About

We recently helped one of our clients which is a FinTech start-up company that was established in early 2019 in BGC, Taguig. They wanted to start their business in e-money, electronic payment, financial services, and all other related businesses. As per a report, the mobile payment industry in the Philippines is estimated to record a CAGR of 24.1% by the year 2025 with a total evaluation of US$ 19,816.4 million.

Similarly, the mobile wallet payment segment will increase at CAGR of 24.2% during the phase of 2018-2025 in value terms. Our client was aware of this fact and that’s why wanted to establish themselves as a leading FinTech firm in the Philippines. And to achieve that, they needed a mobile wallet solution with cutting-edge features that can fulfill all their requirements.

Challenges

To ensure REST API security

Ensuring security was one of the greatest challenges here as it was a digital wallet solution. We have to make sure that all the functionalities of the solution are 100% percent secure. For this securing REST API was a huge challenge since most of the solution provide REST API without any encryption.

Assure Android app security

It was very important to ensure the security of the Android app’s code as anyone can obtain the code by applying reverse engineering if it’s devoid of any kind of protection or security. Apart from that, the application also stores basic details like username, password, etc. So, it was important to secure these data too.

To achieve quick response time

We wanted to achieve quick response time for the application as we didn’t want any user to wait for a longer time and get frustrated.

Establish 100% server availability

We wanted to achieve 100% server availability so that the client can introduce new updates without facing any downtime. Similarly, we wanted to ensure that the application’s server doesn’t face downtime when there’s a sudden surge in the number of users in a short period.

Solution

Provided digital signature with each request

To achieve the REST API security, we encrypted all payload data of each API calls. Moreover, we also provided digital signature with each request.

Applied secure preferences and Pro-Guard rules

To ensure app’s code security we used Pro-guard rules. Moreover, to ensure the security of the saved data like Username, password, etc, we used secure preferences.

Optimized each query and cache databases

To ensure that the user doesn’t have to wait long we achieved quick response time by optimizing each and every query and cache databases.

Employed auto-scaling policy and framed rules

We ensured 100% server availability by employing load balancing, auto-scaling policies, and framed rules.

Features

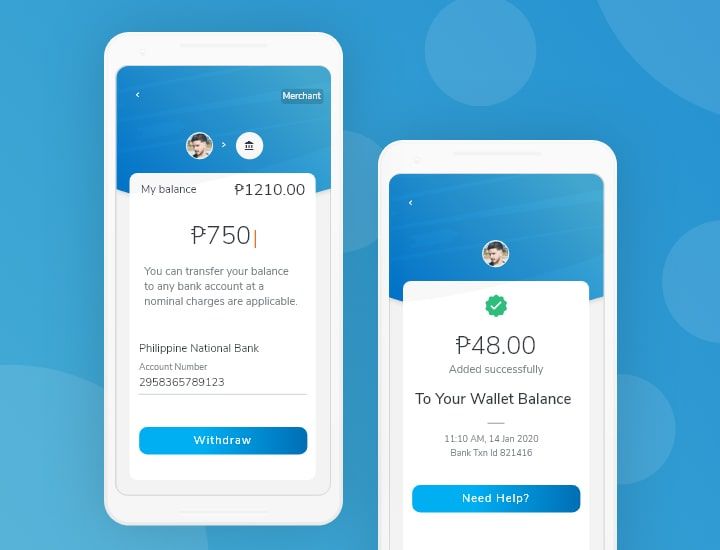

Cash In & Cash Out

It allows their users to cash in and cash out via debit card, online banking, and through offline mode via merchants at various stores.

QR code scan

With this feature, the users can make their payments by simply scanning the QR code present at the store.

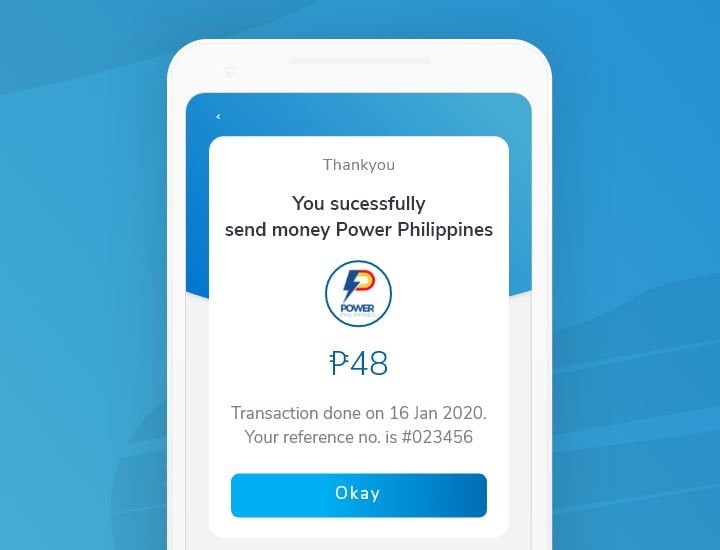

Utility Bill Payment

This feature allows the users to make their utility payments anytime and anywhere by just having a few clicks on their smartphones.

P2P Fund Transfer

The users can transfer funds to their family and friends in a fast and secure manner with P2P fund transfer feature.

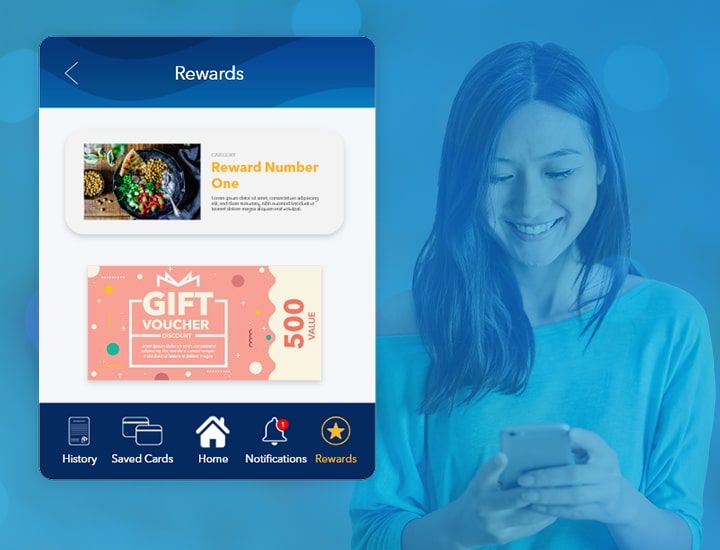

Rewards and loyalty program

This feature enabled them to offer various rewards to their users like promos, discounts, redeemable points, referral bonus, and many more under the loyalty program.

Quick settlements

Merchants can transfer funds from their wallet app to their linked bank account at a lightning speed. They can automate the settlement process by selecting a date or by defining a definite period.