53% of Americans use digital wallets more than traditional payment methods

Well, that’s a fact! Digital wallets are set to nearly replace traditional payment methods like cash and cards. And the reason for this is also simple - young customers! They only prefer digital modes of payment.

Plus, a study reveals that the global digital wallet market size is around $ 13.79 billion and is expected to reach $ 45.17 Billion by 2029. This shows the increasing demand for digital wallets.

So, as a business when you plan to launch a digital wallet service, you must know the benefits it offers and the impact it can have on your business's success.

In this blog, you will know what are digital wallets, how they work, digital wallet benefits for business, and their impact on your business.

Let’s begin the blog with the basics like what is digital wallet!

What is a Digital wallet and how does it work?

Here’s what it means:

What is a digital wallet?

In simple terms, a digital wallet is a digital payment system where your user can link the bank account to the app and make online payment via bank transfers or QR scans.

It is an electronic wallet that does not store your funds but allows you to make all wallet payments like payments to merchants, mobile recharge, utility bill payments, and more.

It offers varied payment options and multiple currency access to make payments. This makes it an extremely convenient and reliable form of digital payment.

How it works?

Digital wallet payments can be made in a few simple steps:

1.User downloads the digital payment app on his smartphone

2.Set up the account with KYC and personal information

3.Add PIN and other security measures like biometrics or face scan

4.Add card or bank details to link the bank account to the app

5.The bank account is verified by the bank and app as legitimate

6.User can now make payments and enjoy the convenience of a digital wallet

You can accept digital wallet payments with a simple process:

1.Meet regulatory requirements and obtain the necessary licenses to offer digital wallet services.

2.Partner with a payment processor that supports digital wallet transactions.

3.Integrate your digital wallet with a payment gateway using the provided APIs.

4.Market your digital wallet to attract merchants and users.

5.Track transactions and performance, and make improvements as needed.

Read More: How do online payments function with digital wallets?

Examples of popular digital wallets

Some well-known digital wallet applications include:

- Apple Pay

- Google Pay

- Samsung Pay

- PayPal

- Venmo

Benefits of digital wallets for businesses

Now that you are aware of the basics of digital wallets, let's explore the importance of digital wallet with their key benefits:

Increased security & decreased Fraud

Today, with fraudsters becoming more tech-savvy, data breaches and financial fraud are major concerns. Digital wallets offer a robust security solution to overcome these concerns.

Digital wallets can significantly reduce the risk of fraud & security breaches by leveraging:

- Advanced encryption techniques

- Tokenization

- Biometric authentication, and more….

This enhanced security;

- Protects your customers’ payment information

- Protects your business reputation, and

- Reduces potential losses from fraudulent activities

Read More:Digital wallet fraud: What is it and how to prevent it

Improved customer experience

Today's customers demand seamless and convenient financial services.

With digital wallets, you can easily deliver on their expectation by offering a frictionless payment experience.

How? Well, payments via digital wallets are fast and easy. It does not need for your customers to carry physical cards or cash.

This improved experience can lead to higher customer satisfaction and loyalty which are very crucial factors to win the competitive financial market.

Streamlined payment processes

Leveraging digital wallets can simplify and streamline payment processes for your customers.

- It integrates multiple payment methods in a single platform.

- Offers quick and easy payment process, and

- Provides digital transaction history to simplify reconciliation & more……..

These benefits can lead to increased operational efficiency and better cash flow management.

Cost efficiency

While there may be initial implementation costs, digital wallets can lead to significant long-term cost savings for your business.

- Digital wallets reduce the need for physical payment infrastructure and handling.

- Transactions via digital wallets often incur lower fees than traditional credit card processing.

Due to these reasons, the operational costs for your business are reduced significantly.

Increased transaction speed

Your customers can make payments instantly with digital wallets due to their advanced payment technologies like QR codes and NFC payments.

Plus, due to faster transactions, your customers feel happy & satisfied with your service. This ultimately leads to more loyal customers and increased profits for your business.

Advanced data and insights

Digital wallets provide transaction history and data that can be leveraged for valuable customer insights.

By analyzing this data, you can gain a deeper understanding of your customers' financial behaviors, spending patterns, and preferences.

These insights can help your business make informed decisions about:

- Product development

- Marketing strategies

- Risk assessment, and

- Future innovation.

All these in the end allow you to tailor services more effectively to meet customer needs.

Increased loyal customers

By offering an advanced digital experience through digital wallets, you can make your customers keep coming back to you. You can offer added features like loyalty programs, referral programs, and more to make your customers engage with your brand for a longer time.

Moreover, with features like speed, security, multiple payment methods, multi-currency efficiency, and more, you can give your customers a sense of peace and convenience.

Integration with other services

Digital wallets can offer so many services, and give your customers a one-stop solution for varied financial needs. This will keep them even more loyal and make your business their first choice.

You can integrate various features and tools like:

- Budgeting tools

- Investment platforms

- Loan applications

- Bill payments

- Peer-to-peer transfers

Regulatory compliance

Many digital wallet solutions are designed with regulatory compliance in mind. This ensures transactions meet the industry standards and legal needs.

