Are you struggling with slow and insecure customer onboarding and identity verification processes? You are not alone. However, you can be one of the first ones to come out of this problem and beat your competitors.

But the question is: How do you verify identity online without compromising security, speed, or compliance? The answer is simple: an automated eKYC verification.

Too vague? How will eKYC verification make your onboarding & verification fast and secure? Well, the answer goes deeper than that!

There are two non-negotiable features of the eKYC solution that can make your onboarding process extremely secure, reliable, and compliant. They are: Document verification and address verification.

But what exactly makes document and address verification such game-changers in modern eKYC? And how can you implement them effectively?

Let’s break it all down in this blog.

Challenges in Traditional KYC Verification Processes

Traditional KYC methods often involve manual verification of physical documents, face-to-face meetings, or postal verification. This isn’t just slow. It’s broken.

The key challenges in traditional verification are:

| Challenges | Details |

|---|---|

| High Operational Costs of Manual Verification | Manual KYC processes drain time and human resources. Verification teams have to go through documents manually. This increases cost and overhead. |

| Delays in Customer Onboarding = Lost Revenue | Each delay in KYC adds friction to the user experience. In modern scenario where customers expect real-time service, this means revenue walking out the door. |

| Increased Fraud Risk from Forgery and Synthetic Identities | Human eyes miss things. AI doesn’t. Traditional KYC makes it easy for fraudsters to slip in fake documents or impersonate others. |

| Inconsistent Regulatory Compliance Across Regions | Different jurisdictions have different standards. Manual processes can’t scale to meet the evolving global regulatory compliance for eKYC. |

| Poor CX Damaging Digital Reputation | If users get stuck during onboarding due to poor KYC document verification, they’ll likely abandon the process—and tell others about it. |

P.S: You can solve all these problems with document and address verification. Let’s first understand their basics below!

Understanding Document Verification and Address Verification in eKYC

Before diving deeper into why these eKYC verifications matter, let's understand what are they.

Document Verification

What is it?: Document verification is the process of validating the authenticity of a customer's submitted documents. It ensures that the information matches official records and confirms the identity of the user.

This is a crucial part of any automated KYC solution that helps meet compliance, detect fraud, and streamline the onboarding process.

How it Works

-

The process starts when the customer submits their identity verification documents.

-

These are then scanned via OCR tech or uploaded into the system.

-

The system runs various checks: document type validation, format verification, and cross-referencing with databases.

-

The verification outcome appears on their screen with a definitive “approve or reject.”

Technologies Used in Document Verification

OCR for document verification (Optical Character Recognition) : OCR extracts data from physical documents and converts it into machine-readable formats. It eliminates the need for manual entry, which reduces errors and boosts speed.

AI & Machine Learning: AI-based document verification software learns from millions of data points. It can detect fake IDs, forgeries, and subtle inconsistencies.

Blockchain (Emerging): Some solutions are experimenting with blockchain for immutable record-keeping. While not widespread yet, it holds promise for the future.

Address Verification

Meaning: Address verification confirms whether the provided address is accurate, real, and belongs to the customer. It’s vital for risk assessment, due diligence, and regulatory compliance.

How It Works

-

User inputs and uploads address document

-

The document format & expiry data are checked automatically

-

The confidence score for the verification is calculated

-

The system “approves or rejects” the document

The goal is to confirm that the person actually resides there or has a legitimate reason to use that address.

Methods of Address Verification

Document-Based: This includes uploading documents like utility bills, bank statements, or tax letters. These documents must be current and verifiable.

Video KYC (Live Agent + Geo-Validation): Video KYC combines human verification with real-time location checks. The agent can ask the user to show the address proof on camera.

Geotagging & GPS Data: Smartphones allow capturing GPS data. Some systems verify addresses by matching document data with real-time GPS coordinates.

Data Strings & Metadata: This includes IP verification and metadata analysis to confirm the consistency of user location and behavior.

