Agency banking is the need of the hour. As a bank or financial institution, you cannot open your physical branch at every location you want to serve; that’s where agency banking software becomes a savior of your business.

If you are new to the concept of agency banking, no need to worry; you will get the basics in this blog. And if you already know the concept, you know how agency banking can make your business accessible to all and boost your profits.

In both scenarios, you need to first choose an agency banking solution that will best fit your business needs and objectives. However, choosing the best agency banking software for your business can be tricky. With so many options available, it becomes challenging.

Businesses like yours want a solution that aligns with their goals, works seamlessly with their existing systems, and can grow alongside them. But how do you know which is the best one for you?

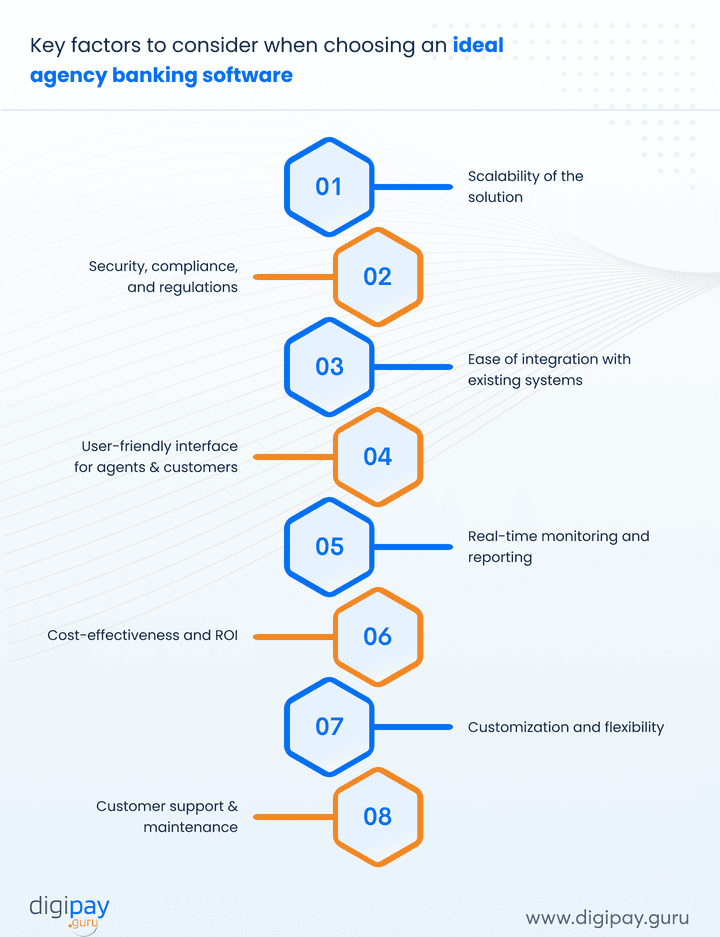

In this blog, you will learn the 8 crucial factors to consider when choosing the ideal agency banking software. This will make it easier to select a solution that fits your specific needs.

Let’s begin!

Understanding agency banking

Before diving into the key points for selecting agency banking software, let’s take a moment to understand what agency banking is, the key parties involved, and how it benefits banks and financial institutions.

What is agency banking?

Simply put, agency banking is a branchless banking solution where banks or financial institutions partner with agents to offer financial services in areas where opening a physical branch might be too costly or impractical.

These agents, who could be local businesses, retail shops, or even individuals, serve as the bank’s representatives. They handle transactions like deposits, withdrawals, account openings, and bill payments.

This model allows financial institutions to extend their reach to underserved communities and rural areas, all without the high overhead costs of physical branches.

Parties involved in agency banking

In any agency banking service, there are three key parties involved:

-

The bank/financial institution: The entity that authorizes agents to offer their services.

-

The agent: The individual or business acting as the bank’s representative that conducts financial transactions on behalf of the institution. They are the ones operating the agency banking software.

-

The customer: The end-user who interacts with the agent to carry out various financial transactions. The customer benefits from banking services at locations that are convenient and closer to them.

