Cash is not the ‘King’ anymore! The digital advent of payments has entirely changed the scenario and has given rise to cashless payments.

The first move towards cashless payment was a credit card in the 90s. In the same decade, the electronic banking system became common. And after that, the innovations in cashless payments continued.

Big names like PayPal and Apple Pay came into the picture. And today, no one wants to carry cash. Everyone wants to reap the benefits of cashless payments. However, cash still has its significance in many places, but the world is gradually moving towards cashless payments.

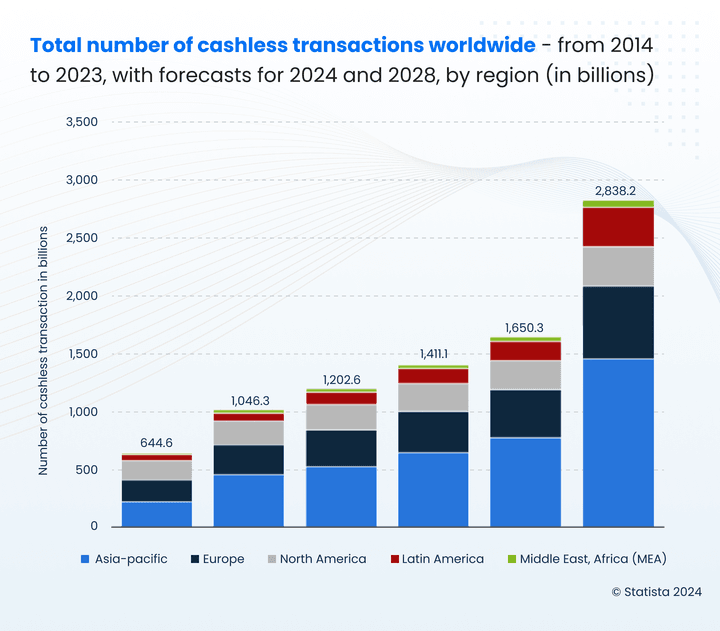

The study by Statista shows a rise in the number of cashless transactions globally. By 2028 the global number of cashless transactions will reach 2838 billion. The above stats show an exponential increase in cashless transactions.

In this blog, you will discover:

-

What cashless payments are

-

The key types of cashless payments and how they work

-

Benefits of adopting cashless payment systems and its challenges

-

Countries quickly shifting toward becoming fully cashless

-

And how digipay.guru can help in this shift

Let’s sit together and begin with the meaning!

What are Cashless Payments?

Cashless payments are transactions conducted electronically, without physical currency such as coins or banknotes. These transactions rely on various digital or electronic methods to transfer funds from one party to another.

In simple terms, cashless payments are “payments done without cash.” Today, there are so many types of cashless payments in the market. (which we will explore later in the blog)

-

As of 2024, Canada has the highest credit card penetration rate globally, with 82.7% of individuals aged 15 and above owning a credit card.

-

India leads globally in digital wallet usage. Approximately 90.8% of Indian consumers adopted digital wallets.

-

The total global value of digital payment transactions reached nearly $8.5 tn in 2024.

How Cashless Payment Systems Work

A cashless payment system enables transactions without physical cash, while relying on secure digital payment methods instead. These systems use encrypted networks to process transactions between customers and businesses instantly.

When a customer makes a cashless transaction:

-

The payment request is securely sent through a point of sale (POS) terminal, an online banking platform, or a mobile wallet.

-

The transaction is then authenticated using technologies like Near Field Communication (NFC), biometric verification, or one-time passwords (OTPs).

-

Once verified, the payment is processed, and

-

Funds are transferred from the customer's banking account to the recipient.

Financial institutions and fintechs like yours depend on cashless payment solutions to offer customers a secure and convenient way to pay. This enhances transaction speed, security, and overall customer experience.

Key types of cashless payments

The major types of cashless payment systems are:

Credit/Debit Cards

Credit and debit cards have been one of the most convenient modes of cashless payments. Rather than paying in cash for goods and services, the user can use a credit or debit card to make payments.

