Small businesses have long been recognized as one of the true engines of global economic growth.

Ben Ellis, Global Head of Visa B2B Connect

With that being said, the true engines of economic growth (small businesses) can also be the true engines of your business growth. And when it comes to cross-border payments, these businesses are now transacting left, right, and center in foreign countries.

A study suggests that the cross-border business payments market is creating a nearly $6 trillion opportunity. This can work as a gateway to serve more than 80 million underserved SMBs

All in all, offering your cross-border payment services to small businesses will offer them speed, convenience, and security. And your business can become an invaluable partner in their success stories and ultimately the global leader in your industry.

In this blog post, you will explore the opportunities and challenges of cross-border payments for small businesses. You will also learn how to overcome cross-border payment challenges with a cross border payment solution.

Let’s begin with the basics first!

What are cross-border payments and their types?

To serve small businesses effectively, you need a clear understanding of cross-border payments and their various forms. This will help you tailor your services to meet your customers’ specific needs.

Cross-border payments

Cross-border payments mean transferring funds from one party to another (be it an individual or business) across borders. This international payment method for small business is the lifeline of their international operations and enables them to:

- Purchase from global suppliers

- Sell to customers worldwide

- Manage overseas operations & more

As a remittance business, you must make cross border transactions as smooth and efficient as possible and remove all the barriers to your customers’ global growth.

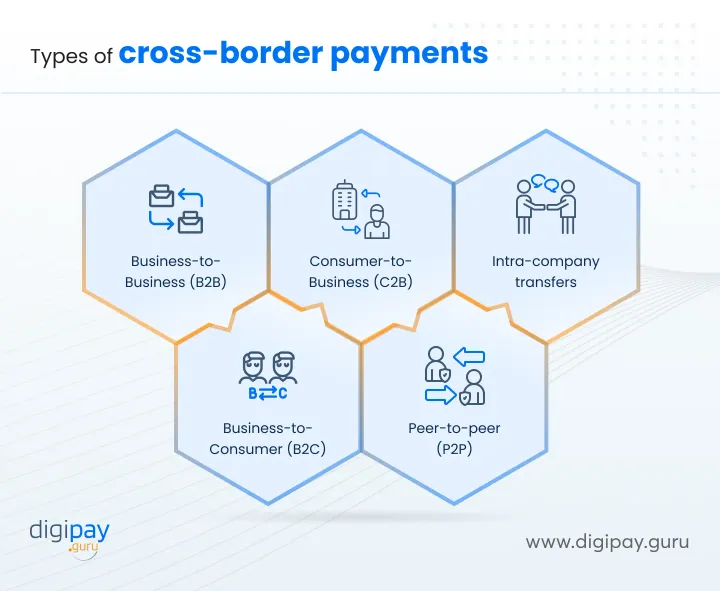

Types of cross-border payments

Small businesses engage in various types of cross border payments. By understanding these types of payments, you can offer targeted solutions.

They are:

Business-to-Business (B2B) payments:

Help your customers pay international suppliers or receive payments from overseas distributors.

Business-to-Consumer (B2C) payments:

Enable small businesses to sell directly to their international customers.

Consumer-to-Business (C2B) payments:

Facilitate payments from individuals abroad to small businesses.

Peer-to-peer (P2P) payments:

Support freelancers or small contractors working with the small businesses you are serving.

Intra-company transfers:

Assist your customers aka small businesses in moving funds between their international entities.

Importance of cross-border payments for small businesses

As a remittance service, you're not just facilitating financial transactions, you're enabling growth.

Cross-border payments allow small businesses to:

- Access new markets and customers

- Expand reach globally

- Collaborate with international partners

- Establish a global presence

- Diversify revenue streams

By emphasizing these benefits, you can demonstrate the value of your cross-border payment services to your customers.

Opportunities in cross-border payments for small businesses

Understanding the opportunities cross-border payments present for small businesses will help you tailor your services and marketing efforts.

Here's how your customers (small businesses) can benefit, and how you can support them:

Expanding market reach

Cross-border online payments for small businesses make it easier to make payments to anyone and anywhere in the world. Hence, they don’t need to think before planning to expand their business in multiple countries.

