The QR code was first invented in 1994 by the Japanese automobile, Denso Wave, led by Masahiro Hara. It was invented with the sole purpose of tracking vehicles in the manufacturing process. It wasn’t expected that it could be used outside the automobile industry, especially in payment systems. But today we all know how QR codes have transformed the payment industry.

But what exactly are they? How do they work? And most importantly, how can you adopt them for your business?

Let’s break it all down for you in this blog, starting with its meaning.

What is a QR code?

In simple terms, a QR code (Quick Response code) is a type of barcode that can store various types of data, such as text, URLs, or payment information. It’s easily scannable by a smartphone or QR code scanner, which makes it perfect for quick and secure transactions.

It’s like a digital bridge, which connects your customer’s device to your payment system without the need for physical cash, cards, or even contact.

Characteristics of QR code

There can be various versions of Barcodes like 1D, 2D, and so on. But, the most popular is the 2D version called QR Code. QR codes come in modules and are used to store information.

- The current version of the QR code (Module 1) is 14, which has a size of 73 x 73, with the capability of storing up to 1,167 digits.

- The largest version (Module 2) is 40 with a size of 177 x 177 and can store up to 7,089 digits.

- There is also an option for a Micro QR code (Module 4) - size: 17*17, capacity: 35 digits.

In payments, as the URLs or the data contained in the code, is encrypted, it's secure and convenient for payment processing. EMV QR Code technology enables merchants to provide their customers with a wide range of payment options using one QR code at checkout.

Types of QR codes

There are two types of QR Codes:

| Dynamic QR Codes | Static QR Codes |

|---|---|

| A dynamic QR code is a type of QR code whose information can be edited and updated after it has been printed or displayed. | A static QR code is a type of QR code that contains a fixed piece of information that cannot be changed after it has been printed or displayed. |

| In this QR code, the URL can be changed with any page of the website, as desired by the merchant. | In this QR Code, the URL of the actual destination website is placed directly in the QR code. |

| It is used for dynamic payments and marketing activities across all businesses. | It is used to facilitate simple and quick payments for businesses. |

| These QR codes can track the number of scans received and know the location & device used to scan the code. | These QR codes do not have tracking functions. |

| Dynamic QR codes facilitate automatic payable amount and all related information for payments when it is scanned. | Static QR codes facilitate manual input of the amount payable while it is scanned. |

What is a QR code payment system?

A QR code payment system enables customers to pay by scanning a QR code with their smartphone. This simple system connects your business with a payment provider, which facilitates smooth and secure transactions without the need for additional hardware.

Whether it’s at a restaurant, a retail store, or even for online shopping, a QR payment system makes the payment process fast and frictionless.

How to generate QR codes for payments

Implementing QR codes for payments may sound complex, but it’s easier than you think. Follow these simple steps to learn how to generate merchant QR code:

-

Choose a payment service provider - Select a provider that supports QR code payments and offers robust features tailored to your business needs.

-

Create a merchant account - Sign up with the payment provider to register as a merchant.

-

Access the QR code–generation feature - Most providers have a QR code generation option in their app or dashboard.

-

Enter payment details - Input the necessary details, such as the payment amount, product description, or account information.

-

Generate the QR code - Click on the option to create the QR code.

-

Test the QR code - Scan it using a smartphone or app to ensure it works correctly.

-

Deploy the QR code - Display it at your payment place, website, or print it for customers to scan.

How do QR code payments work?

One major difference between QR codes and barcodes is that the QR codes are scannable from both ways, i.e., via paper and screen. On the other hand, linear barcodes are scannable only from paper. That’s precisely the reason why you see QR codes both on apps and online stores.

To scan a QR code, you need to have one of the following things:

- A barcode reader with the capability to scan QR codes.

- Tablet or a smartphone with an inbuilt camera.

Nowadays, many QR code scan apps allow users to scan the QR codes with the utmost ease. All the user has to do is open the camera and place it towards the QR code. This will immediately identify it and open a push notification. Then the user has to just tap on it to finish the operation.

Some payment and banking apps can process QR codes for bank transfers and payments. There are many ways in which QR codes can be processed. Some of these ways are:

Scanning recipient’s QR code with a smartphone

In this process, the user has to open the phone camera or the relevant QR code scanner app. After that, they have to scan the code displayed on an individual product, paper bill, or at a store’s checkout. Various offers and loyalty points might also be applied via the application in case it’s a store-specific application.

Retailers scanning QR code on user’s phone screen

In the QR code payment process, the user opens the payment app once the total transaction amount is confirmed in the POS system of the retailer. The QR code payment app displays a QR code that identifies with the user’s card details. The retailer then scans the QR code with a scanner, thus concluding the transaction.

App-to-app payments

In this process, both the sender and the recipient open their applications. The sender then scans the unique QR code generated in the recipient’s application. The sender, at last, confirms the amount to be paid and taps to complete the payment.

How are merchants adopting QR code payments?

QR codes are making lives easy for merchants and businesses. Let's discuss the use cases showcasing how merchants accept payments with a QR code.

Fuel retailers

Fuel retailers can also use QR code payment solution for easy payments for their users. There are fuel retail wallet solutions that allow users to fuel their cars by simply entering the amount (in currency) of fuel in the application. These applications come with multiple payment modes, including scan and pay with QR code.

