Identity verification is crucial, especially in the financial sector. And the traditional KYC processes for identity verification are often slow, manual, and prone to errors. That’s where eKYC comes into the picture.

eKYC, with its advanced features like face recognition, makes identity verification fast, secure, and reliable. Wondering what is face recognition or how it works? Wonder no more. In this blog post, you will learn all about face recognition & identity verification in eKYC, from how it works to its importance, benefits, challenges, security, and more.

Let’s begin with the meaning of face recognition and how it works!

What is face recognition in eKYC?

At its core, face recognition is an AI-powered feature that detects facial features via selfie-based live image/video capture to ensure the legitimacy of customers with stored data.

Through advanced facial recognition software, businesses like you can verify users quickly and accurately. This not only saves time but adds an extra layer of security.

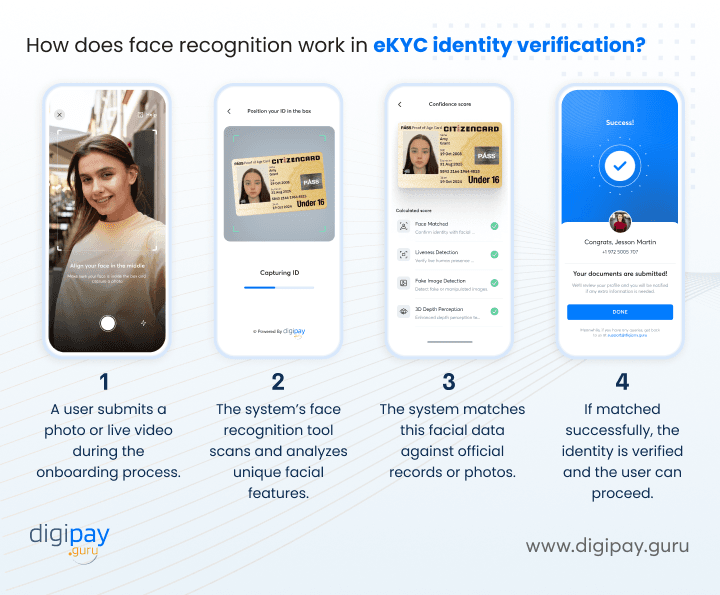

How does face recognition work in eKYC identity verification?

- Step 1: A user submits a photo or live video during the onboarding process.

- Step 2: The system’s face recognition tool scans and analyzes unique facial features.

- Step 3: The system matches this facial data against official records or photos.

- Step 4: If matched successfully, the identity is verified and the user can proceed.

This process is fast, effective, and replaces traditional, often clunky, KYC methods. But why does it matter so much?

Why does face recognition matter for eKYC identity verification?

Face recognition is changing eKYC identity verification by adding another layer of accuracy and speed. In the past, verifying a customer’s identity used to take time consuming manual checks which left room for errors or inconsistencies.

With face recognition eKYC systems can instantly and accurately authenticate a person’s identity by comparing their live facial data with pre-existing images or identity documents. This reduces human error and improves digital identity verification accuracy. Besides improving efficiency face recognition addresses the growing need for security in identity verification.

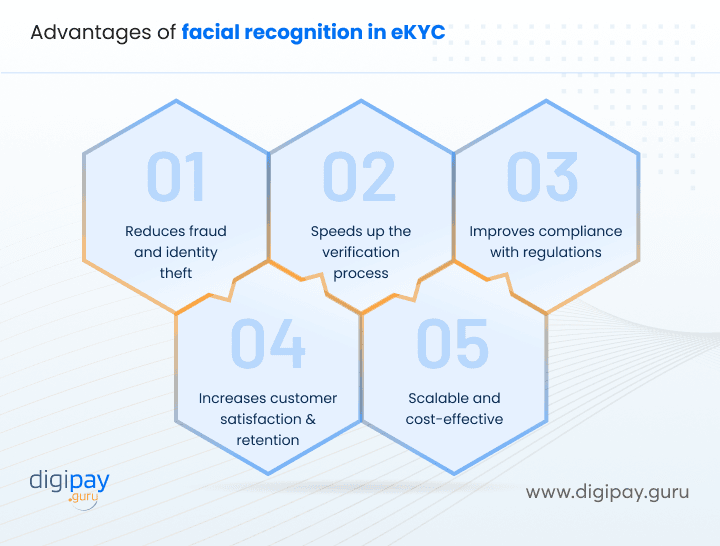

What are the advantages of using facial recognition in eKYC?

Let’s explore why face recognition is becoming the standard for eKYC identity verification. The key benefits of face recognition for eKYC include:

Reduces fraud and identity theft

Identity theft and fraud are significant threats to financial services. Manual verification processes have gaps that fraudsters can exploit. Face authentication for KYC fills these gaps with:

Biometric authentication: This is unique for every individual and is hard to fake or alter

Real-time verification: Instantly verifies identities, which reduces fraud risks as there are minimal chances for security breaches

By using secure face recognition for eKYC, institutions can significantly reduce fraud cases and protect customer identities.

Speeds up the verification process

Nobody likes a lengthy onboarding process. Slow verifications can frustrate customers and increase drop-off rates. With face recognition technology for eKYC:

- The verification process is completed in seconds

- Customers enjoy faster onboarding

In other words, you won’t lose customers to slow processes. Instead, you’ll stand out for your efficient onboarding experience.