Plus, cross-border payments can help small businesses:

- Sell to customers worldwide

- Tap into high-demand markets

- Overcome local market limitations

Enhanced competitive edge

Global payments act as a small business payment solution for your customers. It offers varied features that can help them gain a competitive advantage. Such as;

- Competitive exchange rates

- Secure fund transfers &

- Efficient international transfers

All these features enable your customers (small businesses) to;

- Differentiate from local competitors

- Import materials/products at better prices internationally

- Offer unique & globally sourced products or services

Diversification of revenue streams

Cross-border payment solutions for small businesses enable them to diversify their revenue streams by tapping into international markets.

This helps small businesses to;

- Reduce dependence on local economies & single market

- Capitalize on seasonal demands in different regions

- Protect against local economic downturns

- Help mitigate risks.

Access to global supply chains

Your customers can leverage cross-border payments to access global supply chains and source products and services from international vendors at better prices. This can lead to significant cost savings and better-quality products.

Plus, cross-border payment services can facilitate:

- Provide reliable & fast payment methods for global suppliers

- Participation in international production networks

- Access to specialized components or services

Enhanced customer experience

Offering seamless cross-border payment options can enhance the customer experience. This makes it easier for your customers (small businesses) to purchase goods and services.

Plus, a cross-border payment platform for small businesses can equip your customers with tools for multi-currency processing and integration with popular international payment methods.

This can lead to increased customer loyalty & repeat business which, in turn, will provide a smooth payment experience that can drive customer satisfaction and retention.

Streamlined operations

Cross-border payments can streamline business operations by simplifying international transactions and reducing the need for complex currency conversions.

This can allow small businesses achieve;

- Centralized management of international transactions

- Improved cash flow through faster transfers

- Better financial visibility across markets

- Improved efficiency and cost savings.

Additionally, offering integrated cross-border payment solutions can add significant value to your customers’ business operations.

Challenges small businesses face while offering cross-border payments

As a remittance business, understanding the hurdles your customers can encounter with international small business transactions is crucial. These challenges can significantly impact their global operations and growth.

Here are the key obstacles they face:

Regulatory and compliance issues

The regulations for cross-border payments can change from country to country. Hence, your customers may face challenges in ensuring compliance with all the country rules.

Plus, AML and KYC regulations across multiple jurisdictions can be overwhelming with limited resources. This can also affect the business security of your customers and their users.

Currency exchange risks

If the exchange rates keep fluctuating, it can be a big turn-off for your customers. Not just because it is inconvenient but because such fluctuations can lead to;

- Unexpected losses (no stable pricing, high fees)

- Difficulty in pricing products or services for international markets

- Complications in financial forecasting and budgeting.

These risks can also impact the profitability and financial stability of your customers’ business.

High transaction costs

Cross-border payments can incur high transaction costs compared to domestic payments, such as;

- Bank transfer fees

- Currency conversion costs

- The intermediary bank charges

- Compliance costs

These costs can eat into the profits of small businesses as they are always operating on tight margins.

Security and fraud risks

When the funds transfers are cross-border, the security threats increase. There are middlemen, various payment processing, payment gateways, and more.

Small businesses may face higher risks of cybercrime and fraud when dealing with certain regions. These cyber threats and fraudulent activities can lead to significant financial losses.

They also encounter challenges in verifying the legitimacy of international partners and are more vulnerable to data breaches during cross-border transfers.

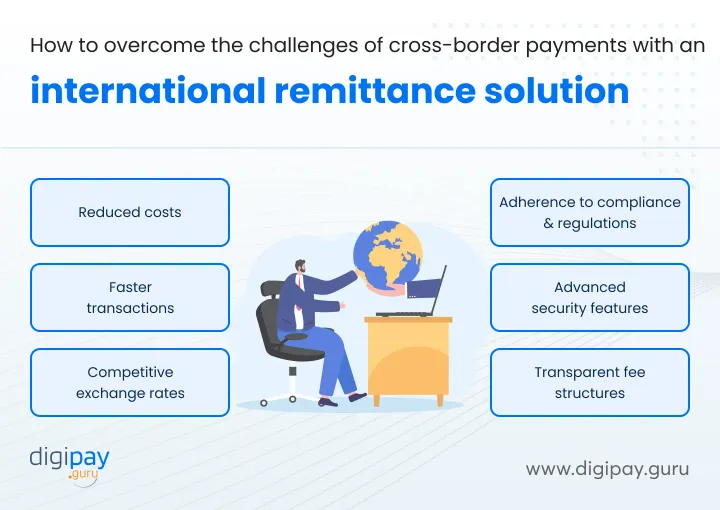

Overcoming cross-border payment challenges with an international remittance solution

