The world of payments is evolving rapidly, and virtual prepaid cards are at the forefront of this transformation. As digital-native generations come of age, the demand for frictionless and secure payment methods has skyrocketed. This has led to a rise in virtual card usage, as more and more people opt for digital payment solutions over traditional payment methods.

According to a recent study, the global virtual card market is expected to grow by a CAGR of 19.1% between 2022 and 2028, reaching a value of USD 37.5 billion by 2028. This growth is driven by the increasing adoption of e-commerce and online transactions and the need for secure payment methods in an increasingly digital world.

Virtual prepaid cards offer a unique solution to the challenges posed by traditional payment methods. Unlike traditional credit and debit cards, virtual prepaid cards are not linked to a bank account or a line of credit. Instead, they are prepaid cards that can be used for online transactions, offering a more secure and flexible payment method.

The need for virtual prepaid cards has never been greater, as traditional payment methods struggle to keep pace with the demands of the digital age. With the rise of e-commerce and online transactions, consumers need a payment method that is safe, easy to use, and accessible from anywhere in the world.

In this blog, we'll explore how virtual prepaid cards work, their benefits, and the potential for virtual cards to transform the payments industry for the digital native generation.

How Virtual Prepaid Cards Work

Virtual prepaid cards work in a similar way to traditional credit and debit cards, with a few key differences. Here's how they work:

Create a Virtual Card

The first step in using a virtual prepaid card is to create one. This can typically be done through a mobile app or website. Users will need to provide some basic information, such as their name and billing address.

Load the Card with Funds

Once the virtual card has been created, it will need to be loaded with funds. This can be done using a credit or debit card or through a bank transfer. The amount loaded onto the card will determine how much can be spent.

Use the Virtual Card for Online Transactions

Once the virtual card has been created and loaded with funds, it can be used for online transactions. When making a purchase, users simply enter the virtual card details, just like they would with a traditional credit or debit card.

One-Time Use or Multi-Use

One of the key benefits of virtual prepaid card solution is that they can be used for one-time transactions or multiple transactions.

For example, if a user wants to purchase from a website they don't trust, they have options of two types of prepaid cards: one-time virtual cards for that purchase only or the virtual card for multiple transactions, they can do so.

Manage and Monitor Spending

Virtual prepaid cards offer greater control over spending than traditional credit and debit cards. Users can set spending limits, monitor transactions in real time, and even freeze or cancel the card if needed. This makes virtual prepaid cards a great tool for managing and controlling spending.

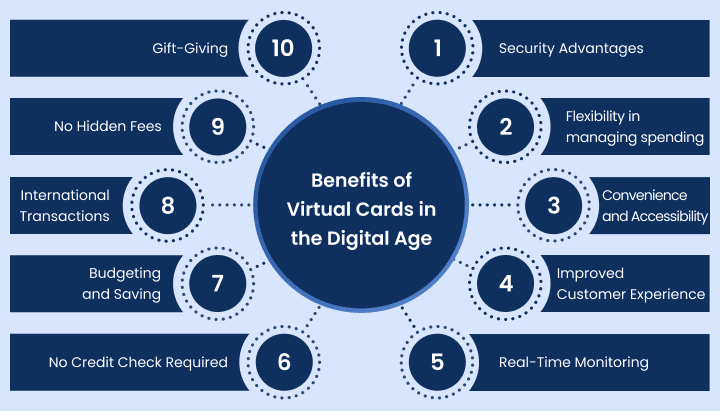

Benefits of Virtual Cards in the Digital Age

In an increasingly digitalized world, the utilization of virtual cards has emerged as a game-changer for individuals and businesses alike. These innovative payment solutions, which exist purely in electronic form, offer a host of benefits that cater to the needs of modern consumers and organizations.

Security Advantages

Virtual prepaid payment cards offer several security advantages over traditional credit and debit cards. Since they are not linked to a bank account or a line of credit, users are protected from potential fraud or identity theft.

Additionally, virtual prepaid cards can be created for one-time use only, minimizing the risk of unauthorized transactions.

The flexibility of Virtual Prepaid Cards for Managing Spending

Virtual prepaid cards provide greater flexibility for managing spending. Users can set spending limits, monitor transactions in real time, and even freeze or cancel the card if needed. This makes virtual prepaid cards a great tool for managing and controlling spending.

Convenience and Accessibility

Virtual prepaid cards are extremely convenient and accessible, making them ideal for digital-native generations. They can be created and loaded with funds quickly and easily and can be used for online transactions from anywhere in the world. This makes virtual prepaid cards a great option for those who frequently travel or shop online.