Plus, the built-in features for transaction tracking, reporting, and identity verification can your business meet regulatory standards like KYC and AML more effectively.

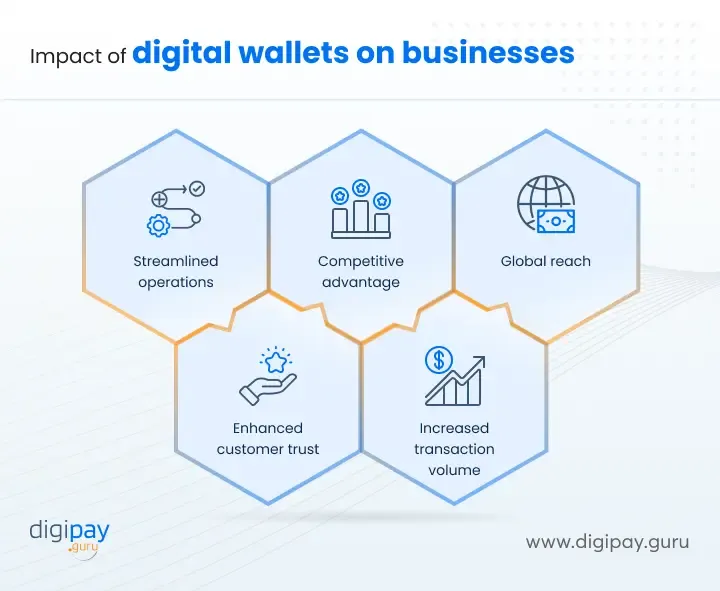

Impact of digital wallets on businesses like yours

As you saw the numerous digital wallet benefits for business, now you must know how they can positively impact your business.

The key impacts include:

Streamlined operations

By digitizing payment processes, you can significantly streamline your operations.

Digital wallets reduce the need for manual processing, paperwork, and physical cash handling.

This streamlining of operations can lead to faster, more efficient operations and allow your business to handle a higher volume of transactions with greater accuracy & less overhead.

Enhanced customer trust

Digital wallets offer advanced security features like tokenization, encryption, biometric authentication, KYC, and even more. This level of security protects customers’ payment data and prevents any security breaches. Ultimately, it builds trust and gives a sense of peace when using your services.

Plus, all the processes in digital wallet transactions are transparent and hence it helps to build and maintain customer trust for a longer period.

Competitive advantage

Offering advanced digital wallet capabilities can set your digital payments business apart from your competitors.

It shows you're at the forefront of financial technology and can meet the evolving needs of tech-savvy customers.

This can be a key differentiator in attracting and retaining customers, especially younger demographics who expect digital-first banking experiences.

Increased transaction volume

The convenience and speed of digital wallets can encourage your customers to conduct more transactions through your business.

Whether it's small daily purchases or larger transfers, the ease of use can lead to an increase in overall transaction volume.

This, in turn, generates more revenue through transaction fees and provides more opportunities for customer engagement & data collection.

Global reach

Digital wallets can facilitate easier cross-border transactions. This opens up new markets and opportunities for your business.

By removing some of the barriers associated with international payments - cost, exchange rate, transparency, speed, etc. you can expand your services globally. And cater to customers who need to make frequent international transactions or those living in underbanked regions.

How DigiPay.Guru can help?

DigiPay.Guru’s advanced digital wallet solution offers secure and reliable digital payment services to your customers without them needing to store funds in the wallet. It is fast, seamless, secure, and scalable.

Here’s what sets us apart:

Lesser risks: Minimize potential financial threats as our solution doesn't store money in the wallet.

Lesser licensing requirements: Simplify compliance with fewer regulatory requirements. This makes implementation smoother and faster.

No need to pre-load funds: Enable seamless transactions directly from banks without the need to maintain a balance in the wallet

Plus, it offers advanced features that can have a great impact on your business and customers

P2P & P2M payments: Facilitate seamless peer-to-peer and peer-to-merchant transactions for your customers with our digital wallet solution.

Utility bills & airtime top-up: Enable users to easily pay utility bills and top up airtime directly from their digital wallet apps.

Referrals and rewards: Boost user engagement by offering referral bonuses and reward programs through your digital wallet platform.

Security: Offer advanced security features like PCI SSF compliance, strong authentication, face verification, biometric authentication, tokenization & encryption, and so on.

Conclusion

Digital wallets represent a significant advancement in fintech and offer numerous benefits for businesses like yours. From enhanced security and improved customer experience to increased cost efficiency and global reach, the advantages are substantial. Plus, embracing digital wallets streamlines operations and extends a brighter future of digital payments.

DigiPay.Guru is committed to helping businesses like yours leverage the full potential of digital wallets. Our tailored solutions and industry expertise ensure that your business can scale, and attract loyal customers for your digital wallet services. With the right solution like DigiPay.Guru’s digital wallet solution you make your business a leader in your market.