This can be done in person by card swiping or inserting the card in the card reader, or it can be done online by adding the card details to the website/app’s payment page.

The most popular credit and debit cards are Visa and MasterCard.

Mobile Wallet Apps

Mobile wallet applications are gaining popularity due to their quick, secure, and convenient cashless payment options. Users can digitally store and manage credit, debit, and other payment cards. These apps allow users to send, receive, and store money, as well as manage loyalty rewards and coupons.

Users can link their bank accounts via phone numbers (OTPs), email IDs, or unique IDs and add funds to send money. Additionally, they can make merchant payments and pay utility bills directly from the app.

Popular examples include Apple Pay, Google Pay, and Samsung Pay.

Mobile Banking Apps

With a mobile banking app, you can check your account balances, pay bills, transfer money, and perform many more banking activities right from your smartphone.

This cashless mobile payment eliminates the need to visit a bank branch or ATM in person, making it easier for users to manage finances on the go.

Mobile banking apps also include features like person-to-person (P2P) payments, which allow users to send money to a friend or family member directly from their mobile device. This can be a convenient alternative to using cash or checks for small transactions.

In addition, some mobile banking apps allow you to make purchases or payments to merchants that accept mobile payments, thereby reducing the need for cash. Today, almost every bank has mobile banking apps across the globe.

Virtual Cards

Virtual cards, also called digital cards or virtual payment cards allow you to make online purchases or payments without using a physical card.

Instead of using a physical card, you can use a virtual card by providing the card information, such as the card number, expiration date, and security code, during the checkout process. It’s generally used via NFC-enabled mobile devices.

The major benefits of virtual cards are that they offer a convenient and secure way to make payments online and help reduce the need for cash. This promotes a cashless society.

QR Code Payments

QR code payments are one of the most popular modes of cashless payment. It uses QR codes to facilitate transactions.

A QR code is a two-dimensional code with a pattern of black squares arranged on a square grid. This code can be scanned with a smartphone or other device to access information or make a payment.

QR codes are widely used to make cashless payments. Here, a user just has to scan the QR code provided by the merchant to complete the transaction. Today, QR codes are almost everywhere.

Read more: The omnipresence of QR codes in the digital payment industry

NFC Payments

NFC, or Near Field Communication, is a technology that allows users to make payments to devices in close proximity of a few centimeters. NFC can be used for contactless payments, ticketing, access control, and more.

With NFC payments, a user can simply tap his NFC-enabled mobile phone against a point of sale (POS) terminal to make a payment. This eliminates the need for cash or physical card payments.

NFC payments are becoming increasingly popular and accepted by numerous merchants, which makes it easier for customers to use.

In addition, NFC payments can offer an extra layer of security, as they are encrypted and require a secure connection to process the transaction.

Users can make payments via NFC-enabled phones at various places such as:

-

Fuel stations

Read more: Know all about NFC payments

USSD

Unstructured Supplementary Service Data (USSD) is a cashless payment for those who don’t have a smartphone or proper access to traditional banking services in their location. The USP of this method is that the user can make payments without a smartphone or internet.

- USSD can be used by dialing *99# to initiate a financial transaction.

- When a user dials this code, he reaches an interactive voice menu via mobile phone.

- The transaction is then completed by following the prompts sent back via USSD.

However, to use this service, the user must ensure that his mobile number is linked to the bank account.

With the help of USSD, users can

-

Make payments

-

Transfer money

-

Top up mobile phone credit and much more.

Cashless VS. Contactless Payments—What is the Difference?