Improved Customer Experience

Virtual prepaid cards offer an improved customer experience compared to traditional payment methods. With virtual prepaid cards, users can avoid the inconvenience of carrying cash or the potential hassle of dealing with lost or stolen credit or debit cards.

Additionally, virtual prepaid cards offer greater privacy, as users can make purchases without revealing personal information.

Real-Time Monitoring

Virtual prepaid cards allow for real-time monitoring of transactions, providing users with greater transparency and control over their spending. Users can track their transactions as they occur, and receive alerts for any unusual or suspicious activity. This makes it easier to spot potential fraud or unauthorized transactions and take immediate action if needed.

No Credit Check Required

Virtual prepaid cards don't require a credit check, making them a great option for those with poor or no credit history. This can be especially helpful for young adults who are just starting to build their credit.

Budgeting and Saving

Virtual prepaid cards can also be used as a budgeting tool to help users stick to their financial goals. Users can allocate a specific amount of funds to their virtual card each month, and use it exclusively for online purchases. This can help them avoid overspending and stay on track with their budgeting goals.

International Transactions

Virtual prepaid cards can be used for international transactions, making them a convenient option for those who frequently travel or shop from international retailers.

Additionally, virtual prepaid cards often offer competitive exchange rates and low transaction fees, which can save users money compared to traditional payment methods.

No Hidden Fees

Virtual prepaid cards often have no hidden fees or charges, making them a transparent and affordable payment option. Users can easily track their transaction fees and balances, and avoid surprises or unexpected charges.

Gift-Giving

Virtual prepaid cards also make great gifts for family and friends. They can be loaded with a specific amount of funds and sent directly to the recipient, making them a convenient and hassle-free gift option.

Use Cases: Who can use virtual prepaid cards?

Gig Workers

Gig workers, such as freelancers and independent contractors, can benefit from virtual prepaid cards as they often work on short-term projects and need a secure and flexible payment option.

Virtual prepaid cards offer a reliable and easy-to-use payment method that allows gig workers to receive payments quickly and avoid the hassle of traditional payment methods.

Millennials

Millennials, who are digital natives, are also a prime target for virtual prepaid cards. They often prefer cashless payments and are comfortable with online and mobile transactions.

Virtual prepaid cards offer millennials a convenient and secure payment option that aligns with their lifestyle and preferences.

Financial Institutes

By offering virtual prepaid cards, financial institutions can expand their product offerings and attract new customers who are looking for convenient and secure payment options.

Online Retailers

Online retailers can use virtual prepaid cards to offer retail loyalty programs to their customers. With virtual prepaid cards as rewards, retailers can incentivize customer loyalty and increase their sales.

Additionally, virtual prepaid cards can be used for refunds or store credits for customers, making them a versatile payment option for online retailers.

Healthcare

The healthcare industry can use virtual prepaid cards to manage healthcare expenses, such as copayments and deductibles.

Virtual prepaid cards offer a secure and easy-to-use payment method that can help healthcare providers streamline their billing and payment processes.

Education

Virtual prepaid cards can also be used in the education sector to manage student expenses, such as textbooks, supplies, and fees.

By offering virtual prepaid cards to students, educational institutions can simplify their payment processes and provide a convenient payment option for students and their families.

Travel and Hospitality

The travel and hospitality industry can also benefit from virtual prepaid cards as they can be used for hotel bookings, transportation, and other travel expenses.

Virtual prepaid cards offer a secure and flexible payment option that can help travel and hospitality providers attract and retain customers.

Transit Systems

Virtual prepaid cards can also be used for public transit systems, allowing commuters to easily pay for their fares without the need for physical tickets or cash.

By offering virtual prepaid cards as a payment option, transit systems can improve their efficiency and provide a convenient payment method for commuters.

BNPL

One of the best use of virtual cards is the Buy Now, pay later (BNPL) platform. By offering virtual prepaid cards as a payment option, BNPL platforms can provide a secure and flexible payment method that aligns with their business model.

Entertainment

The entertainment industry can also benefit from virtual prepaid cards. Virtual prepaid cards can be used for online streaming services, video games, and other entertainment purchases.

By offering virtual prepaid cards as a payment option, entertainment providers can expand their payment options and provide a convenient payment method for their customers.