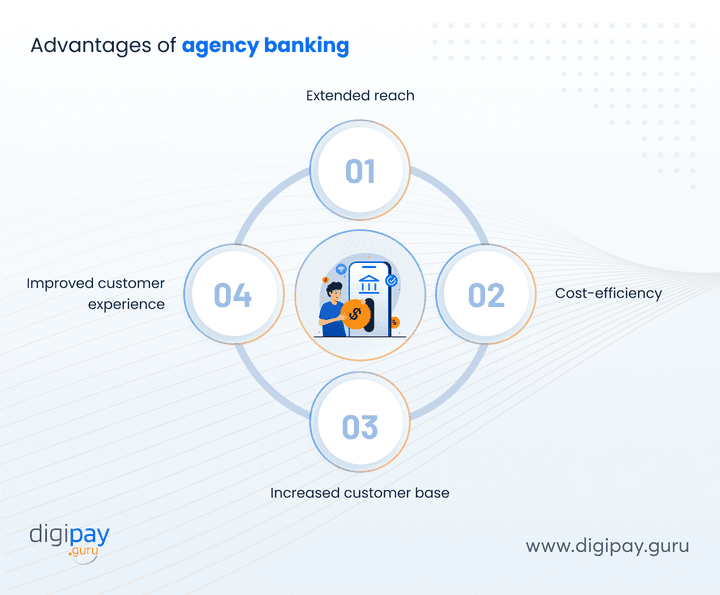

Advantages of agency banking for banks and financial institutions

Now, why should a bank or financial institution like yours adopt agency banking in the first place? Well, there are several reasons:

Extended reach: Agency banking enables your bank to expand its services into remote or rural areas without the cost of setting up physical branches.

Cost-efficiency: Operating an agent network is much cheaper than maintaining full-scale bank branches.

Increased customer base: By reaching previously unbanked or underserved communities, you can tap into a larger customer base, thereby increasing deposits, transactions, and overall revenue.

Improved customer experience: Agents often operate from local shops or businesses that customers are already familiar with. This makes the service more accessible and convenient.

Read More - How Banks are Transforming the Customer Experience

How do you choose the best agency banking software?

Now that you understand the basics of agency banking and why it’s such an attractive model for your business, let’s get into the key factors you should consider when choosing the best agency banking software.

Scalability of the solution

As your business grows, so should your software.

One of the most important factors to consider is scalability. Whether you're a bank expanding into new markets or a fintech adding more agents, the agency banking software solutions you choose need to handle increased demand.

Imagine launching a new service, only to realize that your system can't handle the influx of new agents and customers. It’s like planning a party but running out of snacks halfway through!

Here’s what you need to check:

-

Can the software scale effortlessly as you add more agents?

-

Is there a limit on the number of transactions or agents it can handle?

-

Can it manage an increasing workload without compromising on performance?

A scalable solution future-proofs your business by allowing you to grow without needing to switch to new software every few years. You want a solution that grows with you—not one that limits your potential.

Security, compliance, and regulations

If you’re dealing with customer funds and personal data, ensuring that your system is secure is non-negotiable. Every day, agents handle sensitive financial transactions, and your software must protect both customer data and your business from cyber threats. A data breach can lead to a loss of trust, legal issues, and, worst of all, a tarnished reputation.

But it doesn’t stop there—compliance is equally important. Different countries have different rules and regulations governing banking. Your software must comply with these to avoid hefty fines or legal issues.

Key security features to look for include:

-

End-to-end encryption to protect data during transactions

-

Multi-factor authentication (MFA) for agents to prevent unauthorized access

-

Fraud detection systems that monitor for suspicious activities

-

Regular software updates to fix any vulnerabilities

Compliance features should include:

-

Adherence to KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations

-

Ability to generate regulatory reports when needed

-

Options for customizing the software to meet local legal requirements

Ease of integration with existing systems

Most banks and financial institutions already have existing systems in place, whether it’s a core banking system, CRM software, or a payment gateway. Your agency banking software should integrate seamlessly with these systems. Imagine if you had to revamp everything just to implement a new feature—it would be chaos!

Before choosing a solution, ask these questions:

-

Does the software support APIs (Application Programming Interfaces) for smooth integration?

-

Will it work with your current software and hardware?

-

How complex is the integration process? Will it require extensive customization?

Smooth integration minimizes downtime and ensures that your agent banking services run like a well-oiled machine. No one wants to deal with software that disrupts their operations or requires a lengthy setup process.

User-friendly interface for agents and customers

If it’s easy to use, everyone wins.