Many people confuse cashless payments with contactless payments, but they are not the same. While they share similarities, understanding their differences helps you implement the right cashless payment solutions for your customers.

| Feature | Cashless Payments | Contactless Payments |

|---|---|---|

| Definition | Any transaction that does not involve physical cash | A type of cashless payment that does not require physical contact with a terminal |

| Includes | Credit/debit cards, mobile wallets, online banking, QR code payments, and more | NFC-enabled cards, mobile wallets (Apple Pay, Google Pay), and tap-to-pay methods |

| Technology Used | Digital networks like online banking, mobile payment systems, and POS transactions | Near Field Communication (NFC) and Radio Frequency Identification (RFID) |

| Usage | Any digital transaction, including online and in-person payments | Primarily used for in-store transactions with a tap or wave |

| Security | Encrypted transactions with multi-layer authentication | Highly secure with tokenization and biometric authentication |

Every contactless payment is a cashless payment, but not every cashless payment is contactless. Understanding this distinction is crucial for your business to offer the best payment experience to your customers.

Benefits of Cashless Transactions

Adopting cashless payments brings numerous benefits to customers, businesses, and the economy as a whole. The major benefits of going cashless are:

Convenient and Time-Saving

Customers can make cashless payments without cash or a trip to the bank or ATM. So it is very convenient to use and can be made from anywhere. Plus, it saves users’ time as everything is done online via smartphone.

For merchants, it reduces the payment processing time to their account. The payments are received directly in their business account from cashless payments like mobile banking, QR code payment, NFC, and many more.

Enhanced Security and Fraud Prevention

Cashless payments come with multiple security layers, such as

-

OTP & PIN

-

Tokenization

-

Data Encryption

-

3DS integrations

-

Biometric authentication

-

Two-factor authentication

-

PCI security standards & more

These security layers minimize the risk of fraud as the fraudsters find it very difficult to enter into the payment process framework.

Also, as all the transactions can be tracked, it's easier to identify suspicious activities and flag them immediately. And the customers do not carry cash, which reduces the risk of money theft.

Facilitate Faster Transactions

Making cash payments is time-consuming for customers as well as businesses.

-

With cashless payments, customers can simply swipe their cards, enter a PIN, or use a mobile payment app to complete a transaction.

-

Businesses can receive funds in their account much faster by eliminating the long payment processes.

Seamless Cross-Border Payments

With cashless payments, the complex processes of traditional cross-border payments like wire transfers, drafts, and money orders are eliminated. Cashless cross-border payments are now possible through mobile banking and mobile wallet apps.

Moreover, cashless payment systems make cross-border payments easier by

-

Reducing fees

-

Facilitating automatic currency conversion

-

And increasing speed, security, and accessibility

These systems are more convenient, cost-effective, and secure than traditional methods of cross-border payments. Plus, they can be accessed from anywhere with an internet connection.

Easy Data Collection and Record-Keeping

With cashless payments, the user payments are recorded online in the payment apps’ system. These records can be easily stored and accessed for accounting, tax preparation, and business analysis.

Also, it helps the government to easily track the money movement. And your business can use the collected data for innovation and improvement in your services and experience.

Promotes Better Money Management

Cashless payment methods like digital wallet apps allow users to track their transactions and expenses. It also helps to formulate a spending budget category-wise. This allows them to be more thoughtful towards their money.

In addition, many other cashless systems offer budgeting tools so the user can manage their finances in a better and more efficient way.

Financial Inclusion and Access to Banking Services

Digital payment platforms offer greater accessibility to banking services for underserved populations. This allows users without traditional bank accounts to participate in the formal economy and promotes financial inclusion.

Countries Quickly Shifting Toward Becoming Fully Cashless

Several countries and regions are leading the way in embracing cashless payments.

Sweden

-

Sweden is often regarded as the closest to becoming a truly cashless society.

-

Here, the cash transactions account for less than 10% of the total value of payments made.

-

The widespread adoption of mobile payment apps like Swish and the ability to make card payments virtually everywhere have driven this shift.

China

-

China has also witnessed a remarkable rise in cashless payments. It is primarily driven by the immense popularity of cashless payment companies like Alipay and WeChat Pay.

-

The "super-app" ecosystems have become deeply embedded in the daily lives of Chinese consumers. This has enabled seamless payments for everything from shopping to transportation & utility bills.

-

China's advanced digital infrastructure, tech-savvy population, and government initiatives promoting a cashless economy have fueled this transition.

