In today’s world of cut-throat competition, every interaction with the customer matters as it provides you with an opportunity to leave an everlasting impression on them. Almost all the major companies in the world believe and implement this philosophy.

There are many companies that have extensively focused on customer satisfaction by offering innovative products and services. For example, Alibaba and Amazon have changed the way people shop. Similarly, WhatsApp and Facebook have changed the way we connect with people across the world.

In the industry of financial services, customers are always at the centre of all key operations. Financial institutions incessantly try to improve and come up with better methods to attract and retain customers. However, it does come with its sets of challenges as customers expect the same convenience at banks and financial institutes that they experience with that of Amazon and Facebook.

Nowadays, customers put banks and financial institutions at a very high standard and expect premium digital experiences in return. Customers want an omnichannel presence. Moreover, they also want everything in real-time.

This builds a lot of pressure on banks to come up with a client onboarding process that can deliver their customers with rich experience. In this article, we are going to discuss what client onboarding is, what are the challenges associated with it, and what’s its future.

What is Customer or Client Onboarding in Banking?

Client onboarding can be simply defined as the entire process through which a user starts his journey as a customer or a client of a bank/ financial institution. Similarly, the onboarding experience can be defined as the relationship between the customer and the organization.

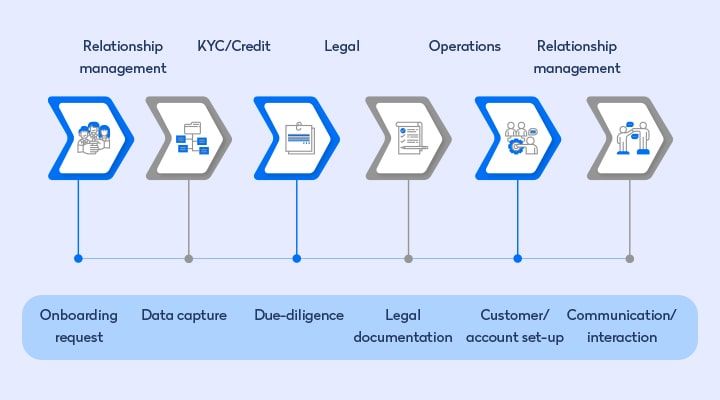

Generally, the customer onboarding process constitutes of multiple activities. It begins with the evaluation of customer’s requirement which is followed by due-diligence, the fulfilment of legal aspects, opening the account, and making it operational.

In terms of commercial banking, the entire onboarding process is only a one-time activity instead of some ongoing process that requires proactive communication between the two parties.

Customer onboarding is crucial as many key variables such as experience, referrals, client loyalty, and profitability directly depend on it. In the current process, there are multiple parties or departments involved which are within the organization like credit, operations, compliance, legal, front office, risk, tax, and other important functions.

Simply put, there are several touchpoints within the various departments that are required to finish the entire onboarding process. To get a perspective, let’s take the example of the Forrester Consulting study, according to which it takes around two to 12 weeks for banks and financial institutions to implement partial onboarding solutions along with necessary workflow capabilities.

Furthermore, it takes less than six weeks for an institution which is more mature to implement a complete end-to-end client lifecycle management solution (CLM).

Client onboarding process in banks is full of challenges. Let’s have a closer look at them.

What are the challenges associated with the current client onboarding process?

According to the Forrester Consulting survey estimates, a client is contacted ten times on an average during the entire onboarding process. Furthermore, they are also asked to submit their documents which range from five to hundred. Let’s have a look at challenges associated with the current client onboarding process.

Absence of a structured process

Client onboarding follows various processes within the departments like legal, credit, and operational. One important thing to note here is that each compliance officer of these departments has its own interpretations pertaining to the regulations.

This results in each department have its own specific process that might be different from the other departments all within the same bank. This means that a single bank can have three or more than three different entities that will have different interpretations of the processes/regulations.

Such different interpretations can get customers confused as to why they should provide the same information at various points of the process. Moreover, the Forrester Consulting survey confirms that it takes approximately 34 weeks for banks and financial institutions to fulfil the manual client onboarding process.

Changing regulations

Regulations keep on changing on a monthly or even on a weekly basis. This is why banks must adapt their systems in accordance with the regulations. This poses a great challenge for the banks as they don’t only have to explain the changes to the client but also have to ensure that they are amended in the onboarding process.

Due to clusters of changes in the regulations, banks require to revisit their current processes/operations. Moreover, they also require to rely on cutting-edge technologies like digital transformation, reengineering, etc to make themselves compliant.