E-ticket booking

QR codes are used in E-ticket booking businesses. The E-ticket booking application enables users to book tickets for buses, flights, trains, movies, amusement parks, and many more by just making a few clicks on their phone. These apps have multiple modes of payment, and QR code payment is one of them.

Toll payments

Toll booths can also use QR codes to facilitate quick and easy acceptance of toll payments. There are toll payment wallet apps that allow the user to make cashless toll payments. These apps include multiple cashless payment options like QR code payments, RFID, and NFC cards.

Parking payments

QR codes can be used as a mode of payment in parking payment solution-providing companies. A parking payment solution allows users to search for and book their parking space through a mobile application. Once the parking space is booked, the user can make payment by simply scanning the QR code present at the parking garage.

Street vendors

Even small business owners like street vendors widely use QR code for business and their minimal range of products. They print a QR code for all their product tags with their description and price. To purchase any product, the user has to scan the QR code and confirm to make the payment.

Micro-business

Micro-businesses that have a small range of goods also use QR codes for payments. Here the merchant generates both the invoice of a particular amount and the QR code. He then displays the QR code on the smartphone screen. To make the payment, the customer has to scan the merchant’s generated QR code from their mobile wallet application.

Read More: Automate micro-finance services with Digipay

SMEs (Small and medium-range businesses)

In SMEs, the merchant prints a QR code for each vendor that indicates the cash register location and other details. To make the payment, the customer has to scan the vendor’s QR code. Then the vendor sends the receipt to the customer’s smartphone from the cash register. Finally, the customer confirms the payment.

Apart from these businesses, there are various other businesses where merchant QR payments can be accepted.

- Restaurants

- Hyperlocals

- Departmental stores

- Service providers

- Food trucks

- Entertainment like live events, and movie businesses

- Art like portrait businesses

- Travel Business

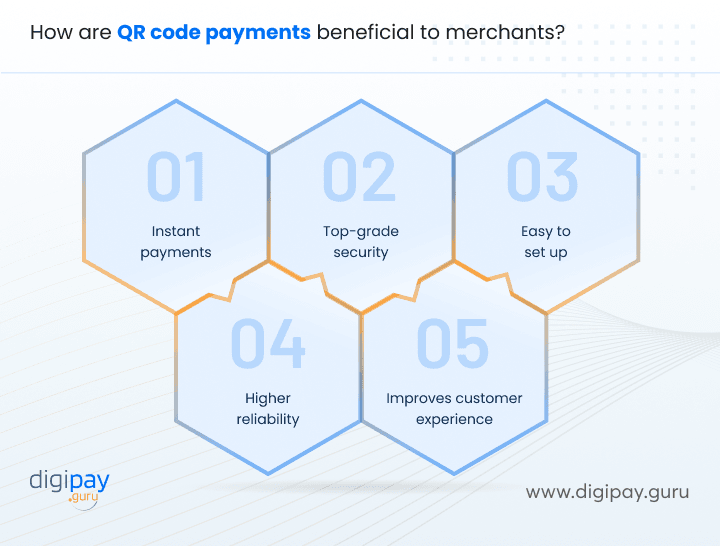

How are QR code payments beneficial to merchants?

The adoption of QR code payments comes with myriad benefits that help you reach out to all your potential customers. Let’s have a look at a few of them.

Instant payments

One of the benefits of QR code payment is that it facilitates instant acceptance of payments. QR code payments are very quick compared to other payment modes. The user just has to open the QR code scan app, scan the QR code, and confirm to process the payment. The users can make payments in just a few seconds.

Top-grade security

Making payments via QR codes is very secure. It’s because the QR code is nothing but a tool to exchange information. And so, any data transferred via QR codes is encrypted, thereby making the payment foolproof and secure.

Easy to set up

Setting up QR code payments is extremely easy as you don't need much infrastructure, but just a smartphone with a camera and a QR code, either printed or digitally. QR code payments also eliminate the requirement of POS machine or any other special payment device.

Higher reliability

QR code payments are a foolproof payment method as it eliminates the probability of any kind of error. Plus, the pattern of black boxes (QR codes) consists of unique data that enhances the reliability of the QR code payments.

Improves customer experience

The adoption of QR code payments allows your customers to pay with their desired digital wallets. This makes the customer journey of making payments smoother and bridges the gap between the face-to-face and digital worlds.

Are QR codes a safe payment method?

Yes! QR codes are secure when implemented correctly. Here’s how QR code payment security is maintained:

- Data encryption protects sensitive information

- Each transaction generates unique dynamic QR codes, preventing misuse

- QR code payment apps often include two-factor authentication for added security

However, merchants should always verify QR code payment security by choosing reliable service providers and educating customers about scanning from trusted sources.

Interested in adopting QR code payments for your business?

DigiPay.Guru is armed with multiple cashless payment options to incorporate into your business, such as QR code payments, NFC, USSD, and virtual cards. These payment options are available within our digital wallet solution, ewallet solution, prepaid card management and issuance platform, and agency banking.

QR code payments can make your customer’s transactions a whole lot easier and quicker. We are on a mission to provide businesses like yours with safe, transparent, instant, and convenient payment solutions all across the globe. If you are a business owner who wants to add a QR code payment system to your solution, get in touch with our experts. Let’s discuss your needs and help you implement them in the right way.