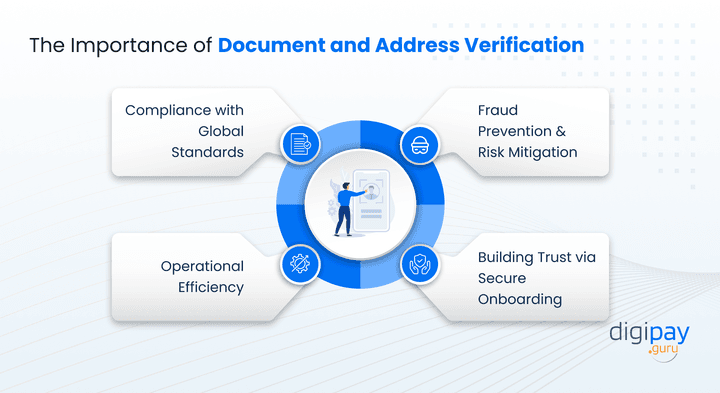

Why Document & Address Verification Matters More Than Ever

Financial businesses like yours today face a hard truth: “Manual checks aren’t just slow; they’re risky.” On top of that, your customers expect seamless, secure onboarding, and regulators aren’t making it any easier.

So, what’s the solution? Let’s talk about the two essentials that can make or break your eKYC process—document and address verification.

Compliance with Global Regulatory Requirements

You’re dealing with constant changes in compliance rules—from FATF to GDPR to AML to local laws. It’s overwhelming. That’s why document and address verification are essential. They help you meet every regulatory demand with confidence.

This helps you gain your customers’ trust and keeps your business secure & compliant at all times.

Fraud Prevention & Risk Mitigation

You can’t afford to trust every document at face value. Fake IDs and addresses open the door to serious financial risks. But verifying documents and addresses upfront can protect your business and your customers from fraud or unauthorized access.

Building Customer Trust through Secure & Fast Onboarding

When your verification process is fast and secure, customers instantly feel safe. You don’t just meet regulations—you earn their trust and confidence every step.

And what better way than to begin this trust-building right from the moment they download your app? Right from the moment your splash screen appears in front of them.

Operational Efficiency in Scaling Financial Services

Manual processes slow you down. They make it hard to expand without sacrificing speed, accuracy, or compliance.

With automated digital KYC processes, you can grow across regions faster, reduce errors, and still meet every regulatory requirement. It’s how you scale smartly—without compromise.

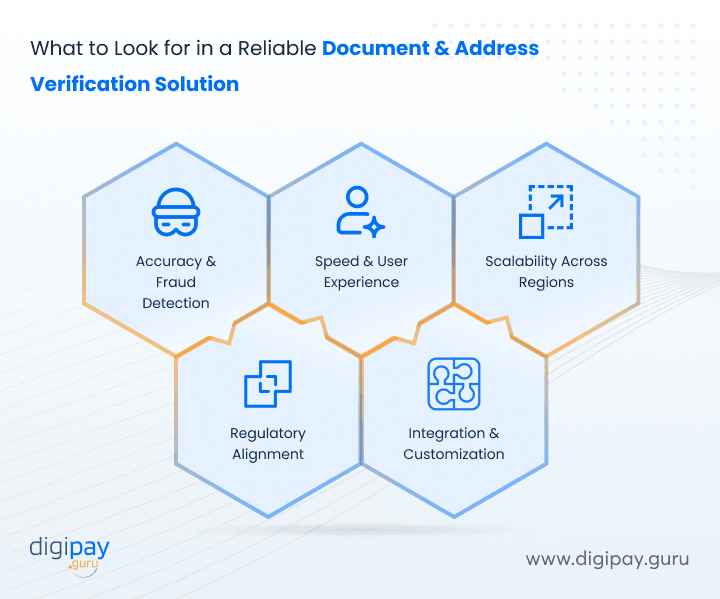

What to Look for in a Reliable Document & Address Verification Solution

Before you pick a document and address verification solution, you need clarity—what actually makes one reliable? It’s not just about ticking boxes for eKYC compliance. You need something that’s accurate, fast, and scalable. Because that’s what your business (and your customers) demand.