Culture

Financial institutions and banks all across the globe want to get close with their customers. However, the lack of drive to understand the changing needs of customers along with dynamics and underinvestment in strategic opportunities have proved to be a great barrier.

As per the McKinsey’s recent survey, for top global executives around the world, culture accounts approximately 33% among the other major barriers to digital effectiveness.

Access

As the usage of modern technology increases in the banks and financial institutions, there’s a pressure on banks to provide every service on a real-time basis. Nowadays, an average customer expects to access all the banking services on their smartphone so that they can avoid visiting the bank branches.

However, there are still many banks which operate on the traditional systems, that’s why providing all the end-to-end digital experiences poses a great challenge for such banks. By using emerging and cutting-edge technologies like robotic process automation (RPA) can prove to be an effective solution.

Time-consuming processes

The client onboarding is a time-consuming process as there is a multitude of documents required. Also, there are multiple touchpoints involved in the process which contributes to the overall time consumption.

For example, let’s consider that bank is having three different entities viz. retail, insurance, and the corporate which caters to different types of customers and businesses. Now, just imagine that a customer who becomes a customer of all these three entities. Now, that customer has to go through entire time-consuming processes of onboarding for thrice.

Quality

According to PwC, the whole remediation exercise of customer shows that the due diligence process varies for each entity from country to country. Thus, this can cause a huge variation in the quality of experience within a single financial service entity.

So, if a customer visits the same bank in the US and Sweden, then he might experience quite a variation in the onboarding process. Banks must focus on achieving uniformity in their onboarding process across the globe.

Future of client onboarding

To overcome all the above challenges, financial institutions and banks are now moving towards cutting-edge technologies to improve their efficiencies. It helps them to kill two birds with a stone as they can satisfy regulatory standards and offer a seamless experience to their end customers at the same time. As we are gradually progressing towards open banking, we might see client onboarding utilizing the following means in their future model.

Artificial intelligence (AI)

Artificial intelligence is the technology with the help of which the computer software can make human-like decisions. Many companies are using this technology for their benefit like PayPal which has reduced its false fraud alerts by almost in half with the help of an AI monitoring system that identifies benign reasons for bad behaviour. Moreover, HSBC has also decided to pledge $2.3 billion in AI technology.

Blockchain

Banks and financial institutions can use distributed ledger technology (DLT) like Blockchain for the KYC process that would enable users to manage their digital identity with high-grade security. Moreover, it can also help financial institutions and businesses to efficiently manage data with reliability and ease.

A consortium of HSBC, OCBC Bank, Mitsubishi UFJ Financial Group (MUFG), and Infocom Media Development Authority (IMDA) in Singapore has become the first to come up with a prototype of Blockchain-based KYC solution in South-East Asia.

Digital identities

An electronic identifies that can verify if you’re the one who you claim to be. This technology is already underpinned by Singapore’ Electronic Identification and Trust Services for Electronic Transactions Regulations 2016. It’s meant to encourage transparency and interoperability across various entities in the country.

Biometrics

These are inherent characteristics of an individual which are used for recognition purposes. These are based on his/her behavioural or physical traits (face ID, fingerprint, voice recognition, iris scanning).

Read More: Biometric technology enhancing security of digital payments.

Biometric technology is already being used by some big banks like BBVA, Maybank, OCBC, etc; however, it’s yet to gain across the board acceptance. iPhone X has come up with its Face ID and is making a huge claim that only one out of a million can be duplicated. One must not be surprised if this becomes an industry-standard in the near future.

Data collaboration

AS per the Chartis RiskTech100 Research 2015, around 71% of the respondents accepted the fact that there was a need of integrating some of the anti-money laundering (AML) and anti-fraud systems into a single technology environment.

This will help financial institutions to mix their external and internal client data and thus gain useful insights into their clients. It won’t be advisable to get rid of all the onboarding process; however, such collaborations can offer us with the advantage of collective knowledge that can, in turn, streamline the process to offer a rich customer experience.

Conclusion

It’s important to understand that focusing on the customer experience will be the key for banks and financial institutions as it will compel them to change how they engage with their customer base. In order to keep attracting and retaining their customers, they must keep reinventing themselves, innovate, create excitement, and most importantly focus on the improvement of customer service.

This might take many years to accomplish. However, with cutting-edge technologies like machine learning and Blockchain, we might accomplish it well before our estimations.