for payments, and even onboard customers with automated KYC checks. APIs give you the flexibility to build services around your business goals.

Adding wallet features increases engagement and revenue. Plus, your customers can pay, transfer, or store value within your ecosystem, which improves retention. For you, it also creates opportunities to cross-sell loans, credit, and insurance through the same platform.

Yes, when chosen from the right provider. Secure wallet APIs use tokenization, fraud detection, and encryption to protect every transaction. They also comply with global standards like PCI-SSF and AML regulations, thereby ensuring both customer trust and regulatory safety.

They cut down onboarding time with automated eKYC, reduce costs by eliminating redundant integrations, and enable faster innovation. For your customers, this means real-time payments, better security, and smoother digital experiences.

Yes. Many APIs support wallets designed for unbanked populations. Users can cash in or cash out through agents, telcos, or mobile money providers, which makes financial services accessible even without traditional bank accounts.