Digital wallets have revolutionized the way you serve your customers. From seamless transactions to instant payments, digital wallets make managing money easier. Hence, more and more people are adopting this payment platform for payments.

However, with rising adoption comes a concerning trend—digital wallet fraud. Businesses like yours are facing challenges in keeping fraudsters at bay while safeguarding their data and users.

But, the stakes are high. A single breach can lead to financial losses, lost customer trust, and regulatory penalties. So, how can you tackle this growing menace?

This blog will help you understand:

- What is digital wallet fraud?

- How does digital wallet fraud happen?

- Why are digital wallets a target for fraud?

- Impact of digital wallet fraud on your business

- How to prevent digital wallet fraud and more

Let’s break it down with the meaning!

What is digital wallet fraud?

Digital wallet fraud refers to unauthorized activities where fraudsters exploit vulnerabilities in digital wallet systems. They target weak security, trick your users, or leverage advanced tactics to access sensitive information.

Digital wallets store critical data like:

- Bank account details

- Credit card information

- Personal contact details

Fraudsters exploit these using phishing, hacking, or social engineering, causing significant harm to businesses like yours.

For example, stolen credentials recently led to unauthorized transactions, costing millions.

So, are digital wallets safe? They can be—if you adopt robust security measures to minimize risks.

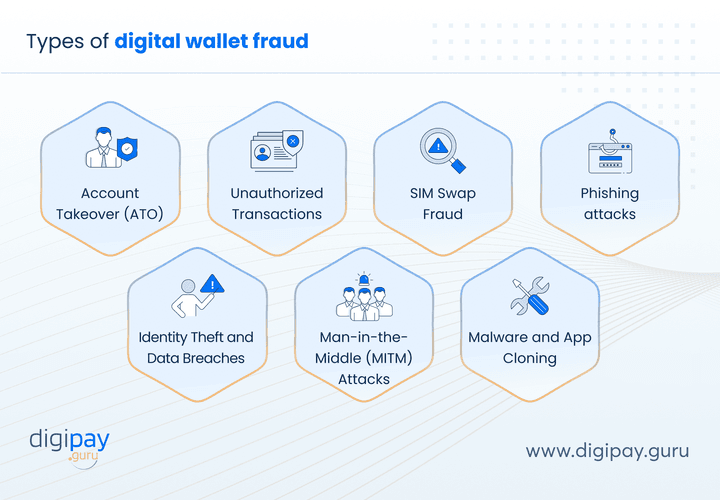

Types of digital wallet fraud

Digital wallet scams has many faces. It can attack your platform in so many ways you would even not be aware of. So, in this section, we will make you aware of the top 7 ways your platform can become the victim of digital wallet fraud.

1. Account takeover (ATO)

Account Takeover (ATO) happens when fraudsters gain access to user accounts using weak passwords, phishing scams, or stolen credentials. This form of fraud can devastate customer trust and lead to massive financial losses for your business.

Common tactics include:

-

Phishing attacks: Fraudsters trick users into sharing login details

-

Credential stuffing: Using leaked credentials to hack accounts

-

Social engineering: Manipulating users into revealing information

Without robust password policies or multi-factor authentication (MFA), your platform becomes a prime target.

2. Identity theft and data breaches

Fraudsters steal user identities to create fake wallet accounts. These fake accounts are then used for illegal transactions or money laundering, which leaves you exposed to compliance risks and financial penalties.

Key signs of identity theft include:

-

Unusual account creation patterns

-

Multiple accounts from the same IP

-

Failed KYC verifications

Moreover, a data breach exposes sensitive information, such as login credentials and payment data, which fraudsters use for further attacks. This can result in significant financial losses and reputational damage.

3. Unauthorized transactions

Unauthorized transactions occur when fraudsters gain access to a user’s wallet and initiate illegal transfers or purchases. This fraud often results in financial losses for both users and businesses.

Primary causes include:

-

Weak authentication processes

-

Stolen credentials from phishing attacks

-

Compromised devices with malware

Customers expect secure digital wallet transactions, so addressing this threat is critical to maintain trust.

4. Man-in-the-middle (MITM) attacks

In Man-in-the-Middle (MITM) attacks, hackers intercept sensitive data during a transaction. If your digital wallet platform does not implement end-to-end encryption, the risk of data breaches increases significantly.

How MITM attacks occur:

-

Hackers intercept unencrypted communications

-

Fraudsters manipulate payment details

-

Sensitive data like passwords and card details are stolen

Securing data during transmission is non-negotiable to protect your platform.

