The global ewallet market is expected to reach $590 bn by 2032!

With such a rise in the ewallet market, customer demand towards ewallet transactions is increasing. They need the utmost convenience. Hence, the need for varied payment methods like NFC and QR codes has increased among ewallet users.

NFC and QR code payments have become the idol of speed, convenience, and security. This is why every customer needs these payment methods and every business must integrate them into their payment system.

So, it can be said that these payment methods have the power to revolutionize the future of e-wallet transactions. But how? Let’s explore that in this blog.

Why are NFC payments booming?

The one-word answer to this question is “convenience”. NFC payments have made their mark globally for the speed, security & convenience it offers to customers.

With just a tap of their smartphone or contactless card, users can complete transactions in seconds. This frictionless experience improves customer satisfaction and increases transaction volumes for businesses like yours.

Moreover, the COVID-19 pandemic gave a pace to the adoption of contactless payments like NFC. At that time, consumers and merchants wanted touch-free payment options.

As a result, many businesses like yours saw a rise in demand for NFC-enabled payment solutions. This made it an essential feature for any competitive e-wallet service.

The rise of QR code payments

The global market for QR code payments is expected to reach nearly $4.8 bn by 2028.

QR code payments have been in the market for two decades now, but they gained a major rise due to the pandemic COVID-19. This was because of the touchless, fast, and secure payments it offered across the world. All that users had to do was scan a code and make payment through their mobile device.

Unlike NFC mobile payments, which require specific hardware, QR codes can be generated and scanned by almost any smartphone. This makes them accessible to a wider range of users and merchants.

Moreover, QR code payment has become omnipresent in countries like China and India. From street vendors to large retail purchases, users use it for almost everything. This has enabled rapid financial inclusion and digitization of payments in areas where traditional banking infrastructure is limited.

Looks like the usage of QR code payments will only increase!

Key features of NFC and QR code payments

Now that you know how NFC and QR code payments rose in popularity. Let’s explore the key features of these payment modes that make them a popular choice for ewallet services:

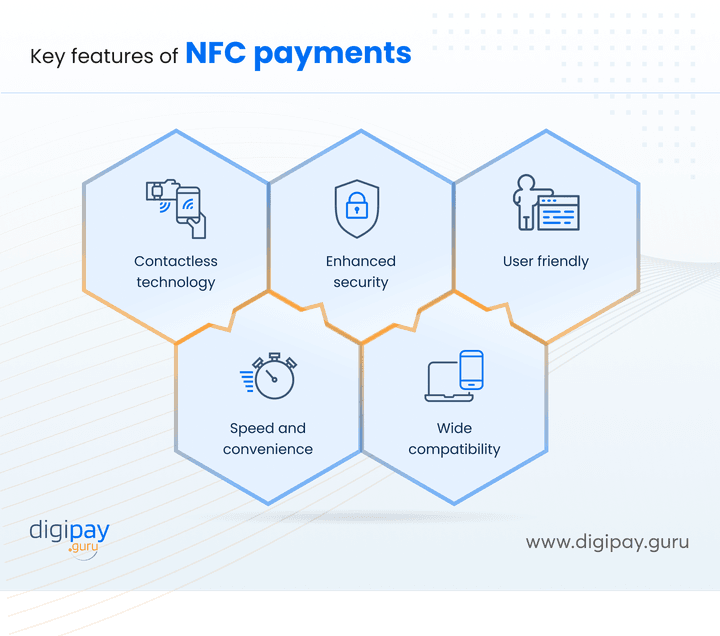

NFC payments

The key features of NFC payments include:

Contactless technology

The one specialty of NFC is payments which has become popular since the beginning is contactless technology. With this technology, users can make payments in close proximity without coming in contact with human touch.

The NFC and contactless payments speed up transactions and add an extra layer of security by eliminating physical contact at payment terminals.

Fast and seamless

The best thing about contactless technology in NFC payment is that it makes transactions fast and seamless. Users can complete a transaction in a few seconds or almost instantaneously, faster than chip-and-PIN or magnetic stripe methods.

This level of speed improves the customer experience and reduces long wait times and queues at busy points of sale.

Enhanced security

- NFC payments employ advanced encryption and tokenization techniques which makes them highly secure.