Accuracy & Fraud Detection Capabilities

Your solution must detect even the smallest signs of fraud. From fake documents to mismatched data, every red flag should be caught in real time.

Plus, accuracy ensures trust, and trust drives long-term customer relationships. This is something your financial service can’t and should not afford to compromise.

Speed & User Experience

Slow verification kills conversions. You need a system that’s lightning-fast and frictionless. Moreover, a smooth experience keeps customers from dropping off. This means when verification feels effortless, onboarding feels like a win and not a chore.

Scalability Across Regions

As your business expands, your verification solution should be able to keep up. Whether you're onboarding users in one city or ten countries, it must work reliably across regions and adapt to local requirements without slowing down your business operations.

Regulatory Alignment

Compliance isn’t optional for anyone - so not for your business either. So, your solution must align with global eKYC compliance standards like FATF, GDPR, KYC, AML, and local regulations.

When you stay audit-ready, you protect your business from legal and reputational risks.

Integration & Customization

No tech stack can be totally the same. So, you need verification tools that integrate easily and let you tailor the flow to match your UX. The right fit saves your team time and improves customer satisfaction across the board.

All in all, the solution you choose should have easy integration capabilities and should support customizations based on your business needs.

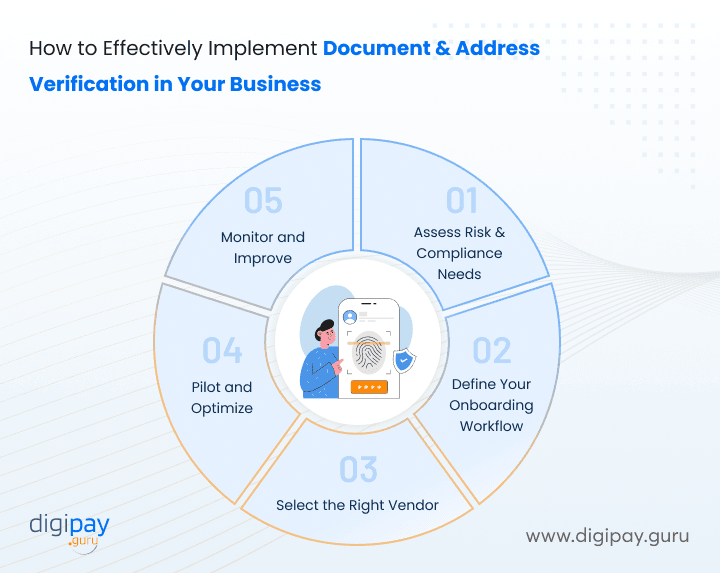

How to Effectively Implement Document & Address Verification in Your Business

Once you’ve selected the right solution, the next step is making it work for your business. Means: how to implement it.

Well, the implementation isn’t just about turning on a tool. It’s about making sure it aligns with your compliance goals, customer experience, and scaling needs.

Here’s how to do it right:

Assess Your Risk and Compliance Needs

Start by evaluating your business’s risk profile and regulatory obligations. Why? Well, because every financial institution is different. So you must first figure out what level of verification you need based on your services, target markets, and legal responsibilities.

Define Your Onboarding Workflow

Map your customer onboarding journey step-by-step. This helps you have a set plan from the very beginning. The moment you decide to offer document verification service. The steps can be to decide when and how to collect documents, verify addresses, and notify users. In the end, due to this, you can easily avoid confusion, delays, or duplicate checks.

Read more - DigiPay.Guru: The ultimate eKYC solution for faster and more secure customer onboarding

Select the Right Vendor

Vendors are the skeleton of the business. So, to find the right vendors, you must compare vendors not just on price but also on tech features, global support, and security. And look for those with proven experience in handling identity verification at scale.

Pilot and Optimize

Before you launch your system in the market, run a test phase with a small user segment. In this phase, measure completion rates, drop-offs, and verification time. Later, use the feedback to adjust flows, fix bottlenecks, and enhance customer experience.