As a financial service provider, you have the power to transform these challenges into opportunities. Here's how to overcome the challenges of international remittance with a cross-border payment solution:

Reduced costs

A cross border payment software for small business can help small businesses reduce costs through;

- Competitive exchange rates close to the interbank rate

- Lower transfer fees compared to traditional methods

- Bulk payment options with discounted rates

These benefits can make cross-border transactions more affordable and improve profitability. Plus, offering cost effective remittance solutions can attract more customers (small businesses) and increase transaction volumes.

Faster transactions

Cross-border solutions can enable near-instant money transfers and offer real-time payment tracking to ensure the recipient can have funds readily available whenever needed.

These online payment solutions for small businesses also improve;

- Cash flow management with quicker payments

- Operational efficiency &

- Financial agility

Competitive exchange rates

Offering competitive exchange rates is essential for mitigating currency exchange risks.

International remittance solutions can:

- Implement dynamic rate updates

- Offer rate lock options for future transactions

- Display transparent pricing

- Provide competitive rates

This helps small businesses manage their foreign exchange exposure.

High adherence to compliance & regulatory standards

Compliance with regulatory standards is critical in cross-border payments. And international remittance solutions can adhere to high compliance standards so that small businesses can easily stay compliant with regulatory requirements across the globe.

Moreover, it enables small businesses to;

- Automate compliance checks

- Stay PCI SSF compliant

- Regularly update your compliance protocols

- Streamline the process of collecting and verifying compliance information

Advanced security features

Your customers need to feel secure about their cross-border transactions, all the time to prevent fraud and security breaches.

Advanced security features are essential for protecting cross-border transactions from fraud and cyber threats.

International remittance solutions with robust security measures can safeguard small businesses' funds and data.

The security features can include;

- Biometric authentication

- Tokenization and encryption

- Anomaly detection & prevention

- AML screening

- Strong authentication

- AI-driven fraud detection systems

- Periodic web pen-testing & more…...

Transparent fee structures

International remittance solutions can offer clear and predictable fees with no hidden costs. This can help your customers (businesses) save costs and budget effectively.

It can offer:

- All-inclusive pricing

- Easy-to-use fee calculators

- Clear communication of all costs upfront

Moreover, providing transparent pricing can build trust and loyalty with your customers.

How DigiPay.Guru can help?

As mentioned above, how an international remittance solution can overcome the cross–border payment challenges for small businesses, DigiPay.Guru’s robust cross-border payment solution can do the same.

It offers all the above-mentioned features and more, which can help small businesses achieve operational efficiency, cost-effectiveness, advanced secure & long-term business profits.

Moreover, DigiPay.Guru provides you;

- Fast & secure cross-border remittances

- Multi-currency corridors & exchange rates

- Cross border bill payments

- AML sanction screening

- Loyalty & rewards

- Alert & transaction thresholds

- Comprehensive admin dashboard

- Data-rich reporting & analytics

- And much more…………

Conclusion

Cross-border payments are a life-saver for small businesses. Your business can leverage the opportunities it welcomes for small businesses and use them to your benefit. You can do this by offering robust remittance features that can amplify the chances for your customers to capitalize on all the above opportunities.

Furthermore, there are still some challenges in performing cross-border transactions for your customers, including security, compliance, costs, and exchange rates. But, a robust international remittance solution like DigiPay.Guru can easily mitigate them with its advanced capabilities.

Embrace DigiPay.Guru’s cross-border solution to stay ahead of the competition, attract more small businesses, and gain international remittance success.