5. SIM swap fraud

In SIM swap fraud, fraudsters hijack a user’s phone number to receive OTPs and reset wallet passwords. This gives them complete access to the user’s wallet account.

How SIM swaps happen:

-

Fraudsters impersonate users to telecom providers

-

They transfer the phone number to a new SIM card

-

OTPs and notifications are diverted to the fraudster

SIM swap fraud is on the rise, which makes it crucial to implement additional security measures like biometric verification.

6. Malware and fake wallet apps

Fraudsters often develop fake wallet apps or inject malware into real ones. These malicious apps trick users into sharing sensitive information or directly compromise devices.

Key risks include:

-

Stolen login credentials

-

Unauthorized fund transfers

-

Exposure of personal and financial data

Users often download these apps unknowingly, which makes education and platform verification essential.

7. Phishing attacks

Phishing attacks are a common tool for fraudsters to steal sensitive user data. Fraudsters send fake links, texts, or emails that resemble legitimate wallet platforms.

Tactics include:

-

Fake login pages to collect credentials

-

Emails claiming account suspension

-

SMS messages requesting urgent action

Teaching users how to spot phishing attempts is essential to combat this threat.

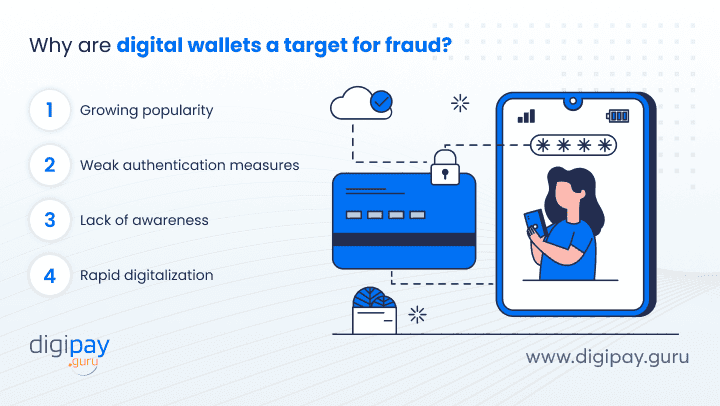

Why are digital wallets a target for fraud?

Yes, all the above kinds of frauds on digital wallet platforms are possible. But, why do these mobile payment fraud attempts happen? The key reasons include:

Growing popularity

The rapid adoption of digital wallets offers fraudsters more opportunities. With more users storing sensitive data digitally, fraudsters see this as a goldmine. Attackers exploit weak mobile wallet security systems and loopholes in platforms that are scaling too quickly to implement advanced security measures. As usage grows, so does the chance of exploitation.

Weak authentication measures

Weak or outdated authentication methods, such as single-password logins, create vulnerabilities. Without multi-factor authentication (MFA) or biometric verifications, fraudsters can easily access accounts.

Attackers use stolen credentials from previous data breaches to exploit wallets that lack advanced login protections. This makes your your platform an easy target.

Lack of awareness

Many users are unaware of the risks associated with digital wallet apps. They might fall for phishing scams, download fake wallet apps, or use weak passwords. Fraudsters take advantage of this lack of awareness, and targets users through email, fake ads, or SMS links. Without proper education, users inadvertently expose themselves and your business to fraud.

Rapid digitalization

The fast pace of digital transformation often prioritizes functionality over security. In the rush to launch wallet services, essential fraud prevention strategies might be overlooked. This leaves significant vulnerabilities in systems, which fraudsters are quick to exploit. Ensuring a balance between innovation and security is essential to mitigate risks.

