The global cross border remittance market size will reach $ 345.42 billion by 2034!

This growth statistic states significantly that the future of cross-border remittance is going to be splendid. The future carries many innovations, emerging trends, challenges, and opportunities for businesses similar to yours.

In this blog, you will discover

- The current state of cross-border remittance

- The emerging trends and innovations in the market

- Regulatory trends and development, and

- Cross-border remittance with financial inclusion

Let’s begin!

The current state of cross-border remittance

Cross-border remittance is on the rise even now. This section below will give you a glimpse into the current state of the cross-border payment market.

Market size and growth

- Remittance flows to low- and middle-income economies reached a whopping $669 billion in 2023.

- India became the world's biggest recipient of remittances in 2023, with inflows of ₹125 billion. Mexico and China followed closely at $67 billion and $50 billion respectively.

- The global average cost of sending a $200 remittance is 6.2%, which is still double the Sustainable Development Goal target of 3%.

- Over $3.3 trillion in cross-border eCommerce transactions will be conducted in 2028.

Key players

The oldest players in international remittance are;

- Money transfer operators (MTOs)

- Banks, and

- Postal services

The new players that are disrupting the market with innovative and customer-centric solutions in the market include;

- Fintech companies

- Mobile money providers, and

- Digital remittance platforms

Challenges

Undoubtedly, the cross-border remittance industry is growing rapidly. Still, there are certain challenges in it, such as;

- High fees

- Limited accessibility

- Regulatory hurdles, and

- Concerns over security & transparency

However, innovative cross-border payment solutions can resolve these challenges significantly!

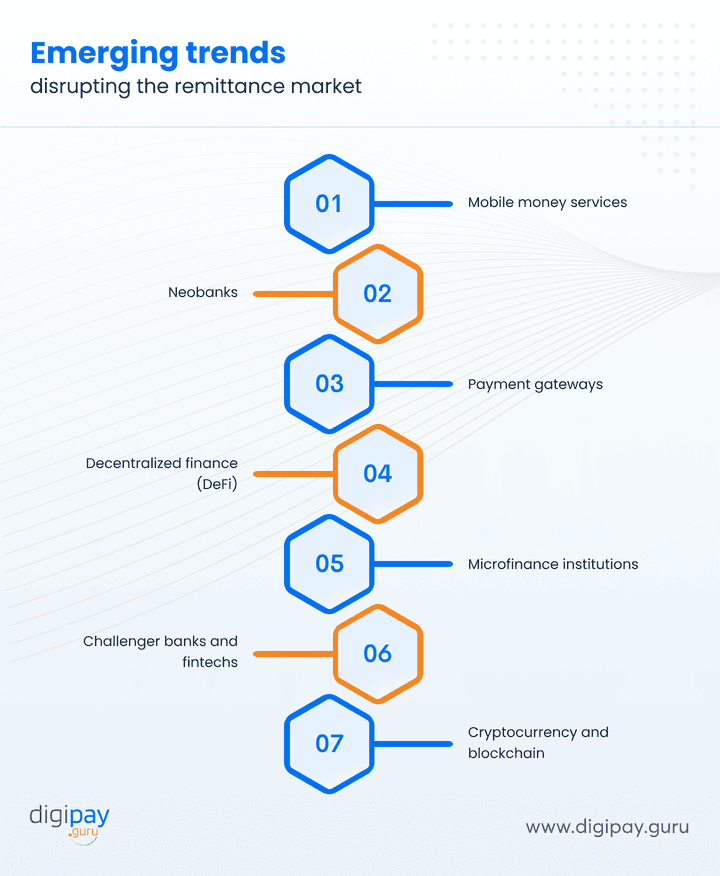

Emerging trends disrupting the remittance market

Now, let’s explore some emerging trends that are currently disrupting the remittance market and will stay effective even in the future.

Mobile money services

Mobile money services are growing fast in emerging markets. They allow underbanked people to quickly send and receive affordable international money transfers using mobile phones and agent networks.

For example, M-Pesa provides affordable international money transfer services via mobile phone. It processes billions of dollars annually in remittances in sub-Saharan Africa alone. It was around $53 billion in 2023.

Neobanks

Neobanks like Monzo and N26 are app-based challengers remodelling banking for the digital age.

Their integration of money transfer software and partnerships with international remittance firms make cheap international transfers a core offering.

Payment gateways

Online payment gateways have emerged as a convenient and secure way to facilitate cross-border remittances.

Payment gateways like PayPal, Stripe, and Square allow small businesses and merchants to accept international payments online with;

- Ease and efficiency

- Competitive exchange rates, and

- Faster transaction times

They enable ecommerce remittances and form an essential part of the fintech ecosystem.

Decentralized finance (DeFi)

Decentralized finance (DeFi) is a rapidly growing trend that leverages blockchain technology and cryptocurrencies to provide financial services without intermediaries.