Monitor and Improve

The work does not end here. After launch, you must track your system’s performance regularly. Review KPIs like verification success rates and fraud detection levels. And if any discrepancies or gaps come to your notice (via metrics or customer feedback), make improvements. Because continuous improvement keeps you efficient and compliant long-term.

How Can DigiPay.Guru Help?

DigiPay.Guru offers a robust eKYC solution to ensure reliable and secure identity verification while onboarding your customers. It allows you to enjoy streamlined onboarding, enhanced security, & peace of mind!

Plus, we offer the most secure and reliable customer onboarding and identity verification with our advanced features—document and address verification.

Document verification

It helps you streamline your identity verification process with robust document verification. You can authenticate and validate the documents in seconds and with high-end security.

-

Real-time results

-

Intelligent OCR scanning

-

Unmatched fraud prevention

-

Accurate document validation

Its key features include:

-

Document validity check

-

Document format support

-

Document expiry check

-

OCR powered engine

Address verification

It allows you to perform seamless customer onboarding with accurate address verification. Plus, it enables you to boost security and trust by effortlessly verifying addresses with the best address verification service.

-

Instant address verification

-

Global address coverage

-

Advanced verification techniques

-

Customizable verification rules

Its key features include:

-

Document validity check

-

Document expiry check

-

Address verification with OCR

Conclusion

Let’s face it—digital onboarding is no longer just about fulfilling KYC requirements.

It’s the first impression you make on a potential customer. If that process is slow, insecure, or outdated, you risk losing both trust and revenue. So, document and address verification are no longer optional—they’re essential pillars of a secure, scalable, and compliant eKYC process.

When done right, they help you prevent fraud, stay compliant across markets, and deliver the kind of seamless experience today’s customers expect. But, relying on manual checks or fragmented tools only slows you down and leaves room for risk.

If you're aiming to grow efficiently while maintaining compliance, it's time to rethink your verification strategy.

That’s exactly where DigiPay.Guru comes in. Our advanced eKYC solution is built for financial institutions that prioritize security, speed, and regulatory alignment. From AI-based document checks to real-time address verification, we help you onboard customers confidently and securely—without friction.

Start building trust from the first click—with DigiPay.Guru.

FAQ's

Document and address verification are key components of the eKYC process. Document verification ensures the authenticity of identity-related documents like passports or national IDs. Address verification confirms that a customer resides at a legitimate, verifiable location. Together, they help you meet compliance, reduce fraud, and onboard customers securely.

Address verification is critical for both regulatory compliance and fraud prevention. It ensures that your customer is traceable and resides at a valid location. This is especially important for high-risk transactions or when dealing with cross-border clients, which helps you stay aligned with AML and KYC norms.

Commonly accepted address proof documents include utility bills, bank statements, driver’s licenses, government-issued letters, and rental agreements. Some institutions may also rely on video KYC with geo-validation or GPS tagging to verify an address in real time, which depends on the risk level.

Yes, most financial regulators mandate document verification as a baseline requirement for all customers. However, the verification depth can vary based on your internal risk policies, transaction size, and regional regulations. Automating this step streamlines onboarding without compromising compliance.

Document verification is usually performed through OCR (optical character recognition) and AI-based validation tools. Customers upload a document, and your eKYC system extracts and cross-verifies the data with official databases or internal records. This ensures it's authentic, unaltered, and belongs to the actual user.

Video KYC is a live video-based interaction where a trained agent verifies the customer’s identity and address in real time. Geo-validation and document capture add a strong layer of trust and help meet regulatory requirements in jurisdictions where face-to-face verification is mandatory.

Companies use AI-powered fraud detection, liveness checks, hologram detection, and data cross-verification to validate uploaded documents. These technologies detect forgery attempts, expired documents, or synthetically generated IDs. This keeps your platform secure and aligned with global eKYC compliance standards.

Absolutely. A reliable eKYC provider ensures end-to-end encryption, secure storage, and compliance with data protection laws like GDPR and local equivalents. You gain peace of mind knowing customer data is processed securely, which reduces the risk of breaches or misuse.