- Each transaction uses a unique, one-time code which reduces the risk of fraud and data breaches.

This enhanced security can help build trust with your customers and mitigate potential losses for your business.

Wide compatibility

Most modern smartphones and many payment cards now come equipped with NFC technology. This makes it widely compatible with most payment places.

This wide compatibility means that by offering NFC payments, you're catering to a large and growing user base which will potentially increase your market share.

User friendly

The simplicity of tapping to pay makes NFC incredibly user-friendly, even for those who might be less tech-savvy. This ease of use can help drive adoption rates and increase customer satisfaction with your e wallet payment system.

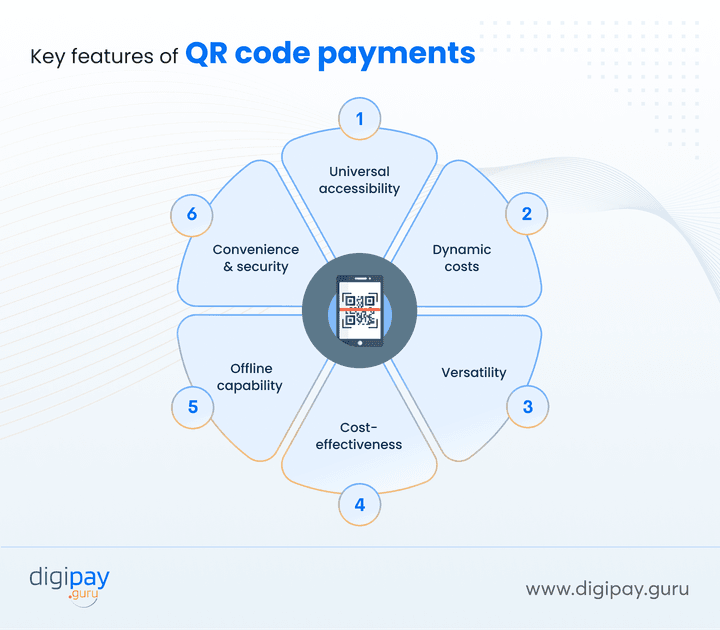

QR code payments

The major features that make QR code payments popular include:

Universal accessibility

One of the biggest advantages of QR code payments is their accessibility.

QR code payments are universal today. It can used to pay for things in many different places, such as;

- At a retail store

- Meal at a restaurant, or

- Even buying something online

Plus, the best thing is that any smartphone with a camera can scan a QR code. This makes QR code payments accessible to a wide range of users without the need for specialized hardware.

Dynamic costs

The cost of processing QR code payments can change based on various factors:

Type of QR codes: QR codes can be static (printed) or dynamic (generated for each transaction).

Transaction amount: The fee might be a “%” of the payment amount.

Geographic location: Fees can vary depending on the country or region.

Payment network: Different payment networks or providers may have different fee structures.

So, QR code payments give flexibility for various implementation options to suit different business needs and budgets.

Versatility

QR codes can be used for more than just payments.

They can also store additional information like;

- Loyalty points

- Receipts, or

- Promotional offers

This provides opportunities for value-added services within your e-wallet ecosystem.

Cost-effective

Implementing QR code payments is generally less expensive than NFC, as it doesn't require specialized hardware.

This makes it an attractive option for smaller businesses and emerging markets to expand customer base.

Offline capability

Some QR code payment systems can work offline. This makes them suitable for areas with unreliable internet connections. This feature can be particularly valuable if you're looking to serve rural or developing markets.

Convenience and security

Like NFC contactless payments, QR code payments offer a contactless, quick, and secure way to transact. They can incorporate encryption and tokenization for added security while providing a seamless user experience.