Read More A comprehensive guide to digital wallets

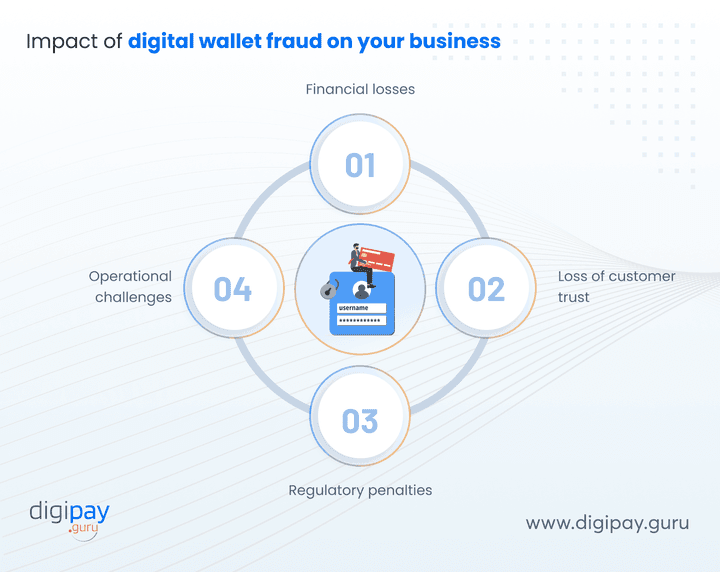

Impact of digital wallet fraud on your business

These digital wallet frauds, be it any reason or type, can greatly impact your business. Here’s how:

Financial losses

Fraudulent activities lead to direct and indirect financial losses for your business. You may have to:

-

Reimburse affected customers

-

Spend resources on investigations

This can significantly impact your bottom line.

Loss of customer trust

If a customer will face fraud or be a part of your application when you faced fraud, they will withdraw themselves from your platform. And winning them back will become next to impossible. This can affect your brand reputation and overall growth.

Regulatory penalties

Failing to secure your digital wallet systems can result in penalties and legal trouble. And compliance is non-negotiable in financial space. So, it can also lead to added scrutiny from regulators, which can then increase the operational pressures.

Operational challenges

High fraud incidents demand extra resources for detection, mitigation, and investigation. This stretches your team thin and diverts focus from strategic goals. Plus, you might also face delays in launching new features or services.

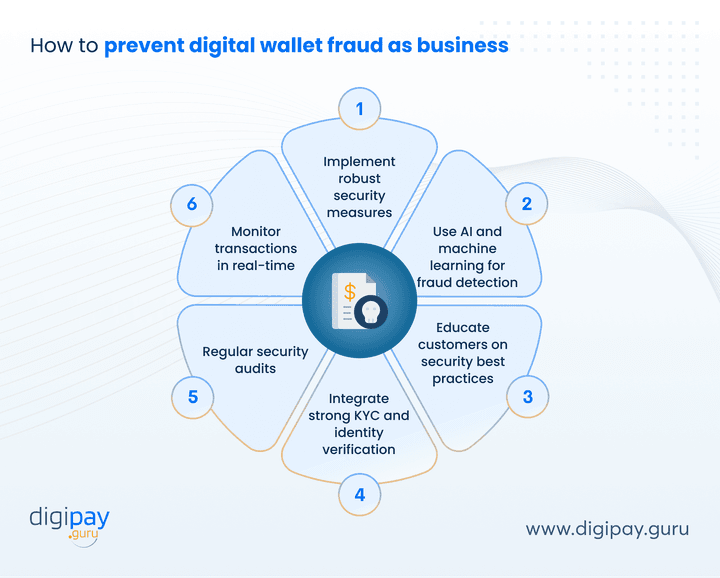

How to prevent digital wallet fraud

Digital wallet fraud prevention starts with building strong defenses and educating users about potential risks. Here's how you can safeguard your platform effectively:

1. Strengthen security measures

Your first line of defense is robust security infrastructure. This means implementing solutions that address both system vulnerabilities and unauthorized access attempts. Key steps include:

-

Multi-factor authentication (MFA): Ensure users must verify their identity through multiple channels like SMS, email, or biometrics, or PIN.

-

End-to-end encryption: Encrypt all data transmissions to prevent breaches during transactions.

-

Device fingerprinting: Track and identify devices accessing wallets to detect and block unrecognized devices.

By integrating these measures, you make it difficult for fraudsters to gain access.

2. Leverage AI for fraud detection

AI technology is a game-changer in detecting and preventing fraud. Machine learning algorithms analyze user behavior and identify suspicious patterns in real time. Key benefits include:

-

Pattern recognition: AI can detect unusual transaction amounts or locations.

-

Adaptive systems: Fraud detection systems learn and adapt to new attack strategies.

-

Proactive alerts: Receive instant notifications for flagged transactions.

AI ensures your platform is prepared for both known and emerging fraud tactics.

3. Educate your customers

Fraudsters often exploit user errors. You can minimize this risk by raising awareness among your customers. Here’s how:

- Teach them to identify phishing emails and fake apps.

- Encourage the use of strong, unique passwords for wallet accounts.

- Share regular updates on the latest fraud trends and prevention tips.

When your users are informed, they become the first line of defense.