Your agents are the front-line operators of your agent banking system, and many of them may not be tech-savvy. On the customer side, users expect fast and easy-to-use solutions that don’t leave them frustrated. A confusing interface can lead to mistakes, lost time, and unhappy customers.

When evaluating an agency banking solution, consider:

-

Can agents easily navigate the system with minimal training?

-

Does the customer interface offer a seamless & frictionless experience?

-

Is the software responsive on mobile devices, tablets, and desktops?

A user-friendly system boosts productivity for agents and ensures a positive experience for customers.

Here’s what you want from the software:

-

Simple menus and quick access to commonly used features

-

Clear instructions and help functions within the platform

-

Minimal downtime and quick load times for all actions

The more intuitive the software, the quicker your agents can get to work. This would mean better service for your customers and higher productivity overall.

Real-time monitoring and reporting

Data is a gold mine in the financial world. The ability to monitor transactions, agent performance, and potential fraud in real time is crucial for making informed decisions. Without these insights, you’re flying blind, which could lead to missed opportunities or, worse, financial risks.

Look for software that offers:

-

Real-time transaction monitoring for instant insights

-

Automated alerts for unusual or suspicious activities

-

Detailed dashboards that track agent performance and customer behavior

Consider real-time reporting as your command center—always alert, always watching. It helps you respond to issues quickly and ensures that your business remains agile and efficient.

Detailed Reporting Capability for Better Decision-Making

Real-time data is great, but what about long-term insights? Your agency banking software should offer comprehensive reporting tools that help you analyze trends over time. These reports can assist in identifying top-performing agents, spotting inefficiencies, and even helping with regulatory compliance.

Some essential reporting features include:

-

Customizable reports for various time frames (daily, weekly, monthly)

-

Easy export options for sharing data with other departments or regulatory bodies

-

Performance metrics that help track the success of your branchless banking solution

With detailed reports, you can make better decisions, optimize agent performance, and ensure smooth operations.

Cost-effectiveness and ROI

Price is always a factor, but it’s important to look beyond just the upfront cost. Ask yourself: what kind of return on investment (ROI) will this software deliver? An ideal agency banking solution should not only save you money but also improve efficiency, increase customer satisfaction, and expand your market reach.

Here’s what you should evaluate:

-

Will the software reduce operational costs in the long run?

-

Does it improve efficiency and reduce time spent on manual tasks?

-

Can it help you reach new customers, thereby increasing your revenue?

Think of it this way: if you buy a cheap solution that breaks down often or requires constant updates, the “savings” quickly disappear. A solid investment in high-quality software pays off through improved performance, better agent productivity, and happier customers.

Customization and flexibility

Every bank or financial institution has its own needs. Maybe you need to operate in multiple regions, or perhaps you offer specialized services that require unique workflows. The best agent banking software should be flexible enough to adapt to your business model, not the other way around.

Check for these customization options:

-

Ability to modify transaction limits, fees, and roles for different types of agents

-

Custom branding to ensure a consistent look and feel for your customers

-

Localization features, such as multiple currencies or languages, for international operations

Customization ensures that your agency banking services align with your brand, regulatory needs, and customer expectations. Flexibility means your software can adapt to changing market demands and is easier to scale and grow.

Customer support and maintenance

Even the best agency banking software will have its hiccups. When things go awry, responsive customer support becomes essential. But it’s not just about fixing problems-it’s about ongoing training to ensure your agents are using the system to its fullest potential.

Here’s what you should expect:

-

24/7 customer support, especially for time-sensitive financial issues

-

Comprehensive training resources, including video tutorials, manuals, and live support

-

Quick resolution times to minimize downtime and disruptions

Strong customer support and training are like the safety net that ensures you can confidently run your operations without worrying about major disruptions.

Read More - All you need to know about Agency Banking

Conclusion

Choosing the best agency banking software doesn’t have to be an overwhelming task. By focusing on key factors like scalability, security, ease of integration, user-friendliness, real-time reporting, cost-effectiveness, customization, and customer support, you’ll be able to make an informed decision.

Remember, your software is more than just a tool—it’s the backbone of your agency banking services. Selecting the right solution will help you offer efficient, secure, and reliable services to your customers while empowering your agents to perform their best.

And if you’re looking for a solution that ticks all these boxes, DigiPay.Guru is here to help. We offer scalable, secure, and highly customizable agent banking solutions that grow with your business. So why wait? Let’s unlock the future of banking together!