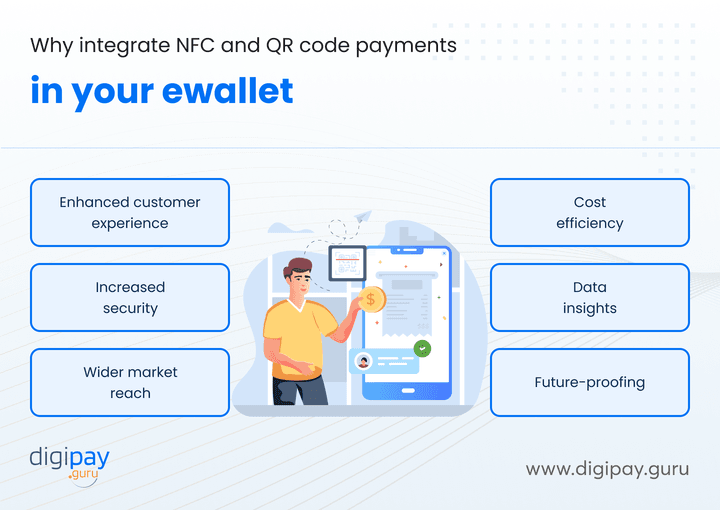

Why integrate NFC and QR code payments in your ewallet?

You explored the key features and the potential they carry to make your business stand out. But, there are some top advantages of e wallet integration with NFC and QR code payments, that will convince you to definitely go for it.

Let’s explore the advantages it offers.

Enhanced customer experience

By offering both NFC and QR code payment options, you're providing your customers with flexibility and choice. They can use whichever method is most convenient for them in any given situation. This leads to higher satisfaction and loyalty.

Increased security

NFC and QR code payments offer advanced security features that can help protect your customers and business from fraud and security breaches. The security features include;

The security features include;

- Encryption

- Tokenization

- Two-factor authentication

- Secure element

- Secure payment gateways & more…

The enhanced security achieved from these features can build trust and confidence in your e-wallet solution.

Wider market reach

NFC and QR code payments cater to different market segments and use cases. By offering both, you can expand your reach and appeal to a broader customer base, from tech-savvy urbanites to rural populations in emerging markets.

Cost efficiency

While NFC might require some initial investment in infrastructure, it can lead to faster transaction times and reduced operational costs in the long run. On the other hand, QR codes are cost-effective to implement and maintain. Optimize your operational efficiency across different market segments by offering both.

Data insights

Both payment methods can provide valuable data on customer behavior and preferences. This information can be used to;

- Improve your services

- Develop targeted marketing strategies, and

- Create personalized experiences for your customers

Future-proofing

Offering both NFC and QR code payments positions your e-wallet as a versatile and forward-thinking solution. This can help you stay competitive and adaptable to future trends and technologies.

Future of e-wallet transactions with NFC and QR code payments

The future of e wallet payment method - NFC and QR code payments is bright. The integration of NFC and QR code payments in e-wallets is opening up new possibilities for seamless, secure, and innovative financial services.

NFC payments :

Increased prevalence:

Nearly all smartphones are projected to have NFC capabilities by 2027, making contactless payments through mobile wallets incredibly convenient.

Faster transactions:

NFC offers a speedy tap-and-pay experience, perfect for our fast-paced lives.

Security enhancements:

Developments in encryption and tokenization are continuously improving the security of NFC transactions.

QR code payments:

Growth in popularity:

The QR code payment market is expected to reach new heights, driven by their ease of use and smartphone penetration.

Strong presence in Asia:

The Asia-Pacific region, with its high mobile usage, is expected to be a major driver of QR code payments.

Accessibility for businesses:

QR codes are a cost-effective way for businesses, especially small vendors, to accept digital payments.

Additionally, we're seeing the emergence of "super apps" that combine payments, banking, and lifestyle services – all in one platform. These apps leverage the speed and convenience of NFC and QR code payments to create a unified user experience.

Conclusion

E-wallet transactions are the future of digital payments. And NFC and QR code payments are not just passing trends, but fundamental technologies shaping the future of e-wallet transactions. With QR code and NFC payments, you can make your customer’s experience extremely smooth, convenient, and secure.

So, for businesses like yours, integrating these payment methods into your e-wallet offerings is crucial for staying competitive in the rapidly evolving digital finance landscape. As you move forward, consider how you can leverage these technologies to create unique value for your customers.

If you are looking to integrate NFC and QR code payments into your ewallet system. Now is the time! With DigiPay.Guru, you can get the most reliable and customizable ewallet solution where you can seamlessly integrate NFC and QR code payment methods. It will not only make you more desirable among your customers but will also attract more customers.