DeFi platforms are exploring innovative solutions for cross-border remittances to offer faster, more transparent, and cost-effective transactions.

Microfinance institutions

Microfinance institutions offer cheaper cross border remittance services to reach underserved populations and disrupt traditional money transfer operators.

Also, microfinance non-profits are facilitating cross-border remittance services for migrant workers who send money home to underserved loved ones. The localized networks of microfinance institutions provide personalized outreach and financial education.

Challenger banks and fintechs

Challenger banks and fintechs are disrupting international money remittance through;

- Optimized foreign exchange

- Transparent low fees

- Faster transfers via streamlined digital platforms, and

- Intuitive mobile apps that improve user experience

For instance, TransferWise, Remitly, and Revolut are money transfer solutions gaining share by offering fast, low-cost transfers and optimized foreign exchange rates. Their cross border money transfer solutions cut out physical intermediaries to streamline the user experience.

Cryptocurrency and blockchain

Cryptocurrency and blockchain technologies allow direct peer-to-peer money transfers worldwide via web-based exchanges.

Crypto offers advantages like;

- Instant settlement

- Lower fees, and

- Elimination of intermediaries

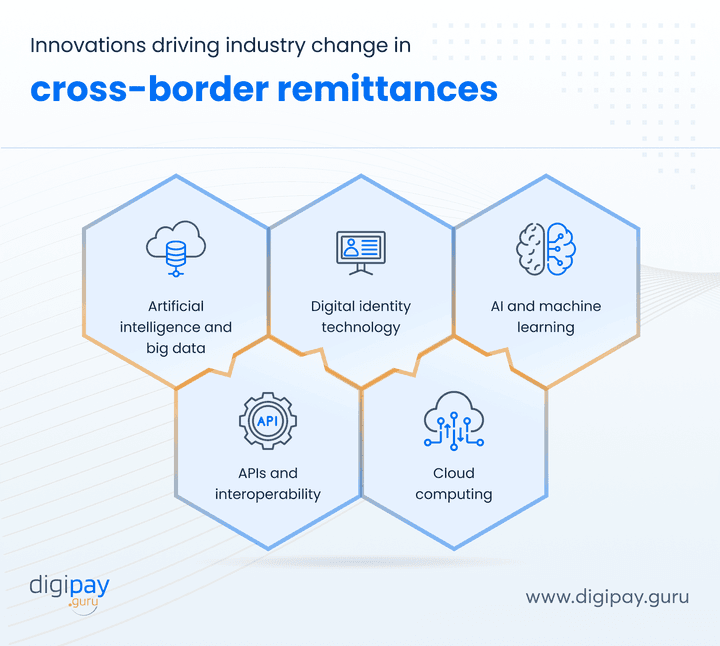

Innovations driving industry change in cross-border remittances

Now that you are aware of the disrupting emerging trends, let's acquaint you with the innovations that are making a bigger difference in ‘how your cross-border remittances function’.

These innovations include;

Artificial intelligence and big data

AI-powered solutions can;

- Streamline processes

- Improve fraud detection, and

- Provide personalized services tailored to individual needs.

Meanwhile, big data analytics helps remittance providers gain valuable insights into consumer behavior, market trends, and risk patterns. This enables them to make informed decisions and optimize their offerings.

APIs and interoperability

APIs and interoperability solutions enable seamless integration between financial services providers. This facilitates cross-border remittances and enhances the overall user experience.

By leveraging APIs, all the parties involved in the financial space - banks, fintechs, and remittance providers can offer integrated services, reduce friction, and ensure a smooth and efficient transfer of funds across borders.

Digital identity technology

Digital identity solutions enable secure and efficient customer onboarding and identity verification processes for cross-border remittance solution.

These technologies enhance compliance with KYC and AML regulations. Plus, it improves the overall customer experience as it streamlines onboarding & reduces the need for physical documentation.

Cloud computing

Cloud computing is a game changer for the cross-border remittance market. This is because it enables scalability, resilience, and cost-effectiveness.

It leverages cloud-based solutions, and remittance providers like you can;

- Scale their operations

- Ensure business continuity, and

- Reduce infrastructure costs

This, in turn, results in more competitive and efficient services for customers.

AI and machine learning

AI and machine learning employ advanced fraud detection, risk management, and compliance monitoring in financial services. Hence, they have the power to transform the cross-border payment industry.

Additionally, these technologies can analyze vast amounts of data, identify patterns, and detect anomalies. This helps remittance providers mitigate risks, comply with regulations, and provide a secure and trustworthy service to their customers.