Kenya

- Kenya stands out as a pioneer in mobile money adoption, with the success of M-Pesa, a mobile phone-based money transfer and payment service.

- Launched in 2007, M-Pesa has become a ubiquitous platform for financial transactions. It allows users to send and receive money, pay bills, and access banking services through their mobile phones.

- The service's ease of use, affordable pricing, and extensive agent network have driven its widespread adoption, particularly in rural and underbanked areas.

Challenges & Risks of Going Cashless

Cashless payments are the future of the payment and financial landscape. While there are myriad advantages of cashless transactions, they still come with some challenges:

-

In parts of Africa and Asia, limited access to banking services, inadequate digital infrastructure, and low digital literacy levels can hinder the transition to cashless payments.

-

Cultural preferences and trust issues related to digital transactions may slow the adoption process in certain communities.

-

In some developed economies, such as the United States and parts of Europe, cash remains more prevalent compared to countries like Sweden or China.

-

Concerns about privacy, security, and the digital divide may contribute to a slower pace of cashless adoption in these regions.

However, the COVID-19 pandemic has accelerated the shift toward contactless and digital payments. This suggests that these barriers may gradually reduce over time.

Enable cashless capabilities for your customers with DigiPay.Guru

The adoption of cashless payments is no longer optional—it is necessary to stay competitive. DigiPay.Guru offers your customers the best digital payment experience with cashless payment solutions and payment capabilities like:

- Digital wallets

- QR code payments

- Mobile banking

- International remittances

- Contactless payments (NFC)

- Virtual prepaid cards

- Scan & thru, and

- Merchant payments

We help you become the pioneer in cashless payments. And increase revenue by providing an end-to-end solution to manage all payment needs with our advanced mobile money solutions.

If you are a financial business looking to deliver a cashless payment experience to your customers, get in touch with DigiPay.Guru.

Conclusion

Cashless payments have become increasingly popular in the payment landscape because of their no-cash approach and multiple modes in the market. Plus it's convenient, fast, secure, and reliable—a perfect combination to catch a customer’s eye.

Almost every country is shifting toward cashless payments, with Sweden and China pioneering the space. Hence, we can say that cashless is the future of financial services. And customers love it!

DigiPay.Guru offers secure and convenient cashless payment systems that help you streamline transactions, enhance security, and improve customer experience. With these systems, you can change the payment game for your customers and multiply your profits + customer base.

HCashless payments refer to transactions that don’t involve physical cash. Instead, funds move digitally using credit/debit cards, mobile wallets, online banking, or QR codes. These transactions are faster, more secure, and reduce operational costs for businesses.

Cashless payments cover all digital transactions, including online banking, mobile wallets, and card payments. Contactless payments, a subset of cashless payments, allow users to pay by tapping NFC-enabled cards or devices on a terminal without inserting a card or entering a PIN.

Credit/Debit Cards – Secure and widely accepted for online and offline transactions.

-

Mobile Wallets – Digital payment apps like Apple Pay and Google Pay enable quick payments.

-

QR Code Payments – Customers scan QR codes to complete transactions.

-

Online Banking & Virtual Cards – Used for seamless money transfers and payments.

-

USSD Payments – Mobile-based transactions without the need for internet access.

Pros: ✔ Faster transactions and improved customer experience ✔ Reduced cash handling costs and risks ✔ Increased security and fraud protection ✔ Better financial tracking and reporting

Cons: ✖ Cybersecurity threats and hacking risks ✖ Dependence on internet and power availability ✖ Resistance from customers unfamiliar with digital payments

To ensure secure cashless transactions, you need:

Encryption & Tokenization – Protects sensitive data during transactions.

Multi-Factor Authentication (MFA) – Adds an extra layer of security.

AI Fraud Detection – Identifies suspicious activities in real time.

Regulatory Compliance – Ensures adherence to financial security standards like PCI-DSS.

Cashless payments streamline financial operations, reduce cash management overhead, and enhance customer convenience. Plus, automated digital payments minimize errors, improve cash flow, and provide real-time insights. This helps you make better financial decisions.