What’s next? The future of virtual prepaid cards for digital native generations

As digital payment solutions continue to grow in popularity, the future of virtual prepaid cards looks bright. Digital-native generations are increasingly relying on cashless payments, and virtual prepaid cards offer a convenient, secure, and flexible payment option.

Increased Adoption

As digital natives, who have grown up with technology, become the dominant consumer group, the adoption of virtual prepaid cards is likely to surge. These cards offer convenience, security, and flexibility, making them appealing to this tech-savvy demographic.

Seamless Integration with Digital Wallets

Virtual prepaid cards are expected to integrate seamlessly with popular digital wallets such as Apple Pay, Google Pay, and Samsung Pay. This integration will enable users to load their virtual cards into their preferred digital wallet and make payments at various online and offline merchants with ease.

Enhanced Security Features

As cyber threats continue to evolve, virtual prepaid cards will likely incorporate advanced security features to protect users' financial information. This may include multi-factor authentication, biometric verification (such as fingerprint or facial recognition), and real-time transaction monitoring to detect and prevent fraudulent activities.

Customization and Personalization

Virtual prepaid cards will likely offer more customization options, allowing users to personalize their cards with designs, colors, and even animated features. This personal touch enhances the user experience and creates a sense of ownership.

Peer-to-Peer Payments

Virtual prepaid cards can facilitate peer-to-peer payments between individuals. This feature will enable digital natives to split bills, repay friends, and conduct other person-to-person transactions conveniently through their virtual cards.

Read More: Creating a Robust and Compliant peer-to-peer payment app

Integration with Loyalty Programs

Virtual prepaid cards can be integrated with loyalty programs, allowing users to earn rewards and cashback for their purchases. This integration will provide an added incentive for users to opt for virtual prepaid cards as their preferred payment method.

Blockchain and Cryptocurrency Integration

As cryptocurrencies gain mainstream acceptance, virtual prepaid cards may incorporate blockchain technology to enable the use of digital currencies. This integration would allow users to load their cards with cryptocurrencies and make payments to merchants that accept them.

Experience hassle-free crypto payments with DigiPay's cryptocurrency wallet solution

Enhanced Financial Education

With the rise of virtual cards, financial institutions, and providers may focus on providing comprehensive financial education to the digital native generation. This education can help them understand concepts such as responsible spending, budgeting, and managing digital transactions effectively.

Expanded On-Premise Availability

In the future, virtual prepaid cards are likely to become more widely accepted at physical retail locations. Currently, their usage primarily revolves around online transactions. However, as the demand for digital payments increases, merchants will adapt their point-of-sale systems to accept virtual prepaid cards.

This expanded on-premise availability will enable digital natives to use their virtual cards at a wider range of physical stores, restaurants, and other brick-and-mortar establishments, enhancing convenience and usability.

Broader Use Cases for B2B & B2C

Virtual prepaid cards will find broader applications in both business-to-business (B2B) and business-to-consumer (B2C) contexts. In the B2B space, virtual prepaid cards can be used for employee expense management, supplier payments, and corporate incentives.

They offer a streamlined and efficient way to allocate funds and track expenses. For B2C, virtual prepaid cards can be utilized for gifting, micro-payments, and as a secure payment method for online subscriptions and digital services. This expansion of use cases will cater to the evolving needs of digital natives in various sectors and industries.

Wallet Sharing to Providers

Wallet sharing to providers refers to the integration of virtual prepaid cards into third-party digital wallet platforms, beyond the popular ones like Apple Pay and Google Pay.

In the future, financial service providers may collaborate with digital wallet providers to enable the seamless integration of virtual prepaid cards into their platforms. This integration will allow users to access and manage their virtual cards directly within these provider-specific wallets.

By enabling wallet sharing to providers, users can consolidate their financial accounts and transactions into a single digital platform, simplifying their financial management and providing a seamless user experience.

Read More: Prepaid Cards Vs Digital Wallets: A Perfect Match?

Conclusion

virtual prepaid cards have emerged as a popular and convenient payment option for digital native generations. With numerous benefits of using virtual payment cards, such as increased security, real-time monitoring, and spending controls, it's no wonder that more and more consumers are turning to virtual prepaid cards for their payment needs.

Additionally, as the payments industry continues to evolve, we can expect virtual prepaid cards to play an increasingly important role in shaping the future of payments.

At DigiPay.Guru, we understand the needs of businesses and consumers alike. That's why we've developed an advanced mobile money solution in the form of a virtual prepaid management solution that can help you take your business to the next level. Our solution offers a range of features that can help you streamline your payment processes, improve customer experience, and increase revenue.