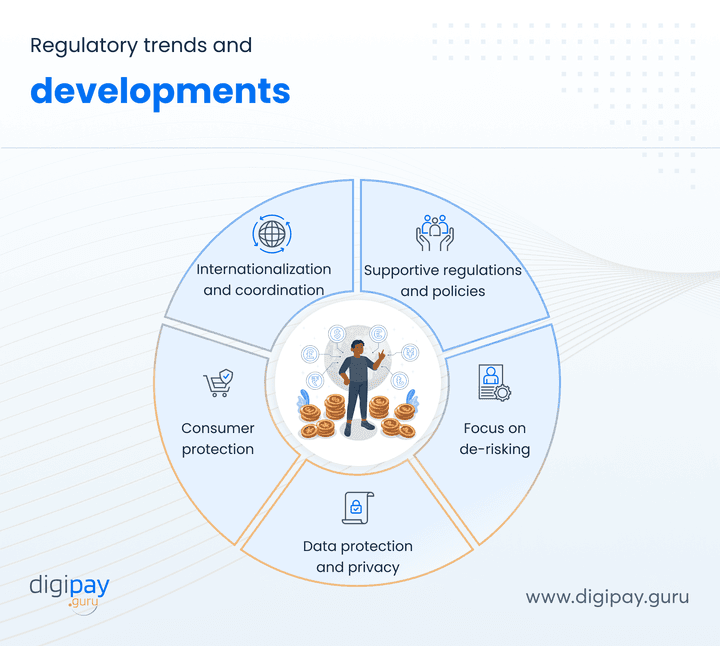

Regulatory trends and developments

Regulation is both an opportunity and a challenge when encouraging an inclusive, innovative cross-border remittance market.

Here are the key regulatory trends and developments in the remittance space:

Supportive regulations and policies

Policymakers are increasingly supportive of international remittance innovation. Hence they are implementing supportive regulations and policies to offer innovation & boost a more inclusive financial system.

These efforts include;

- Streamlining licensing processes

- Reducing regulatory burdens, and

- Encouraging bank-fintech collaboration

Focus on de-risking

Regulators are now emphasizing de-risking with smart approaches to risk management. The purpose is to prevent money laundering, terrorist financing, and other illicit activities.

The de-risking approach involves;

- Enhanced due diligence

- Risk-based problem-solving, and

- Improved reporting mechanisms

It ensures that cross-border remittances are conducted securely and transparently.

Data protection and privacy

With the rapid increase of digital remittance solutions, data protection & privacy have become critical.

Implementing strong data protection like GDPR safeguards consumer financial information. It also promotes responsible data-handling practices within the remittance industry.

Also, enabling appropriate data use, analytics and selective sharing with third parties power innovation that improves services.

Consumer protection

Consumers are the key to every business. And so regulatory bodies are taking proactive measures to protect consumers from fraudulent activities, excessive fees, and unfair practices in the remittance market

The measures include;

- Mandating transparency in pricing

- Implementing dispute mechanisms, and

- Enforcing strict compliance with consumer protection laws

Internationalization and coordination

With the increase in cross-border payments, regulators are recognizing the need for international coordination and harmonization of regulatory frameworks.

This involves;

- Collaboration between regulatory bodies

- The adoption of international standards, and

- The development of common guidelines to facilitate seamless cross-border transactions.

However, rigid local AML, KYC, and cybercrime regulations still complicate transfers or block channels entirely despite progress.

Financial inclusion and cross-border payments go hand-in-hand

Cross-border remittances and financial inclusion have deeper roots connected as both of them make financial services more accessible for families across the country.

With affordable & secure money remittance services, customers can;

- Participate in the formal financial system

- Build savings and invest in their communities

This helps drive economic growth and financial empowerment.

Moreover, mobile money platforms, digital wallets, and agent-based networks are expanding the reach of remittance services. This enables your customers to send and receive funds irrespective of traditional bank accounts or physical branches.

Read More: Boost financial inclusion with cross-border payment system

How DigiPay.Guru can help?

DigiPay.Guru has always been a trendsetter in the digital payment space. And with its robust international remittance solution, it now offers future-ready cross-border remittance services.

Our solution strives to simplify cross-border payments for your customers while making them secure and cost-effective at the same time.

We offer advanced features & benefits such as;

- Real-time money transfers

- Multiple modes of payment

- Multi-currency corridors

- Dynamic exchange rate management

- Transparent fee structures & FX rates

- Faster bill payments

- Improved cash flow management

- AML sanction screening and much more

Conclusion

The cross-border remittance industry is undergoing rapid change driven by emerging technologies that offer faster, cheaper transfers and expand financial access. From blockchain and cryptocurrency to mobile platforms and AI, innovation is unlocking new potential. At the same time, supportive regulations are evolving to enable responsible disruption.

For businesses like yours, this transformation creates opportunities to meet international remittance needs in impactful new ways.

At DigiPay.Guru, our advanced digital money transfer solution helps you offer your customers the next generation of remittances. With extensive expertise and industry-leading capabilities, we make it easy to send and receive funds worldwide while keeping you ahead of the curve.