4. Integrate strong KYC verification Know Your Customer (KYC) processes aren’t just regulatory requirements—they’re fraud prevention tools too. Advanced KYC checks help you identify legitimate users and block fraudsters. Key tools include:

-

Face verification: Verify users’ identities with facial recognition.

-

Biometric authentication: Add a layer of security that’s hard to bypass.

-

Document scanning: Ensure uploaded documents are authentic.

Strong KYC processes make it nearly impossible for fraudsters to create fake accounts.

4. Integrate strong KYC verification Know Your Customer (KYC) processes aren’t just regulatory requirements—they’re fraud prevention tools too. Advanced KYC checks help you identify legitimate users and block fraudsters. Key tools include:

-

Face verification: Verify users’ identities with facial recognition.

-

Biometric authentication: Add a layer of security that’s hard to bypass.

-

Document scanning: Ensure uploaded documents are authentic.

Strong KYC processes make it nearly impossible for fraudsters to create fake accounts.

5. Conduct regular security audits Security threats evolve constantly. Regular audits help you stay ahead by identifying and fixing vulnerabilities before they’re exploited. Essential steps include:

-

Penetration testing: Simulate attacks to test your system’s defenses.

-

Code reviews: Check for errors or loopholes in your platform.

-

System updates: Ensure all software is patched and up-to-date.

Routine security checks are a proactive way to keep your digital wallet platform safe.

6. Monitor transactions in real-time

Real-time monitoring tools allow you to detect and respond to fraud before it escalates. Here’s how they help:

-

Anomaly detection: Flag transactions that deviate from normal patterns.

-

Instant alerts: Notify administrators or users when suspicious activity occurs.

-

Account freezing: Temporarily suspend accounts linked to fraudulent behavior.

By acting immediately, you can prevent further losses and protect your users.

How DigiPay.Guru helps prevent digital wallet fraud

DigiPay.Guru offers a robust digital wallet platform that employs strong security measures that can effectively prevent fraud from entering your system. Our key digital wallet security measures include:

Multi-factor authentication (MFA): Verifies user identities during logins and digital wallet payments.

AI-powered fraud detection: Detects and flags suspicious wallet activities.

eKYC and face Verification: Prevents fraudsters from creating fake accounts.

End-to-end encryption: Protects data from breaches and MITM attacks.

Real-time monitoring: Tracks all wallet transactions and prevents unauthorized access.

Our other core measures include: Role based access management, SAST, dynamic testing, SCA, PAN testing, audit trials, infrastructure security and more.

Moreover, we are compliant, which is necessary to avoid in fraud. Our certifications include:

PCI SSF, SOC Type 1 & Type 2, and ISO 27001

Conclusion

Digital wallet fraud is a growing threat. Fraudsters exploit weak security measures and user vulnerabilities to target wallets. The consequences for businesses like yours are severe: financial losses, loss of trust, and regulatory issues.

To prevent fraud, adopt multi-factor authentication, AI-powered digital payment fraud detection, and real-time monitoring systems. Plus, educating your users and integrating advanced eKYC solutions is equally critical.

With DigiPay.Guru’s secure digital wallet solution, you can combat fraud effectively while ensuring a seamless user experience. Ready to secure your digital wallet platform? Explore DigiPay.Guru’s advanced solutions to safeguard your business and customers.

FAQ's

Yes, digital wallets are generally safe, but their security depends on the measures you implement. Features like multi-factor authentication, end-to-end encryption, and biometric verification enhance security. However, educating users about phishing scams and the importance of strong passwords is crucial for minimizing risks.

Mobile wallet fraud involves unauthorized access or misuse of wallet accounts to steal funds or sensitive data. Fraudsters use techniques like phishing, SIM swaps, or malware to exploit vulnerabilities. Strengthening security measures and educating users about these tactics can help you prevent such fraud.

The most secure digital wallets are those that offer advanced security features like biometric authentication, multi-layer encryption, and real-time fraud detection. Wallets integrated with AI-powered monitoring and robust KYC processes provide the best protection against cyber threats.

Yes, someone can steal access to a digital wallet if proper security measures are not in place. Hackers may exploit weak passwords, phishing attempts, or data breaches to gain unauthorized access. Securing your wallet with MFA, biometric locks, and educating users reduces these risks.

To report wallet fraud, immediately contact your digital wallet provider and explain the issue in detail. Provide transaction IDs or other relevant information for faster resolution. Reporting to local authorities or regulatory bodies may also be required, depending on the severity of the fraud.