Improves compliance with regulations

Your business must comply with stringent KYC and AML regulations. Face recognition for KYC compliance offers:

- Automatic and verified records which keep clear digital trails for audits

- Instant notifications alert you about suspicious attempts

Increases customer satisfaction and retention

A good customer experience is crucial. When onboarding is quick and accurate, customers are happy and more likely to stay. With face recognition for eKYC:

- Customers feel valued and secure

- Businesses build long-term trust

Scalable and cost-effective

Manual verification isn’t just slow – it’s costly. Face recognition tools automate verification which saves money while allowing the process to scale with your business (when the volume of onboarding increases). Benefits include:

- Handling high verification volumes without added costs

- Reducing the need for manual intervention

Read More: Face verification: Fast & safe identity verification process

Challenges for using face recognition in eKYC.

While face recognition software for eKYC is powerful, it comes with challenges that your business should be aware of. The major challenges of face recognition in eKYC are:

Privacy and data security concerns

With biometric data, security is non-negotiable. So your business must ensure that data is:

- Stored securely to protect against unauthorized access

- Handled in compliance and adhered to regulatory frameworks like GDPR, AML, and KYC

Failing to secure data can lead to heavy fines and reputational damage. Hence, choosing biometric security solutions with strong safeguards is essential.

False positives and errors

No system is perfect. Face recognition technology can can misidentify users sometimes, especially when the facial data is unclear due to presentation attacks or mask attacks. This can lead to:

- False positives: Misidentifying individuals as known users

- False negatives: Incorrectly rejecting legitimate users

While this happens less with face recognition & identity verification in eKYC, be prepared to handle such errors.

Technological and ethical challenges

Emerging technologies in eKYC come with ethical and technical challenges. Making this technology fair and unbiased is key for businesses to build trust in their eKYC process.

Your business must:

- Be transparent and inform customers of everything about data collection

- Adopt fair practices to ensure that the data is used ethically

Addressing these challenges early can build trust and reassure customers about biometric authentication in eKYC.

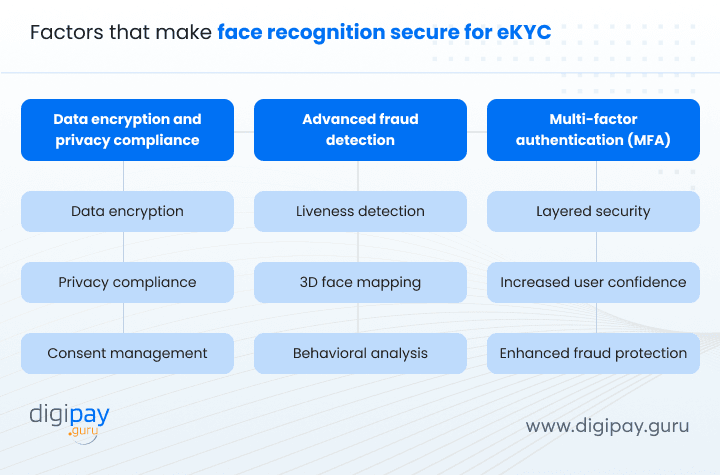

Is face recognition secure for eKYC processes?

Security is top of mind when implementing face recognition in eKYC. Businesses like yours need to be assured that biometric data is secured and face recognition technology meets high security standards.

Data encryption and privacy compliance

Biometric data in eKYC is encrypted with advanced encryption to prevent unauthorized access. Data privacy regulations like GDPR add an extra layer of protection by enforcing strict data management.

- Data encryption: Biometric data is stored in encrypted formats to prevent unauthorized access

- Privacy compliance: Only essential data is collected and stored, with secure deletion as required

- Consent management: Customers must provide explicit consent, thereby enhancing transparency

Advanced fraud detection

Face recognition technology uses AI-based fraud detection techniques, making it harder for fraudsters to exploit. These measures ensure only genuine users can pass the eKYC process.

- Liveness detection: Differentiates real-time facial movements to prevent spoofing

- 3D face mapping: Adds depth to facial data, making fake images or videos ineffective

- Behavioral analysis: Detects unusual patterns in expressions or movements for extra security

Multi-factor authentication (MFA)

For additional security, many businesses use multi-factor authentication (MFA), which combines face recognition with a secondary step, such as a PIN or OTP. This layered approach increases reliability and security. This means two steps of authentication before a user enters your system.

- Layered security: MFA ensures that accounts are protected even if one layer is compromised

- Increased user confidence: Customers trust that their accounts are secured by more than one method

- Enhanced fraud protection: Provides an extra shield against sophisticated fraud tactics

In short, face recognition is a secure, compliant, and reliable option for eKYC when supported by encryption, privacy standards, and multi-factor authentication.

How DigiPay.Guru can help?

DigiPay.Guru offers a robust eKYC solution that comes with an AI-powered face verification system. It offers frictionless and secure onboarding with automated face verification. You can onboard only real customers and give accurate results with advanced face recognition tools.

It offers:

- Results in seconds

- Facial liveness detection

- Anti-spoofing checks

- Fake image detection

- AI mapping techniques

- Bypass attack detection

- Microexpressions analysis

- Human face attribute analysis

It offers extra-level security with its advanced capabilities:

- Liveness detection

- 3D mask attack detection

- Presentation attack detection

- Configurable confidence score

- Near passive user action

- Accessibility compliance and more…

Conclusion

Face verification plays an important role in eKYC identity verification. It not only enhances security but also improves customer experience and compliance. By adopting this technology, businesses like yours are setting themselves up for a future where digital identity verification is fast, effective, and widely trusted.

With DigiPay.Guru’s advanced eKYC solution, you can also begin offering robust identity verification services to your customers combined with face verification features. It is secure, fast, reliable, and compliant. So, don’t wait; get ready to leverage the power of a robust eKYC solution.